Recently, a new buzzword is floating around in the crypto space. LSDfi (Liquid Staking Derivatives finance) as they call it. It’s the new hype, and you should pay attention, since it’s breathing new life into DeFi.

As of now, leading the LSDfi charge is Pendle Finance. With its recent token $PENDLE listing on Binance, you can tell it’s not a shoddy project.

As a matter of fact, you can earn good yields for your assets on Pendle. Pendle allows you to tokenize future yields for your crypto. In turn, this opens up a spate of DeFi strategies. Today, we’re going to go through three such strategies to earn crypto with Pendle.

Strategy #1 – Pendle Earn

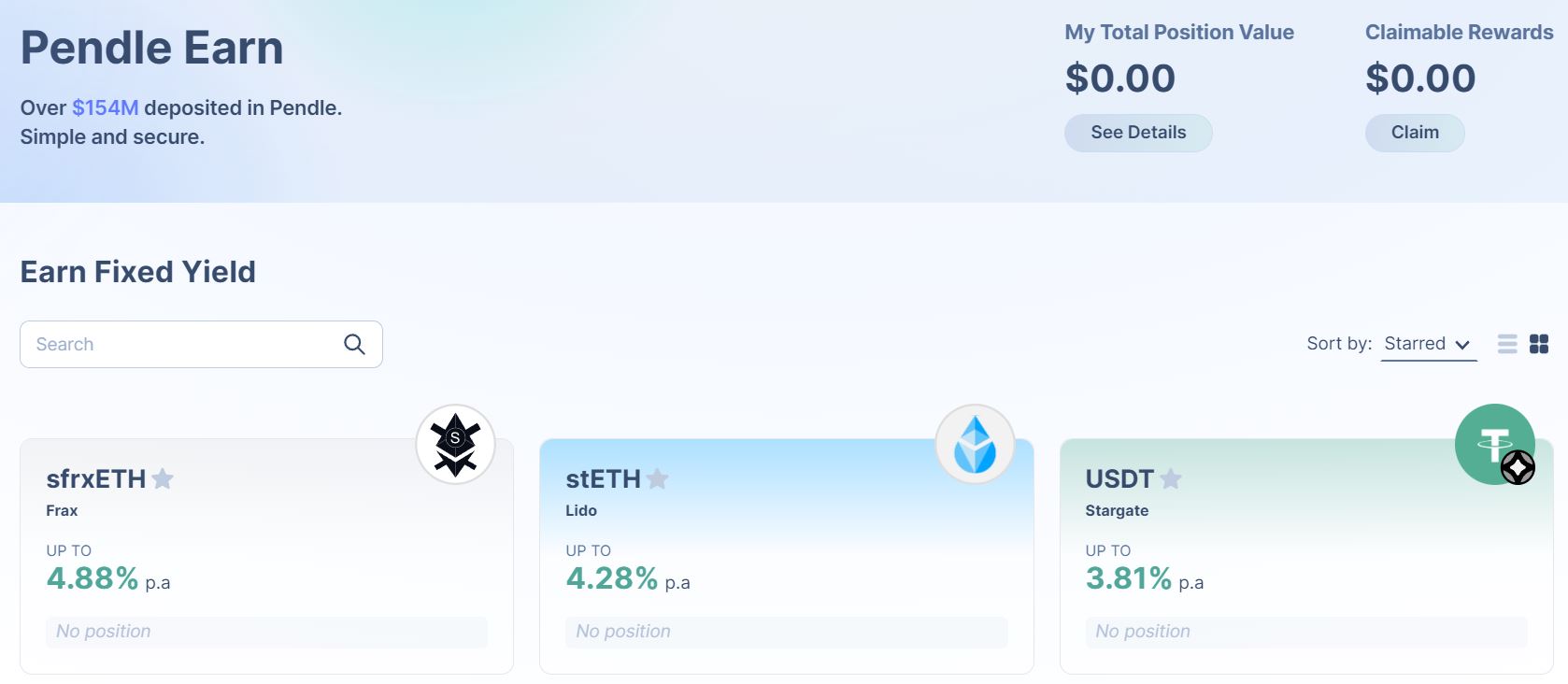

The first and simplest way to earn crypto with Pendle is through Earn. With Earn, Pendle hopes to bring fixed-rate deposits to users like you and me. Usually, Centralized Exchanges (CEXs) offer these. But, Pendle brings these deposit offerings on-chain.

In addition, Pendle provides users a seamless experience using Earn. Developers can integrate with Earn using their own Decentralized Applications (dApps) too. Below, you can view the yields that Earn provides. So far, it accepts deposits for $sfrxETH, $stETH and $USDT. But, we expect more vaults to be launching soon.

