We’re well over half a year into 2023. That’s enough for CoinMarketCap to have a look back at the first six months of this year. This is Part 1 of our two-part series on this topic.

So, let’s take a look at the state of the crypto market during the first half of 2023.

Crypto Market Overview

The CMC report starts with a crypto market overview. They kick this off with some positive news. At the end of Q2, there’s a $1.17 trillion global market cap. That’s a year-to-date increase of 48%. However, Q2 was not as strong as Q1. They noted that Q1 had stronger market narratives. For example, that’s when the Bitcoin price doubled.

Furthermore, we saw important narratives as L2s develop. For instance, Arbitrum or ZKSync. On the NFT front, we saw the Blur token issue. This signaled a strong interest in NFTs. During Q2, we saw meme coins and BRC-20 tokens rise to the occasion. However, they didn’t generate the same excitement levels as we saw during Q1.

Another interesting development was with the crypto ‘Fear and Greed’ index. The year started with ‘Fear’, measured at 30. However, towards the end of Q2, this index stood at 52, which is neutral. So, in general, the market sentiment improved during the first six months of 2023.

Let’s take a look at the top 20 crypto exchanges. They saw a peak in March in their Spot trading volume. Thereafter, it inclined by 26% quarter-to-quarter. So, by the end of Q2, it was down to $523 billion per month and almost stagnant.

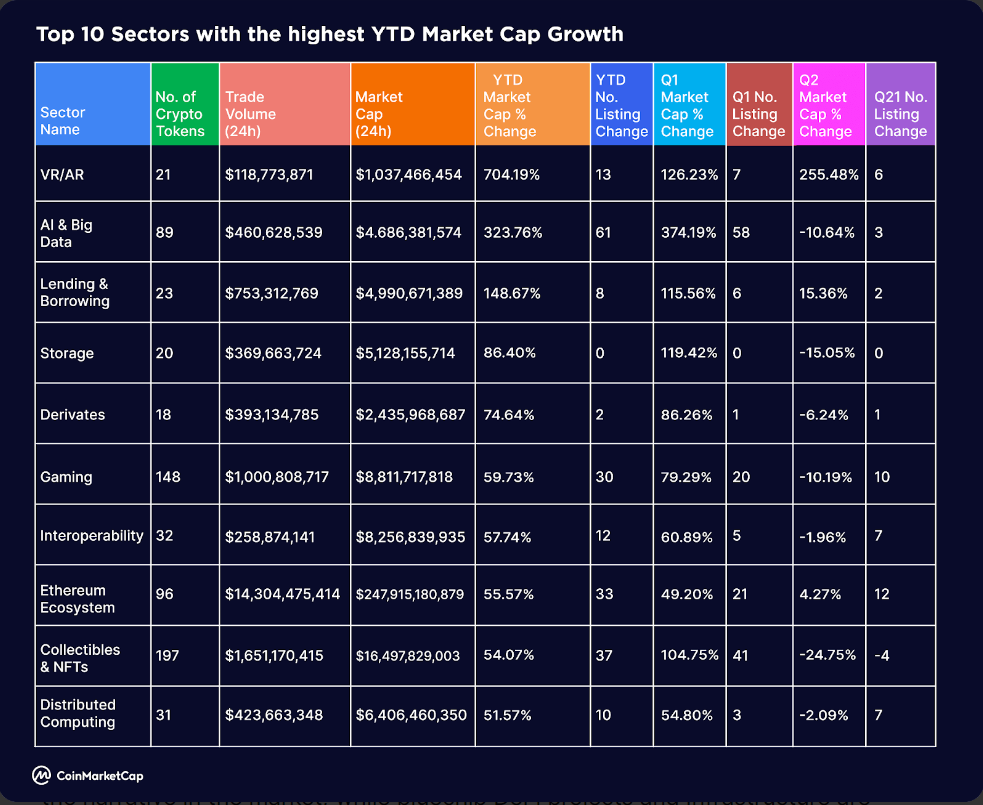

There were also some growing sectors. Especially the VR/AR narrative stood out. This sector increased by 704%. AI and Big Data came in second with a 323% growth. We also saw blue-chip NFTs and Infrastructure projects with a comeback. See the picture below. For example:

- Lending & Borrowing (149%).

- Derivatives (75%).

- Storage (86%).

