Bitcoin is still trading below the $27k price range. We are seeing reduced activity, be it on sentiment or volume. Some random coins, which are not so random, are pumping and meeting ‘premium’ levels to retrace further.

In this article, we’ll see how Bitcoin is performing in September and how will be in October. If you want to see this kind of research, you need to join Altcoin Buzz Alpha.

The Scary September

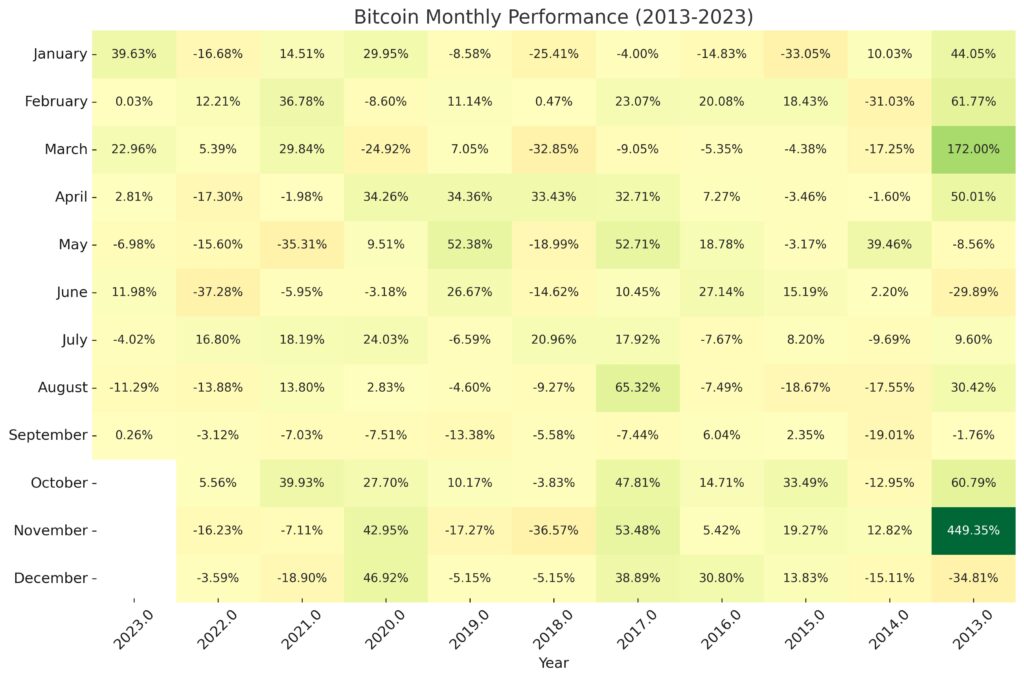

Traditionally, the month of September is known for its negative returns for the entire crypto industry. Let’s analyze the past 10 years and find out why. Here is a table covering the monthly price action of Bitcoin. For your convenience, the numbers are color-coded.

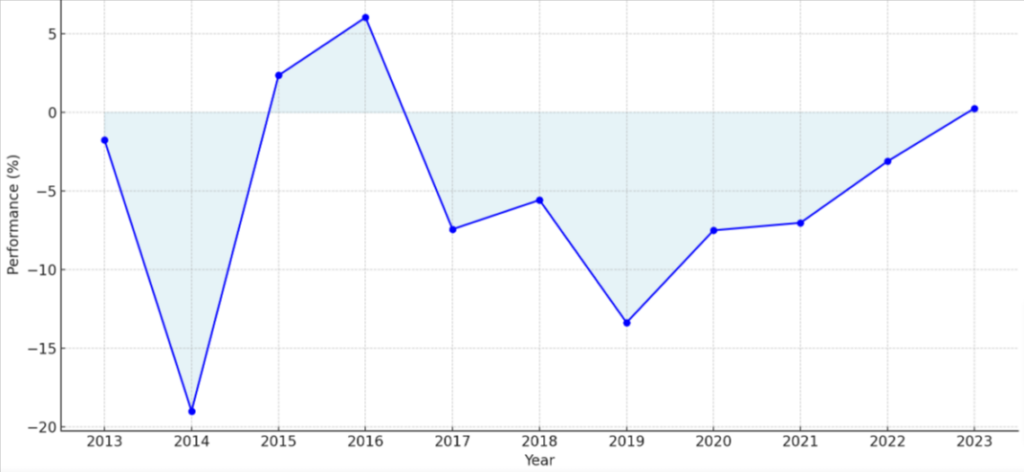

From 2013 to 2022, Bitcoin consistently dropped its value in the month of September. That means 8 out of the last 10 years, Bitcoin was down in September. The only exceptions were the years 2015 and 2016, when Bitcoin recorded moderate 2.3% and 6% gains, respectively.

In 2015, Bitcoin started with a negative return of 33% in January and another 18% drawdown in August. That was the reason behind a 2.3% uptrend in 2015 September. Investors start the year with a negative bias, and the performance in August month consolidates that bias.

While in 2016, Bitcoin experienced an 18% dip in January 2016 and another 7% dip in August. This led to bottoming of the market and a fair return of 6% in September 2016. Since 2015 was an extremely bearish year and 2016 followed the same path, a full bear market was completed.

More About September’s Performance

2022 was an extremely bearish year, and 2023 follows the same pattern. Expecting similar dips and pumps would be a mistake because of the changing investor profiles. However, you can see the market trying to reach the end of the bear market before the halving event in 2024.

Above all, in 2023, Bitcoin started the year with a positive growth of 39%, similar to 2013. Even though 2013 was a super bullish year for Bitcoin, 2023 might not follow the same pattern as Bitcoin went through a negative 11% performance in August 2023, whereas it was a positive 39% growth in 2013 August.

All such data suggest that history could repeat itself, and Bitcoin could experience negative growth in September 2023 and subsequent bullishness in October and November 2023.

Why September is so Bad for the Crypto Industry?

Is the September Effect on Stocks Real? September has been a challenging month for stocks, too. Since 1928, the S&P 500 has fallen by 0.42% on average in September, registering positive returns only 40% of the time. The trend continued in 2022, especially with inflationary pressures and the Federal Reserve’s decision to hike interest rates.

The September Effect is more psychological than economical. September is the month investors fully re-enter the stock market. The bearish or bullish bias influences bearish analysis and portfolio adjustments. Also, businesses start budgeting for the next financial year, which may include cutting costs in a sluggish year. Even mutual funds wrap the fiscal year in September and offload losing positions to solidify their offering.

On one hand, you have individual investors acting on the historical bias. Also, you have mutual funds and other institutional investors re-adjusting their portfolios. The combined effect leads to the September Effect on stocks.

However, let’s be realistic for a moment. Past price actions do not promise future price actions. A piece of positive news could push Bitcoin above 30k, and we would be discussing an entirely different scenario next month. Unless this or a short squeeze happens, Bitcoin could respect the trend.

Conclusion

In any market, there are patterns. The patterns are even more visible, especially for Bitcoin, an incredibly transparent asset. In the last 10 years, Bitcoin has performed poorly in September, and the same may continue even in 2023. Watch out for the negative funding rates followed by the Open Interest collapse in September. If a massive liquidation event follows both, Bitcoin will be on its way to new yearly highs with the halving around the corner.

But how will the perpetual market impact crypto? How will the performance of the stock markets impact crypto? Are we foreseeing a major liquidation event soon?

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.