LSDs are liquid staking derivatives, and DeFi has taken an interest in this field. So, protocols built on top of LSD, qualify as LSDfi. They offer extra yield options. This way, you can get the most out of your LSTs (liquid staking tokens).

Why is there now so much interest in LSDfi? There must be an opportunity. So, let’s see what this opportunity is all about.

Source: Twitter

What is LSDfi?

When you take part in DeFi LSD, you receive a new token. This is the LST token. It represents the locked staking tokens. For example, 1 ETH staked with Lido, will give you 1 stETH. In this case, the LST is stETH. Now, in LSDfi, you can use this stETH to earn more yield. You can use your stETH in a variety of DeFi protocols.

In other words, you can double your DeFi rewards. Once from staking your assets. The second time is by using LSDfi. For example, loan collaterals or provide liquidity. As a result, the various LSDfi protocols all have different use cases. We will look at them shortly. But first, here are some abbreviations that are helpful. For instance,

- LSD – The Liquid staking Derivative. The name for all liquid staking apps.

- LST – The Liquid Staking Token. The token that you receive from an LSD platform. For example, stETH for Lido or rETH for Rocket Pool.

- LSDfi – Liquid Staking Derivative Finance. DeFi protocols use LSD platforms and their LSTs to earn extra rewards.

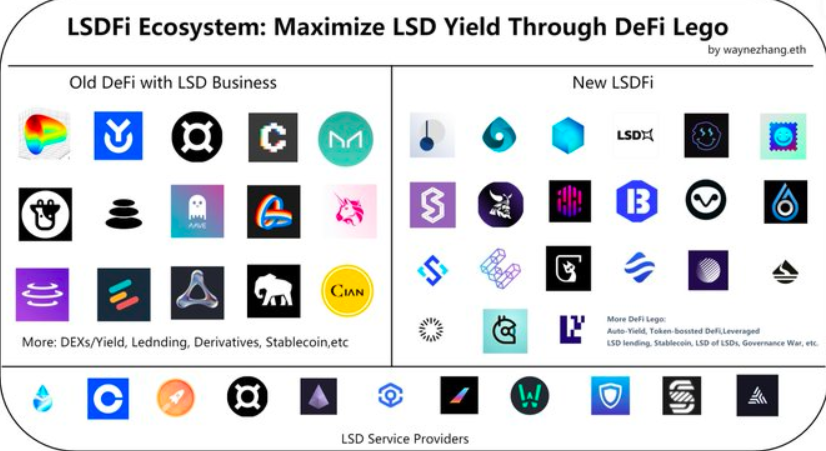

Here are two more reasons why you want to keep an eye out for LSDfi:

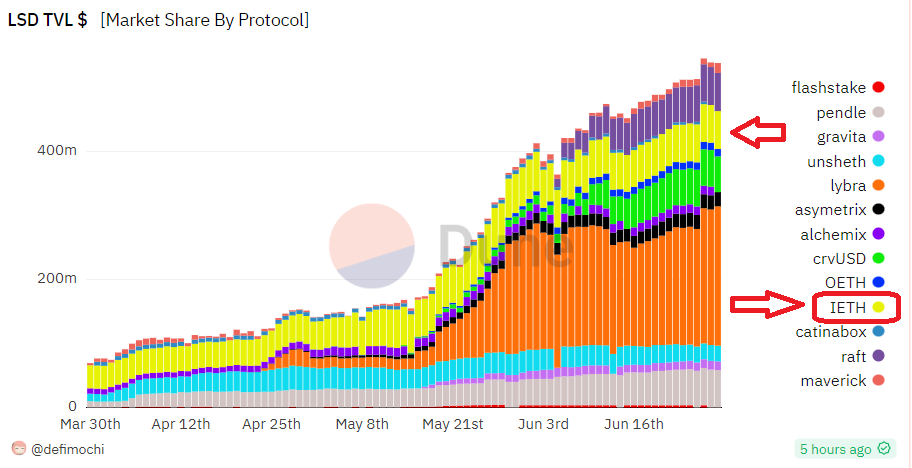

- Since March, combined TVL for LSDfi projects has grown. Especially since mid-May, the TVL has doubled to over $400 million.

