Constructing and growing a crypto portfolio should be every crypto investor’s top priority. With a good portfolio, you can manage your own risk appetite. All while getting the best gains from the risk you’re taking. Now, whether you’re a Bitcoin Maxi or a micro-cap degen, this article is for you.

Today, we’re taking a look at the top 8 mistakes people make in creating a crypto portfolio. For this article, we’ll be taking reference from the tweet below from Mr Shetty. Note these mistakes as you could be making them right now! Rectify them in time, and you could be saving yourself from unnecessary losses.

Before we begin, do note that the mistakes we discuss below are not financial advice. So, do your own research before investing in crypto!

Mistake #1 – Over or Under-Investing in Crypto

Imagine if you’re a retiree and you’ve got a million dollars in savings. You invest all of it into a memecoin called RocketInuPoopCoin after it’s done a 10x. Then, it goes to zero. Or, imagine you’re in your late teens with a thousand dollars in savings. You invest $50 into Bitcoin, hoping it does a 100x. In both cases, the retiree and the teenager aren’t taking the right risks.

- The retiree is taking too much risk by over-investing. Also, he or she is investing in the high-risk tokens.

- The teenager is taking too little risk by under-investing. In the unlikely case that $BTC does a 100x from here, he makes a profit of only $5,000.

So, what’s the solution? How much of our wealth should we invest in crypto? Well, it depends on your situation, age and risk appetite. In a nutshell, Mr Shetty believes that your crypto investment “should not keep you up at night“. That’s a statement we can agree with.

Aside from that, you can use this handy formula: (100 – age) = % of wealth for crypto. For instance, let’s say that I’m 50 years old this year. With this formula, I can risk 50% of my wealth in crypto. However, we feel that this formula is for someone with a really high risk appetite. You could adjust it a little to suit your investment preference.