Hmm.. the yields are pretty low here though. All of them are below 5% Annual Percentage Yield (APY). Surely we can get higher APYs with our assets? With Pendle, we can! Let us show you how with our next strategy.

Strategy #2 – Fixed Yield and Long Yield

The next way to earn crypto with Pendle is through Fixed Yield and Long Yield. What do I mean by this? To understand both these yields, you’ll need to know what Pendle does first. Let’s hop on over to its Markets page to find out more.

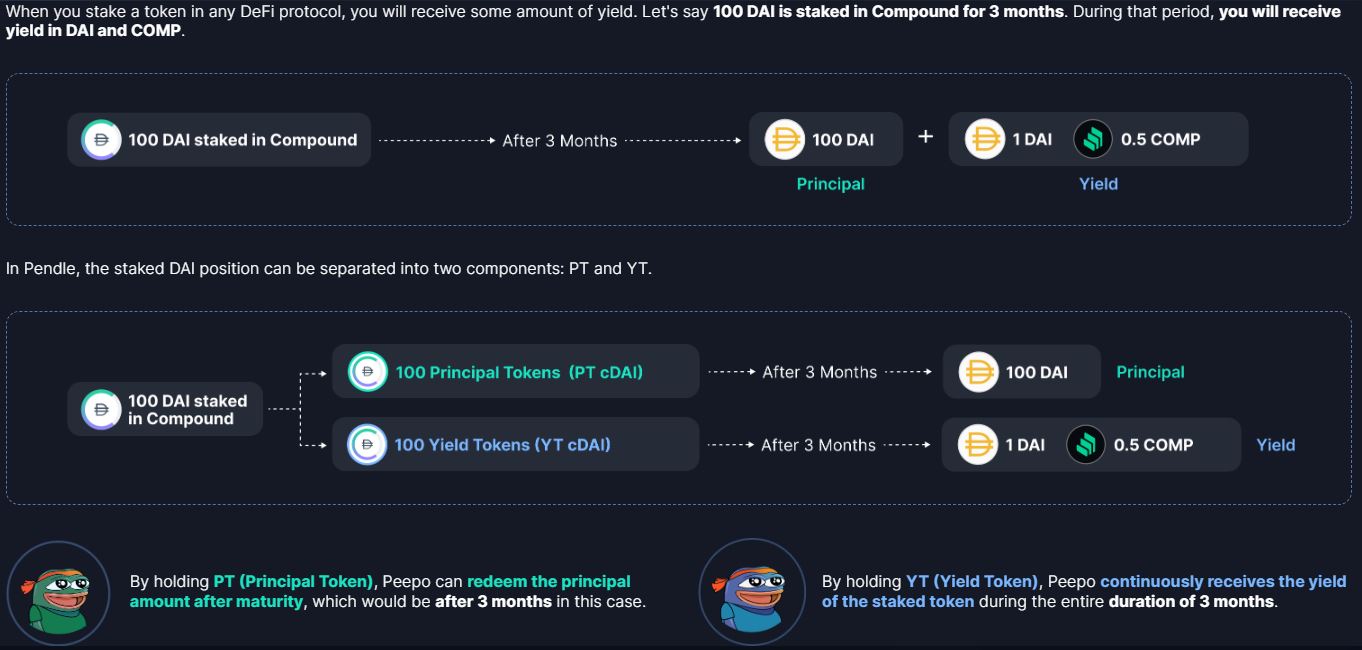

When you deposit crypto into Pendle, the dApp splits it into two types of tokens. Namely, these are:

- The Principal Token (PT)

- The Yield Token (YT)

Both these tokens serve different functions. We use $DAI on Gains protocol as an example. Below is a screenshot of the $gDAI vault on Pendle markets.

Assuming you’ve just made a deposit of 100 $gDAI. You’ll receive 100 PT gDAI and 100 YT gDAI. Note that the sum of 1 PT gDAI and 1 YT gDAI’s price will equate to 1 $gDAI.

-

Fixed Yield

As of time of writing, the Fixed APY for PT gDAI is at 8.36%. PT gDAI is the principal token. This means if you hold it, it’ll return you your exact $gDAI deposit at maturity. From the screenshot, the maturity date is 250 days later.

So, how do we use PT tokens to earn fixed yield? This depends on your confidence in the future yield of $gDAI on the Gains protocol. If you believe said future yield will decrease, you can buy more PT GLP tokens. This guarantees you the principal after maturity. The yield of 8.36% APY by Pendle is also guaranteed.

-

Long Yield

For YT gDAI, the Yield APY is at 6.82%. Remember, YT gDAI is the yield token. This token represents the future yield of your $gDAI deposit.

