Arbitrum is currently one of the most popular Layer 2 solutions around. It solves the issues that Ethereum has. Arbitrum offers fast and low-cost transactions. It also solves scalability issues.

So, let’s dive a bit deeper into some current top Arbitrum coins.

1) GMX (GMX)

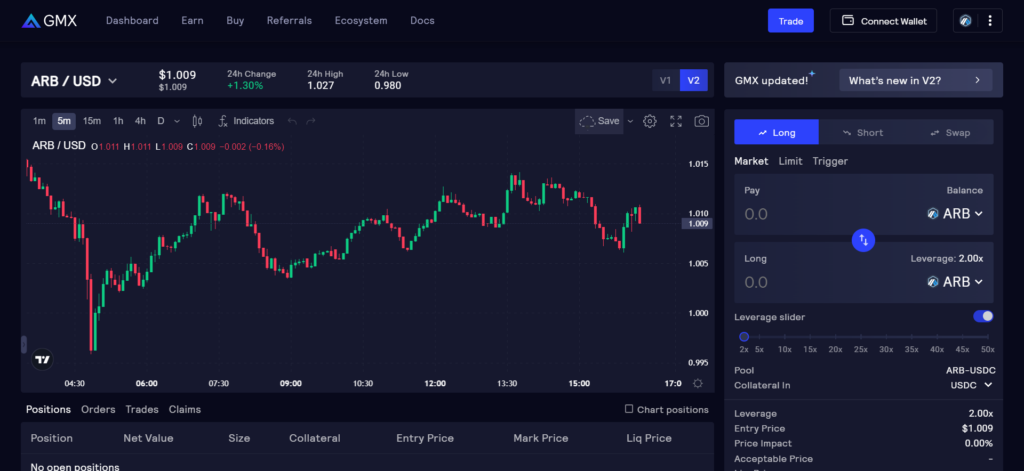

GMX is a decentralized spot and perpetual exchange. Perpetuals or perps are trading instruments whose value is tied to an underlying asset. Leverage trading is one of the features the platform offers. You can trade with up to 50x leverage. However, be careful when trading with leverage. Profits can be high, but your losses can also be extensive. Especially for new traders, it’s best to first get some experience.

GMX Telegram bot v2.0 is now live!

🧵Short thread on the available calls to get you some stats on $GMX v2

Link to the bot on the final tweet 👇 pic.twitter.com/kiuqoiix7h

— SniperMonke.soul (@SniperMonke01) August 18, 2023

According to DeFiLlama, it has the highest TVL on Arbitrum. With $428 million, Arbitrum has twice as much TVL as second-ranked Uniswap V3 on Arbitrum. The platform is currently also live on Avalanche, besides, of course, on Arbitrum. It’s already been around since September 2021.

To offer correct price predictions, the platform uses Chainlink oracles. Currently, you can use the V2 beta version as well. Although the platform only offers 9 tokens, it is quite popular. Earlier this year, it was definitely a blue-chip token on Arbitrum. The crypto space is dynamic, though, and new projects are always knocking on the door. It’s a fast-paced space and things can change fast as well.

Currently, GMX is still on top of the Arbitrum derivatives pile, but you may want to look up HMX as well. The following picture shows the updated GMX V2 dashboard.

Source: GMX

2) Uniswap (UNI)

Uniswap launched on 31st August 2021 on Arbitrum. This is only 1 of the 8 chains you can use Uniswap on. The other chains include, for example, Ethereum, Polygon, BSC, Optimism, Base, or Avalanche.

DEX usage is on the rise 📈

Why? In part, because of the options! Uniswap has 20x more tokens listed on CoinGecko than the leading CEXs 💫

Read @variantfund’s new piece on the resiliency of DEXs ⤵️https://t.co/HYrPnxPCIR

— Uniswap Labs 🦄 (@Uniswap) August 23, 2023

Uniswap is an OG on Ethereum. However, gas fees at times went through the roof. That’s why the Uniswap multichain approach works well. On Layer 2 or other Layer 1 chains, the gas fees aren’t as high as on Ethereum. Transactions process faster, and these chains address scalability issues.

