Crypto lending stands out as a highly prosperous and extensively utilized DeFi offering, with numerous crypto exchanges and platforms providing borrowing and lending services.

THORChain, the decentralized cross-chain liquidity protocol, has introduced a groundbreaking Lending design featuring zero expiry, zero liquidity, and zero interest. As recent events witnessed the collapse of prominent players like Voyager Digital, BlockFi, and Celsius, the question arises: Can THORChain’s upcoming lending model forge a new paradigm and bring stability to the crypto lending landscape? Let’s dive in!

What Is THORChain?

THORChain is a decentralized cross-chain liquidity protocol enabling seamless asset swaps across various blockchain networks. It functions as a settlement layer, facilitating smooth exchanges between eight prominent chains: Bitcoin, Ethereum, Binance Chain, Avalanche, Cosmos Hub, Dogecoin, Litecoin, and Bitcoin Cash.

The real deal.$WBTC unwrapping to $BTC, no custodian checks, no KYC, no gate-keeping.

Unwrapping at a rate of 1:0.997 (fees included). pic.twitter.com/IV6QB0SnU2

— THORChain (@THORChain) August 11, 2023

Embracing the foundation of liquidity pools, THORChain revolves around three crucial financial primitives:

- Asset Swapping: Users can efficiently swap {Asset X on Chain A} to {Asset Y on Chain B}.

- Asset Saving: THORChain allows users to securely store {Asset X on Chain A}.

- Asset Lending and Borrowing: Users can lend {Asset X on Chain A} and borrow {Asset Y on Chain B}.

Employing Tendermint, the Byzantine Fault Tolerant engine empowering Cosmos, THORChain operates on a Proof-of-Stake blockchain, where network validators must bond RUNE tokens. Validators face potential punishment through token slashing for misbehavior, acting as a strong deterrent.

Additionally, network nodes play a vital role in creating vaults and validating transactions within the system. THORChain’s key selling points encompass the following:

- The ability to directly exchange native assets across multiple chains, exemplified by native BTC to ETH swaps

- No user registration; executing a transaction suffices to engage with THORChain.

- THORChain eliminates the need for wrapped assets, ensuring all assets remain natively secured.

- Transparent and equitable pricing, avoiding reliance on centralized third parties.

- The protocol maximizes its efficiency through continuous liquidity pools.

First DEFI 2.0 protocol : @THORChain

✅ Multi chain liquidity

✅ 0.1% slippage multichain swaps

✅ Lending & borrowing

✅ Single side yield on $btcIn the mail :

📨Decentralized Perps

📨DEX orderbook

📨Decentralized algo stableIdea : decentralized wbtc

— TCB (@THORmaximalist) August 10, 2023

What Is $RUNE?

$RUNE serves as the native token of THORChain, playing a crucial role in upholding the ecosystem by offering essential economic incentives that safeguard the network. Moreover, all liquidity within the system is connected to the RUNE token.

Additionally, THORChain nodes must meet specific participation criteria, requiring them to contribute a designated amount of $RUNE. Furthermore, THORChain $RUNE finds utility in paying transaction fees within the network and participating in the governance and management of THORChain’s operations.

ThORChain: More Than A Protocol

THORChain transcends being just a protocol; it represents a comprehensive ecosystem that addresses the prevalent challenges cryptocurrency exchanges face today.

The creators of THORChain envision an inclusive ecosystem that remains chain-agnostic, accommodating all existing digital assets, even those yet to emerge. This approach ensures THORChain is not competing with other exchanges and protocols but aims to establish a unified and liquid decentralized network at its core.