Mistake #2 – Preserving VS Growing Your Wealth

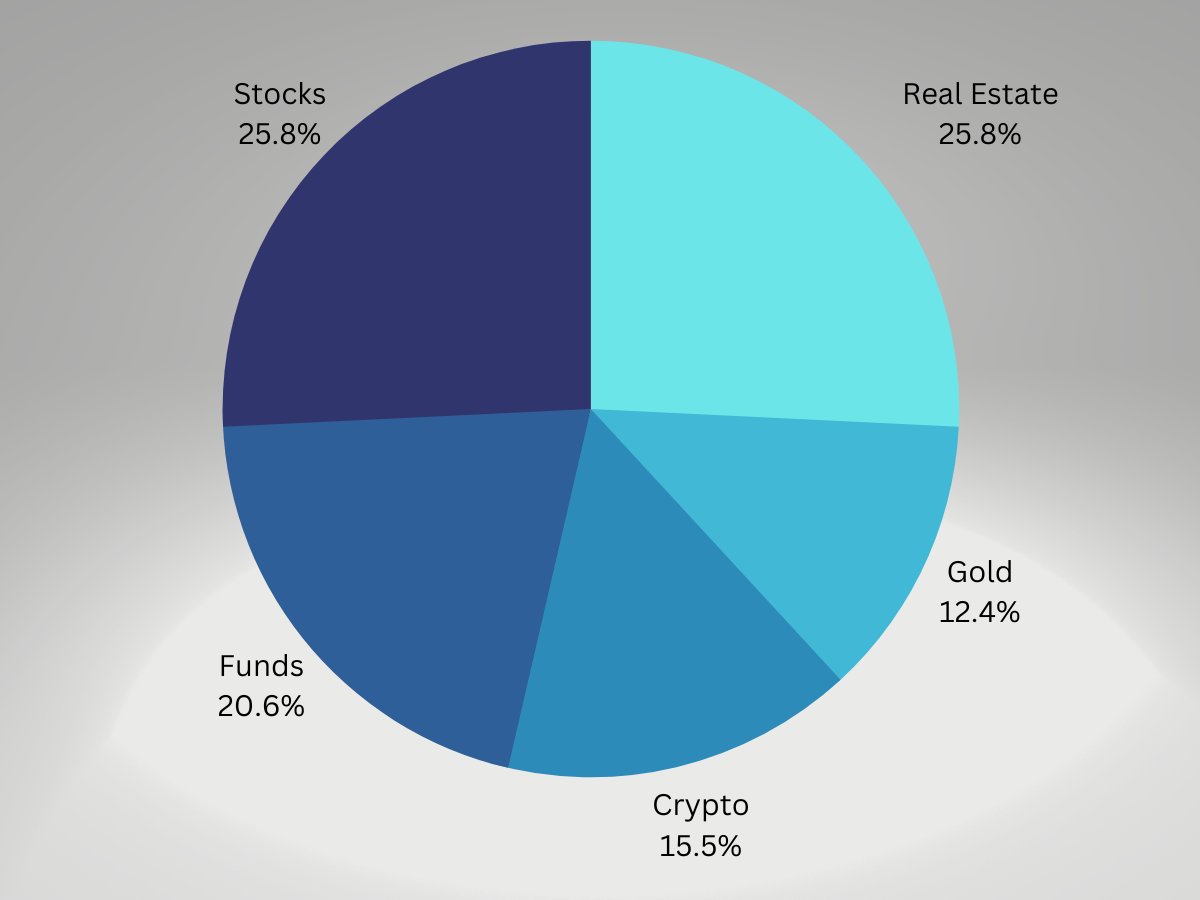

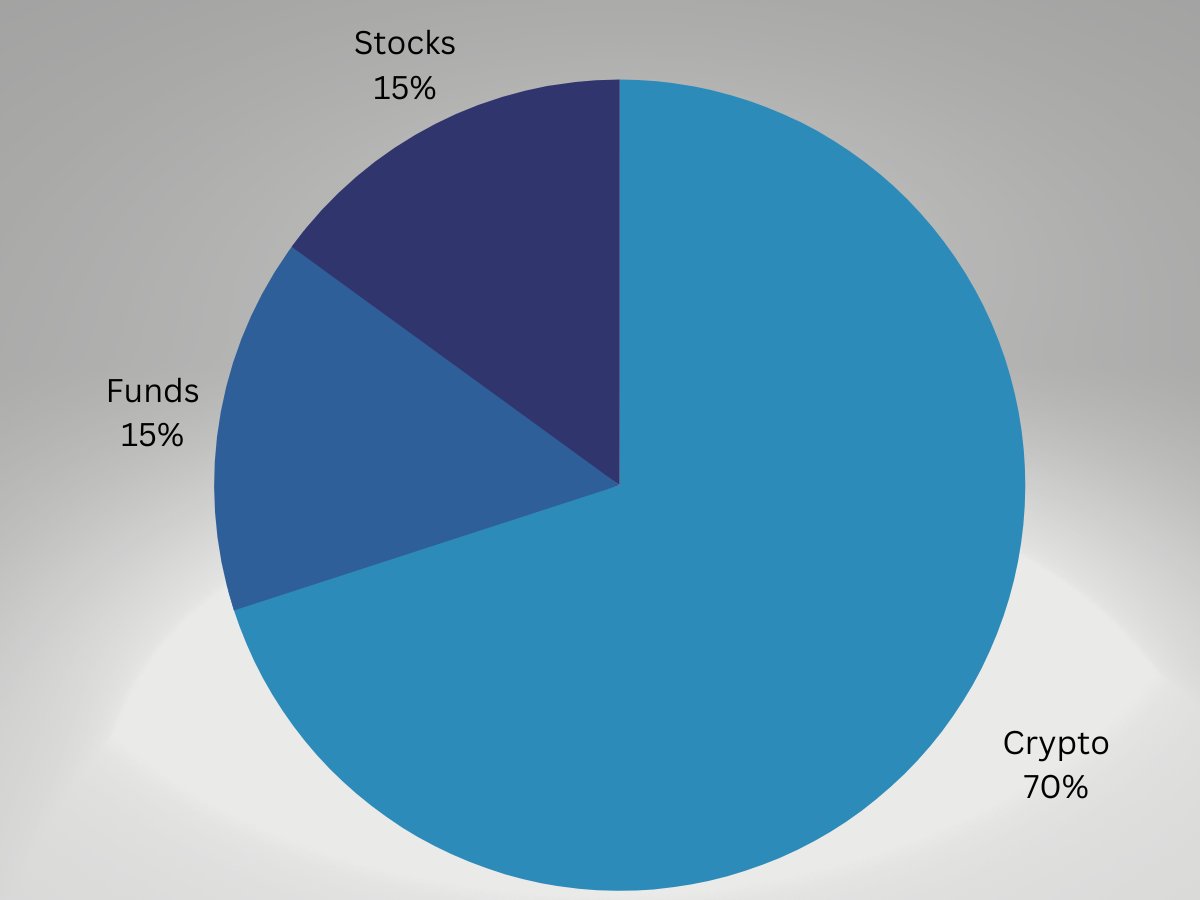

When building your crypto portfolio, you’ve got to understand its main purpose. Crypto is meant to grow your wealth. Not to preserve it. Now, take a look below at two portfolios below.

In the above portfolio, the goal is to beat inflation, while keeping risk to a minimum. With that, there is a lower percentage allocation to crypto. Moreover, some funds are allocated to Gold and Real Estate.

In comparison, this portfolio above has a high crypto allocation. It focuses on growth that far exceeds the rate of inflation. However, such a crypto portfolio will experience high price volatility.

All in all, you’ve got to allocate funds to crypto based on your end goal. Aim to grow your wealth quicker? Put more money into crypto. Want to play it safe instead? Then put less into crypto. Simple.

