With Arbitrum increasing parabolically to a new ATH.

It’s time to explore the top 7 promising projects in its ecosystem. But first, let’s take a look at why Arbitrum is boosting its ecosystem.

Introduction

Ethereum has faced challenges due to its increasing popularity, leading to heightened transaction costs and network congestion. While some advocate for on-chain adjustments to address scalability issues, others explore alternative solutions- Layer 2. One such L2 is Arbitrum.

Among the various Layer 2 solutions, Arbitrum stands out for its distinctive approach to tackling these challenges. Arbitrum has rapidly gained traction, positioning itself as one of the largest blockchains in the industry.

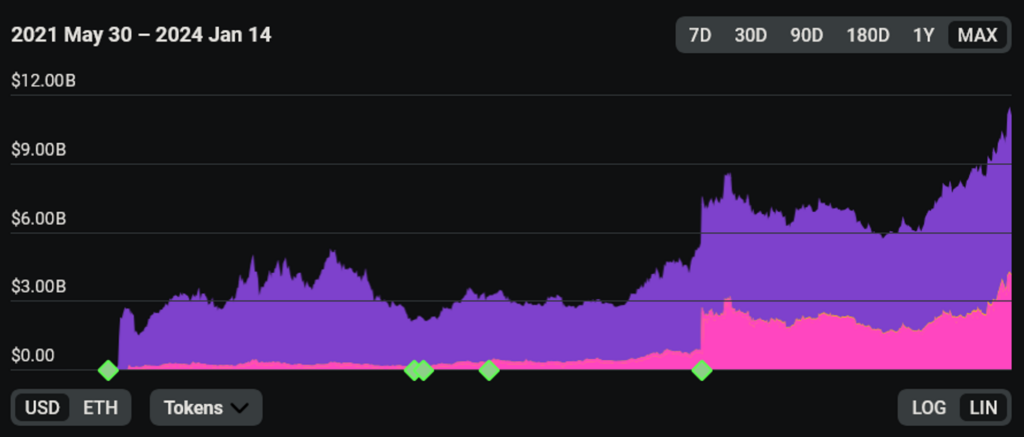

Source: L2BEAT

Currently, Arbitrum leads the Layer 2 landscape with a TVL of $11.03 billion, primarily attributed to its low transaction fees. Moreover, the platform’s surge in activity and innovative features is propelling DeFi to new heights.

As we explore the Arbitrum ecosystem, certain projects are emerging with the potential to outshine others. Whether due to their inventive solutions, user engagement, or practicality, these projects are shaping the trajectory of the future. Let’s dive in!

1) Kenshi ($KNS)

Kenshi develops products tailored by and for developers. Collaborating closely with a network of partners and protocols. Kenshi aids the builder community in overcoming complex challenges.

#Kenshi is a Swiss-based tech company with a focus on blockchain and Internet of Things

Kenshi thrives to bridge the gap between traditional web technologies (Web 2.0) and the decentralized future powered by Web 3.0

With solutions ranging from Custom #OracleNetworks to Data… pic.twitter.com/7b3i8gmstl

— Kenshi (@KenshiTech) January 12, 2024

Kenshi’s ecosystem facilitates the creation of data flows between the blockchain and off-chain data sources. With their dashboard and APIs, developers can unlock new possibilities on the blockchain, enabling seamless interaction between external dApps and blockchain data.

A recent addition to Kenshi’s offerings is Unchained, a decentralized, peer-to-peer network for data validation. In this system, Unchained nodes collaborate to validate data and get rewarded with KNS tokens. Consumers can then query validated data in exchange for KNS tokens, making Unchained an economically autonomous platform for data validation and exchange.

Kenshi Services

Kenshi offers many services, bringing #data_integration and interoperability to #blockchain industry. In this #thread🧵, we will explain how we're goings to revolutionize the Web3.0 landscape!

[1/5] pic.twitter.com/MvHqGazINM

— Kenshi (@KenshiTech) January 18, 2024

Besides, Kenshi’s services are compatible with eight blockchains, including Ethereum, Arbitrum, Aurora, Avalanche, Bitgert, BNB Chain, Fantom, and Polygon. Accessing Kenshi’s services, such as requesting a deep indexing node, is simplified so developers can complete the process by filling out a form on the Kenshi developer’s dashboard and clicking a submit button.

$KNS Token

The Kenshi token ($KNS) serves as a utility token, allowing users to access the Kenshi ecosystem.

| Market Cap | $15M |

|---|---|

| Circulating Supply | 860,000,000 |

| Total Supply | 1,000,000,000 |

| Max Supply | 1,000,000,000 |

Key utilities of the Kenshi token include:

- Products & Services: Users can utilize the token to unlock access to Kenshi’s various products and services.

- Voting: Users can use the token to vote on community matters or influence the direction of the Unchained network.

- Unchained Nodes: The protocol implements a Liquid Proof of Stake consensus mechanism, and validators stake KNS tokens to enhance the security of the Unchained network.

- Unchained Consumers: Users can employ $KNS to access validated data stored on the Unchained network while validators obtain these tokens as compensation for maintaining an active node.