- Interoperability with 58%.

We also saw 260 new meme coins listed. That was the most in all sectors. AI & Big Data ranked as #2 by adding 61 coins. DeFi added another 47 new tokens.

Key Events for Bitcoin and Ethereum

Here are some prices and key events for Bitcoin. For example:

- Bitcoin Ordinals took the market by surprise in mid-February.

- The Silicon Valley Bank collapsed in mid-March.

- MicroStrategy ended a loan agreement with Silvergate. They bought another 6,455 BTC in late March.

- The US inflation data outperformed the market forecast in mid-April. Bitcoin breaks out into $30k territory.

- In May, the BRC20 tokens hype starts.

- Mid-May sees Tether buying BTC.

- Hong Kong starts crypto legislation on 1st June.

- In early June, the SEC classified 12 crypto assets as securities.

- Mid-June sees BlackRock applying for a Bitcoin ETF.

- The end of June sees the launch of the US-based EDX Markets exchange.

The highlights for Ethereum are, for instance:

- Ssv Network launches in mid-January with a $50 million ecosystem fund. This is an open ETH staking network.

- The ERC-4337 token standard was launched. So, now you can add various users to your transactions.

- Euler receives $10 million worth of stolen ETH back from the hackers.

- Mid-April sees a successful Shapella upgrade.

- Towards the end of May, the chair of the SEC labeled Bitcoin as a commodity. However, he refuses to label ETH.

- The end of June sees the launch of Ethscriptions. This allows you to store files, images, or text under 96kb. It’s cheaper compared to storing on-chain data with smart contracts.

See the picture below for the major Ethereum events.

Understanding Crypto

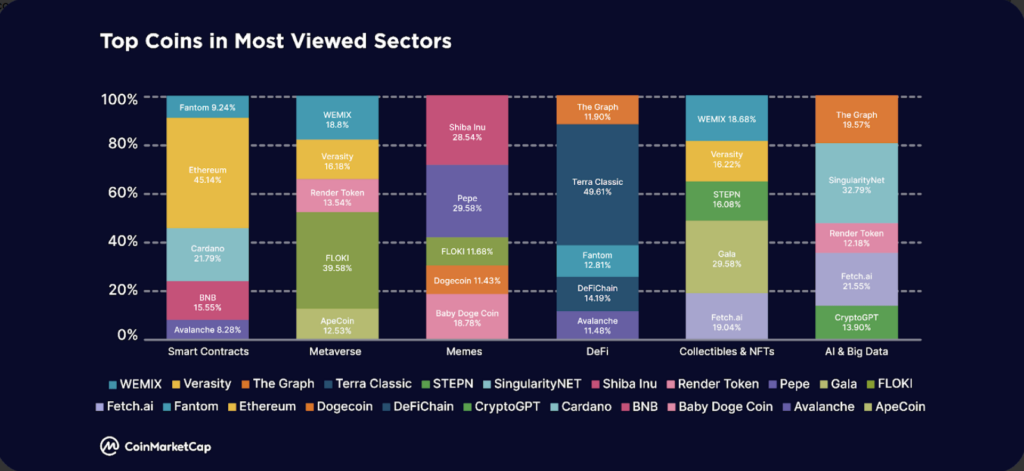

To understand crypto markets, CMC starts with the most popular sectors and coins. For instance,

- In April and May, there was a lot of interest in meme coins. PEPE started a full-on memecoin season. This token did an x3700. However, DOGE, SHIB, and BabyDoge remain the most popular meme coins.

- DeFi secured the second spot. Terra Classic (LUNC) attracted quite some interest. For instance, Binance helped by burning 2.65 billion LUNC tokens. They were worth $236,000.

- In Q1, there was an increased interest in NFTs. The airdrop for Blur Season 1 sparked this. However, during Q2, this interest faded again.

- AI and Big Data also made a grand entrance. The ChatGTP launch attracted a lot of attention. During June, AI-related tokens started to surge again. SingularityNET (AGIX) and Fetch.ai (FET) did well.

See the picture below to find the top coins in the most viewed sectors.

Conclusion

This is Part 1 of a 2-part series about the state of the crypto market in Q1 and Q2, 2023. We looked at the crypto market overview, and major events for Bitcoin and Ethereum. Understanding crypto markets is also part of this. In Part 2 we elaborate further on this topic.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.