If you have been around in DeFi, you most likely have heard of impermanent loss. It’s a term that keeps coming back when you research yield farming and liquidity pools.

But what causes impermanent loss, and can you avoid it? We are going to have a closer look at what impermanent loss is.

How Does Impermanent Loss Happen?

You can find most liquidity pools in an automated market maker (AMM). Your typical deposit into a pool is an equal part or 50/50. The number of tokens in a pool and how many LPs (liquidity providers) are important. They can tell you something about the IL risk. Most pools consist of an ERC-20 token like Ethereum and a stablecoin like DAI. This gives less exposure to IL than for instance an ETH-SUSHI token.

It is also essential to understand that the token prices, in a pool, depend on the ratio between the tokens. They don’t depend on the price of an external market. This is because an AMM uses an algorithm to calculate the asset price.

What Is Impermanent Loss?

Impermanent loss is when you add liquidity to a pool, and the price of one of the assets changes. It is a phenomenon that only happens in DeFi liquidity pools. For example, with yield farming. So, once the price of your deposited token changes from the price at the time when you deposited the token, you have impermanent loss. Now, it doesn’t matter if the price change is positive or negative. However, the bigger the price change is, the higher the impermanent loss will be.

The reason it’s called impermanent loss is that it is a loss on paper only. In other words, as long as you leave the tokens in the pool, the loss is impermanent. After all, the price of the tokens can go back to the original price at deposit. At that moment, there is no more talk of IL. It only becomes a permanent loss once you withdraw your deposit from the pool.

So, why would you still add liquidity into a pool? Well, the answer is relatively easy.

- You can make more money from trading fees. This will offset the IL.

- If you receive LP tokens, you can invest them again. Now you receive yield from two sources. Your original pool and from the farm where you deposit the LP tokens.

Impermanent Loss Example

To show you how impermanent loss happens in DeFi, we’ll give you a sample. That’s usually the best way to understand a concept. Don’t worry, we keep it as simple and easy-to-understand as possible.

- In a Uniswap pool, you stake 1 ETH and 100 DAI.

- After a week, the price of your ETH is worth 200 DAI.

- If you had kept 1 ETH and 100 DAI without adding them to a pool, you gained 50%. That’s because ETH is now worth 200 DAI.

- In case you take part in the ETH-DAI Uniswap pool, you make less gains. That is, when compared to the 50% if you didn’t take part in that pool.

Source: Pexels Alesia Kozik

Impermanent Loss in Numbers

So, now you have 1 ETH and 100 DAI that are worth $200 in the pool. You deposit 50/50, so $100 in DAI and $100 in ETH.

The value of the pool is 10 ETH and 1,000 DAI. This makes your share of the pool 10%. Total liquidity of this pool is $10,000.

Now, let’s say that in a week’s time, the price of 1 ETH goes up to $400. This increases the ratio of ETH over DAI. As a result, arbitrageurs come in to play, and they balance the pool again. However, the ratio change also affects the value of both assets. So, to find out if you suffered IL, you need to withdraw your 10% share from the pool.

Because of arbitrage, the pool is now 5 ETH and 2,000 DAI. Instead of 1 ETH, you now have 0.5 ETH.

0.5 ETH x $400 = $200. Plus, your 10% DAI share is also $200. In total, you get $400 out of the pool, so a nice profit of $200.

However, if you had kept your ETH and DAI, you would have made $400 profit on your $100 ETH. Plus, you still had your $100 worth of DAI. In total, you would have $500. This is a profit of $300.

Compared to joining a liquidity pool, you would have made $100 more profit by hodling your coins. This shows clearly what difference impermanent loss can make.

How Can You Avoid Impermanent Loss?

There are a couple of ways how you can avoid impermanent loss. We are going to show you a few of these options here.

Avoid risky and volatile pools

Yes, we know, these pools probably give the highest yield. However, at the same time, they’re also the most volatile and risky. Many times, these are new tokens. Their price can go up or down rather quickly, which leaves you exposed to IL. ETH and WBTC are also volatile at times. But not anywhere near as volatile as many smaller coins.

Provide liquidity for same-pegged assets

In general, we are talking stablecoins here. Because they are one way or another pegged to the USD, price changes are not high. For example, USDT, USDC, BUSD, or Dai. In this case, a USDT-DAI pool will have hardly any to no IL at all. The reason being the assets don’t move much in price.

