Remember the times when Ethereum was a proof-of-work Blockchain? Well, if you’ve been keeping tabs on the crypto space, you’d know that those days are long gone.

Today, you can stake $ETH directly on its new chain.

What is Ethereum Liquid Staking?

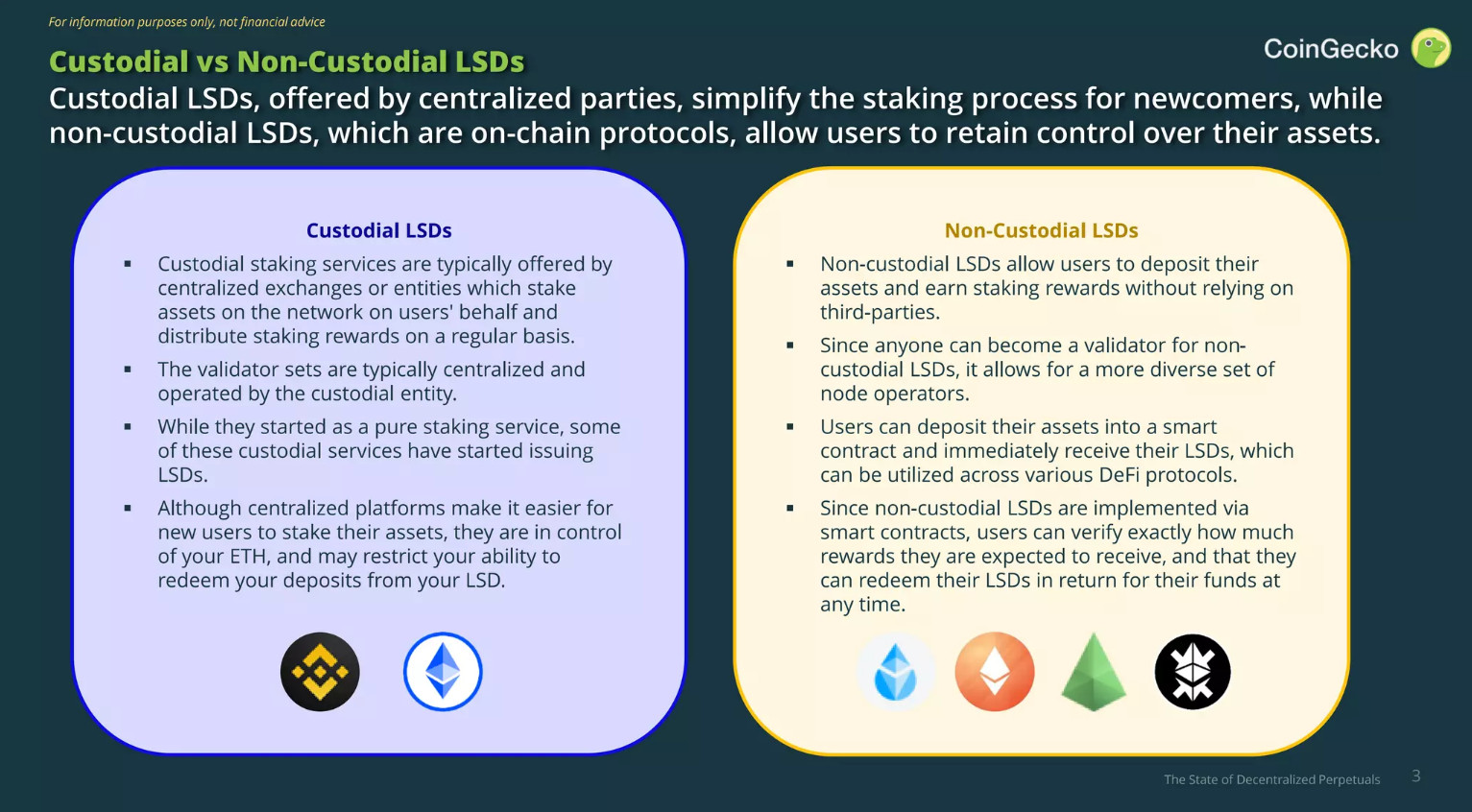

Ethereum Liquid Staking refers to a user staking $ETH, and receiving another token in return. This token is proof that represents your stake. Said token is also known as a Liquid Staking Derivative (LSD).

