This is Part 2 of an article series about staking Ethereum. Here’s a link to Part 1.

This is a continuation article from our previous guide on staking Ethereum (ETH). Today, we’ll be answering another three key questions.

First, we’ll look at where to stake ETH. Then, we’ll look at where to stake ETH classic, or ETC. Lastly, we’ll review the safety of staking ETH in today’s crypto climate.

Introduction

As you already know, ETH tokens are no longer earned via mining today. As of the 15th of September this year, the Ethereum blockchain has completed its Merge. Now, the way to earn ETH tokens would be through staking.

Let’s have a quick recap on what staking is. To put it simply, to stake ETH means locking up your ETH tokens. By doing this, you help to validate blocks on the Ethereum blockchain. Also, you provide security on Ethereum via its proof-of-stake (PoS) consensus. In return, you receive an annual percentage yield (APY) on your ETH.

Now, let’s move on to where you can stake ETH!

Where Can I Stake ETH?

There are four types of places you can choose from to stake ETH on:

- Centralized Exchanges (CEXes). These include Binance, Kucoin, Uphold, and so forth.

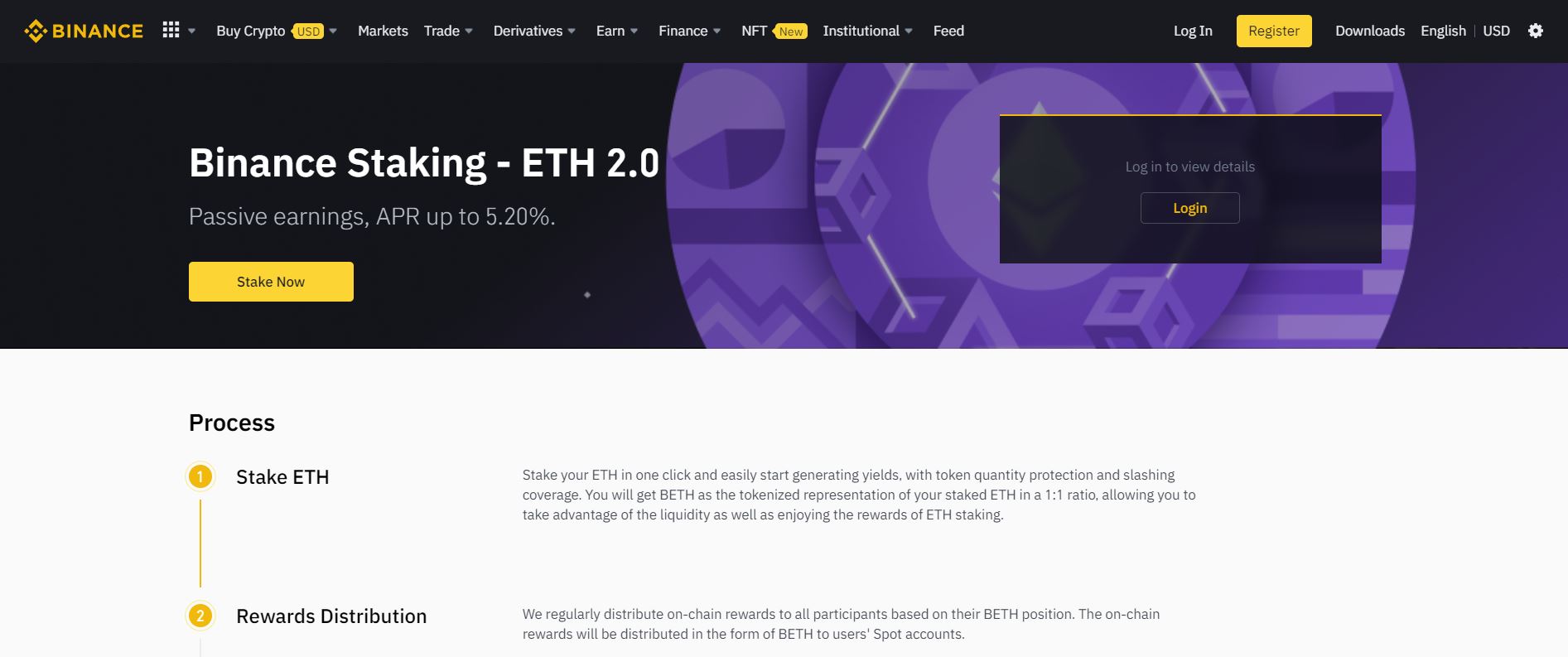

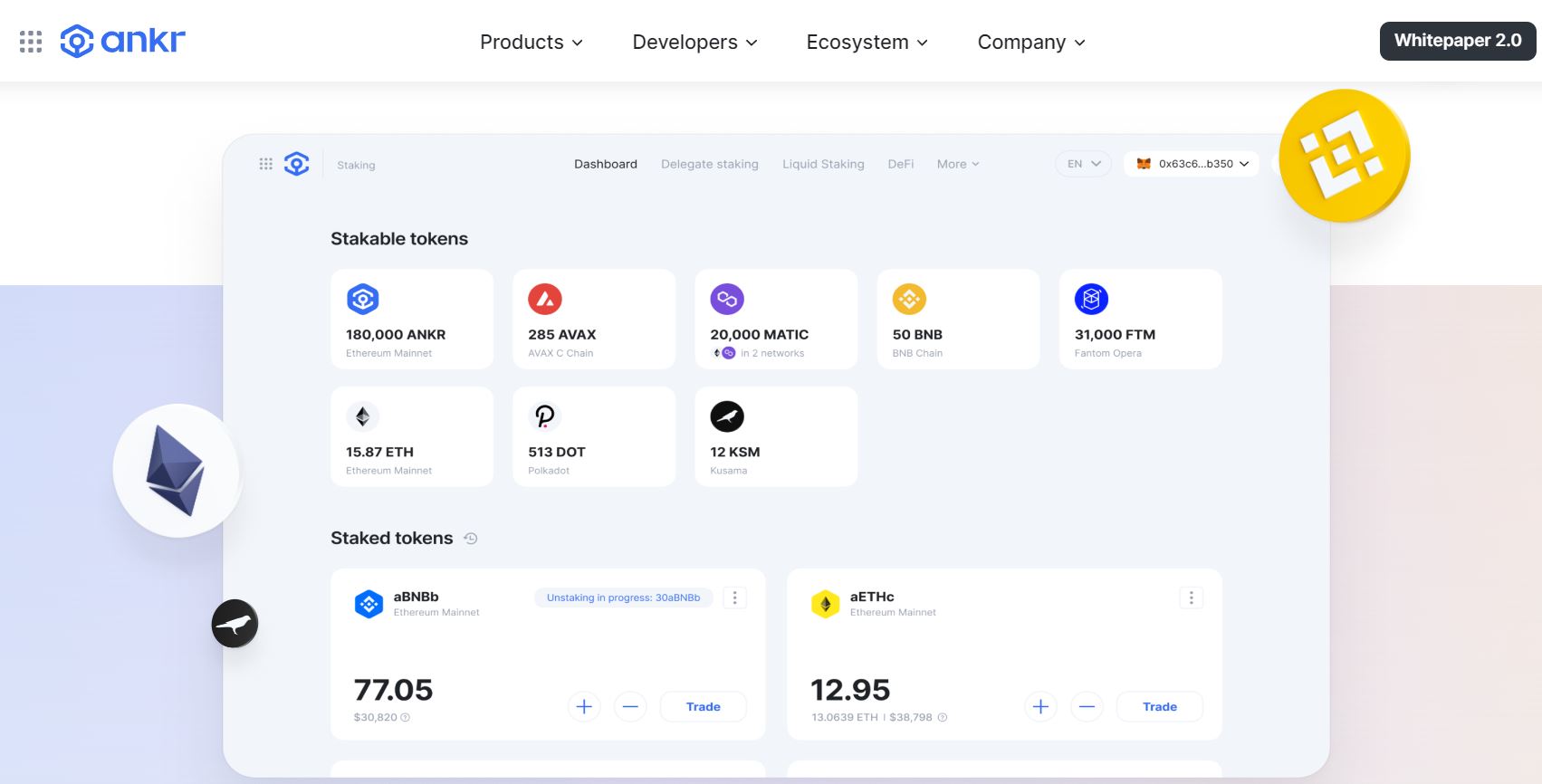

Source: Binance - Staking Pools. These include Lido, Ankr, and so forth.

Source: Ankr - Staking as a service. This would require you to stake at least 32 ETH. The service that you’re staking with does the validation for you.

- Solo home staking. This would require you to run your own validator on the Ethereum network.

To keep it simple, the scope of this article will only cover points 1 and 2 above. For points 3 and 4, they are technically complex. They also require a high initial capital of 32 ETH. Hence, we will not discuss these in our article here. For further reading, you could refer to Ethereum’s very own staking guide here.

Moving on, let me elaborate on ETH staking on CEXes. So far, this is the simplest and most user-friendly option to stake ETH. I’ve shared some links above in point 1 for ETH staking on some exchanges. Chances are, your exchange now offers them too. You can choose to stake any amount of ETH. However, staking on CEXes carries a larger amount of risk. You’re trusting that your ETH is truly being staked by the CEX.

Moreover, your ETH is locked up within the CEX platform until the Ethereum blockchain allows for ETH withdrawals. This is unless your exchange offers liquid staking options. For instance, Binance offers $BETH as a representation of your staked ETH. This allows you to trade your staked ETH by trading $BETH for a similar price.