However, this also covers other pegged assets like sETH and stETH, which peg to ETH. Another sample is WBTC and renBTC. They peg to BTC.

One-sided staking pools

Various platforms offer single-sided staking. Bancor, Trader Joe, and Liquity are just a few samples.

With Bancor, you provide liquidity to a pool, and the other asset will be the Bancor BNT token. Bancor provides this asset. By doing this, Bancor eliminates the risk of IL since you only deposit one token.

Trader Joe offers you an LP token when staking Joe, like rJoe, sJoe, veJoe, or xJoe. Each new Joe token has different benefits and requires a different strategy.

Reminder that our single-sided xJOE farm is live!

✅ No risk of IL

✅ 375%+ APR (or 4000%+ APY)To learn how to stake your JOE to xJOE, check out our tutorial: https://t.co/p1nSFYfcx0 pic.twitter.com/XXqzQzfKB3

— Trader Joe🔺 (@traderjoe_xyz) August 5, 2021

Deposit in uneven liquidity pools

The Balancer platform offers this. You can join pools that have an 80/20 or even a 95/5 weighting. Although they may not cut IL, they reduce the risk and impact of IL.

Impermanent Loss Calculator

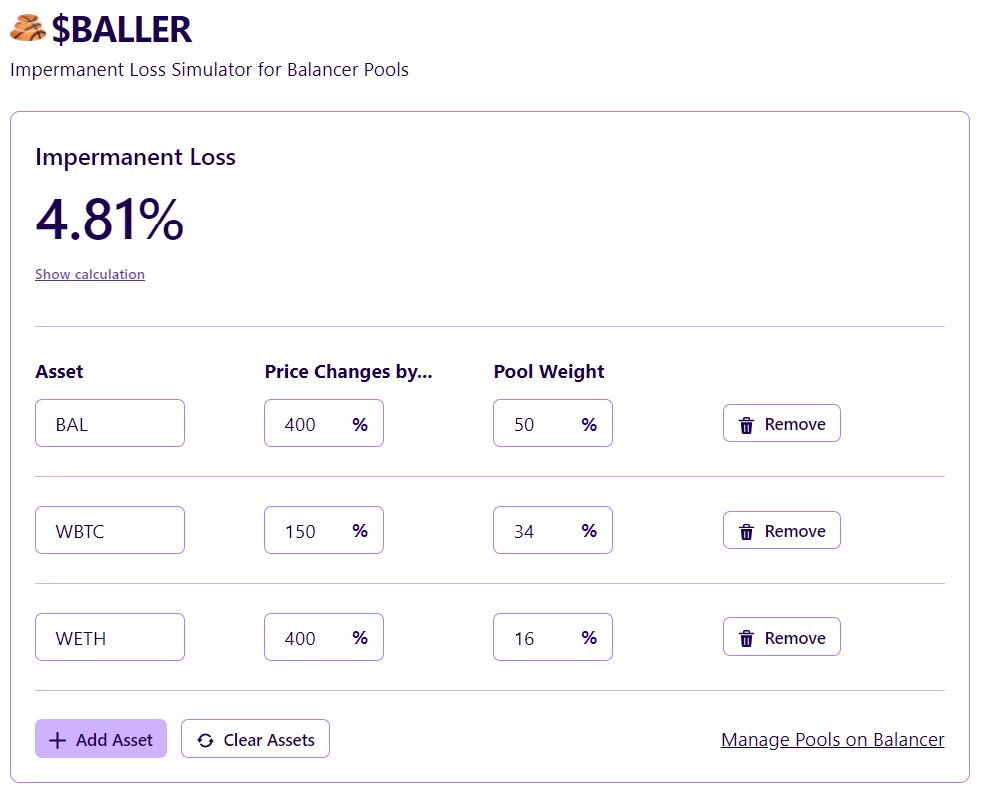

To make live easy, there are various IL calculators out there. CoinGecko has a good one. Or if you like one with sliders, use this calculator. If you use Balancer or any other pool with more than two tokens, Baller has a calculator just for that reason. See the picture below.

Source: Baller

Conclusion

Here we are, with an explanation of what IL is. We also gave you a sample of how impermanent loss works. Furthermore, we gave you access to a few impermanent loss calculators. There are also a few ideas of how you can avoid or minimize IL. We kept it as easy and simple as we can, to give you a better understanding of impermanent loss.

⬆️Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.