Crypto traders are currently searching for the next 500x token because a bull run is around the corner. And that’s when prices usually skyrocket. If this is your first bull run, know that picking the right project can make a difference.

While it’s hard to predict what token will hit the jackpot, there’s a science to picking the right token. Experts have shown the right ways to spot your next crypto gems that will hopefully bring in the profit you hope for. Here are a few ways.

1) Avoid Projects With Frequent Token Unlocks

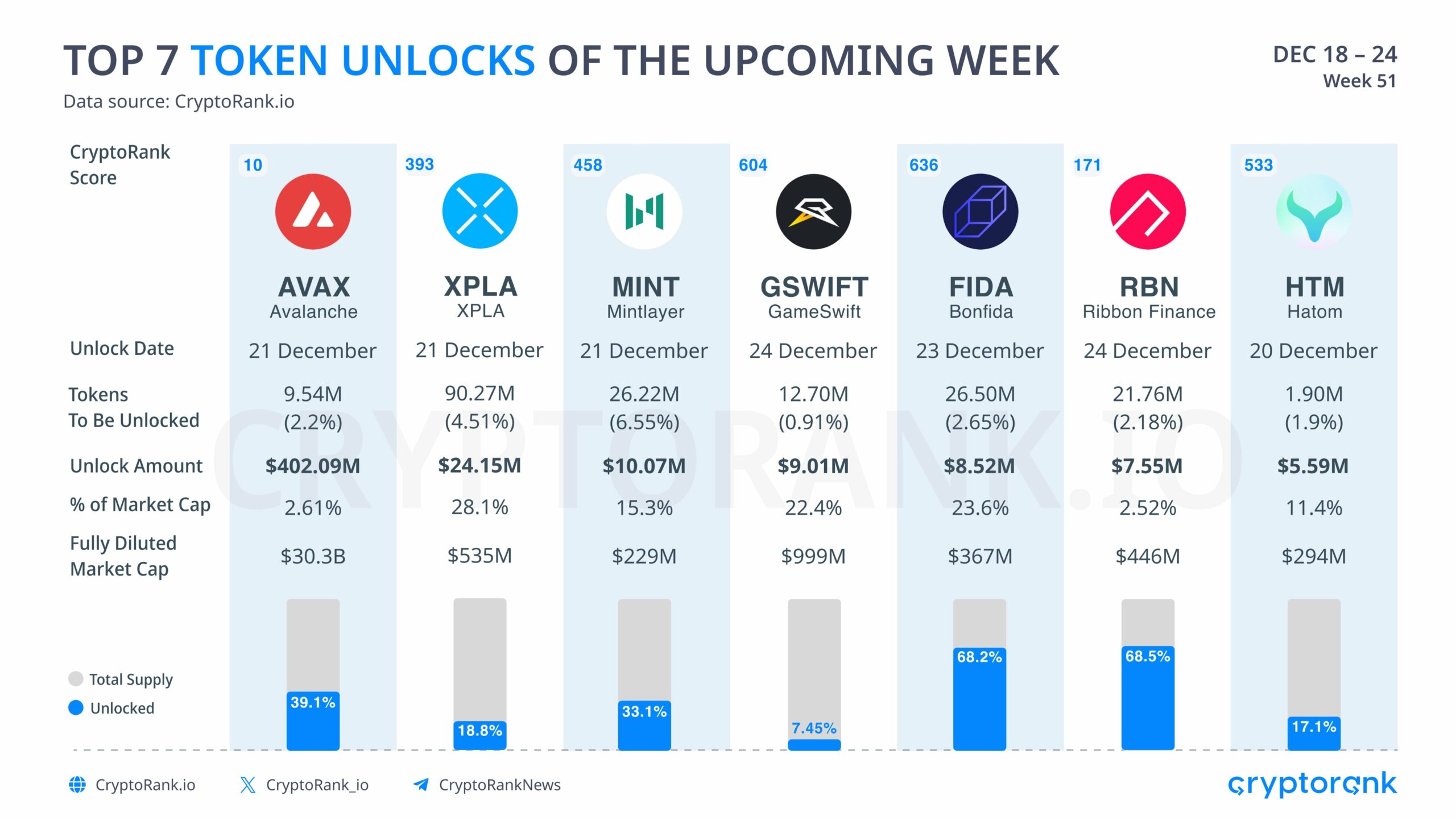

We often inform our community of upcoming token unlocks. That’s because we know these events can cause price slumps, and we don’t want our community to suffer such shocks. Similarly, some can choose to buy the dip from the crashed price.