With this LSD token, you’re now free to participate in DeFi. You can provide liquidity, deposit the token as collateral, or even transact your token. At any time, the holder of the LSD can withdraw the staked $ETH. To do this, you exchange the LSD token for your initial stake and accrued rewards.

Above are some examples of LSD protocols. They could be custodial or non-custodial. But the main principle remains. LSD protocols help you unlock the value of your staked assets.

How Is Ethereum Liquid Staking Doing in 2023?

To answer this question, we’ll be analyzing the details from CoinGecko’s report here. In short, this has been growing with strength since its inception. Let’s look at how that is so below.

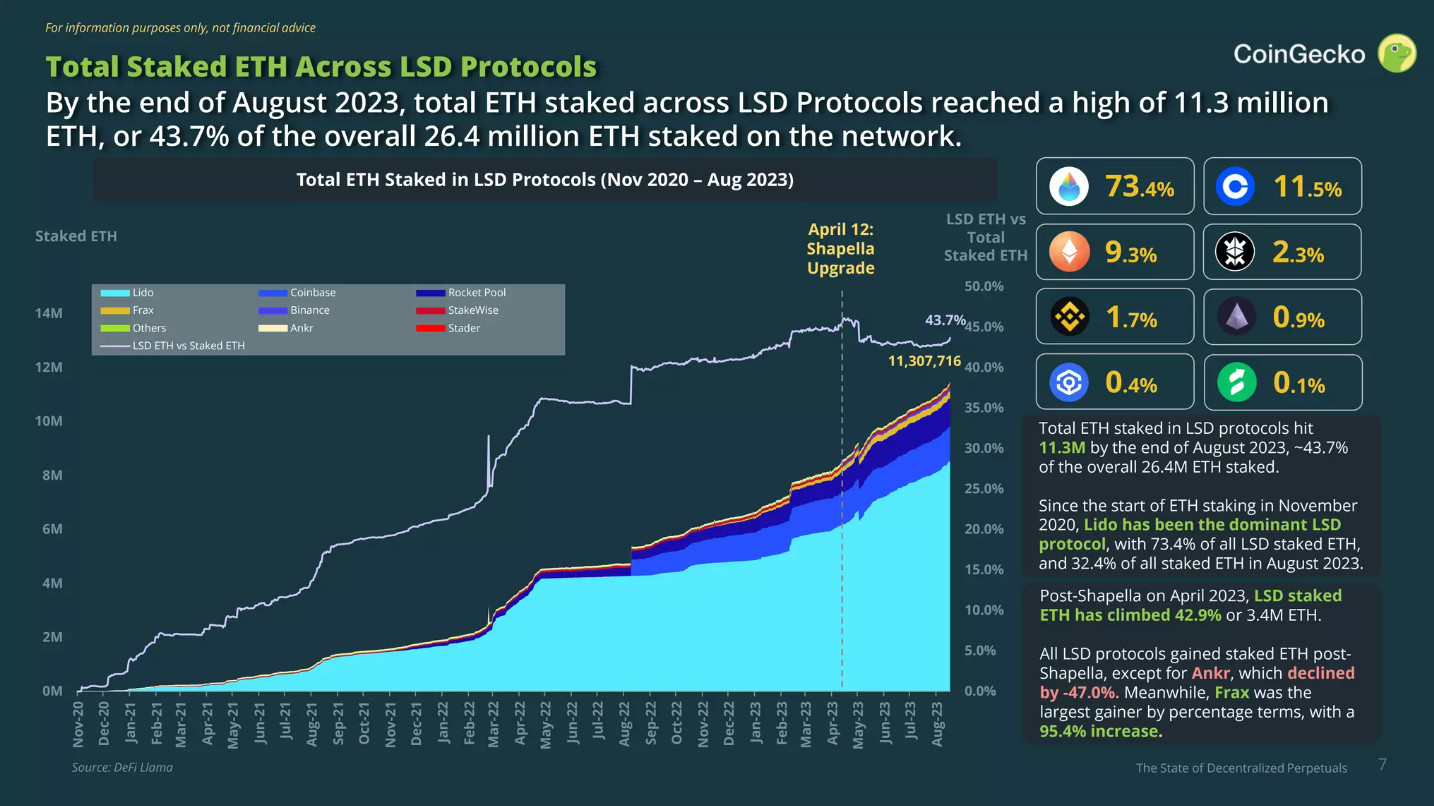

#1 – Total Staked $ETH Across LSD Protocols

Let’s look at the first bullish sign for this trend. As you can see above, the amount of $ETH staked on LSD protocols have been on a solid uptrend. This is since the launch of Ethereum staking in December 2020.

To add on, LSD protocols hold a market share of 43.7% for staked $ETH. That’s a pretty huge number. At the end of August 2023, 11.3 million $ETH lies on LSD protocols, with Lido being the dominant player. If you want to learn more about how to stake your $ETH on Lido, you can refer to our previous guide here.

#2 – $ETH Inflows Across LSD Protocols

2/ Despite $ETH withdrawals being enabled with Shapella, LSD protocols as a whole experienced net $ETH inflows post-upgrade.

Yet, there were heavy outflows from @Coinbase and RocketPool on several days. Meanwhile, Lido, the leading LSD player, saw daily net inflows of +18K ETH. pic.twitter.com/vUDc0icvKQ

— CoinGecko (@coingecko) September 26, 2023

Indeed, since LSDs have been created, many of them had large $ETH deposits. Over time, the entire sector has had net inflows. This means that $ETH deposits outweigh withdrawals. In turn, this shows confidence from the crypto space towards LSD protocols.

