As entities such as Cboe and Blackrock refile for ETFs, the market has experienced a remarkable turnaround following a bearish week. This bearish sentiment arose due to the SEC’s scrutiny of certain CEXes and the classification of several crypto assets as commodities.

But things are starting to look good for Bitcoin and the market!

Macro Scene

The possibility of significant volatility looms ahead, potentially impacting the crypto market. We can anticipate this volatility to stem from macroeconomic catalysts rather than specific to cryptocurrencies. One significant catalyst is the upcoming launch of FedNow.

NEW: 🇺🇸 Federal Reserve services site gets FedNow rebrand 😮 pic.twitter.com/7zUHE5uPsn

— Bitcoin News (@BitcoinNewsCom) July 2, 2023

The introduction of FedNow suggests that there may not be a set limit on the number of transactions individuals can make daily, although there is a transaction cap of $500k. It could potentially increase the vulnerability of the US banking system to bank runs, which could set the stage for a major crisis.

Speculation of Catalysts

Interestingly, US banks recently underwent a stress test where hypothetical scenarios were simulated, including a 10% rise in unemployment and a 40% crash in housing prices. The tendency of authorities to simulate such events before they occur has led to speculation about an impending significant volatility event. Alarmingly, chart analysis indicates that this event could be imminent.

VIX is currently at the same 13.50 level as February 2020. The next level below is 12. pic.twitter.com/YYngpIRz97

— Financelot (@FinanceLancelot) June 29, 2023

As observed by some on Twitter, the volatility index (VIX) has reached its lowest level since February 2020, just before the crash caused by the COVID-19 pandemic in March 2020. The VIX, aka the “fear index,” measures expected volatility in the stock market, particularly the S&P 500 index. Unusually low volatility is often a precursor to high volatility, typically in a downward direction.

However, despite the low volatility, the puzzle’s missing piece is the catalyst that could trigger a market crash. Speculation regarding potential catalysts includes factors related to geopolitics. One notable development is the US contemplating a ban on exporting advanced AI chips to China, a significant issue in the global AI race.

In response to this consideration, China has expressed its willingness to resume high-level military talks with the US if it lifts existing sanctions and imposes no further sanctions. It’s worth noting that China suspended such talks last August following a visit to Taiwan, a territory China claims as its own, by then-Speaker of the House Nancy Pelosi.

Geopolitical Tensions

The situation intensifies further when considering recent events. US Secretary of State Anthony Blinken visited China a couple of weeks ago to improve bilateral relations. Following the visit, Blinken stated that the US does not support Taiwan’s independence. Many interpreted this statement as a signal to China that it could proceed with invading Taiwan without US intervention.

In fact, there are beliefs that the US would even resort to bombing Taiwan to prevent advanced microchips manufactured by TSMC for the US military from falling into the hands of the Chinese Communist Party (CCP). Although they have not confirmed these plans officially, US military officials and politicians have discussed them. Besides, Taiwanese officials have stated that Taiwan would defend TSMC from US attacks.

Today these Chinese military planes and vessels intruded into Taiwanese waters and airspace.

17 PLA aircraft and 5 PLAN vessels around Taiwan were detected by 6 a.m.#Taiwan #China #ChinaTaiwan

Info from Taiwan’s Ministry of National Defense@MoNDefense pic.twitter.com/PV6WCxFfdX

— Taiwan News (@TaiwanNews24_7) July 4, 2023

Undoubtedly, the imminent invasion of Taiwan has been a concern since tensions between China and the US began escalating last summer. Moreover, the situation has deteriorated further in terms of geopolitics and economics. The Chinese economy is not experiencing the expected growth level, and the yuan value is declining rapidly.

The yuan’s weakness could be due to China’s economic struggles, but it might also indicate an impending black swan event from the East- economic or geopolitical. Alternatively, it could signify nothing substantial, and we can only hope for the latter.

Good Times For Miners Ahead?

Investing in Bitcoin mining companies has proven highly profitable, as many stocks in this sector have experienced significant valuation growth since the start of the year. While 2022 was challenging for these crypto equities, 2023 has seen remarkable performances, surpassing even the impressive rally of BTC. These top-performing mining companies have demonstrated resilience and have kept pace with AI stocks, the current favorite in TradFi investments.

Source: TradingView

But why is mining becoming lucrative?

Institutional And Political Acceptance

The environmental concerns surrounding crypto mining have posed challenges, particularly among those on the left side of American politics. However, the recent refiling by BlackRock for a Bitcoin ETF has sparked optimism within the crypto industry, suggesting that resistance to crypto may decrease soon.