Source: CryptoRank

However, it is generally agreed that a project with frequent token unlocks might be a red flag. Similarly, be careful of projects with very low circulating supplies. The reason is the basic law of economics: price is determined by the balance between supply and demand. So, increasing supply without a corresponding growth in demand can lead to a price decrease.

2) Avoid Tokens Where VCs or Angels Have a Lower Entry Price Than Others

Here’s the best scenario to explain this: Imagine investors’ tokens unlocking around the corner. And the token is trading at 100X from their entry point. There’s every likelihood they’ll sell and dump the price. So, it’s best to stay off.

🔷 3. Token Unlocks

Unlocking Token Transparency: Stay Informed with @Token_Unlocks – Unveiling Incoming Token Unlocks from Teams, VCs, and Previous Sales pic.twitter.com/5Z50gJezxn

— CILLIONAIRE.COM (@cillionaire_com) June 11, 2023

3) Don’t Fail to Participate in ICOs

Most crypto users underestimate ICOs, especially in a bull market. There’s often a surge in the number of ICOs in a bull market. ICOs are where new blockchain projects raise funds by issuing new tokens.

New projects are risky, but they have potential. And ICOs are where you get them at cheaper rates. Getting the right projects could be the way to have the best bull market ever.

2017: ICOs

2018: IEOs

2019: Exchange tokens

2020: DeFi

2021: NFTs

2022: Metaverse

2023: Inscriptions

2024: Bitmaps 🟧— Daryoush.sats (@TheRealDaryoush) December 18, 2023

4) Check Market Caps and Compare Them With Others

Price is merely a single measure of a cryptocurrency’s value. Investors prefer to use market cap to compare the values of different cryptocurrencies and provide a more thorough narrative. As a crucial metric, the market cap can reveal a cryptocurrency’s potential for growth as well as whether purchasing it is risk-free in comparison to alternative options.

Beginner investors are often too price-focused, and can be misled by high or low prices 🪙

In this video, let's learn about what #crypto market cap is, why it's important, and how it can help you level up your analysis!

Watch the full video: https://t.co/lOJOtj9mmS pic.twitter.com/DKI7mAZWGN

— CoinGecko (@coingecko) November 14, 2022

There are three divisions of market caps:

- Large-caps cryptos.

- Mid-cap cryptos.

- Small-cap cryptos.

If a market cap is too large, the profit accrued might not be much.

5) Select Your Tokens Based on Narratives

Tokens often surge based on their narratives. For example, DeFi coins were the big winners from the last bull market. So, we advise you to study the narrative you believe will trend and select your crypto gems from the pack.

The next crypto bull run could make you a millionaire if you play your cards right! 🔥

Several explosive narratives have the potential to deliver life-changing 1000x gains!

Which are they?

A thread!🧵

The name of the game is identifying and investing in the most promising… pic.twitter.com/joZiBlvh4l

— Abhinav Kumar (@singhabhinav) December 15, 2023

Some of the biggest narratives of 2023 include:

- Layer 1s.

- Layer 2s (Optimistic rollups and ZK rollups).

- Artificial intelligence.

- Liquid staking derivatives.

- Real-world assets.

- Decentralized stablecoins.

- Blockchain interoperability.

- BTC Ordinals.

- BRC-20 tokens.

Some of these narratives will continue to dominate. But others will have reduced engagement. Here is another article with five extra tips to find your bull run crypto gems.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.