Kyber Network recently announced the launch of the KyberSwap Elastic, which allows users to provide liquidity to a pool within a custom price range (concentrated liquidity). KyberSwap Elastic brings flexibility to users, allowing them to provide liquidity to pools with different fee settings.

TLDR – If you want to deposit liquidity and don’t want to return every day to reinvest, KyberSwap Elastic is probably the best choices out there. It give you access to 11 chains and it allows you to swap tokens and get one of the best exchange rates on these chains – all within one platform.

The KyberSwap Elastic protocol automatically reinvests users’ fee earnings by adding them back into the liquidity pool, enabling them to earn more fees from compounding. The protocol also acts as a shield from sniping attacks. KyberSwap Elastic comes ready-made with an anti-sniping feature that ensures that attackers do not take advantage of liquidity providers during a swap.

Since the launch of the KyberSwap Elastic Protocol, there have been many comparisons between it and the Uniswap V3. Some have even assumed that the Elastic Protocol is a fork of the Uniswap V3. Although both platforms are strong competitors, such claims are false.

The Uniswap V3 source code is under the Business Source License 1.1. This means that it is not fully open source. Due to copyright policies restricting unauthorized commercialization of the source code for two years, the earliest a fork of the Uniswap V3 can take place is in 2023. So, the KyberSwap Elastic Protocol is not a fork of the Uniswap V3. Instead, it was developed with original source code.

The confusion surrounding both platforms is quite understandable since they are similar in many ways. For example, both protocols are tick-based AMMs and have customizable price ranges. They also use NFTs to represent liquidity positions. But that’s all there is to their similarity. The Elastic Protocols differ from the Uniswap V3 in several ways. Let’s look at them.

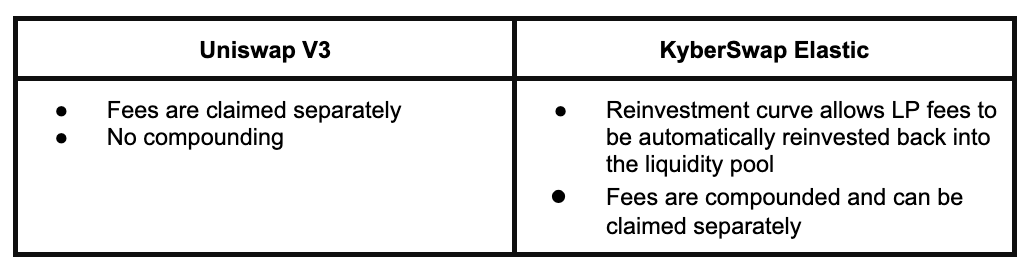

Compoundability

One of the core differences between the two protocols, Compounding refers to the process of gaining revenue on an asset’s reinvested profits. On Uniswap V3, users claim their fees separately, and there is no room for compounding. However, KyberSwap Elastic allows for compounding and fees can be claimed separately. The reinvestment curve on the protocol allows LP fees to be automatically reinvested back into the liquidity pool and enhance their earnings.

JIT/Snipe Protection

Security is a part of the core values of Kyber Network, and the Elastic protocol was deployed with ready-made security features. One such example is the JIT/Snipe protection feature. A snipe attack usually aims to steal fees generated in a swap. However, the Elastic protocol snipe protection tool prevents this.

KyberSwap Elastic’s JIT/Snipe Protection locks the trading fees and earnings of liquidity providers and vests them based on the LP’s duration of liquidity contribution. So, in this way, KyberSwap Elastic ensures the safety of the earnings of each liquidity provider.

On the other hand, the Uniswap V3 protocol does not have this feature.

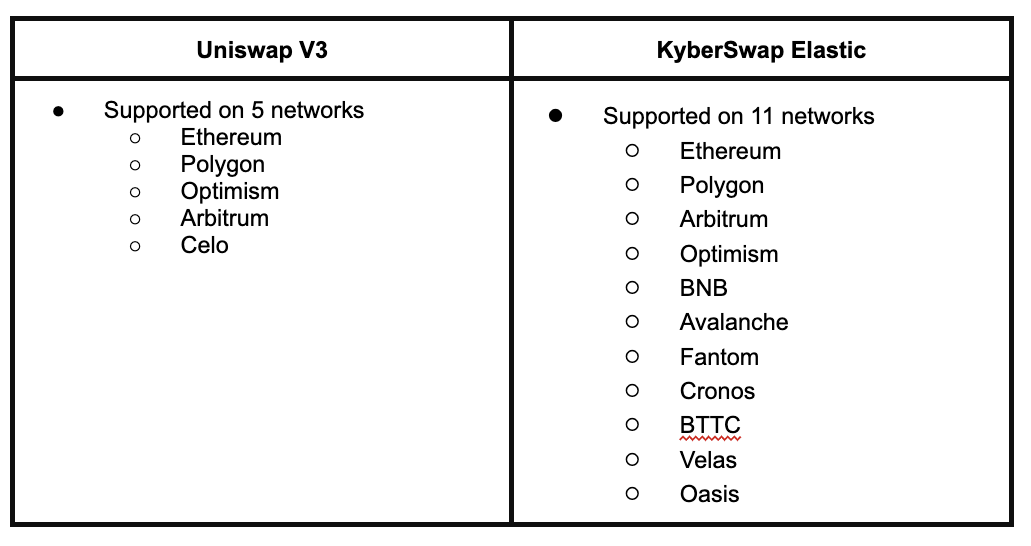

Connectivity

As of now, 11 chains presently use KyberSwap Elastic while the KyberSwap Classic is deployed on 12 chains. This increases the flexibility, accessibility, and possibility for LPs and traders to use KyberSwap in any ecosystem of their choice.

On the other hand, Uniswap V3 is only deployed on 5 chains, some of which already support KyberSwap Elastic.

Conclusion

The launch of the KyberSwap Elastic protocol was not simply to create more competition in the industry. Instead, it was to offer and enable collaboration in the DeFi market. Both platforms are distinct in their respective ways and are not clones of each other. While the Uniswap source code is licensed, the KyberSwap Elastic code is open source. This means that developers are welcome to fork it.

Kyber Network prides itself on running a transparent system. And opening its code to other developers mirrors its goal of enhancing collaboration in the DeFi space.

Stop losing money on DEX exchange fees! Use Kyber’s aggregator and get access to one of the best exchange rates from 11 chains and 80 DEXs today.

⬆️Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Kyber. Copyright Altcoin Buzz Pte Ltd.