2) MUX Protocol ($MCB)

The Mux Protocol is a comprehensive suite of meticulously crafted protocols to provide traders with an unparalleled trading experience. The protocol achieves this through consolidating liquidity and comparing all underlying perpetual decentralized exchanges (DEXes), ultimately presenting traders with the optimal position.

At the core of Mux Protocol is the first decentralized perpetual trading aggregator, known as the MUX Perpetual Aggregator. This innovative tool furnishes traders with deep aggregated liquidity, cost-effective trading, leverage of up to 100x, a range of market options, and distinctive features like smart position routing, aggregated position tracking, leverage boosting, and liquidation price optimization.

What a week.💥

7D Volume on MUX soars from $1B → $1.3B! 🪁

As the market heats up, trading volume sizzles on MUX.🔥

The lowest-cost routed trades from GMX, Gains Network and the MUXLP — just a click away⚡ https://t.co/0KmPkThVrS pic.twitter.com/WmnPLAnnaM

— MUX Protocol (@muxprotocol) January 13, 2024

The MUX Perpetual Aggregator has seamlessly integrated with prominent perpetual liquidity sources such as GMX (V1+V2), Gains, and the MUX native pool. The protocol is compatible across multiple blockchains, including Arbitrum, Optimism, Avalanche, BNB, Fantom, etc. Key components within the Mux Protocol Suite include:

- MUX Perpetual Aggregator: This decentralized sub-protocol within the MUX suite automatically selects the most suitable liquidity route, minimizing composite costs for traders while addressing the requirements for opening positions. The aggregator additionally provides extra margins, optimizing liquidation prices and enabling leverage up to 100x across underlying protocols.

- MUX Native Trading Protocol: A decentralized perpetual trading protocol offering zero price impact trading, up to 100x leverage, no counterparty risks for traders, and an optimized on-chain trading experience. Traders engage with the MUX native pool (MUXLP pool) on this native trading protocol.

Notable statistics for the aggregator include $612 million in aggregated liquidity, $28 billion in cumulative trading volume, $20 million in current open interest, and $18 million in cumulative protocol income.

MUX Protocol’s Tokens

The protocol’s tokenomics encompass four tokens: MCB, MUX, veMUX, and MUXLP. $MCB serves as the primary token of the protocol. Users can lock $MCB, acquiring $veMUX in return, granting them access to protocol income and $MUX rewards.

| Market Cap | $41M |

|---|---|

| Circulating Supply | 3,803,143 |

| Total Supply | 4,803,143 |

| Max Supply | 4,803,143 |

Over the past few months, MUX Protocol has experienced significant growth, establishing itself as one of the top-tier perpetual DEXes. Concurrently, the protocol actively monitors the market dynamics to ensure competitiveness, even with CEXes, and has implemented strategies such as reducing certain fees. Nevertheless, MUX is committed to its clear roadmap, continually evolving to meet the market’s demands.

3) Timeswap

Timeswap stands out as the pioneer in oracle-less lending and borrowing protocols, facilitating the creation of money markets for ERC-20 tokens. Inherent to its design, Timeswap ensures that all loans are non-liquidatable and fixed-term, operating entirely without oracles. This unique approach eliminates the prevalent risks associated with oracle manipulation in DeFi.

1/ Gm Time Travelers 👩🏻🚀

Here's a rundown of all things Time Travel in 2023 🥳

Read more about our TVL growth, volume, partners and some sweet alpha for 2024 😉https://t.co/gVxkgqffqI

— Timeswap ⏳ (@TimeswapLabs) January 5, 2024

Currently operational across platforms such as Arbitrum, Mantle, Polygon PoS, Polygon zkEVM, and Base, Timeswap boasts several key features:

Features

- Oracle-less Operation: Timeswap’s reliance on user-driven pricing and risk management processes negates the need for oracles. It shields the protocol from Oracle manipulation attacks and allows the creation of lending and borrowing markets for a diverse range of ERC-20 tokens.

- Permissionless Access: Timeswap empowers anyone to create markets for any ERC-20 tokens, and participants can freely engage in lending, borrowing, and liquidity provision within existing pools.

- Non-Liquidatable Loans: Borrowers benefit from the security of non-liquidatable loans, enabling them to borrow against their token holdings without the constant threat of liquidation. In case of failure to repay before maturity, the protocol forfeits the borrower’s collateral.

- Fixed-Term Transactions: All lending and borrowing activities in Timeswap adhere to a predefined loan duration and fixed interest rate, providing users with certainty and transparency.

- Flexible Withdrawals: Despite being fixed-term, users, including lenders, borrowers, and liquidity providers, can exit their positions early. However, it’s essential to note that early withdrawals may incur slippage.

- Market-Driven Interest Rates: The free market determines the interest rates within Timeswap through a generalized automated market maker (AMM) inspired by Uniswap V2’s x*y=k AMM. The absence of stored historical data in the AMM ensures unbiased interest rates.

- Isolated Markets: Each lending and borrowing pool in Timeswap operates in isolation, containing risks within a specific pool and ensuring that participants are not affected by the outcomes of other pools.

