Binance, in a blog post shared on Feb. 19, said that it would no longer support Binance Leveraged Tokens (BLT).

The decision is reportedly part of its product review and the exchange’s decision to focus on products and services that yield the most value to its users.

Binance Ends Leveraged Token Support in April

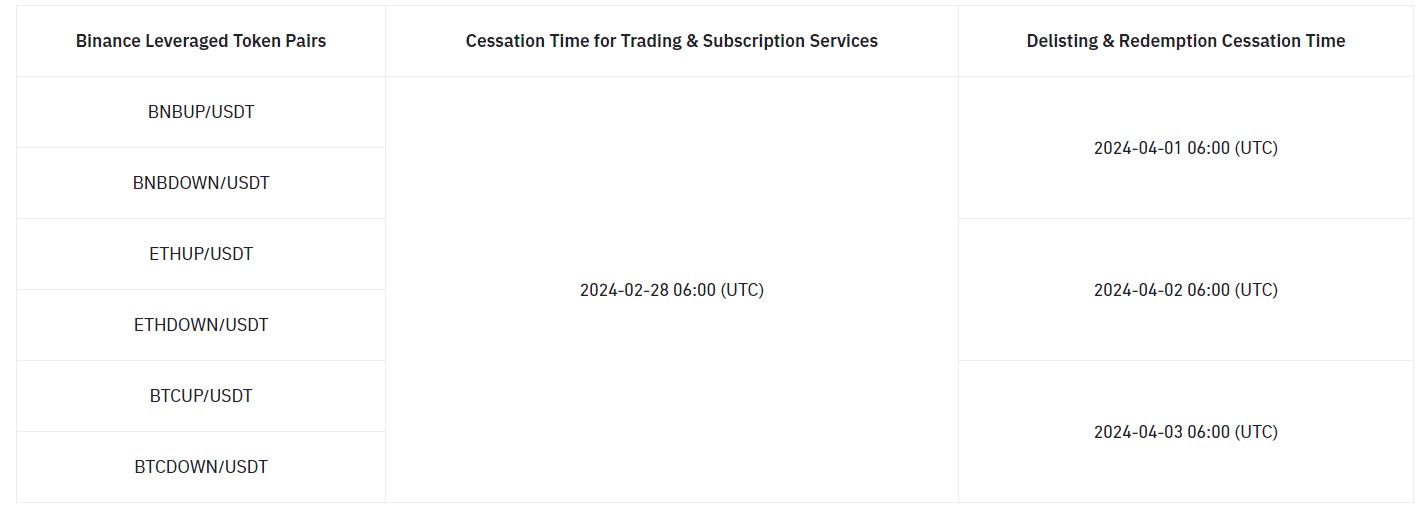

Binance announced that it would stop trading and subscription services for all of its leveraged tokens by February 28, 2024. According to the notice, BTCUP and BTCDOWN, ETHUP and ETHDOWN, and BNBUP and BNBDOWN are among the affected leveraged tokens.

In addition, Binance warned that it would automatically remove all trade orders for leveraged tokens on the specified date, meaning that users wouldn’t be able to place orders afterward. However, the crypto exchange encouraged its customers to trade their leveraged tokens for other assets before the announced date.

Binance plans to delist and cease redemption of the tokens from April 1 to April 3. The exchange added that users can redeem their tokens before the date above. In addition, Binance will convert unredeemed tokens to USDT using their value on the delisting date. Afterward, the exchange will transfer the tokens to the users’ accounts and take the leveraged tokens out of their wallets.

Hey, to clarify, Binance is just removing support for the following leveraged tokens:

🔸 BNBUP

🔸 BNBDOWN⁰

🔸 ETHUP⁰

🔸 ETHDOWN⁰

🔸 BTCUP⁰

🔸 BTCDOWN⁰⁰You can find more details here 👇⁰⁰https://t.co/TMy1rikOgt

— Binance Customer Support (@BinanceHelpDesk) February 19, 2024

Binance’s move to cease support for leveraged tokens reflects its dedication to improving its services and focusing on products that match user preferences and market developments. It also emphasizes the need for crypto platforms to frequently evaluate their offerings to ensure compliance and secure their competitive advantage.

What are Leveraged Tokens?

Binance notes that its leveraged tokens simply represent a basket of perpetual contract positions. These tokens are more suitable for short-term trading and are not an alternative to margin-leveraged products.

🚨 Important Update from #Binance 🚨

They're discontinuing some leveraged token services like BNBUP/USDT, BTCUP/USDT, and ETHUP/USDT. But they have been removing these pairs since 2021

Don't panic if you have positions open, as they are not suspending Futures trading and your… pic.twitter.com/nHAgPxiula

— Sahil | Crypto Gems (@DaCryptoGems) February 19, 2024

Leveraged tokens provide traders with exposure to leveraged positions without requiring them to put up any collateral. In addition, traders do not need to worry about being liquidated. However, leveraged tokens allegedly come with associated risks. This includes the “effects of price movements in the perpetual contracts market, premiums, and funding rates.”

Users affected by this cessation are expected to adjust their trading strategies.