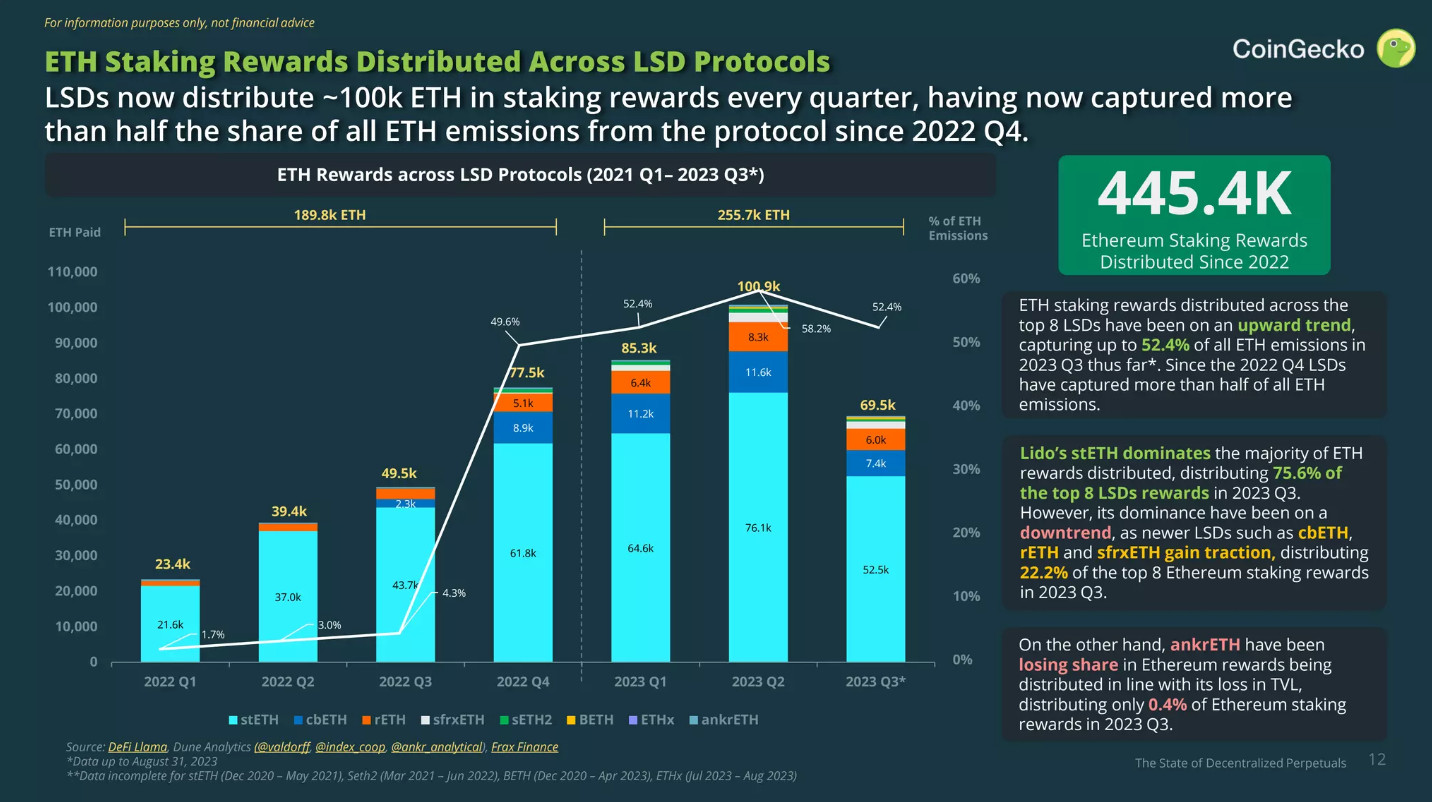

#3 – $ETH Staking Rewards For LSD Protocols

Another bullish sign for the liquid staking trend is the allocation of $ETH rewards. From the above, $ETH rewards for LSD protocols have been on an uptrend. Naturally, you need to stake more $ETH to get more rewards. Again, this uptrend reflects confidence from the public towards LSDs.

Let’s talk about something else interesting in the above chart. You can see that Lido’s $stETH (in teal) is losing dominance. It’s still the market leader though, but its competitors are catching up. This means the space is heating up. Hey, competition’s good for us right? With competition comes innovation, and the space can progress as a whole.

#4 – Other Bullish Signs

Some other bullish signs that reflect the rise of LSD adoption include:

- $ETH validator queues reaching highs of 45 days. In comparison, the exit queue takes 10 days. This shows interest in $ETH staking in general, including that from LSD protocols.

- Yields from staking $ETH on LSD protocols are expected to decrease. This reflects the increased interest of $ETH staking in general as well. With more people and protocols staking $ETH, yields will naturally decrease.

- The amount of staking fees earned from LSD protocols is on an uptrend. LSD protocols charge a fee when you stake your $ETH with them. Since they’re earning more, this shows that the amount of $ETH staked with them is growing.

For sure, the signs are clear that Ethereum Liquid Staking is growing. In the next section, we take a look at some projects that are leveraging this trend.

LSDFi Projects – What Are They?

LSDFi projects focus on the LSD niche. Usually, they use DeFi to increase the value of LSD tokens. In the tweet below, you can see who are the leading LSDFi projects, by Total Value Locked (TVL).

5/ Total Value Locked (TVL) in LSDFi protocols grew 5,870% (58.7X) since January 2023 and has reached $919.3M at the end of August 2023. 📈

The Top 10 LSDFi Protocols by TVL 👇 pic.twitter.com/53htX8AHmY

— CoinGecko (@coingecko) September 26, 2023

As you can see, LSDFi projects are gaining adoption as well. That’s because they’re building on a growing trend. In turn, LSDFi could turn out to be a strong niche in today’s crypto market too!

If you’re interested in learning more about LSDFi projects, we’ve shortlisted some great ones here.

Conclusion

The answer’s clear. Ethereum Liquid Staking is growing with strength. Despite this bear market, we can still tell that many are confident in the future of Ethereum. Aside from that, it’ll be wise to keep tabs on the LSD and LSDFi landscape. As this is a pretty new niche, there are plenty of opportunities to earn yield or to scoop up some gems.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.