In the crypto space, you can make massive gains. There are many options available to reach this goal. One option is to spot crypto gems early on.

For example, BNB, DOGE, MATIC, or SOL. They are all up between 30,000x and 50,000x from their TGE (token generation event). Let’s explore more about these rules.

Key Guidelines for Identifying Upcoming Crypto Opportunities

So, how can you find these crypto gems? We have a two-part guide for spotting these crypto gems.

1) Which VCs Back the Project?

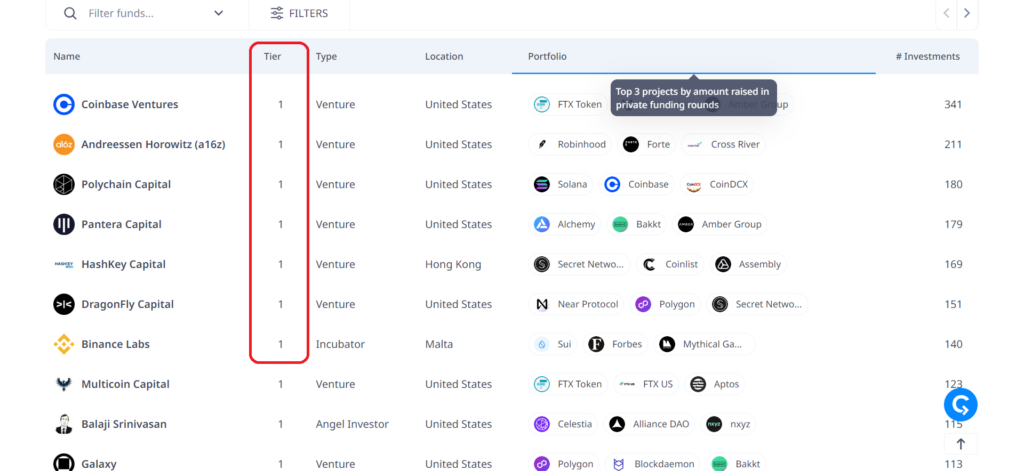

Follow the money! This also counts for your research. So, in this case, are any VCs funding the project? Once you find out who they are, start researching these VCs. This is important because they can influence the token price. They can give the token an upward swing, or, on the other hand, bring the price down.

Source: Cryptorank

The more tier 1 investors in a project, the better. They provide advice, much-needed money, and experience. With their investments, crypto start-ups can go a long way. However, in return, VCs can ask for certain degrees of control over a project. That’s where they can influence prices negatively. For example, their demand for control can cause conflicts. However, you can find a list of VCs in the picture below.

2) Find New Coins

Stay away from altcoins from the last bull run. In a new bull run, you want to look for new coins. The coins from the last bull run already had their ATH (all-time high). They also may already have a high market cap. So, not all coins will be able to smash their ATH. Some holders may be lurking to get rid of their underwater bags. People may have lost faith in them.

Finding the gems in the sea of new #crypto projects is tough, but it doesn't have to stay that way! 💪

Learn how to find undervalued projects here 👇https://t.co/ObUA0rFa4p

— CoinMarketCap (@CoinMarketCap) December 11, 2023

On the other hand, new coins have a blank slate, so to speak. Maybe they are an improved version of the older coin? Does the new project address the failures or pain points of the old project? There can be completely new genres, like AI. In short, new coins don’t carry that much baggage and are more likely to do well.

3) Look for Utility

Don’t look for a fancy ticker name, check if the token has utility. This requires research into the tokenomics. Find out what the function of the coin or token is. Ask yourself if it’s a governance token, or if it’s inflationary or deflationary. Can you stake it and earn rewards? Which function does it have in the ecosystem?

Tokenomics analysis is the key to profitable crypto investments.

But it's a time-consuming process that demands expertise.

Here's how to analyze tokenomics in few minutes using ChatGPT🧵👇 pic.twitter.com/yQnt3IBZwV

— 𝗰𝘆𝗰𝗹𝗼𝗽 (@nobrainflip) June 25, 2023

For example, it can be a payment option in the ecosystem. So, you have plenty of questions to find answers to. Tokens with no substance may thrive for a short while. However, eventually, they will implode. Without a good foundation, projects and their tokens will most likely not survive.

4) Look Up the Price History

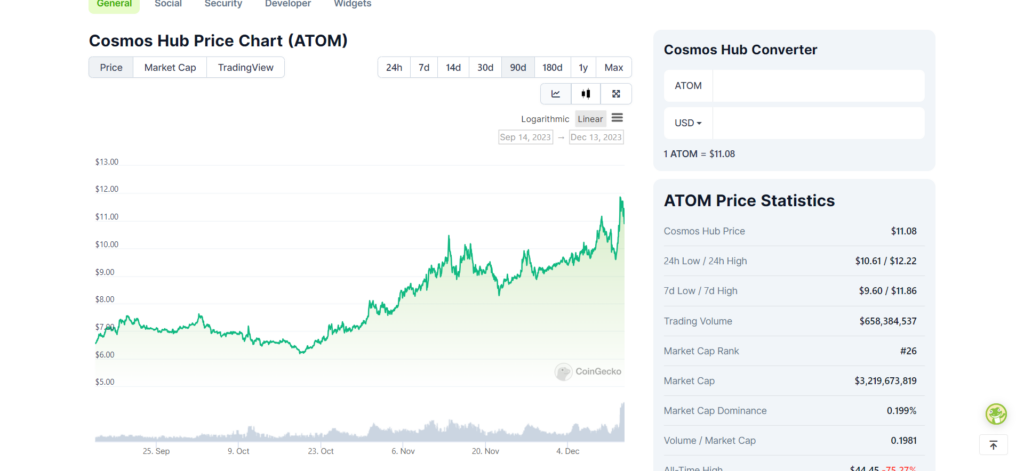

Look at the price development of a token. If a token flattens out after a serious and recent pump, it may not pump in the same way again soon. However, tokens that haven’t pumped yet, or aren’t even listed yet, may still pump hard. For example, keep some dry powder on the sidelines. In other words, keep some stable coins at your disposal. It can well be, that the biggest gains during the coming bull run, are with a coin that hasn’t even launched yet. Here is an example that shows the 90-day ATOM chart on CoinGecko.

Source: CoinGecko

Especially coins or tokens with a low market cap that haven’t pumped yet, are true crypto gems. These are the ones to keep an eye out on. Platforms like CoinGecko or CoinMarketCap are good for finding this information. We also posted a video on our YouTube channel today, with 3 micro and low-cap crypto gems.

5) Find Tools that Help You

There’s a wide variety of tools available that can help you with finding crypto gems. For example, we published a 4-part series of 20 free crypto tools. These tools can help you in various fields and ways. You can find information on upcoming ICOs, the TVL of chains or protocols, or a crypto news aggregator. There’s much more information available. It’s good to have these tools at hand and ready.

The more you learn about a project, the better informed you are about the pros and cons of the project. Knowledge is power, and that also counts in the crypto space. If you want to make the most of this bull run, DYOR (do your own research) is your friend. Don’t rely on influencers, they tend to look after their interests. On the other hand, objective tools help you to get informed.

Conclusion

Finding crypto gems is a good way to be successful in this bull run. We collected 10 rules for you to stay safe. This is a two-part series.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.