This is Part 2 of a 2-part series about the state of the crypto market in Q1 and Q2, 2023. CoinMarketCap made a report on this. We will look at the most engaged communities in the crypto market and key themes for H2 in 2023.

Here’s the Part 1. So, let’s take a closer look at the state of the crypto market in the first half of 2023.

Most Engaged Communities on CoinMarketCap

CoinMarketCap has a community section on its website. They keep track of the most active communities and sectors. With the meme season raging full-on in April and May. This section had the most engagement. PEPE, SNEK, and LADYS took the lead here. They also had incredible pumps.

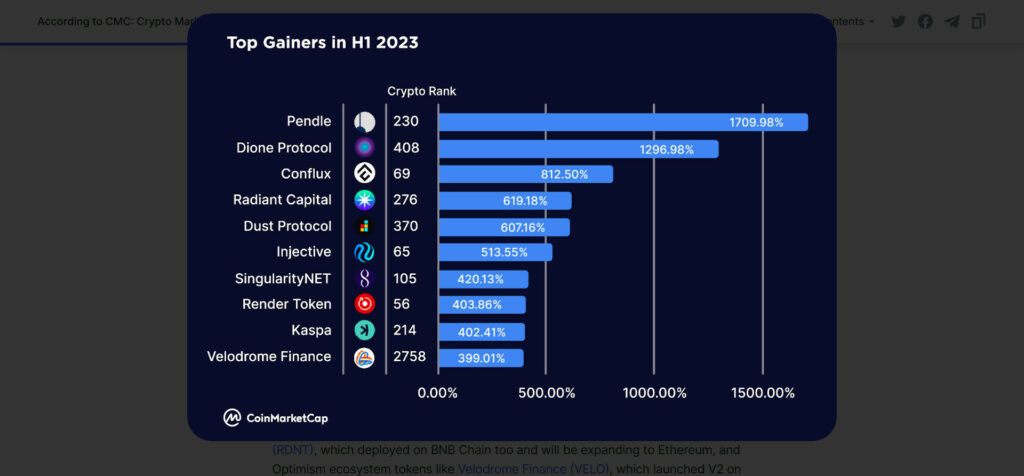

Other tokens that did well are tokens from the Arbitrum ecosystem. For example, Pendle (PENDLE) or Radiant Capital (RDNT). You can find these two tokens on the BNB chain. Radiant is also deploying on Ethereum. PENDLE gained 1709.98% and Radiant 619.18%.

Optimism projects and tokens also fare well. For instance, Velodrome Finance (VELO). This project launched its V2 in late June and gained in a short time frame 399%.

Dione Protocol (DIONE) was also high in the engagement ranking. It’s a layer 1 chain that focuses on renewable energy. It gained no less than 1296.98%. The reason was the launch of their Odyssey Testnet beta. They came in second-best after PENDLE.

Other projects that did well are Conflux (CFX) and Injective (INJ). They rallied respectively with 812.5% and 513.55%. Conflux rallied as part of the Hong Kong legislation. Injective is an L1 built on Cosmos and part of the IBC. It caters to financial projects. AI-tokens also did well. For example, SingularityNET (AGIX) with 420.13% or Render (RNDR) with 403.86%.

Source: CoinMarketCap

Important Topics for H2-2023

With H1 behind us, it’s time to look forward to some important topics in H2. Here’s a list of these topics, with, for instance,

Bitcoin ETF

BlackRock filed for a Bitcoin spot ETF in June 2023. They are the world’s largest asset manager. Out of having applied for 575 ETFs, they only had one rejected. On the other hand, the SEC has declined all spot ETF applications so far. So, this will be an influential application by BlackRock. Within a week after BlackRock filed, various other companies also filed for a spot ETF with the SEC.

Providing the SEC approves these ETFs, it can be an impulse for institutional money to enter BTC. The next step is that BTC will reach a new ATH. The latest deadline for the SEC to approve or decline this application is 23rd February 2024.

Real-World Assets (RWA)

Projects that offer RWAs are plentiful. It’s a popular narrative with good prospects. For example, you can secure loans or financing. Another popular option is to tokenize RWAs. For instance, real estate, stock, or intellectual Property. Goldfinch or Tangible are RWA projects. The expectation is that they will become and stay popular well beyond 2023.