If progressive voices shift their focus away from the environmental impact of crypto, it could lead to a reduction in anti-crypto policies in the United States. This shift in sentiment would create a more favorable environment for adopting proof-of-work (PoW) crypto assets, ultimately benefiting miners.

Moreover, as the United States already pursues a policy of rapid decarbonization, with initiatives like the Inflation Reduction Act supporting the deployment of clean energy resources, the carbon emissions associated with US-based crypto mining are likely to decrease. BlackRock and other entities may recognize this opportunity and aim to align themselves with the future shift toward green energy proactively.

Not On SEC’s Radar

In early June, the SEC took action against major CEXes in the crypto industry, Binance, and Coinbase. The enforcement actions also involved the SEC categorizing several tokens as securities.

SEC Files Lawsuits Against Binance and Coinbase – A breakdown.

— SmallCapSteve (@smallcapsteve_) June 26, 2023

The SEC specifically focused on tokens utilizing Proof of Stake (PoS) consensus mechanisms in its complaints, targeting projects such as Solana (SOL) and Cardano (ADA). Interestingly, tokens issued by Layer 1 blockchains that utilize PoW consensuses, such as Litecoin (LTC) and Dogecoin (DOGE), seemingly received different treatment from the SEC.

The reasoning behind this decision remains unclear. However, it suggests that a significant portion of the PoW market, which involves mining operations, may not fall within the SEC’s definition of what it considers to be security.

Leveraging AI Market

In their efforts to address declining revenues amidst the challenges of the bear market, many Bitcoin miners have transformed from crypto-focused specialists to high-performance computing (HPC) generalists. Notably, these generalist miners are now gravitating towards the lucrative AI sector within the HPC market.

While venturing into AI HPC is undoubtedly expensive, successful Bitcoin miners who establish a presence in this field stand to gain a diversified revenue stream and valuable customer relationships in an industry poised to revolutionize global productivity. According to estimates, the dedicated AI HPC budget reached $6.3 billion in 2022 and could experience a 56% growth over the next four years, reaching $9.8 billion by 2027.

Transaction Explosion

Bitcoin has recently experienced a remarkable increase in functionality and network usage thanks to the Taproot upgrade. One notable development was the emergence of ordinals, which significantly impacted the market in early February. This advancement brought NFTs to the Bitcoin network and led to a surge in transaction fees- reaching unprecedented levels compared to the bear market period.

Following ordinals, BRC-20s became prominent. Leveraging ordinal tech, BRC-20s replicated Ethereum’s widely adopted ERC-20 fungible token standard on the Bitcoin blockchain. The rise of BRC-20s coincided with the surge in meme-coin mania on Ethereum in May. As speculation ran rampant in BRC-20 marketplaces, Bitcoin transaction fees skyrocketed, forcing average users to pay over $30 per transaction. And these rising fees positively impacted the BTC mining circle.

Check out https://t.co/AjlYktGD9v latest update👀

You can now use the “Sort by” feature to navigate thro the #brc20 eco-system easily!

We have also added “Swap BRC20” button that redirects to the only liquidity DEX on @Bitcoin : @BitX_Brc20 #WAGMI pic.twitter.com/LXoVHgaO6R

— BitX – BRC20 DEX🟧 (@BitX_Brc20) July 4, 2023

However, it is essential to consider that Bitcoin’s next halving event looms on the horizon. As this event approaches, miners’ profits derived from Bitcoin mining will dwindle, leading to an inevitable consolidation within the industry. Let’s look at some on-chain data.

