The crypto space in Q3-2023 saw a lot of sideways movement. CoinGecko published a report with their findings for Q3-2023.

They covered six areas, including, among others, NFTs, RWA, and stablecoins. In this article, we will recap all six areas from the CoinGecko crypto industry report.

Total Crypto Market Cap

The total crypto market cap declined by 10% during Q3-2023. That equals $119.1 billion. However, that’s still 35% higher compared to a year-to-date. The average daily trading volume also declined. That took an 11.5% hit compared to Q2-2023. In Q3-2023, it sat at $39.1 billion.

We also saw some coins moving positions in the top 25. Notably, Solana (SOL) went from #10 to #7. Another big mover was TrueUSD (TUSD), jumping from #23 to #19. On the other hand, other coins dropped. For example, Litecoin (LTC) went from #9 to #14 and Avalanche (AVAX) slid from #15 to #22.

1/ Total crypto market cap fell 10% in Q3 🔴

• Total crypto market capitalization decreased by $119.1B, but it remains 35% higher YTD.

• Notable ranking changes in the top 30 cryptocurrencies included $SOL climbing from #10 to #7, and $TUSD from #23 to #19. pic.twitter.com/Ua00mgfbZk— CoinGecko (@coingecko) October 24, 2023

Stablecoins

If we look at the top 15 stablecoins, we see that they shrank by 3.8%. That’s a market cap loss of $4.8 billion during Q3-2023. As a result, the market cap sat at $121.3 billion.

USDT’s market cap remained stable, and the coin actually gained a 2.6% market share. USDC had a bigger loss to absorb, it declined by 8.3%. That’s an absolute loss of $2.26 billion. On the other hand, Binance USD (BUSD) declined by 45.3%. That’s because Binance will stop supporting the coin in early 2024.

The only stablecoin that gained in market cap was TUSD. It saw a 12.8% increase.

2/ Top stablecoins shed $4.8B with $TUSD being the sole gainer 🪙

• $TUSD was the only gainer in the top 5, with a 12.8% increase in market cap.

• Notable newcomers outside the top 5 include $FDUSD, $CRVUSD, & $PYUSD. pic.twitter.com/FiIfRNLmvM— CoinGecko (@coingecko) October 24, 2023

RWA Assets

The RWA (Real-world assets) sector was the only crypto space with growth in Q3-2023. We saw one asset sticking out above the rest of the RWAs. These are the tokenized treasury bills. Their market cap saw a 5.84x gain. It had a cap of $114 million in January 2023. This went all the way up to $665 million by the end of September.

TradFi or traditional finance was in control here. However, we saw a triple increase in projects offering T-bill tokens. The biggest player in this space is Franklin Templeton with a 46.6% share. Ethereum hosts 49% of all RWA protocols. However, Stellar is not far behind with 48%.

3/ Tokenized T-bills lead RWA asset growth with a 5.84x increase 🏦

• Tokenized T-bills saw explosive growth in 2023, surging from $114M in January to $665M by September.

• TradFi institutions lead the market, primarily using #Ethereum and #Stellar blockchain networks. pic.twitter.com/qcX5haFxht— CoinGecko (@coingecko) October 24, 2023