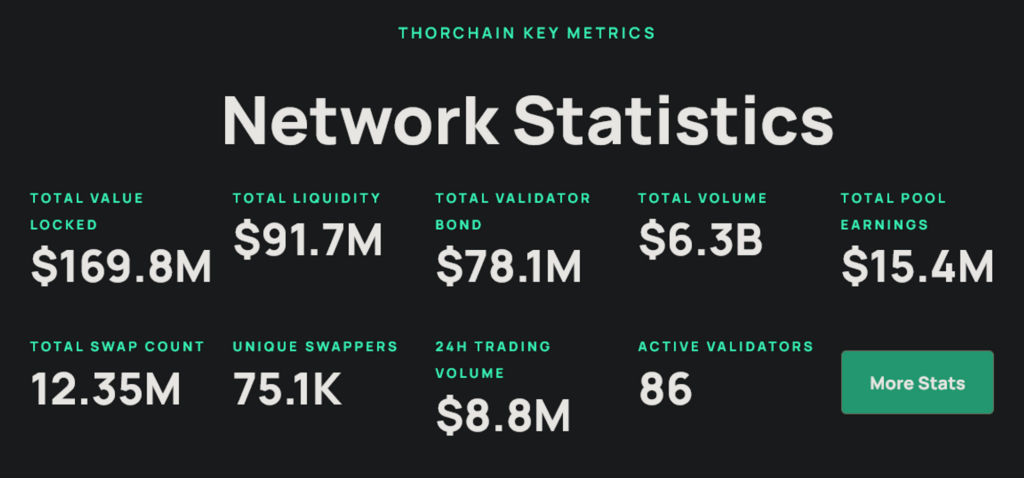

Source: THORChain

The decentralized nature of THORChain empowers it to tackle these issues trustlessly, potentially rendering third-party involvement in the exchange ecosystem obsolete over time.

As a result, THORChain emerges as a pioneering force capable of providing solutions while fostering greater efficiency and inclusivity within the cryptocurrency space. One such solution is the upcoming lending model.

Is THORChain Reinventing Lending?

Next feature for THORChain is lending.

5m RUNE collateral cap; BTC, ETH as collateral.Who's ready for no-interest, no-expiry, no-liquidation L1 loans?

Some big claims, let's get it. $RUNE

— THORChain (@THORChain) July 28, 2023

THORChain envisions its Lending feature to function similarly to other decentralized money markets, taking inspiration from pioneers like MakerDAO on Ethereum. However, what sets THORChain’s Lending design apart is its groundbreaking approach, offering unparalleled features such as zero expiry, zero liquidity, and zero interest (with potential slippage during loan initiation or closure).

How Will THORChain Lending Work?

THORChain’s approach diverges from other competing decentralized money markets as it does not mandate over-collateralization due to the volatile nature of cryptocurrencies.

In this innovative model, borrowers deposit collateral and acquire debt at a collateralization ratio (CR) determined by the market. The collateral limits and CR increase as users initiate more loans on the platform. As the collateralization ratio increases, the system’s safety improves proportionally.

Very soon:

Deposit 1 BTC worth $27k

Withdraw $13.5k in USDT*Never get liquidated, never pay interest, never have to pay it back (unless you want to).

* Collateralisation rate set by the market

— THORChain (@THORChain) May 24, 2023

Unlike other platforms, THORChain clarifies that it will use TOR, a stablecoin tracking USD value regardless of the collateral type, to denominate the debt.

Notably, TOR is non-transferable and always has a market cap of $0. The platform derives TOR’s valuation by computing the median price from the active USD pools.

THORChain will implement collateral constraints and incorporate risk management strategies, such as slip-based fees when initiating and settling loans, dynamic CR, and a circuit breaker on RUNE supply.

The platform highlights that loans can be repaid at any time and in any supported asset, with all repayments automatically converted into TOR. Nevertheless, this design raises several critical questions that demand clarification:

1. Who Provides the Assets Borrowed in THORChain?

Assets are sourced through swapping $RUNE with the borrowed asset via liquidity pools, subsequently delivered to the borrower. As long as the pools remain operational, there will always be available assets for borrowing. The depth of the pool determines the level of slippage encountered.

Keep in mind that these liquidity pools operate independently of the lending system. As long as the pools remain healthy and operational, any assets withdrawn through lending will trigger arbitrageurs to rebalance them (as they typically do).

2. Who Manages the Collateral In THORChain?

The collateral is swapped for $RUNE through the pools, implying that no single entity “holds” the collateral. The pools remain resilient and dynamic, ensuring arbitrageurs rebalance the collateral deposited as usual.

3. What Happens if the Collateral Value Decreases In THORChain?

When the platform initiates the loan, the collateral is already swapped through the pools, dissociating THORChain from any concern or risk associated with collateral value drops. This strategic detachment facilitates the achievement of a zero-liquidation design.

4. Who Acts as the Counterparty in THORChain?

The core of the lending design revolves around the $RUNE burning/minting mechanism.

Essentially, all $RUNE holders collectively become the counterparty to borrowers. Opening loans result in $RUNE burning, distributing value to all $RUNE holders. Conversely, when loans are closed, the same $RUNE holders bear the consequences of $RUNE minting.