Miners Channel Over $1 Billion in BTC to EXs

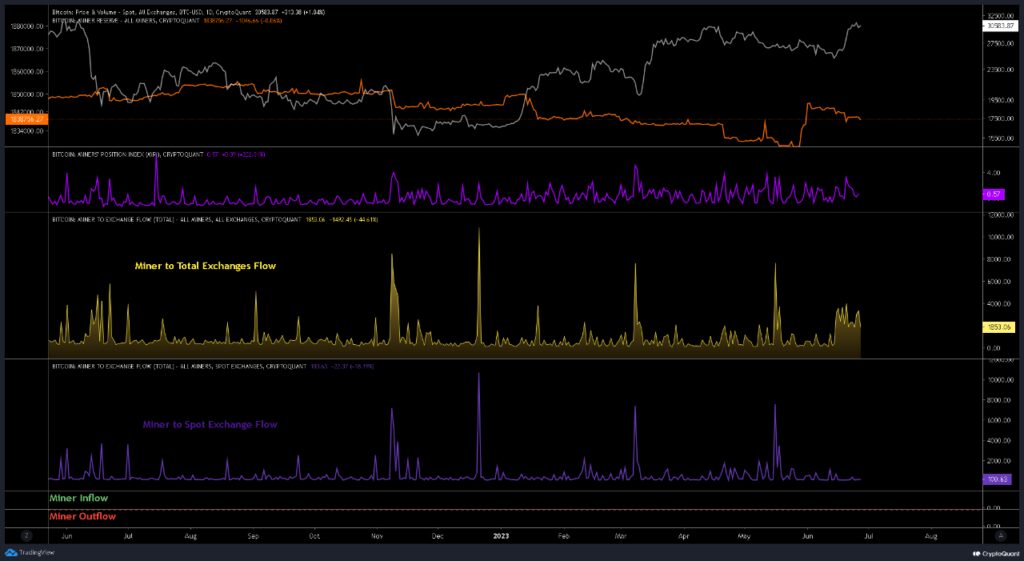

Since June 15th, miners’ portfolios have displayed indications of currency outflows directed toward exchanges. However, a closer analysis reveals that activities involving derivative instruments like perpetual futures contracts or options drive this capital flow. Different wallets transferred approximately 33,860 BTC to derivatives exchanges during this period, but the majority has since been reclaimed and returned to original wallets.

Consequently, miners have witnessed a reduction of around 8,000 BTC in their reserves, only sending a small portion to spot trading exchanges.

Source: CryptoQuant

This pattern suggests miners might utilize their newly generated coins as collateral for derivative trading endeavors. A common strategy in this type of trading is “hedging,” where people take positions opposite the prevailing market consensus.

By doing so, potential losses resulting from the anticipated market scenario can be offset or mitigated by open positions in derivatives. Despite the substantial value involved, these coins are not being transferred to spot exchanges. Likely, this does not signify actual market selling pressure impacting the price.

Smart Money Back To Crypto?

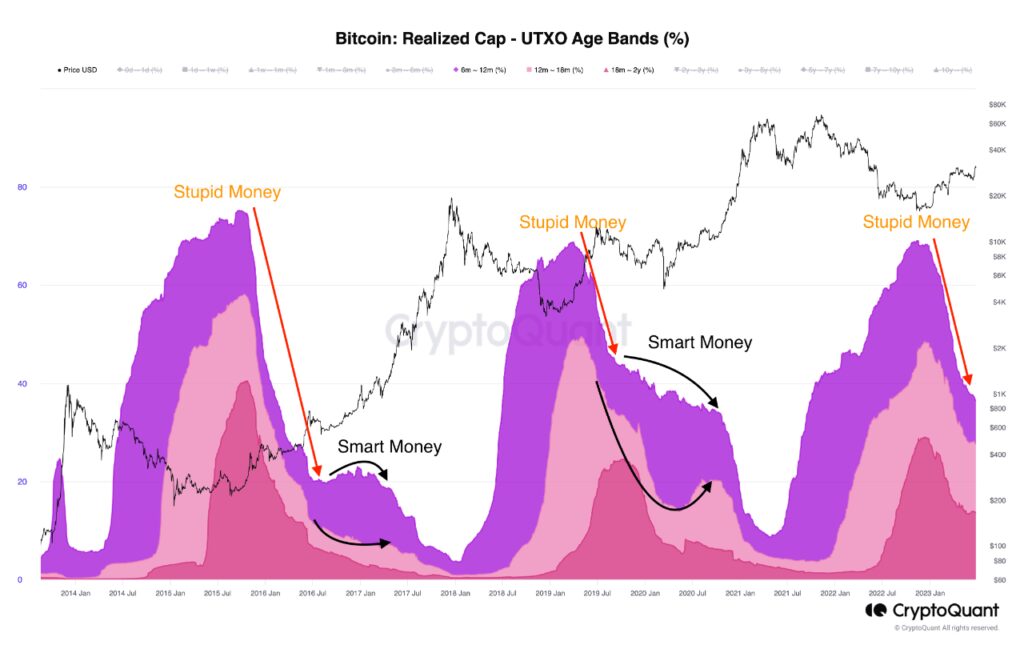

Source: CryptoQuant

In the market cycle, there is a recurring pattern where “Stupid money” participates late during the bull market, while “smart money” enters the market in advance before the bull market. The dominance of “Stupid Money” reached its highest point towards the end of 2022, which often aligns with the lowest point of the market cycle.