- Overcollateralized Loans: Timeswap’s design, with states and the adoption of arbitrage, prevents borrowers from obtaining undercollateralized loans at any given time and price. This approach enhances security and stability for lenders.

- Immutable: As a base-layer protocol, once a Timeswap contract or pool is deployed, it remains unchanged. Nevertheless, certain protocol-level parameters, such as fee switches and token distribution, may be altered through governance once the $TIME token is live.

$TIME Token Review

Timeswap is currently in the development phase of launching its native TIME token, which enhances the protocol’s governance with active involvement from the community members. This token will enable active participation within the decentralized network, with users having the option to acquire it for involvement in liquidity provision through a dedicated liquidity mining event.

GTA 6 x $TIME pic.twitter.com/d6C340E9FG

— Timeswap ⏳ (@TimeswapLabs) December 6, 2023

As the DeFi ecosystem undergoes continuous growth and maturation, protocols like Timeswap are pivotal in addressing structural and capital inefficiencies and introducing new financial primitives to enhance the ecosystem.

4) Dolomite

Dolomite is a dapp that facilitates trustless trade settlement and provides overcollateralized loans. It distinguishes itself by refraining from assuming custody of users’ funds and offers features such as margin trading utilizing spot settlement and on-chain liquidity through AMM pools.

Notably, Dolomite excels in offering a range of financial instruments, including over-collateralized loans, margin trading, and spot trading.

With a broader vision, Dolomite aspires to evolve into a central hub for DeFi activity. It would enable various entities such as other protocols, yield aggregators, decentralized autonomous organizations (DAOs), market makers, hedge funds, and more to manage their portfolios efficiently and execute on-chain strategies.

2023 has been quite a busy year for us at Dolomite!

🤝 24 asset integrations

🎙️ 30 Twitter Spaces

✨ 48 XP campaigns

📈 7,633 unique borrow positions

🙋♂️ 9,945 unique usersBuckle up as we take a journey through everything accomplished over this amazing year 👇 pic.twitter.com/soxMnssHP7

— Dolomite 🏔️ (@Dolomite_io) December 29, 2023

In May 2023, Dolomite raised $2.5 million in a funding round led by Draper Goren Holm (DGH) and NGC Ventures. Besides, the strategic partnerships with industry leaders like ChainLink, Harvest Finance, and Arbitrum further enhance Dolomite’s capabilities.

Furthermore, Dolomite distinguishes itself from other lending protocols in the assets it supports and the features it offers to optimize user engagement. Users on Dolomite can stake, vest, and earn rewards directly from the platform’s interface, even while utilizing borrowing services or other offerings.

Importantly, Dolomite ensures that users receive the entirety of the rewards, fostering a user-centric approach. The platform’s extensive asset support facilitates complex strategies like looping and hedging that were previously unattainable.

Additionally, Dolomite has introduced Pause Sentinel, a groundbreaking feature designed to mitigate contamination risk between assets in case of issues with a particular isolation mode asset on the platform.

Dolomite’s Native Token Review

While Dolomite currently does not have its token yet, there is a possibility of a future token launch, and early users who have engaged with the DEX may receive an airdrop if the platform launches such a token.

Meanwhile, Dolomite has recently unveiled vARB, a token designated for “vote-enabled ARB,” enabling holders to participate in governance voting on the Arbitrum network. Dolomite plans to keep vARB in “isolation mode” within the protocol, allowing users to utilize it specifically for voting on Arbitrum. It is a functionality not available with ARB tokens locked in liquidity pools for lending and borrowing. Traditional ARB tokens locked in various DeFi protocols like Aave or Compound lack the capability for governance votes.

Starting today, humble $jUSDC strategists can stake their assets without paying fees!

We also are rolling out auto-staking, so all $jUSDC deposits and zaps will automatically be staked to maximize your yield 🚜🤠 https://t.co/YJ5Z6eTXNc

— Dolomite 🏔️ (@Dolomite_io) January 17, 2024

One notable advantage of vARB is its flexibility, as users can convert their ARB to vARB, enabling them to use the same tokens for voting and lending/borrowing. Additionally, vARB holders can leverage their tokens to amplify the weight of their votes. The process involves depositing vARB as collateral, allowing users to borrow more ARB. Subsequently, they can exchange the extra ARB for vARB, with this conversion possible up to five times.

Importantly, holders face no risk of liquidation due to price movements, as the value of vARB remains consistent with that of ARB.

Dolomite stands out in DeFi by offering a seamless platform for users to acquire assets and native DeFi rights and engage with unique features.

Conclusion

Arbitrum, renowned for its speedy and secure transactions, has become the preferred choice for numerous innovative crypto projects.

- Kenshi focuses on user-friendly blockchain services

- Mux Protocol provides a decentralized perpetual trading aggregator

- Timeswap pioneers oracle-less lending

- Dolomite aims to be the one-stop shop for users to engage with DeFi

The remarkable growth trajectory of Arbitrum is evident, with an expanding array of projects. The highlighted projects merely scratch the surface. So, DYOR! This is the second part of this article. Here is the first part.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.