With Ethereum consistently trading around $1,800 the last couple of weeks, traders and institutions are seeing this as a once-in-a-lifetime buying opportunity – causing the floating supply of ETH to continue drastically reducing.

Let’s examine some notable Ethereum (ETH) news from the last week.

Possible Supply Crunch on the Horizon for Ethereum

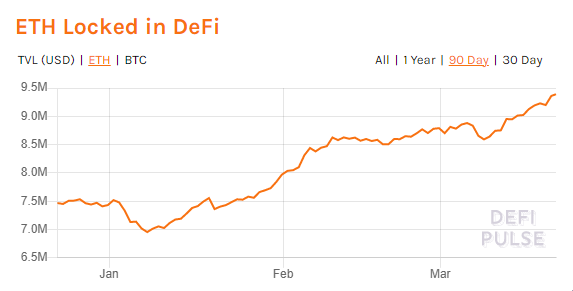

According to DeFi Pulse, there is currently 9.3 million ETH locked in DeFi. This number has been constantly increasing since the start of this year. With the current circulating supply of Ethereum sitting around 115.1 million, this represents roughly 8.1% of ETH’s supply locked in DeFi. The chart below shows a relatively constant uptrend.

Image source: DeFi Pulse

Anthony Sassano noted in his March 18th newsletter that he expects many public companies to announce that they have purchased ETH in the coming months. He thinks some of these companies will buy ETH for various reasons: to stockpile ETH to use as gas, to stake in ETH 2.0, and to implement ETH on their balance sheet as a SoV/reserve asset (similar to Bitcoin). This will be something to keep a close eye on as public companies continue to release their Q1 earnings in the coming weeks.

Not to mention, the whale addresses currently holding ETH are not budging. According to Santiment, there are only .9% less whale addresses holding ETH compared to last month. This means, despite the relatively current stagnant Ethereum price, holders are not selling. This may suggest that holders are optimistic for the future of ETH’s price.

🐳💪 #Ethereum's top holders aren't showing major signs of budging after its #AllTimeHigh hit four weeks ago. There are 0.9% less 10,000+ $ETH addresses compared to last month. Meanwhile, 100-10,000 $ETH addresses have dropped a much more substantial 7.2%. https://t.co/bg4WVcQadM pic.twitter.com/jcFF48X6bo

— Santiment (@santimentfeed) March 17, 2021

In conclusion, ETH’s supply is being sucked up (a majority of it by whales). As a result, we can expect the price of ETH to rise in the future. This conclusion is based off a basic economic principle: supply and demand. ETH’s floating supply is decreasing as demand continues increasing – thanks to DeFi.

Author of Rich Dad, Poor Dad Says To Buy Bitcoin and Ethereum

Our second bit of Ethereum news features best-selling author Robert Kiyosaki saying on his Rich Dad Radio Show podcast that he is scrambling to buy as much Ethereum as possible. Robert says “just buy something” as the economy is showing signs of weakness. This is due to the Fed’s excess money printing to stimulate the economy. As a result, the U.S. dollar has been weakening and the potential hyperinflation scenario seems imminent. Therefore, he says he holds Ethereum as a hedge against these two scenarios.

SwissBorg Users Can Now Earn a Yield of up To 17.5% on ETH

SwissBorg, a popular blockchain-based wealth management platform, announced on March 18 that users can now earn up to 17.5% yield on ETH. Jacqui Pretty, Head of Marketing, says this ETH Smart Yield wallet has five main characteristics:

- SwissBorg is able to find the best return with the least risks through their strategy optimizer, which monitors and rates all investment opportunities on a daily basis.

- The wallet is able maximize returns by offering a variable yield. You will be able to get the highest available yield while taking into consideration the best risk/return ratio.

- The yield earned will also compound every 24 hours. This will, over time, result in higher earnings.

- There is no minimum investment period to get the highest yield. Users won’t have to lock their funds for a specific amount of time (30 days, 90 days, etc.).

- Just like all of the other Smart Yield wallets on SwissBorg, this ETH Smart Yield wallet will have their Safety Net Program incorporated in it, which protects against smart contract risk.

🎉 Giving you this long-awaited news brings us joy: Ethereum Smart Yield is available on our app! Go Premium to 2x your #yield. Earn up to 17.5% p.a. on #ETH. 🚨 Update your app to access the smart yield. Read the details here: https://t.co/AjjEbKyGaV#Ethereum #CHSB #SwissBorg pic.twitter.com/4afv61O23G

— SwissBorg (@swissborg) March 18, 2021

Publicly Traded Chinese Technology Company Increases Its Ethereum Holdings

Meitu Inc. – a publicly traded Chinese technology company – had previously disclosed earlier this month that they acquired 15,000 ETH for a total of $22.1 million. On March 17th, the board issued another statement where they disclosed another purchase of 16,000 ETH at a total cost of $28.4 million. This totals their ETH holdings to 31,000 ETH at an aggregate price of $50.5 million. Meitu seems to be the MicroStrategy of Asia.

BREAKING – Hong Kong Listed Company Meitu Inc has purchased another 16,000 ETH at $28.4million and 386 BTC at $21.6million.

The group now has $90mil worth of cryptocurrencies.https://t.co/P367TtPuiO pic.twitter.com/sYPSWPjOpJ— frxresearch (@frxresearch) March 17, 2021

Messari Research Analyst Says Ethereum Could Overtake Bitcoin

In our last bit of Ethereum news, Ryan Watkins, a research analyst at Messari, said in a recent interview that Ethereum could overtake Bitcoin as the most valuable cryptocurrency. He sees this as a possible scenario for two main reasons:

- Ethereum’s shift to Ethereum 2.0 which changes the coin’s monetary policy (making ETH deflationary).

- Watkins also said Ethereum is continuously improving its blockchain utility in the cryptocurrency market. This is due to the rise of DeFi and dApps (decentralized apps) being built on the Ethereum blockchain.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.