According to DeFiLlama, Uniswap has the second-highest TVL on Arbitrum. Uniswap total TVL is $2.81 billion. Arbitrum takes up $220 million. This is quite impressive and shows how popular Arbitrum is. It’s almost 3x more than third-ranked Polygon with $77 million. However, note that this is the V3 on Arbitrum. Now Uniswap is testing their brand new V4. This should even cut gas by 99%!

Uniswap also supports an Arbitrum token bridge. This allows you to deposit tokens on the Arbitrum network. You can also deposit tokens on Uniswap through exchanges. Here’s an extensive guide by Uniswap on how to use the app on Arbitrum.

Uniswap v4’s singleton contract means lower gas costs and faster transactions! 💨

In v3, assets transfer in and out of pools after each swap. v4 only net balances transfer

The result? Lower gas fees 🔥

Early estimates suggest launching pools with v4 will cut gas by 99% 😮💨 pic.twitter.com/qB9gHj3QKJ

— Uniswap Labs 🦄 (@Uniswap) August 23, 2023

3) Radiant Capital (RDNT)

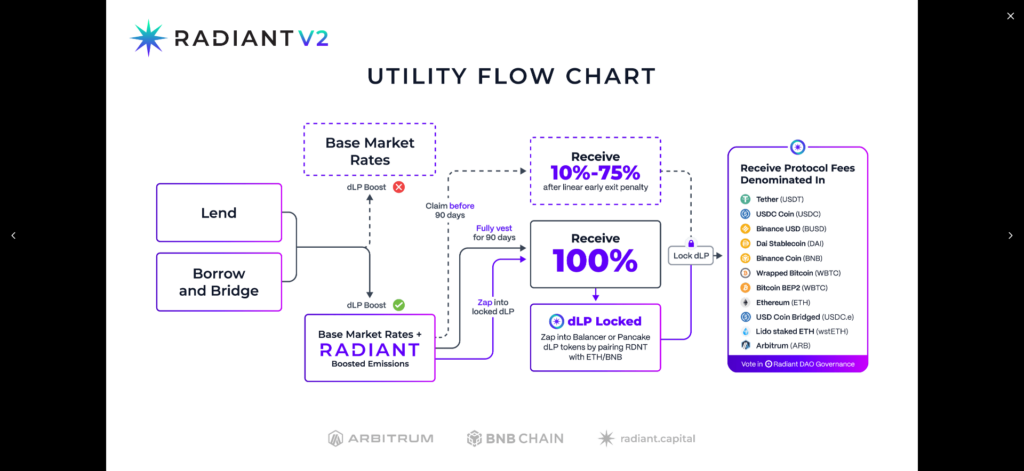

Our third pick of the day is Radiant. This is a cross-chain lending protocol. You can find it on Arbitrum and the BSC chain. It ranks third in TVL in Arbitrum. What makes Radiant stand out, is that no venture capital is involved. The founders funded all by themselves. They are built on Layer Zero’s Stargate interface. This gives high flexibility for withdrawing assets on a variety of chains.

Preparations for Radiant's landing on @ethereum are imminent.

Standby for further instructions on October 3, 2023. pic.twitter.com/uIKbVR7XC0

— Radiant Capital (@RDNTCapital) August 22, 2023

The platform has been around since July 2022. Radiant offers Balancer pools with dLP (Dynamic Liquidity Provision). These constitute 80% of their RDNT token and 20% ETH. To earn fees, you need to lock 1, 3, 6, or 12 months. If you locked your assets for 6 or 12 months, you are eligible for an ARB token airdrop. Here’s an explanation of the dLP utility and the max locking APR by Radiant.

Radiant had several audits as well. Solidity Finance and PeckShield audited the protocol successfully. More launches on other chains are in the pipeline. There’s also a liquidation procedure. This activates when your collateral falls below your loan or debt. The liquidation penalty is 15%. 7.5% goes to the liquidator and the other half goes to the Radiant Growth Fund. This allows the Radiant DAO to finance projects. In the meantime, it doesn’t have to sell any RDNT tokens.

Source: Radiant Capital docs

Conclusion

In this article, we took a closer look at the top Arbitrum coins in Q3-2023. We covered the top 3 projects by TVL. Currently, these are GMX (GMX), Uniswap (UNI), and Radiant Capital (RDNT).

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.