- The current staking ratio of ETH is only 16.1%. The top 20 PoS chains have an average of almost 60% staked tokens. The more ETH everybody stakes, the more LSD there will be. In turn, this will lead to more LSDfi.

In other words, the potential is huge.

Source: Twitter

Now, here are 3 very interesting LSDfi projects:

1) Raft

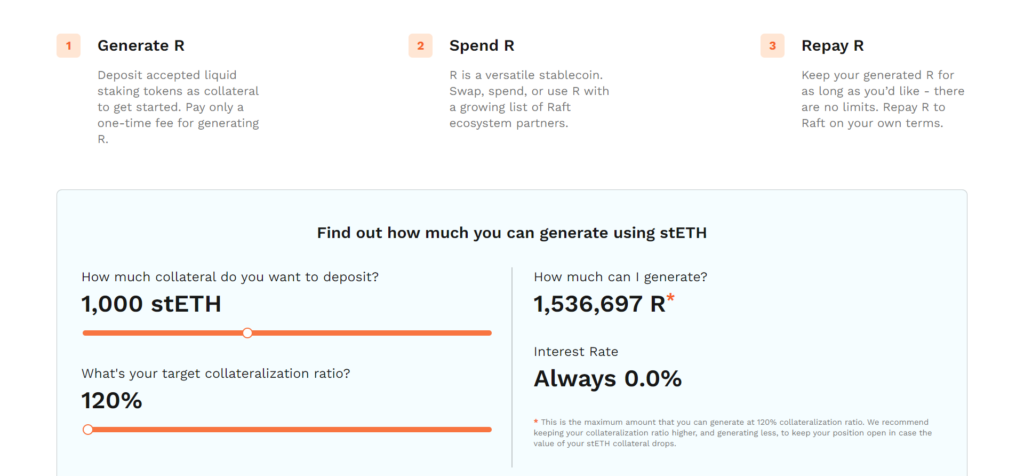

Raft is currently one of the leading protocols in this young DeFi market segment. Each LSDfi protocol has a different way of how they go about earning extra yield. For example, Raft offers $R. This is a decentralized stablecoin pegged to the USD. It’s backed by stETH.

According to DeFiLlama, Raft saw impressive TVL growth this month, June 2023. From $1.115 million to $60.69 million. All this without their own token. The team works on a RAFT token. This should decentralize their ecosystem even further. It will also raise demand to mint more $R.

Source: Twitter

Once you mint $R, you can start using it. There’s a minimum collateral of 120% of stETH. You can pay back $R whenever it suits you. So, there’s no limit. The picture below shows the stETH deposit vs. collateral calculator on their website.

2) Instadapp

Instadapp positions itself as a DeFi hub. It offers a variety of interesting features:

- Avocado – Their Web3 wallet.

- Instadapp Pro – Be in control of your assets. It offers built-in strategies, automation, and batch operations.

- Instadapp Lite – Once you deposit stETH, this protocol will put it to work for you.

Source: Twitter

Instadapp integrates a variety of Dapps. This allows you to form strategies and earn yield. Options to choose from, include, but are not limited to:

- Refinancing.

- Vaults.

- Automation.

- Flash loans.

- LP rebalancing.

All these strategies allow you to earn higher rewards on your ETH. Instadapp also has its own iETH token, which currently holds a 13.38% market share in LSDfi. See the picture below.

Source: Dune

3) Pendle

You can find Pendle on Ethereum and Arbitrum. So, for cheaper gas fees, we favor Arbitrum. What Pendle does is tokenize future yield. In turn, you can trade this on their AMM. In other words, it’s a derivative of a derivative!

Source: Twitter

This article only elaborates on their LSDfi feature, but Pendle has a lot more cooking. For example, you can buy ETH at lower than current rates and receive it in 2 or 3 years. In the meantime, you lock it up. Where do you expect the price of ETH to be in 2 or 3 years? But I’m digressing. Back to LSDfi.

Pendle allows you to set your risk levels and time preferences. According to DeFiLlama, their TVL is currently at $119 million. That started to grow in March, when it still was at $30 million. Pendle also has a growing ecosystem.

Source: Twitter

Conclusion

This is Part 1 of a 2-part series about LSDfi. Here is the Part 2. We discussed what LSDfi is and looked at three popular projects. These are Raft, Instadapp, and Pendle. All promising projects have a lot to offer besides LSDfi.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.