Now, how do we use YT tokens to earn long yield? If you believe the yield of $gDAI on Gain protocol will increase, you can buy more YT GLP tokens. Do note that the yields here fluctuate and are not guaranteed. With this, Pendle’s ability to tokenize future yield becomes clear. It’s able to do so by representing your deposit’s yield via YT tokens.

Last but not least, let’s move on to the last strategy. This one provides the highest yields, so don’t click away!

Strategy #3 – High Yield Liquidity Pools (LPs)

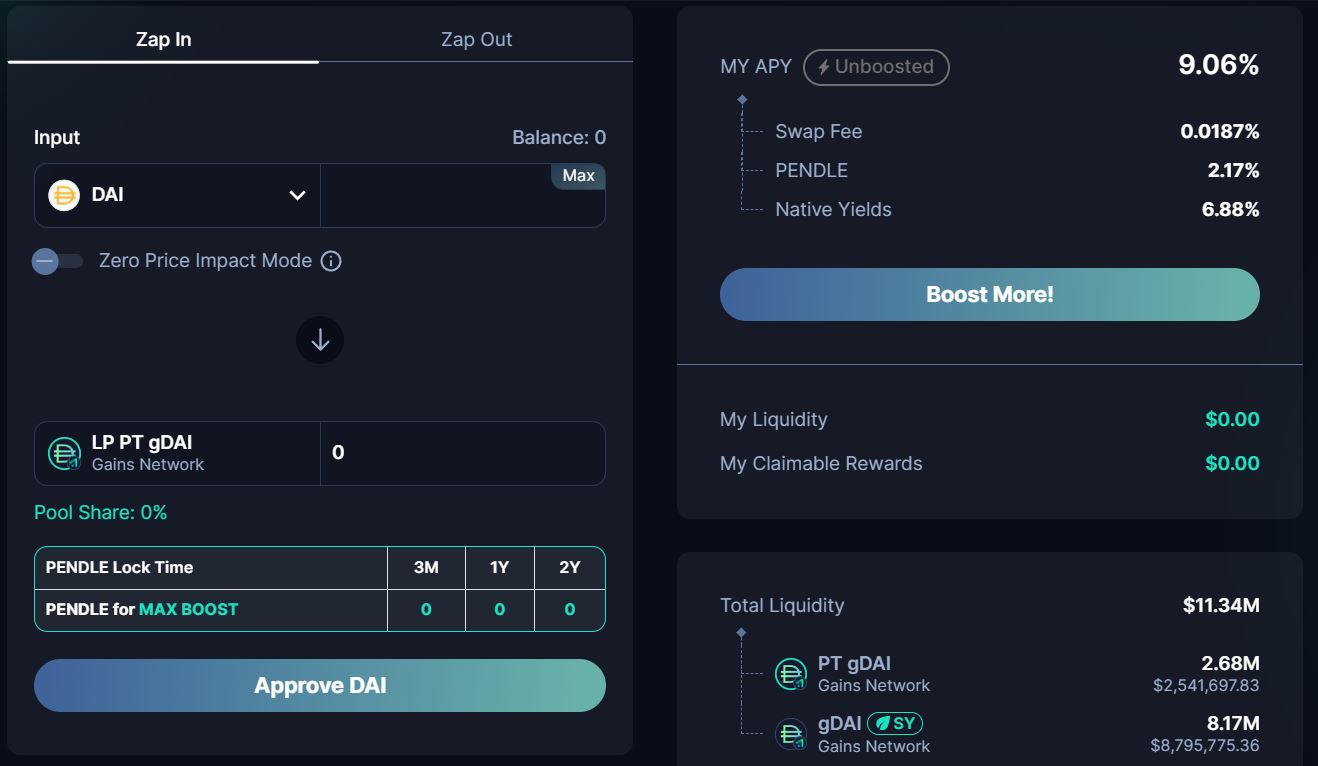

The last way to earn crypto with Pendle is through High Yield LPs. In Pendle’s Pools page, you can provide liquidity to LPs. When doing so, your deposit will be split to two tokens within the LP. For instance, a 100 $gDAI deposit into the DAI pool will be split to 50 $gDAI and 50 PT gDAI.

The yields from LPs are usually very high. But, where does this yield come from? Normally, these are from:

- Swap Fees.

- $PENDLE emissions.

- Yields from the native protocol (E.G. Gains, GMX, Stargate etc).

On top of that, if you stake $PENDLE tokens, you’ll get vePENDLE. And this boosts your LP yields up by 250%! Now that’s a lot of yield. All in all, you could get LP yields of over 80% APY!

Conclusion

Pendle is a great innovation in today’s DeFi space. It allows its users to tokenize future yield. With this, users like you and me can earn better yields on our deposits. Today, we’ve looked at three strategies to earn crypto with Pendle. Choose one strategy which fits your portfolio and get to depositing!

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.