Next, let’s look at staking pools. These are slightly more complex for the daily ETH staker. You can choose to stake ETH in any amount you want as well here. Most staking pools also offer liquid staking tokens. I would recommend you stake with these pools. This ensures you retain liquidity of your staked ETH.

Similarly, I’ve shared two good staking pools in point 2 above. Each of these have their own liquid staking token. For instance, Lido has $STEth, and Ankr has $AETHC. For a full list of staking pools, you can refer to Ethereum’s website here.

But, you could be wondering, “Do we stake Ethereum Classic ($ETC) in the same way as well?”

Where Can I Stake ETC?

Unfortunately, you can’t stake your $ETC tokens. Why is that so?

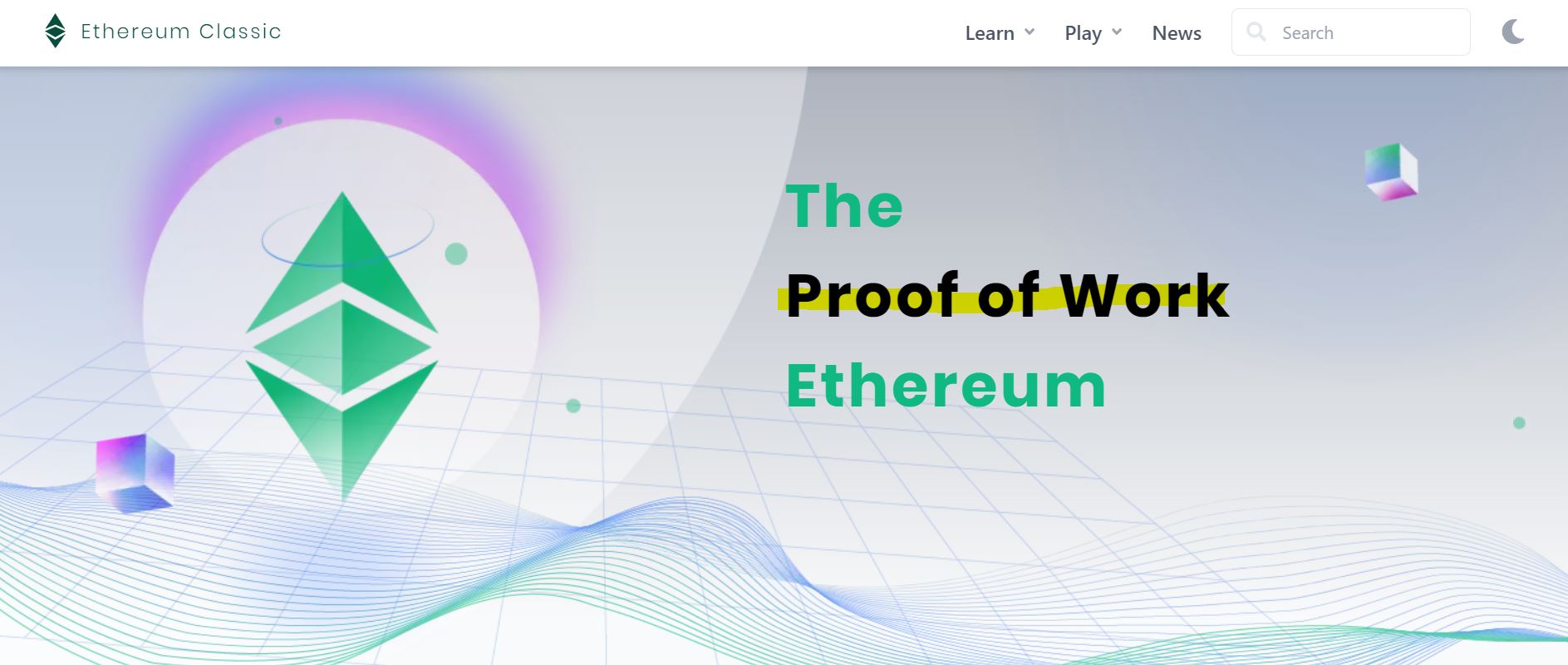

Well, that’s simply because ETC is not a PoS token! Remember, ETC was a fork from the original ETH chain in July 2016. As of today, only Ethereum has transitioned to PoS. On the other hand, ETC still uses proof-of-work (PoW) for validating transactions. To earn $ETC tokens, you’ll have to mine them.

