The crypto market was in chaos on Tuesday 9th. This was caused by a fake X (Twitter) post from the SEC’s account claiming it had approved a spot bitcoin exchange-traded fund (ETF).

However, the SEC later claimed the post was “unauthorized” and its account had been hacked. If you aren’t familiar with what happened, here is a brief timeline.

False Alarm from The SEC’s X Account

The fake post read: “The SEC grants approval for #Bitcoin ETFs for listing on all registered national securities exchanges.” Interestingly, the post spiked Bitcoin’s price by over $1000, leading to hopes of further price surges.

Meanwhile, SEC Chair Gary Gensler took to his Twitter account to dismiss the news. He explained:

The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

— Gary Gensler (@GaryGensler) January 9, 2024

SEC had no 2FA Security Filter

Interestingly, X’s safety team provided clarity to the SEC’s hack in a post dated January 10. The team noted that the commission did not have two-factor authentication (2FA) activated on its main X account. So, this allowed a hacker to access it.

We can confirm that the account @SECGov was compromised and we have completed a preliminary investigation. Based on our investigation, the compromise was not due to any breach of X’s systems, but rather due to an unidentified individual obtaining control over a phone number…

— Safety (@Safety) January 10, 2024

Furthermore, X’s safety page added that the SEC hack happened as a result of an unknown actor taking possession of the account’s phone number. And using it to access the SEC’s official X website. This form of attack is often known as a SIM swap hack.

US Lawmakers Demand an Explanation.

US lawmakers and politicians were outraged at the SEC’s inadequate security measures over its accounts, especially Republicans, who have long voiced dissatisfaction with how Gensler runs the agency.

Just like the SEC would demand accountability from a public company if they made such a colossal market-moving mistake, Congress needs answers on what just happened. This is unacceptable. https://t.co/tWtLqHtqpu

— Senator Bill Hagerty (@SenatorHagerty) January 9, 2024

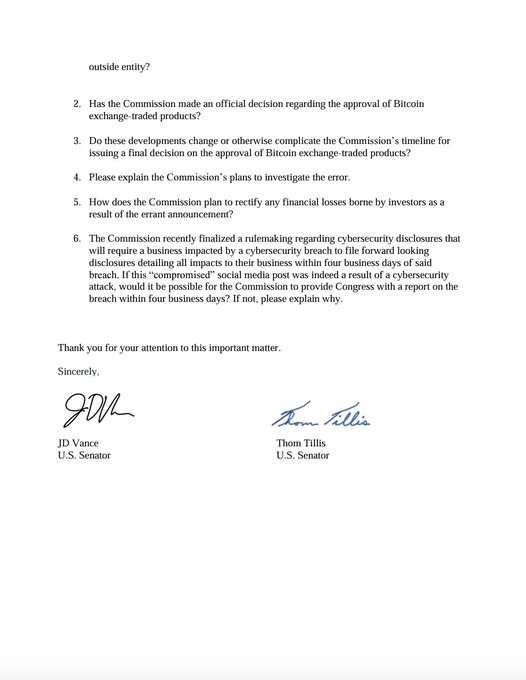

Senators J.D. Vance and Thom Tillis expressed concerns about the SEC’s internal cybersecurity protocols in a letter they wrote to SEC Chair Gary Gensler yesterday. The letter said the situation was “antithetical to the Commission’s tripartite mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.”

Concerned about the latest intrusion, which they said caused “widespread confusion,” the two senators have asked the SEC to submit a report on the event to Congress, citing a rulemaking on cybersecurity disclosures that was recently enacted.

The senators wrote: “If this ‘compromised’ social media post was indeed a result of a cybersecurity attack, would it be possible for the Commission (SEC) to provide Congress with a report on the breach within four business days? If not, please explain why.”

Is This a Case of Market Manipulation?

There have been several claims that the fake post was a market manipulation scheme by the SEC. Interestingly, securities attorneys have allegedly informed Charles Gasparino of Fox Business that the SEC “will have to investigate itself” for market manipulation.

