$320 million losses in liquidation! Leading tokens ADA, MATIC, BNB, & SOL have been accused of being securities. Hell broke loose on Monday when U.S. Securities and Exchange Commission SEC sued Binance for misusing customer funds and other 13 Securities violations. And it’s worsening as SEC sued Coinbase today.

The lawsuit hurt Binance in a big way as $700M in Withdrawals were triggered. And now investors like me are facing the most significant question – Are my funds safe with Binance? Or is this a HUGE MISTAKE made by SEC? Let us try and find answers to all these questions.

Did SEC declare War on the Crypto Industry?

For those who have yet to catch up on the SEC Crypto crackdown saga in the US. Let me tell you that this is not the first time, in 2023 that SEC has come after a crypto exchange. Gary Gensler has gone after 4 exchanges, numerous projects, & forced crypto offshore.

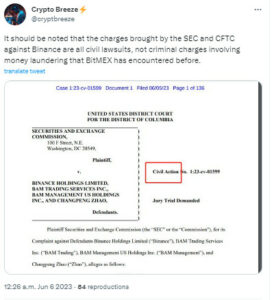

In March, the Commodity Futures Trading Commission (CFTC) filed a complaint against Binance and CEO CZ in a federal court in Chicago. The complaint alleges that Binance offered crypto futures and derivatives to U.S. residents without registering these offerings with the CFTC.

Source: Twitter

Asset Shuffling Controversy: Binance faced scrutiny for moving approximately $1.8 billion in assets to hedge funds between August and December 2022 without notifying customers. Despite previously telling customers that the tokens were 100% backed, the move raised concerns about transparency and trust.

Interestingly, after the March lawsuit by CFTC, Binance saw this coming. And now market speculation states that CZ might step down as CEO and his successor Richard Teng might take over. But will Binance be able to recover from this Lawsuit?

SEC VS Binance

The spiciest bit of the SEC vs Binance suit is Binance’s Chief Compliance Officer Samuel Lim, who was also named in the CFTC suit, allegedly told a coworker “We are operating as a fking unlicensed securities exchanged in the USA bro” … this could get Binance into trouble or Samuel. We don’t know.

Source: Twitter

Charge #1

Binance and its founder Changpeng Zhao misused customers’ funds, and internally used Market makers that CZ “owned and controlled”. It enabled manipulative trading on the Binance US platform and also diverted user funds to a CZ-owned entity called Sigma Chain that conducted “manipulative trading’. This inflates the volume of trading on the crypto exchange.

While this sounds something like the FTX scenario. It must be noted that the lawsuit against Binance is a civil suit, not a criminal suit, unlike FTX. So Binance could get away with the suit by simply paying a hefty fine.

Source: Twitter

Charge #2

Binance and Binance.US offered unregistered securities, such as the BNB token and BUSD stablecoin, to the public.

Charge #3

The SEC also alleges that Binance’s staking service violated securities laws.

Charge #4

Binance and Zhao claimed the company’s U.S. subsidiary was independent, but alleged they controlled it behind the scenes.

Are your funds in Binance safe?

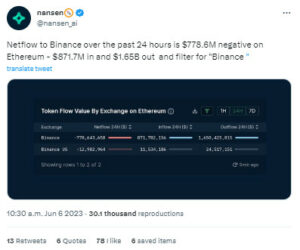

Data from Nansen.ai shows that outflows from Binance across all protocols hit $780 million over a 24-hour period.

Source: Twitter

Despite the seemingly staggering net outflow, that shows no signs of slowing down, Nansen data also shows that Binance’s stablecoin balance remains healthy. The exchange currently has a stablecoin balance of just over $8 billion, with a seven-day outflow of $519 million, or roughly 6% of holdings.

In the Twitter thread shown above, Seoul-based crypto analytics firm CryptoQuant pointed out that the withdrawals are well within historical norms. At the moment things seem to be under control. We will keep a close watch on the situation and will keep you updated.

What Does CZ Have to Say About the Situation?

Binance takes it to Twitter and strongly denies the SEC’s claims, calling the lawsuit baseless, and intends to vigorously defend itself. They argue that the SEC’s actions seek to harm the industry and stifle innovation, emphasizing the need for Congress to establish a workable regulatory framework for digital assets:

In response, Binance has published an official response to the SEC, claiming that it “aims to unilaterally define crypto market structure.”

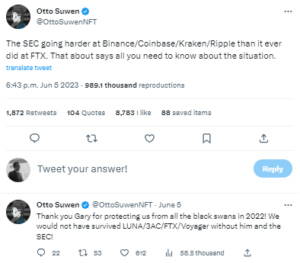

Zhao denied the allegations, calling the suit “unjustified” and one of many of the SEC’s “misguided actions” targeting crypto. CEO Changpeng “CZ” Zhao also retweeted a post highlighting that the SEC has taken more action against long-standing crypto entities than it ever did against the now-defunct centralized exchange FTX.

Source: Twitter

CZ says they’re prepared to fight the SEC “to the full extent of the law” and urges to stay “strong together”.

What Do Other Industry Leaders Have to Say?

Cardano founder Charles Hoskinson also tweeted about the lawsuit. Probably because the lawsuit accuses ADA to be a security.

Charles stated that this is nothing but an “agenda-based CBDC partnered with a handful of massive banks and end-to-end control over every aspect of your financial life.”

He added that “ We are going to be fine. Everything’s alright and the future is bright for the industry.”

Source: Twitter

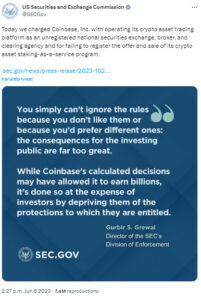

Coinbase was also Sued by SEC

Just a couple of hours back SEC Sued Coinbase. Shares of leading crypto broker Coinbase have already tumbled so far on Monday, falling by more than 10.5% to $57.69. Berenberg analyst Mark Palmer wrote in a note on Monday.

“We observe that several of the details of the lawsuit that the commission filed against Binance echo those it previously filed against crypto exchanges Bittrex and Kraken, and we believe these cases in aggregate represent a preview of the action that is likely to be filed against COIN,” He also stated that least 37% of Coinbase’s net revenue could be at risk if that exchange is subject to charges from the SEC.

Coinbase has already received a warning by SEC in March 2023 and now this suit.

Source: Twitter

What Should Crypto Investors Do?

The lawsuit news had a significant impact on the cryptocurrency market, with Bitcoin and Binance’s BNB token experiencing notable price drops (5.5% and 10.5% respectively)

The bearish sentiment is evident as the downward trend in BTC remains strong.

Further downside movement is possible, with potential support at $26,000.If Bitcoin manages to reclaim the $26,750 level, there are chances of a rebound toward the next resistance level at $27,250.

The relative strength index (RSI) and moving average convergence divergence (MACD) indicators are currently in a bearish zone.

This indicates that the probability of a continued bearish trend remains high today. Therefore, it is important to keep a close eye on the $26,750 level, as it is likely to act as a key level for Bitcoin.

A break below this level may allow investors to enter a strong selling position in Bitcoin. However keep in mind, there are a lot of uncertainties, and the number of questions that we can ask right now is infinite, but all we can do is wait and watch what happens. Plus there’s no denying that a lot of accusations in the SEC charges seem extremely concerning.

Conclusion

SEC’s regulatory actions cause a $50B loss in 12 hours. So, investor protection efforts come at a cost, with $301.3M liquidated in 24 hours. And pushing crypto players out of the US. What is SEC trying to do?

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.