NFTs

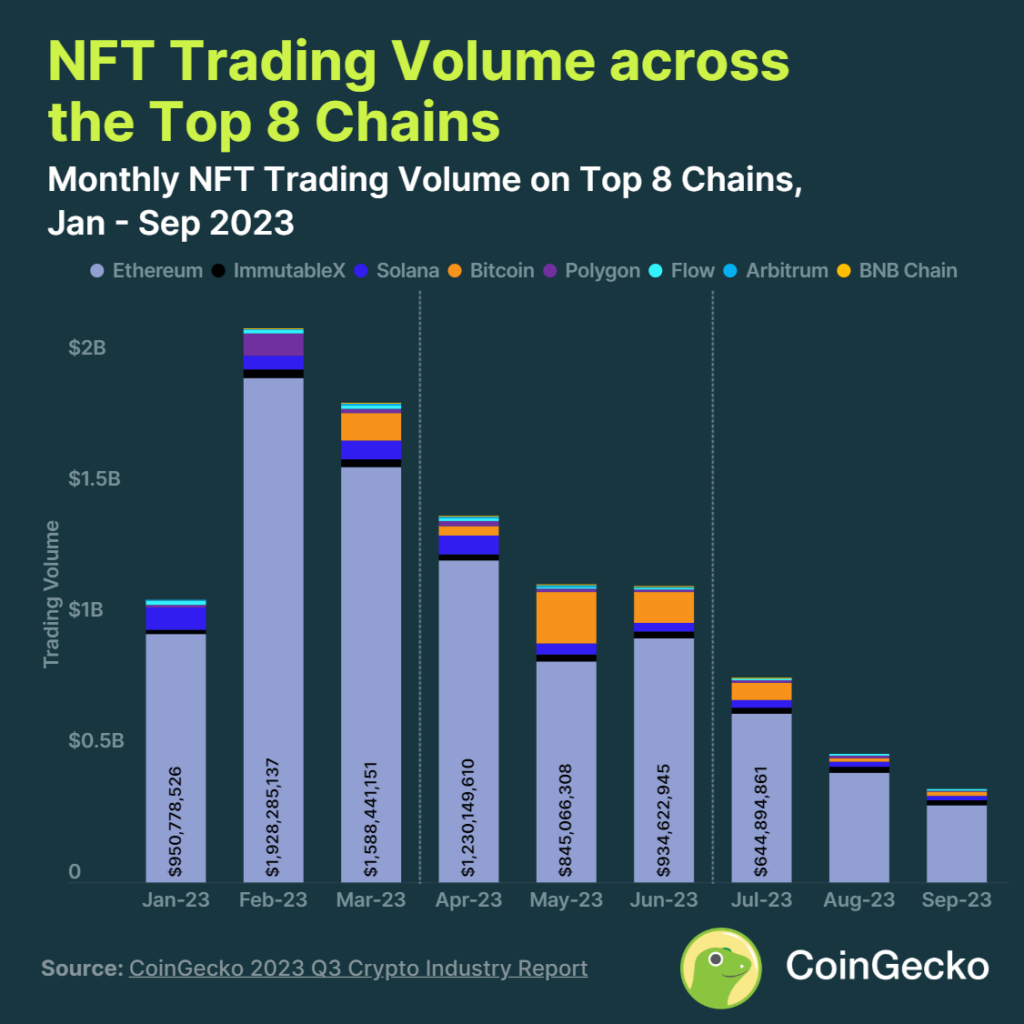

NFTs across all chains are having a hard time. Their trading volume went down by a staggering 55.6%. However, Ethereum is still leading the pack with an 83.2% market share. We did witness an unexpected newcomer, though. Bitcoin managed to grab a 5.6% market share.

The one project that had a strong Q3-2023 was ImmutableX. It had a monthly trading volume that averaged well north of $20 million. ImmutableX also saw two consecutive quarters where its market share increased. Q2 by 2.1% and Q3 by 3.9%.

