By now, we know that the SEC is going full force after the crypto space. Unless you’ve been living under a crypto-free rock. It appears that they are extending their grip to the NFT space as well.

They sued Impact Theory for selling NFTs as securities. So, let’s see what the SEC’s views on NFTs are.

Impact Theory’s NFTs

Impact Theory‘s goal is ‘to build the next Disney’. To reach this goal, they have, among others, podcasts. With these, they reach up to 13 million people per month. They also offer a 3D blockchain-based alternate reality game. Last but not least, they offered NFTs. The co-founder and podcast host is Tom Bilyeu.

Now, with the NFTs, they had three tiers. These are the Founder’s Keys. They labeled the three tiers as “Legendary,” “Heroic,” and “Relentless.” However, they also promised that NFT investors would have “tremendous value”. They also told investors: “Will make sure that we do something that, by any reasonable standard, people got a crushing, hilarious amount of value.” As a result, they raised no less than $30 million with the NFTs. This was back between October and December 2021.

Today we charged Impact Theory LLC, a media and entertainment company headquartered in Los Angeles, with conducting an unregistered offering of crypto asset securities in the form of purported NFTs. Impact Theory raised approximately $30 million from hundreds of investors.

— U.S. Securities and Exchange Commission (@SECGov) August 28, 2023

However, on the same day that the SEC filed the allegations, they also reached a settlement. Impact Theory will, for instance, have to:

- Pay a $6.1 million dollar penalty.

- Set up a “fair fund” to return money to investors who had purchased an NFT.

- Destruct all NFTs in the team’s possession.

- Publish a notice on the project’s social media.

- Cut any royalties on all future secondary sales.

Tom Bilyeu commented this about the settlement: “The settlement is called a neither-admit-nor-deny basis. This means that I neither agreed nor disagreed with the SEC’s takes.”

It’s also of interest to point out that this was not with the unanimous support of all SEC commissioners. Commissioner Hester Peirce and Commissioner Mark Uyeda released a statement. This included, among others, the following: “The SEC does not routinely bring enforcement actions against people that sell watches, paintings, or collectibles along with vague promises to build the brand and thus increase the resale value of those tangible items.”

The SEC vs. NFTs

So, what is the SEC trying to achieve here? The SEC alleges that the Impact Theory NFTs are security investment contracts. So, Impact Theory made a lot of noise, stating that the NFTs would increase in value. However, buying NFTs is not the same as buying shares in a company. NFTs also don’t offer any form of dividend for the buyers. So, the real question is, were the NFTs offered and sold as investment contracts?

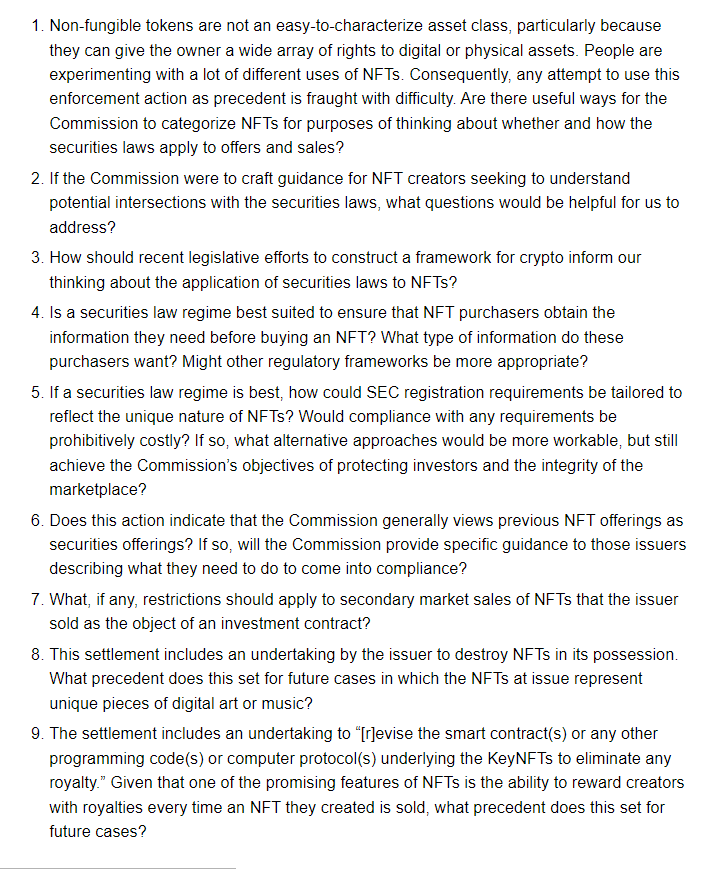

It looks like the answer to this is already given. However, it’s not always that simple. It is interesting, that the two SEC commissioners came up with a list of questions. They would like to see a discussion about NFTs. The picture below shows a list of some of their questions:

Source: SEC

So, although the SEC is on an aggressive route towards NFTs, not everybody in the SEC agrees with this. This gives reasons to be optimistic. The list of questions by the two commissioners is a good list. It’s thoughtful and gives hope that there will be a reasonable discussion about NFTs.

Conclusion

The SEC keeps throwing cases at the crypto space. Now they also include NFTs. However, some of these cases start to backfire. See the XRP and Grayscale cases. The crypto space can do with some form of regulation. However, blindly throwing cases at crypto is not going anywhere. So far, the American justice system seems to be doing a good job of this.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.