Mistake #3 – Over-Diversifying in Crypto

You may find the task of managing your crypto portfolio overwhelming. If this is so, you may be over-diversifying. When you hold too many assets, you can’t keep up with the news on these cryptos. The top 2 signs below indicate that you’re over-diversifying:

- You don’t know what crypto assets you hold,

- You’re apeing into coins that you have not research into.

- You hold coins from over five sectors in crypto (E.G. DeFi, NFTs, Gaming etc).

So, how do we avoid over-diversifying our crypto portfolio? First, identify your own niche or circle of competence. Then, pick your winners in that niche and allocate more funds to these. It’ll be easier to keep up with news and developments when you focus on a few niches.

There are many benefits to staying within our Area of Expertise

– You can learn everything about the Sectors

– You can keep up with the News

– Easy to dig deeperThis helps to spot an alpha and be early to a project

Most gains are made by being early to a Narrative & Project pic.twitter.com/p6oor9U6TS

— Mr Shetty (@TheMrShetty) July 10, 2023

Mistake #4 – Having Wrong Expectations About Returns

Of course, you can’t benchmark your returns in crypto with single percentage gains. Similarly, don’t benchmark against the bank deposit rate or index funds rate. If you’re managing your crypto portfolio actively, your returns will far exceed these.

The more effective solution would be to benchmark your gains against $ETH‘s returns. For example, let’s say $ETH did a 4x this bull run. If your portfolio did a 5x, you did well in comparison.

Mistake #5 – Knowing the Difference Between Bull and Bear

Here, Mr Shetty preaches that your crypto portfolio should adapt to different markets. In short:

- During a bull market, your portfolio should be aggressive.

- In contrary, during a bear market, your portfolio should be defensive.

You can view the differences in the two portfolios below.

However,

Look at his current Portfolio (Bear Portfolio)

He has moved all his money back to

– Bitcoin

– Ethereum

– StablecoinsA few high-conviction low-risk projects, which he thinks might do well in the next Bull Market

I now hold most of my wealth in Bluechip and Cash. pic.twitter.com/gkVoMvgR1p

— Mr Shetty (@TheMrShetty) July 10, 2023

Basically, an aggressive portfolio should contain more mid to low-cap altcoins. A defensive one should hold more $BTC, $ETH and stablecoins. However, we disagree to a certain extent. You can’t be entirely out of the altcoin market. There’re gains to be made during the bear too!

Mistake #6 – Allocating Funds to Coins Wrongly

Indeed, it isn’t wise to be holding 100% memecoins in your crypto portfolio. Yet if you hold only $BTC and $ETH, your gains will be really limited. That’s if you compare against mid or low-cap coins that do 50x or more.

So, what’s the solution? Well, we’re on the same page with Mr Shetty on this. We think investors should:

- Have a higher percentage of your portfolio in blue chip cryptos (E.G. $BTC, $ETH, $BNB). For instance, 50% for starters is great.

- Then, have a mix of low and high-risk coins for the remaining 50% allocation.

A good allocation is shown in the tweet below.

The other 50% can be

Let's say

Low Risk- 20%

Medium Risk – 15%

High Risk – 10%

Degen Plays – 5%If any of the categories are imbalanced then

We can move the profits back to Bluechips to balance it

We may have to balance more often during Bull Market than Bear Market.

— Mr Shetty (@TheMrShetty) July 10, 2023

Mistake #7 – Mis-Reading the Psychology of Market Cycles

In every crypto market cycle, there will be new favorite coins. Indeed, you should be doing only one thing to get ready for the bull market. Buying these coins before they become the next bull cycle’s favorites. Here, Mr Shetty states that many of the previous favorites did not perform well after their first bull cycle.

Hence, take that into mind when buying and holding tokens which’ve had their run. You can find some of these tokens in the tweet below.

Most old projects might not reach their previous ATH.

Because,

Retail investors prefer newer projects over older ones.

Having enough money to buy these new projects can make or break our Portfolio

Last year, I made the mistake of buying older projects on every dip possible.

— Mr Shetty (@TheMrShetty) July 10, 2023

Mistake #8 – Not Having an Emergency Fund

For the last mistake for your crypto portfolio, many investors do not have an emergency fund. As the name states, it’s for emergency purposes like loss of income or accidents in your personal life. You could also treat it like a fund to buy crypto coins when they fall in price.

Nevertheless, it’s always wise to hold some stablecoins in your crypto portfolio. Again, what percentage of stablecoins to hold depends on many factors like:

- Bull or Bear market.

- Your personal risk appetite.

- Your investment goal (growth or preservation), and so forth.

Conclusion

With the wisdom from Mr Shetty’s tweet, we hope that you can learn from these mistakes. Now, you could be already making these mistakes. Or you could already have the perfect crypto portfolio. Nevertheless, it’s good to learn from the mistakes of others, to prevent losing money in the crypto market.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.