Currently, if Bitcoin’s dominance, which has remained steady for over six months, starts to rise again, it can be viewed as a significant indicator of the entry of “smart money” into the market.

Based on these insights, we can infer that the bottom of the market cycle has already passed, and the shift in dominance and the entry of “smart money” may pave the way for a new phase in the market, potentially indicating the beginning of a bull market cycle.

Finding The Cycle Bottom

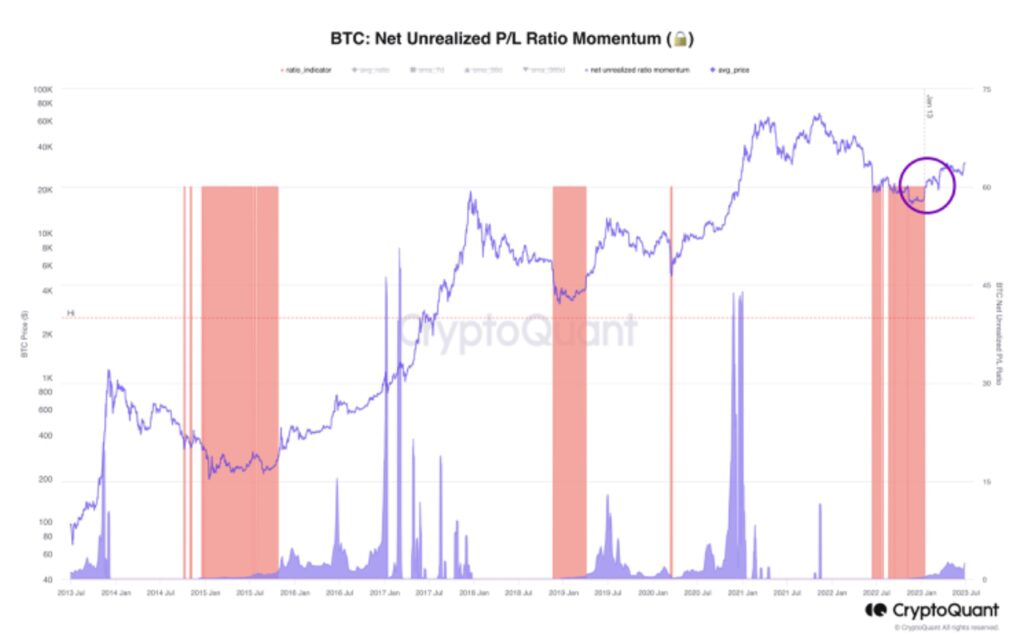

To determine the timing of the current cycle’s bottom, we can utilize the Net Unrealized Profit/Loss Ratio, which provides insights into the relationship between unrealized profit and loss for Bitcoin. This ratio helps us identify periods when market participants may have potentially sold their assets at a loss, indicating a probable ‘bottom’ of the cycle.

Source: CryptoQuant

The chart shows the periods when the Net Unrealized P/L turned negative, represented by the color red. In this context, ‘unrealized’ refers to profits or losses that have not yet been realized through selling the assets. During these marked periods, if market participants were to sell their Bitcoin, they would incur a loss on average.

We can pinpoint the ‘bottom’ on January 13 in the current cycle. This particular day marked the final instance when the average Net Unrealized P/L Ratio dropped below 1, indicating that most market participants would have experienced losses if they had sold their Bitcoin. This noteworthy day signifies a crucial moment that marked the beginning of the market’s recovery.

A New Bottom In This Cycle?

The strong upward trajectory of Bitcoin since early 2023 has led to a notable increase in the MVRV indicator, currently standing at 1.51. This rise has pushed the indicator beyond the undervaluation range of 1.0.

But what is the MVRV indicator? The “Bitcoin MVRV” serves as an indicator that assesses the ratio between the market cap and the realized cap of Bitcoin.

By comparing the realized cap with the market cap in the MVRV ratio, we can gain insights into whether Bitcoin is currently undervalued or overvalued. A value above 1 in the MVRV indicates that BTC is now overpriced, whereas values below this threshold suggest it is underpriced

Source: CryptoQuant

Historical analysis reveals that the MVRV indicator strongly surpasses 1.0 at the bottom of a bear market and continues to rise for several months. There has not been a case where Bitcoin bottomed out again.