Liquid Staking Derivatives (LSD)

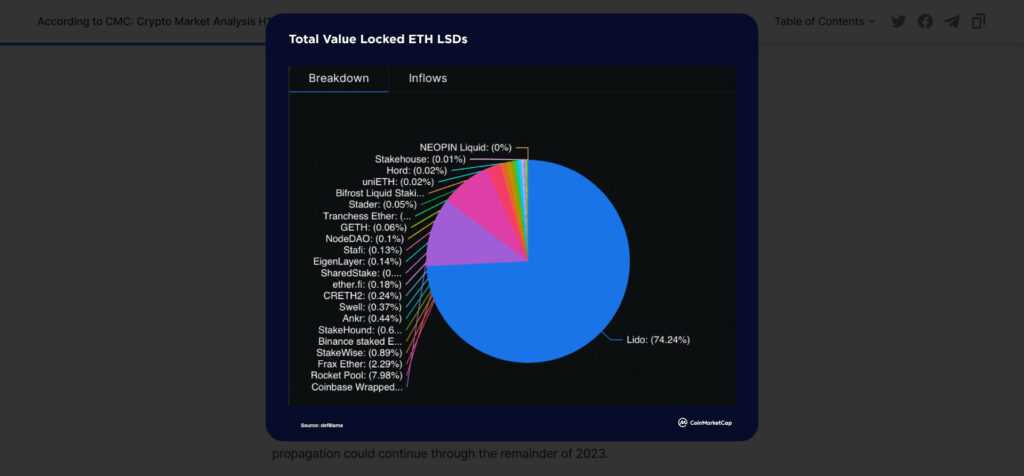

After the Ethereum Shapella upgrade, LSDs saw a surge. Lido and Rocket Pool are the current market leaders. Their respective TVL went up by 138% and 220% during H1. Towards the end of H1, LSD platforms saw their stake in ETH TVS (Total Value Secured) grow to a third. At some stage, Lido even had 75% captured at its height.

LSDfi also took a turn for the better. For example, protocols like Pendle, Lybra, or Flashstake saw their TVL go up. It may be worthwhile to keep an eye out for LSDfi during H2.

Restaking

Restaking allows you to reuse staked ETH or liquid staked ETH on the consensus layer. The EigenLayer protocol started this. In other words, you can earn extra yield by restaking your assets elsewhere.

EigenLayer deployed their restaking smart contracts in June 2023. Their limits maxed out within a day after launching. Their restaking capacity is about to increase. This may attract new platforms on the restaking scene.

ZkSync

ZkSync is an L2 solution that uses zero-knowledge rollups. This allows you to prove something without revealing important information. In March, it launched its mainnet, zkSync Era. This was the first zkEVM that reached that went live on a mainnet.

Towards the end of H1, its TVL was $686 million. That is still behind Arbitrum with a TVL of $5.66B and Optimism’s $2.12B TVL. However, it started to catch up.

1.1 million unique wallet addresses are active on the platform. It also has already clocked well over 1.38 million transactions. There’s a potential airdrop coming up, and many projects will launch on zkSync. These are all ingredients that can make zkSync an influential player in 2023 and beyond.

Modular Blockchains

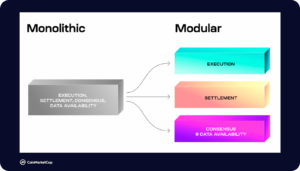

A modular blockchain breaks up and delegates the three main responsibilities to other chains. These can be sidechains or L2. The responsibilities are,

- Transaction execution.

- Consensus.

- And data storage.

This makes them more scalable, composable, and decentralized. Celestia is a sample. On the other hand, Ethereum or Solana are monolithic chains. These chains themselves take care of all three responsibilities.

Source: CoinMarketCap

Worldwide Crypto Users

Bitcoin remains the most viewed cryptocurrency on CoinMarketCap. We can also see growth in Bitcoin’s dominance from 40.09% to 50.39% in H1. BlackRock’s ETF filing and the Bitcoin halving in 2023 may contribute to this.

Shiba Inu (SHIB) remains the most popular meme coin. Baby DogeCoin (BabyDoge) is also popular. Ethereum, Polygon, and Arbitrum are also doing well, in various regions.

Most crypto users are in the US. They generated 17.4% of all traffic in H1. Followed by users in India, Turkey, Germany, Brazil, and Vietnam. However, the second-placed India didn’t manage to reach double digits with 7.9%.

Conclusion

This is Part 2 of a 2-part series on the state of the crypto market. We covered the most engaged communities, important topics for H2, and worldwide crypto users. Here’s a Part 1.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.