ETH saw a significant decline in price over the weekend, but everything seems to be fine according to on-chain analytics. There were also four Ethereum Improvement Proposals (EIPs) implemented in the Ethereum network along with some more interesting news.

Let’s examine some notable Ethereum (ETH) updates/news from last week.

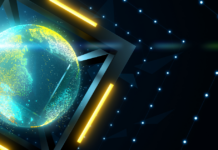

On-Chain Update – ETH: Net Unrealized Profit/Loss (NUPL)

With the rapid growth in the price of ETH in recent weeks, we feel it is essential to give an update on where ETH currently is in regards to a metric called “NUPL.” Briefly, NUPL is a metric that has been historically accurate at pointing out local/market cycle tops in ETH and BTC (the top two cryptocurrencies). In this case, NUPL shows how much of the Ethereum (ETH) network is in profit/loss.

Image Source: Glassnode

In the NUPL chart above, you can see that every time ETH was in the “Euphoria – Greed” (blue) zone, there was some sort of local/market cycle top. This area tends to be around 0.9.

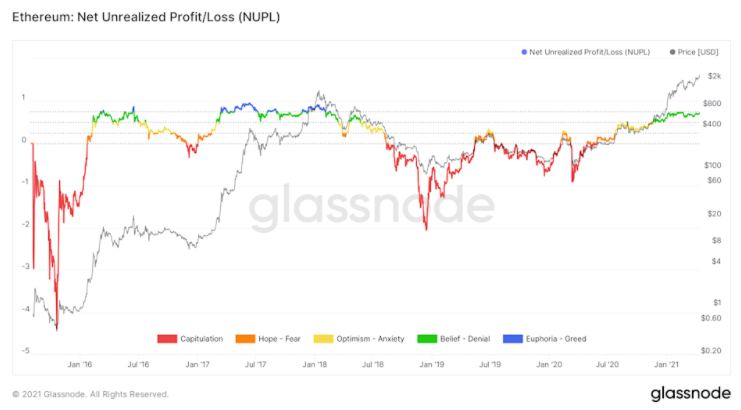

Image Source: Glassnode

Taking a closer look, you can see in the chart above that ETH is still in the “Belief – Denial” (green) zone. At the moment, ETH holders are in the clear, despite the rapid price growth recently – currently sitting around .74. Therefore, there is still room for growth in the price of ETH.

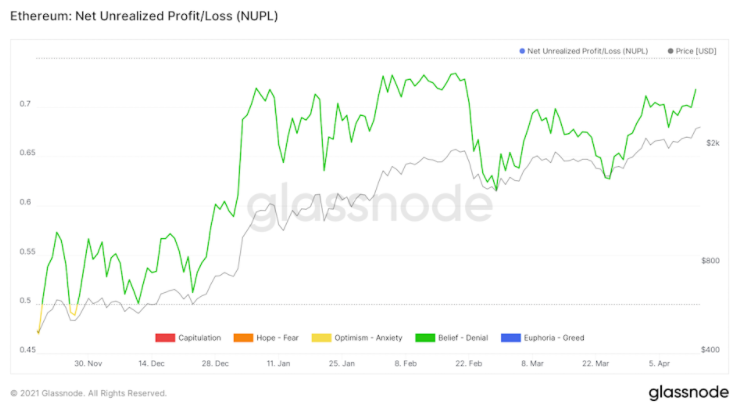

On-Chain Update – ETH: Daily Active Addresses

On April 17, we started to see a sharp decline in the price of ETH. There were a few things that played a key role in the declining ETH price. But, there is one simple on-chain metric that can reveal fear in the market when prices start declining – “Daily Active Addresses.”

Image source: Santiment

As seen in the chart above, the number of daily active addresses on April 17 for ETH hit roughly 632k (a level not seen since 2018). In this case, the large spike in daily active addresses on April 17 was most likely traders selling their ETH due to fear of the price crashing further. At the moment, the spike in daily active addresses on April 17 seems to just be an outlier. It will be key to see if this balances out over the next few days or if daily active addresses continue to remain at high levels.

Berlin Hard Fork

On April 15 at block 12,244,00, the Berlin Hard Fork officially went live. This is a huge stepping stone for the much larger London Hard Fork (set for July of this year).

The Berlin Hard Fork had four Ethereum Improvement Proposals (EIPs) implemented into the network:

- EIP 2929: Increases gas costs for some operations – opcodes that access memory. This increase in price helps prevent hackers from forcing all nodes to perform costly/slow disk access.

- EIP 2565: Lowers gas prices for modular exponentiation transactions. This will foster more use in a wide array of cryptographic operations in smart contracts.

- EIP 2718: Uses envelope transactions to ensure existing transactions feature backwards compatibility.

- EIP 2930: Defines a new transaction type where there are predefined addresses/keys for another transaction. This allows for low gas prices via smart contracts.

Canadian ETH ETFs

On April 16, Canada approved three ETH ETFs (exchange-traded fund). The three companies approved for these ETFs are:

- Evolve ETFs

- CI Global Asset Management/Galaxy Digital

- Purpose Investments

All three ETFs will be available on the Toronto Stock Exchange (TSX) on Tuesday, April 20th. This will provide more exposure to ETH for investors that have a preference to trade only ETFs. We think this may help provide a sense of urgency for the SEC to consider approving cryptocurrency ETFs (most likely BTC first and then an ETH ETF following) in the U.S. as they are seeing a close counterpart already approve multiple ETH/BTC ETFs.

Coinbase ETH Staking Begins

ETH2 staking has begun. We’ve started allowing customers off the waitlist to earn up to 6% APR on their ETH. If you haven’t already, join the waitlist so you can start staking soon. https://t.co/ORMpiikY4E

— Coinbase (@coinbase) April 16, 2021

One of the largest cryptocurrency exchanges is now allowing users to begin staking their ETH2 on the Coinbase platform. To get this feature, users need to join the waitlist and will be notified when they can start staking their ETH2.

Key features of staking ETH2 on Coinbase:

- 6% yield.

- No minimum amount of ETH required to stake.

- See rewards in real-time.

- Initially, users will not be able to sell/send the ETH they stake, but Coinbase plans to offer a way to trade staked ETH in the coming months.

Although there are DeFi platforms that offer high yields for staking Ethereum (ETH) (like SwissBorg), some users may feel more comfortable staking on a large exchange platform like Coinbase for security reasons.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.