Source: CryptoQuant

Furthermore, there has been a recent increase in Bitcoin dominance and a rising overall market, aligning with a bull market’s early stages. It suggests a limited window, possibly until 2023 or the beginning of 2024, to make stable investments in Bitcoin and Ethereum.

While concerns about a potential recession and uncertainty surrounding Fed policies persist, the market may reach its peak as these uncertainties resolve. Consequently, it might be prudent to prepare for a potential selling phase rather than expecting further significant market gains.

Institutional Fund Accumulation

Fund holdings encompass the cryptocurrency assets institutional investors hold, including hedge funds, investment firms, and cryptocurrency private funds. Analyzing these holdings yields valuable insights into market dynamics and investor sentiment.

Source: CryptoQuant

A careful examination of fund holdings reveals a notable upward trend in the accumulation of BTC by these institutional entities.

This exponential growth in holdings indicates a strong interest among institutional investors in acquiring Bitcoin, even at its current price level. These entities actively seek long-term investment opportunities in Bitcoin, reflecting a patient approach that contrasts with the short-term focus of other investors who closely monitor price fluctuations.

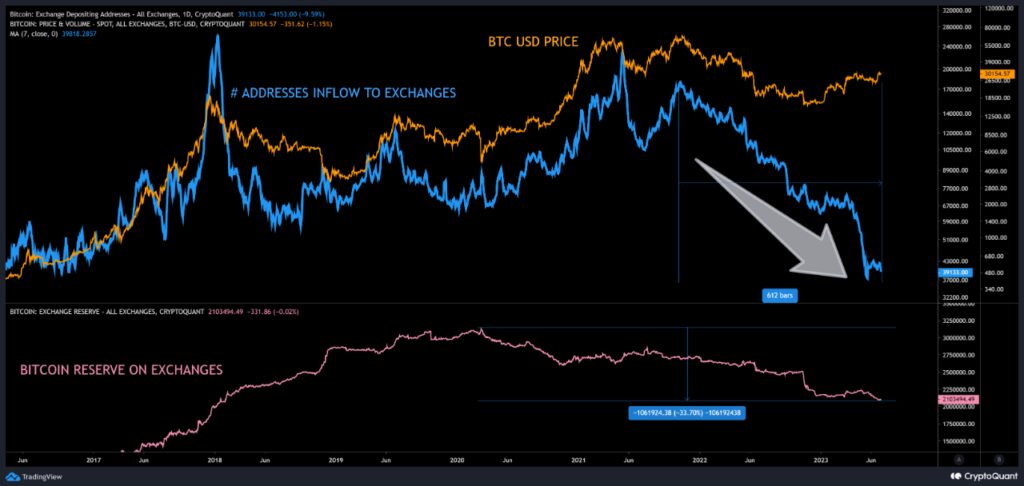

Record-breaking Drop in Bitcoin Inflows and Supply

The decline in the number of Bitcoin addresses associated with inflows, often interpreted as a bearish bias indicating selling or capital for derivative trading, has reached unprecedented levels. Over 600+ days (and still ongoing), there has been an 80% decrease in addresses logging inflows since October 2021.

Source: CryptoQuant

If we measure from the peak in May 2021, the decline in addresses rises to 84%. These figures surpass the second-highest drop in addresses associated with inflows observed during the 2017 parabolic top into the 2018 bear market, which stood at 78.5%.

Decreasing Bitcoin Supply on Exchanges

Notably, this analysis does not consider addresses that have transitioned to self-custody, nor does it differentiate between miner activity and retail traders. However, this is a significant deviation from historical trends in depth and duration and from bullish scenarios on higher time frames.

Furthermore, despite occasional periods of increasing supply, the overall trend for Bitcoin held on exchanges shows a decline in supply. Since March 2020, Bitcoin reserves on EXes have decreased by over 30%, marking a record decline in duration and depth. March 2020 recorded the highest-ever supply held on exchanges, followed by a consistent growth trend over the previous ten years. The subsequent 1200 days have witnessed the first sustained period of supply decline in Bitcoin’s history.

These observations suggest a lasting and positive evolution in the general perception of BTC. The recent filings and re-filings for Bitcoin ETFs by entities like BlackRock and the introduction of regulatory frameworks in leading markets, particularly among the G20 nations, reinforces this sentiment. Both retail traders and institutions are increasingly holding more BTC than ever before, adding to the positive outlook.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.