Investment firms can help you to invest your hard-earned money. They should have the knowledge and expertise to generate a good ROI for you.

That’s the return on your investment. Now, a big US investment firm considers Bitcoin as a good investment. In this article, we’ll show you a very interesting report from a very important investment fund. Here is the second part of the article.

Bitcoin Is the Best Money

We’re talking about Fidelity Investments. They are a multinational financial service organization in the US. Earlier this week, they published new research explaining this in 10 steps. This is Part 1 of two articles about why Web2 should invest in Bitcoin. So, let’s take a closer look into these 10 reasons.

Fidelity manages $4,500,000,000,000.

43,000,000 investors trust Fidelity.

Yesterday, they published new research explaining why investors should consider #bitcoin

Here are 10 key points 🧵👇 pic.twitter.com/mXLEYZpnRr

— Documenting ₿itcoin 📄 (@DocumentingBTC) October 10, 2023

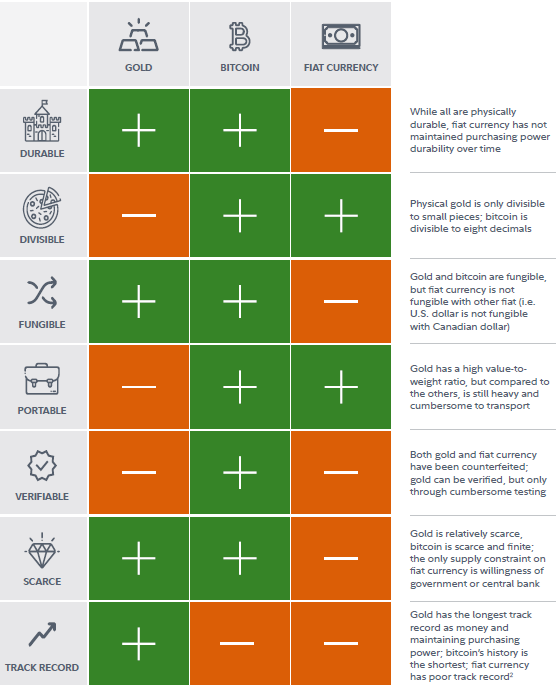

Fidelity sees Bitcoin as being fundamentally different from all other digital assets. They see it as the most secure and decentralized money. Before a society accepts something as money, it needs to have various characteristics. Bitcoin possesses plenty of these characteristics. For example, its scarcity. It’s also easy to use and store. Unlike other assets, it is finite. There will only ever be 21 million BTC. This can also make it a store of value.

Furthermore, it is also censorship-resistant. In other words, nobody can influence its course. No person(s), firms, or governments have any influence over Bitcoin. Only through network consensus, you can change its code. Although this is possible, it’s not very likely to happen. The picture below shows some bitcoin characteristics. It’s compared to two other monetary assets, gold, and fiat.

The Virtuous Cycle of Bitcoin

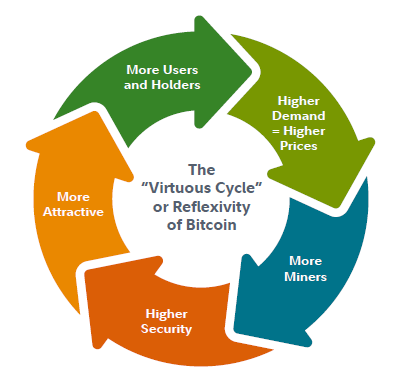

Fidelity explains the virtuous cycle of Bitcoin. It shows why Bitcoin has the potential to be the primary monetary good. Bitcoin has powerful network effects. This allows it to dominate the digital asset ecosystem.

Networks grow stronger and more powerful when more users enter. That’s why Bitcoin is the strongest and best monetary network. It’s big, secure, decentralized, and liquid. Furthermore, it has a reflexive property. Meaning, it has passive (users) and active (miners) participants.