Spot Trading Volume on CEXes

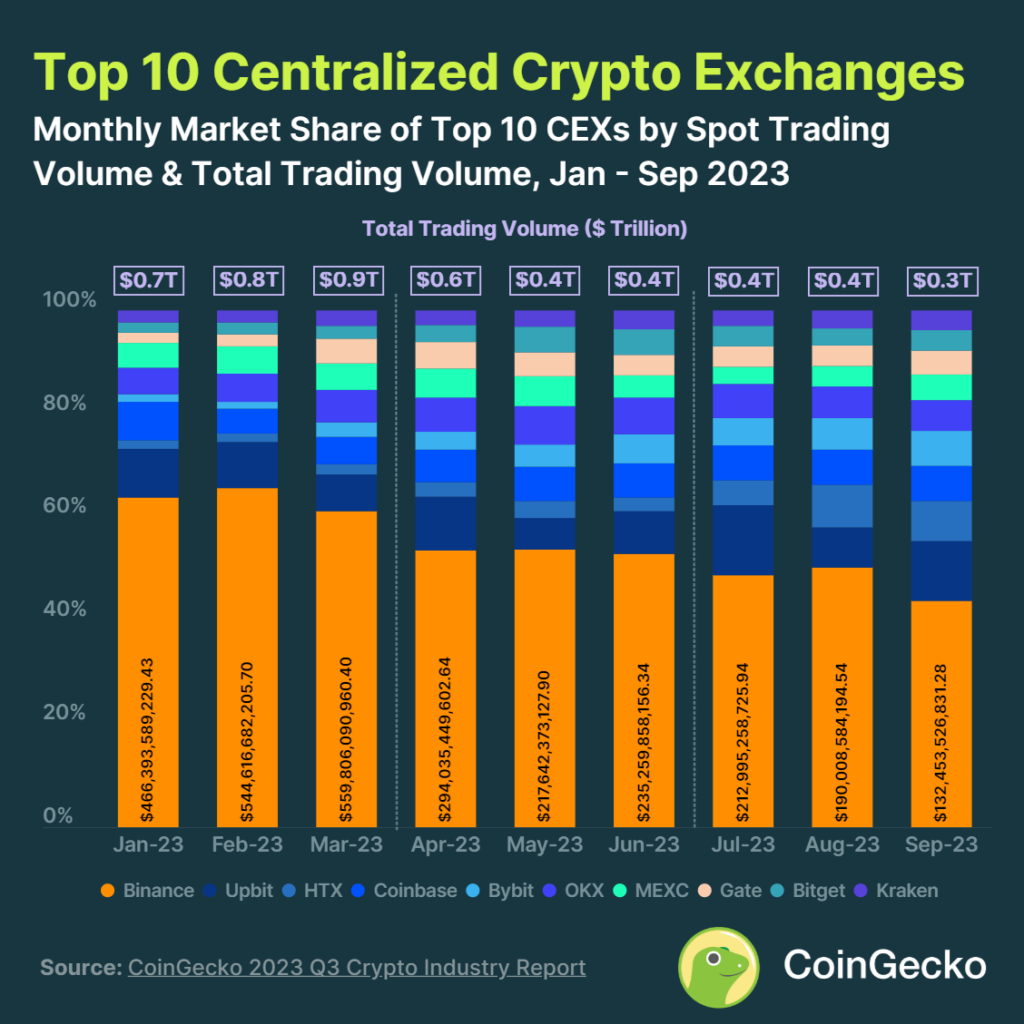

The spot trading volume on the top 10 CEXes declined by 20.1%. That’s a total of $1.12 trillion. Tall trees catch much wind, and Binance answered to this. Among others, it experienced regulatory scrutiny. Binance also left various markets, and some top executives left Binance. This affected its market share, being 66% in February (a year high) compared to 44% in September (a year low).

Huobi, which came back under a different name, HTX, managed to enter the top 10 again. This went at the cost of KuCoin, that’s now outside the top 10.

Spot Trading Volume on DEXes

The spot trading volume on the top 10 DEXes declined by 31.2%. That brought the total volume down to $105 billion in Q3-2023. THORChain saw the most gains. Its volume went up by 113% or $1.27 billion. However, we need to point out that this included transactions by bad actors. For example, the FTX hacker was a THORChain user, as was the North Korean hacker group Lazarus. At the end of September, THORChain’s market share reached 3%.

On the other hand, SushiSwap dropped out of the top 10. This made room for the Solana-based Orca DEX. Orca now has a 1% market share.

6/ DEXs see 31.2% drop in spot trading volume 💱

• Spot trading volume on top 10 DEXs totaled $105B, representing a -31.2% drop from Q2.

• @THORChain was the largest gainer in 2023 Q3, with volume climbing 113%, while @SushiSwap fell out of the top 10 in the same period. pic.twitter.com/dCYaAFubWR— CoinGecko (@coingecko) October 24, 2023

Conclusion

We recapped the CoinGecko crypto market report for Q3-2023. In six different market segments, we saw a decline in five of them. Only the RWA sector saw an increase in market share. In total, the crypto market declined by 10% during Q3-2023. That’s still 35% better compared to last year.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.