In crypto, time passes really fast! In the blink of an eye, we’re already in 2023’s last quarter. But, before we end the year, let’s review the events and lessons from Q3-2023.

To do this, we’ll be summarizing key points from Binance’s Market Q3-2023 Report.

Our latest State of Crypto Report summarises all the key insights, events, and learnings from Q3.

Find everything you need to know about developments in the space, including analysis of:

🔸 Layer 1s & 2s

🔸 DeFi

🔸 NFTs

🔸 GamingStart reading here ⤵️https://t.co/ES5z6g8FMU

— Binance Research (@BinanceResearch) October 19, 2023

Overview

To start off, Binance’s market Q3-2023 report provides an overview of the crypto space. In a nutshell, the outlook is pretty bleak in this quarter. Despite major developments, key metrics are mostly trending downwards. Let us look at what these are below:

- Market Cap for the entire crypto space fell 8.6% from Q2-2023.

- Developer Activity fell slightly from Q2-2023.

- The amount of funds raised for crypto projects hit a new 3-year low. Compared to Q2-2023, the total amount of funds raised has decreased by 21.4%.

- Crypto Fear & Greed Index fell 9 points from Q2 2023. At the end of Q3-2023, the index is slightly below the neutral line. This indicates a slightly fearful sentiment.

Apart from the above info, Binance adds more insights in terms of crypto price action. These include:

- For Year-To-Date (YTD) price performance, $BTC reigned supreme. $BTC has risen 63% since the start of 2023. Other major cryptos with similar price movements include $XRP, $SOL, and $TRON.

- Bitcoin Dominance fell 1.5% from Q2-2023.

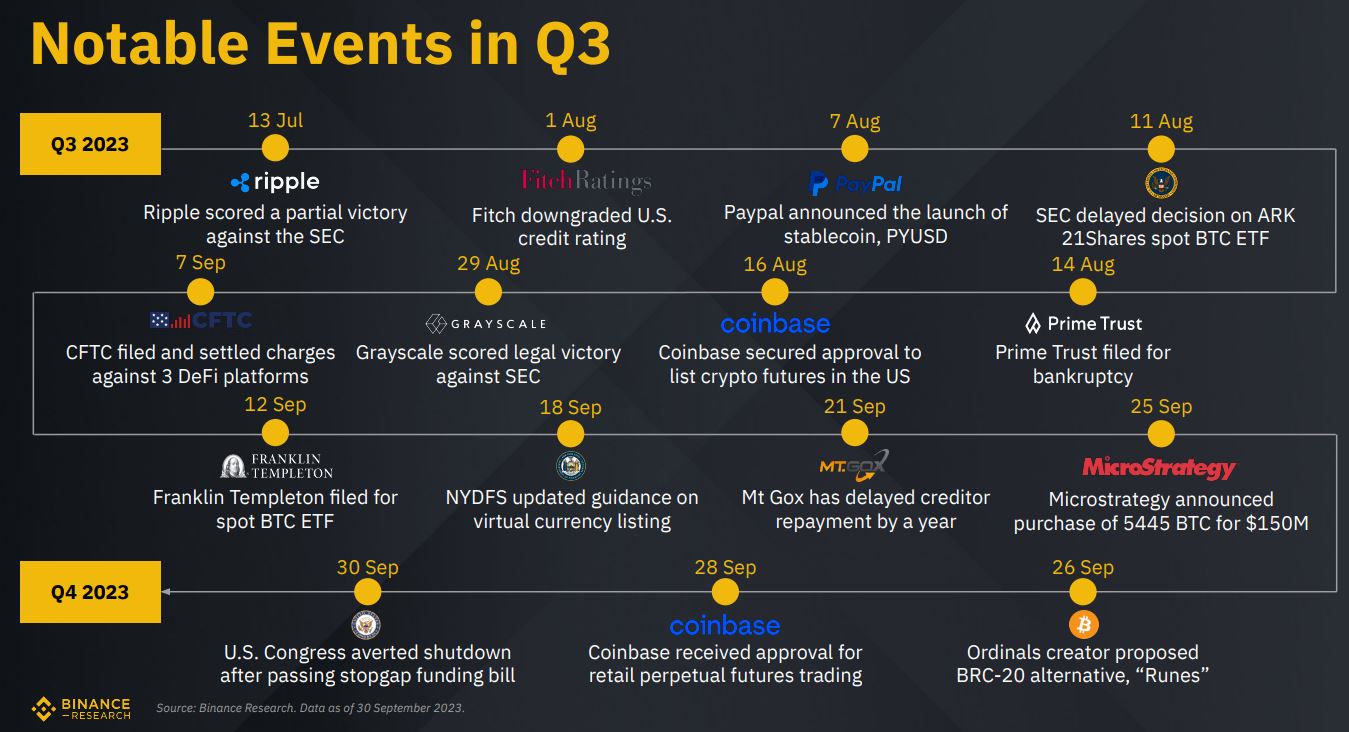

Next, Binance adds on some notable events in Q3-2023. You can take a look at these in a timeline format below. Some of these events are bullish for Bitcoin. For instance, many institutions like Franklin Templeton are filing for $BTC ETFs.