Fraudulent announcements, like the one that was made on the SEC’s social media, can manipulate markets. We need transparency on what happened.

— Senator Cynthia Lummis (@SenLummis) January 9, 2024

Representative Ann Wagner of the United States raised concerns about the incident, calling it “clear market manipulation” that affected millions of investors. “I plan to get more answers from Chair Gensler on this incident,” Wagner stated.

BREAKING: Securities lawyers tell @FoxBusiness the @SECGov will have to investigate itself for market manipulation after moving the price of $BTC up and down following the hacked tweet that it had approved the first spot BTC ETF and then saying it was fake. That said, for the SEC…

— Charles Gasparino (@CGasparino) January 9, 2024

Timothy Peterson, an investment manager, claims that the SEC’s security violation may have been a case of market manipulation. This is exactly what the agency is meant to guard against.

Deeply concerned with this alleged hack of the SEC’s Twitter account.

This is clear market manipulation that impacted millions of investors. I plan to get more answers from Chair Gensler on this incident.

— Ann Wagner (@RepAnnWagner) January 9, 2024

Layah Heilpern, an advocate of Bitcoin, also made some observations. He noted that the SEC’s fake post received at least 4.4 million views in the twenty minutes it was live. Heilpern suggested that the move was pure market manipulation.”

The SEC knew the tweet was false for 20 minutes and left it up.

This is absolute market manipulation. @SECGov what is going on right now?

— Layah Heilpern (@LayahHeilpern) January 9, 2024

What Are Other Possible Theories?

Crypto analysts and users have continued to post possible theories about the situation. Most agree that this could be an inside job. However, others believe it could have been caused by the SEC’s carelessness.

If the "hacker" had half a brain he would've said the ETF was denied & got a -20% candle instead of this whipsaw

My money is on the intern clicking "publish" instead of "schedule," & Gary is saving face calling it a Twitter hack while taking the intern out back to shoot him.

— Sicarious (@Sicarious_) January 9, 2024

Others claim that the SEC’s use of the terms “compromised” and “unauthorized” implies that the account had not been compromised. Some claim that the regulator planned to send the post later.

Nah, we got Punk’d.

The "tell" on the official SEC account was when it used the btc emoji cashtag:

" #Bitcoin "

on the "official" Tweet. pic.twitter.com/mW3b5nt339

— Compound248 💰 (@compound248) January 9, 2024

Can This Delay the Big Announcement?

The SEC is set to investigate the embarrassing hack. However, crypto users have expressed concerns that this could delay the big announcement. However, some observers believe this is only a remote possibility. But, some believe the SEC could use this as a justification to postpone the decision past the January 10 date.

What if this was an inside job? Is the only way to stop or delay a Bitcoin ETF is to create an event like this?

It would be unreasonable to delay… and this event should change nothing IMO. However, nothing surprises me anymore.

Or did the message just get published early?

— Gabor Gurbacs (@gaborgurbacs) January 9, 2024

Dennis Porter, CEO of Satoshi Action Fund, provided another perspective. Porter explained in an email that “if the SEC is looking for ways to continue delaying the ETF process, it’s possible they could use this as a reason to slow down the rollout.”

Fwiw, at least one prospective spot bitcoin ETF issuer is concerned SEC “hack” could result in approval delay…

My take? There’s a *hard* deadline tomorrow. All indications point toward approval.

There’s a regulatory process to follow here. That doesn’t involve X.

via @Reuters pic.twitter.com/O1hiV2mI4z

— Nate Geraci (@NateGeraci) January 10, 2024

Mati Greenspan of the finance firm Quantum Economics expects the SEC to leverage this moment to postpone a decision. He wrote, “I can certainly see a situation where the SEC would try to use this fiasco as a way to delay the ETF approval. It wouldn’t be the first time they’ve used underhanded methods to force their agenda on the markets.”

Some sources within the SEC have maintained that its employees had nothing to do with the posts. However, crypto users are eager to see how this plays out.