Another perspective is that the entire THORChain protocol effectively underwrites the loans. The lending mechanics can continue functioning as intended as long as the RUNE token holds value.

5. What are the risks in THORChain’s Lending?

One evident risk involves excessive minting of $RUNE during more loan closures compared to loan openings. This scenario potentially arises if the $RUNE to Collateral price ratio decreases between overall loan opening vs. loan closure.

Besides, a circuit breaker design exists to address the risk of $RUNE supply surpassing 500 million. In this scenario, Reserves intervene to redeem the loans instead of further minting, leading to the halt and sunset of the lending design while allowing other aspects of THORChain to continue unaffected.

Some other notable risks include smart contract vulnerabilities, regulatory uncertainties, and market volatility. Risks concerning the lending design are always subject to heated debate!

6. What Are the Benefits of This New Lending Model For THORChain?

Looks like we are go for launch.

THORChads – ready to borrow against your L1 bluechips?

Get on @Lends_so https://t.co/MWMDDjvhJ8

— THORChain (@THORChain) August 3, 2023

The benefits of Lending for the THORChain protocol include the following:

- Increased Capital Efficiency: Lending enhances the capital efficiency of the pools, leading to higher system income and real yield.

- Additional Trading Volume: Lending creates more trading volume within the ecosystem.

- Increased Total Bonded: Lending encourages more assets to be bonded, facilitating the scalability of THORChain.

- Attractive Capital Sink: Lending provides an appealing destination for capital.

How Will the New Lending Model Impact $RUNE?

Only L1 bluechips are eligible for loan collateral.

Specifically, the ADR will rule out RUNE as collateral. RUNE as collateral would be rugger-central (standard playbook).

THORChads are not here for a quick one, they're here to build what is needed. https://t.co/iCnQuSHuLC

— THORChain (@THORChain) August 3, 2023

THORChain Lending will have a deflationary impact on $RUNE whenever users create new loans, while loan repayments generate an inflationary effect.

There will be no net effect if the collateral price remains unchanged relative to $RUNE during loan creation and closure. This equilibrium results from the fact that when the loan is closed, the platform mints the same amount of $RUNE burned during loan initiation (minus the swap fee).

Nevertheless, if the value of the collateral asset rises compared to $RUNE from when the loan is opened to when it is closed, it will lead to net inflation of the $RUNE supply.

What Could Happen In Bull Market with THORChain?

In a bull market, the lending dynamics within THORChain can have intriguing implications for the $RUNE asset.

As more users engage in lending during a bull market, lured by optimistic market sentiments and potential opportunities, the effects on $RUNE can be magnified. The heightened demand for loans may lead to the THORChain burning more tokens, contributing to a deflationary effect on $RUNE.

On the other hand, the increased demand for loans may also result in more loans being closed, leading the platform to mint an additional amount of $RUNE, causing inflation.

However, it’s essential to consider that there is a higher likelihood of the collateral asset appreciating in value relative to $RUNE in a bull market. This appreciation can lead to a net inflationary effect on the $RUNE supply when the loan is eventually closed.

Ultimately, the net impact on $RUNE depends on the overall market dynamics, and reaching a conclusive point is challenging. However, if the number of people actively taking loans exceeds those closing loans, the net effect on $RUNE will likely be deflationary.

Conclusion

THORChain presents a complex technological and mathematical framework that revolves around a simple and powerful concept: incentivizing liquidity creation and fostering complete interoperability among blockchains. By connecting liquidity pools and blockchains, THORChain aims to enhance liquidity, encourage mass adoption of cryptocurrencies, and enable seamless transactions with any currency, anywhere in the world.

There's a risk of a black swan event in DeFi.

As per Defillama, if CRV drops below $0.37, there's 300M CRV to liquidate in Aave -most from Curve's founder

The problem? There's not a single Exchange or DeFi protocol where one can sell such a large CRV amount.

Risks explained 🧵 pic.twitter.com/Ug12IsJ3et

— olimpio (@OlimpioCrypto) July 31, 2023

Moreover, as other lending markets face challenges, THORChain’s innovative approach, offering ‘no liquidation’ and ‘no expiring’ loans, emerges as a potential game-changer.

This unique proposition and the project’s vision of creating a truly interconnected and liquid ecosystem position THORChain at the forefront of driving Web3 adoption and paving the way for a decentralized financial future.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.