To summarize, the overview of Q3 2023 shows a bleak, but not hopeless outlook. We’re looking forward to a turnaround in this current Q4-2023. Now, let’s dive into the details of other sectors of the crypto space.

Layer 1 (L1) And Layer 2 (L2) Activity

Here, Binance’s market Q3-2023 report provides insights on activity for the L1 and L2 projects.

L1 Projects

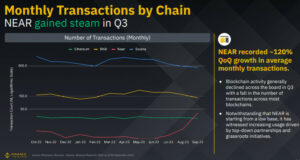

The report compares 4 prominent L1s, namely Ethereum, BNB Chain, Solana, and NEAR protocol. These are the findings:

- For monthly transactions, only NEAR had an increase. All 3 other projects had slight decreases.

- For active addresses, only NEAR had an increase. The other 3 projects had slight decreases.

- For Twitter followers, BNB Chain had the best performance. As of the end of Q3-2023, it overtook Ethereum with 3.2 million total Twitter followers.

Aside for the above comparisons, the report provides some further on-chain insights:

- Ethereum’s gas fees fell in Q3-2023 from the previous Q2-2023. This is not a good sign as it shows a drop in activity on the Ethereum chain.

- The amount of $ETH staked on Ethereum continues to increase. This is a good sign as it shows confidence in Ethereum. To add on, Liquid Staking has gained much traction in Q3-2023 too.

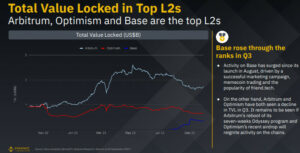

Moving on, we take a look at the state of L2 projects in Q3-2023.

L2 Projects

For L2 projects, the report compares with 3 major ones. These are Arbitrum, Optimism, and Base. For Total Value Locked (TVL), Arbitrum and Optimism fell short. But, Base increased its TVL since its August 2023 launch. For sure, Base has entered the fray with a bang. In fact:

- For daily active addresses, Base has exceeded Optimism on several occasions.

- For daily transactions, Base has outperformed both Optimism and Arbitrum combined on certain days.

Yet as of today, Arbitrum is still the dominant L2. Will Base take over Arbitrum soon? Only time will tell!

DeFi

DeFi is one of the most important narratives in crypto. Binance’s market Q3-2023 report shows some data on its performance.

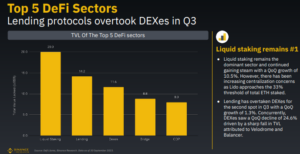

- DeFi’s TVL fell in Q3-2023 from its previous Q2-2023 by 13.1%. Yet, innovations and development continue in this space.

- Liquid staking is the #1 sector within DeFi. The other sectors include Lending, Decentralized Exchanges (DEXs) and bridges.

- Ethereum remains the undisputed leader in DeFi by TVL. Tron saw slight improvements in its TVL.

Moreover, the report provides more info on DeFi Decentralized Applications (dApps).

- For dApps, Lido remains the leader by TVL.

- Stablecoin activity has increased across the board.

- Funds lost due to hacks were at the highest in Q3 in 2023.

With the above info, the growth of DeFi does seem to be slowing down in Q3 2023. Now, let us segue into the NFT sector.

NFTs

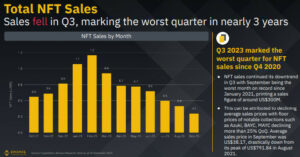

Binance’s market Q3-2023 report presents some data on the NFT scene. Sad to say, Q3-2023 isn’t a great quarter if you’re an NFT enthusiast. The metrics below have all fell in Q3-2023 compared to the previous Q2-2023:

- NFT Sales.

- NFT Transactions.

- Number of unique NFT buyers.

- NFT-500 Price Index.

A deeper look into the NFT space shows Gaming and Metaverse NFTs declined the worst. Speaking of gaming, the report has some data as well. That’s coming up in the next section.

Gaming

For web3 gaming, the report deep dives into some pertinent data below:

- BNB Chain dominates the blockchain gaming space with 1/3 of the market share.

- Across the gaming landscape, only 27.6% of games are live. The rest are still in development. This clearly shows the infancy of the blockchain gaming space.

- The most popular blockchain game is Alien Worlds. This is followed by Sweat Economy and SuperWalk. Both of which are Move-to-Earn games.

- $SAND, $AXS, and $MANA remain the top 3 tokens in the gaming space.

All-in-all, there’s not much data on how gaming is doing in Q3-2023. Rather, the report informs us on the leaders within this space.

Conclusion

To conclude, Binance has released a pretty solid and informative report for us. The verdict? It has been a bleak Q3-2023. But for some, it’s a good opportunity to get into the crypto market at low prices.

Moreover, the month of October seems to be bullish too! Hence, we look forward to better data and activity for the last Q4-2023.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.