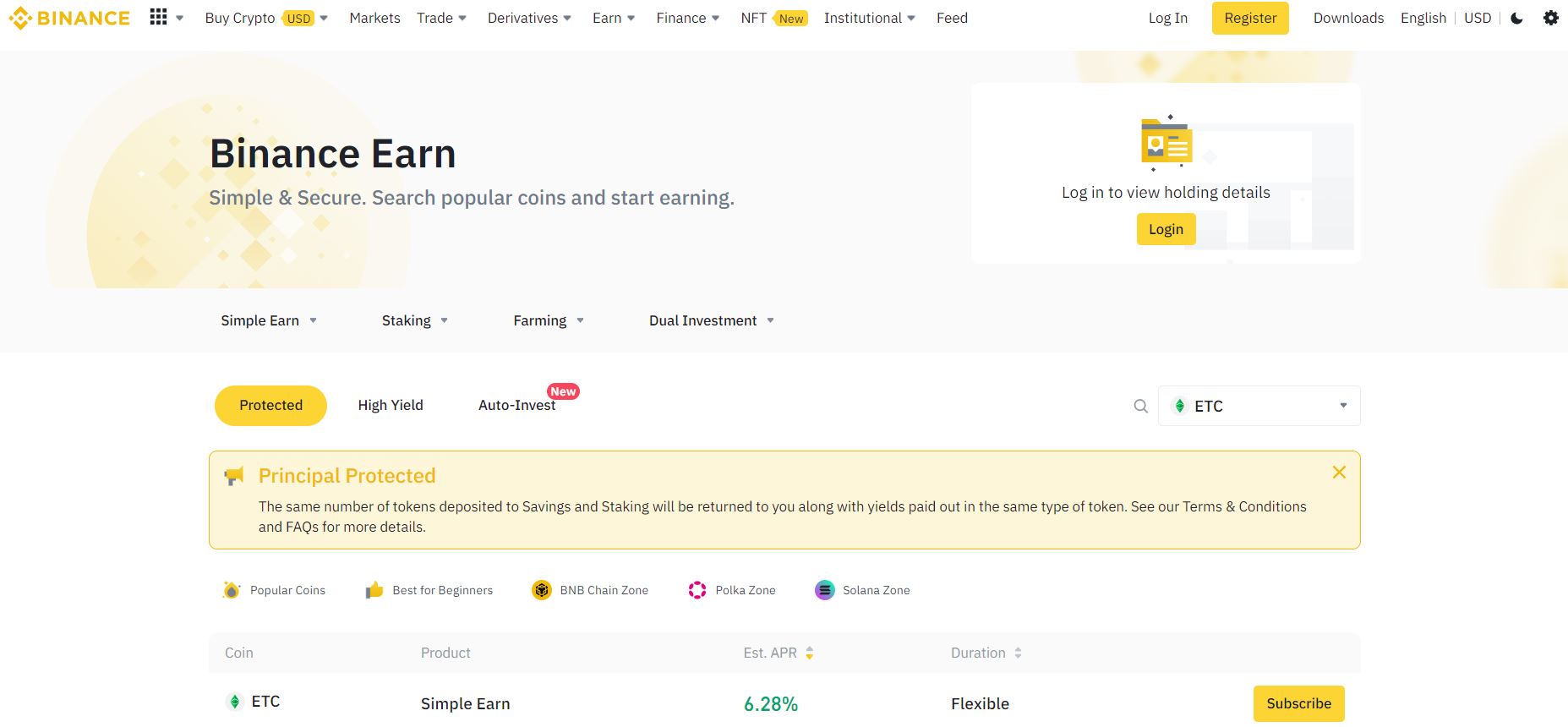

Now, there’re some CEXes that offer a return on deposited $ETC tokens. For instance, Binance offers 6.28% per year for depositing $ETC on their Earn platform. But, please note that Binance is not using your $ETC for staking to offer you the above return.

Is It Safe to Stake ETH?

As with anything in crypto, staking ETH has its risks. The main risks are:

- Slashing. PoS consensus employs slashing when validators “misbehave.” Such bad behaviors include being inactive, signing two blocks for a similar slot, and so forth. When slashing occurs, your staked ETH will be lost.

- Liquid Staking Token De-peg. When extreme market conditions occur, your liquid staking token’s price could de-peg from ETH’s price. This was evident during $STEth’s de-peg just a few months ago.

- CEX-Related Risk. In the current climate, CEXes could easily fail. Hence, your ETH could be lost when that happens. Celsius and even FTX have recently went under.

However, if you’re willing to support Ethereum’s security and earn a healthy return, you’ve got to manage the above risks. In my opinion, it is generally safe to stake ETH. But, I would suggest for you to stake a portion of your ETH, and not your entire holdings. Moreover, you would need to understand that staking ETH is a long-term commitment.

Conclusion

To conclude, I hope you’ve learnt more about where to stake ETH. I’ve also outlined some risks which you would need to manage when you stake ETH. Now, what are you waiting for? Don’t let your ETH sit idle!

The current ETH price is $1,319.18, with a $159.4 billion market cap. There’s an infinite supply of ETH, but after The Merge, it should become deflationary. The current circulating supply is 120.5 million tokens.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group. And for a limited time, it’s FREE. Just click the link and try it today.