Once more people start to believe that Bitcoin is the best monetary good, demand will increase. In turn, this leads to a higher price. Especially with the fixed BTC supply. This leads to more miners and computing power. As a result, bitcoin has become more secure. Which makes it more attractive. This results in more user inflow. See the picture below.

No Need to Reinvent the Wheel

The next step is that Fidelity compares Bitcoin to the wheel. As we know, there’s no need to reinvent the wheel. Because it’s already there. Back in the day, the wheel was an entirely new technology. Bitcoin offers the same, a new technology for digital assets and monetary goods.

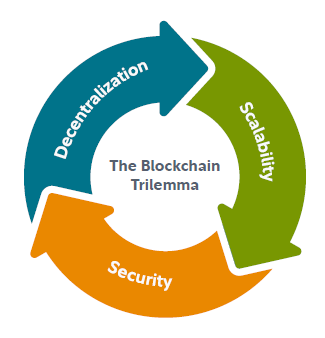

It solved digital scarcity and peer-to-peer options. Compared to other digital assets, it is the most secure and decentralized network. So, to topple Bitcoin, you would have to come up with a new monetary good and sacrifice one of these two features. This touches on the blockchain trilemma.

On the other hand, you can also copy its code and launch it. But there’s no need to trade the original for something identical but with a much smaller size.

On the Bitcoin network, transaction fees are voluntary amounts users pay to incentivize miners to include their transactions in the “blocks” that they mine.

For an introductory comparison and analysis explaining transaction fees, click here: https://t.co/UQ9z1PJfEg pic.twitter.com/RoEpCqwLFb

— Fidelity Digital Assets (@DigitalAssets) October 10, 2023

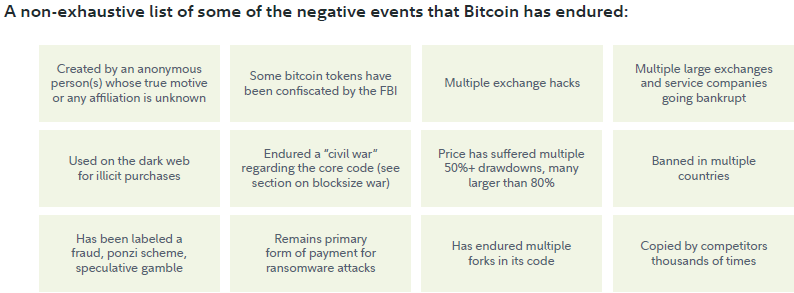

Bitcoin Keeps Surviving

Bitcoin appears to succumb to Lindy’s Law or Effect. Here’s the definition:

“The longer a non-perishable item has been around, the longer it’s likely to persist into the future.”

The name comes from Lindy’s Delicatessen in New York. Broadway actors gathered and discussed shows here. This led to the above observation. A classic sample is ‘The Mousetrap’ which has run in London’s West End, since 1952.

So, for Bitcoin, the longer it survives, the stronger it will be in the future. It becomes more robust and battle-tested. For example, the picture below lists negative events that it already survived. This includes people calling it a Ponzi scheme or some countries banning BTC.

Bitcoin Is Secure

The Bitcoin code is open source. In other words, anybody can copy it and try to improve it. However, doing so, would imbalance the blockchain trilemma. For example, if you increase its speed or decentralization, the security will suffer. So, there’s always a trade-off. This is part of the blockchain trilemma.

In crypto, it appears that you can only fulfill two features of this trilemma, but not all three. That’s a statement made by Vitalik Buterin, one of the Ethereum co-founders. So, Bitcoin is secure and decentralized. However, it’s not that scalable.

Now, here’s how secure this coin is. Let’s look at the amount of computational power it takes to change its consensus. It’s immense, and unlikely to ever happen. For instance, the rewards would not outweigh the effort and cost.

Conclusion

It’s interesting to see that big investment corporations have started to offer Bitcoin. Fidelity Investments is one of the biggest investment firms in the US. They recently published new research. In this, they point out why investors should consider bitcoin. This is a good development. It brings mass adoption one step closer.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.