One of the biggest sectors for the coming bull run may be the RWA sector. That’s Real-World Assets and the tokenization of them. This sector could well reshape the DeFi sector. In 3 months, it managed to accumulate $5.88 billion in TVL.

So, we’re going to take a look at RWA. What it is, look at some projects, and crunch some numbers.

What Is RWA?

Real-world assets (RWA) are tangible assets but tokenized. You turn them into an NFT. That process we call tokenization. For example, you can tokenize real estate, gold, carbon credit, or t-bills. The latter is a Treasury Bill, which is a debt obligation. It’s the US Department of Treasury who issues them.

✅ RWA(Real-World Assets)'s time is coming

💡Before delving deeper, a brief overview of #RWA

– RWA are physical or tangible assets that are represented and traded on the blockchain after being tokenized.

– RWA TVL Increasing in a year $750M > $6BThat's all you need to know.… pic.twitter.com/XIo8hTYlI6

— Layergg (@layerggofficial) November 28, 2023

However, before you can tokenize an asset, you need to establish its value beyond any doubt. Things to look for are, for example:

- The current market price.

- How was its historical performance.

- What’s the physical condition.

From a legal perspective, there are also some aspects to consider. For instance, there must be uncontested legal ownership. For clarification of this, you can use deeds or invoices.

Now you can start the tokenization process. All important information and data can go into the NFTs metadata. That’s where DeFi comes into play. It’s all about demand and supply now. RWAs will be critical to the further growth of the DeFi space. For starters, they combine TradFi with DeFi.

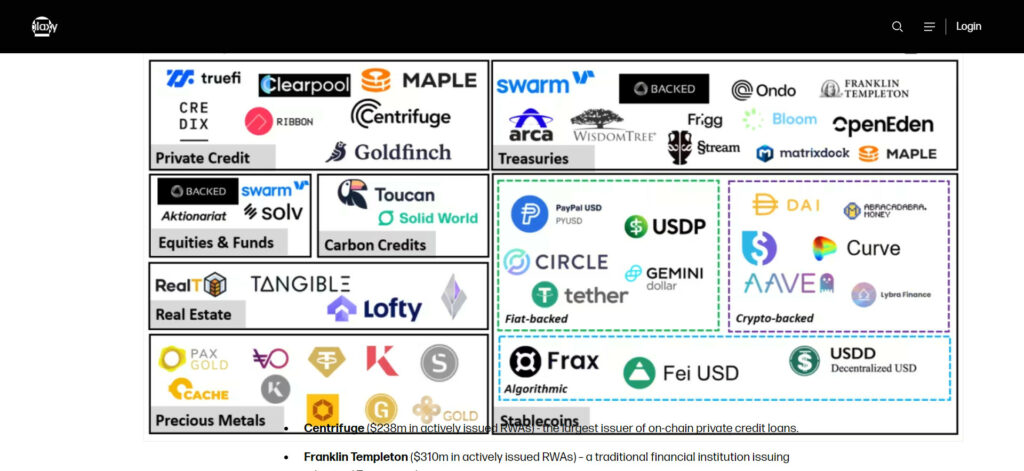

It’s a new way of trading and investing. You can tokenize almost any physical asset. As a result, you have access to better financial integration, accessibility, and efficiency. Some RWA issuers are, for example:

- Centrifuge and Goldfinch for private credit.

- Pax Gold for precious metals.

- Stablecoins, like USDT by Tether, DAI, or Frax.

See the picture below.

Source: Galaxy

Crunching Some Numbers and DeFi Adoption

The RWA market is gigantic. By 2030 it’s projected to be a $10 trillion industry. But, let’s focus first on today’s values and numbers. Currently, private credit loans have a valuation of $1.4 trillion. By 2027 that should almost double to $2.4 trillion.

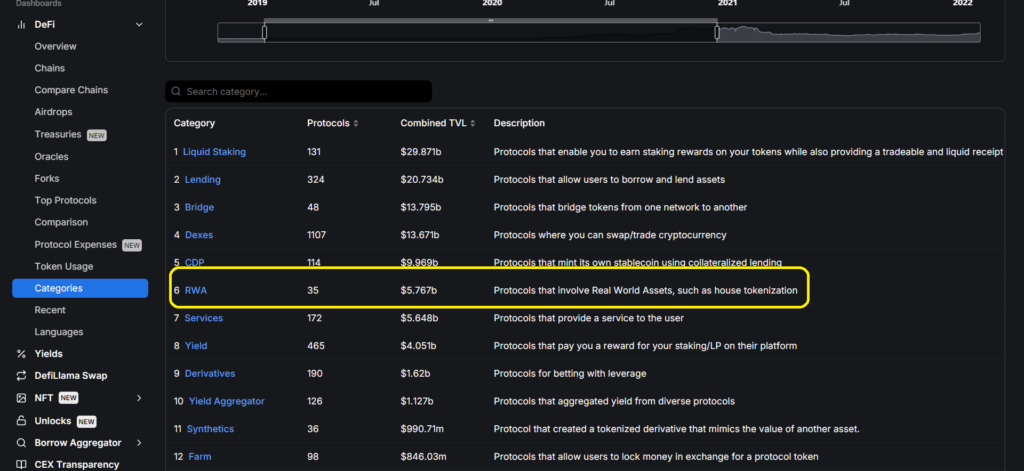

The TVL is currently almost at $6 billion and growing. This makes it the 6th biggest vertical in DeFi. That’s out of 35 listed categories on DeFiLlama. In other words, this is not some kind of hyped-up space. This is a complete game-changer. The potential is massive, as previous numbers already showed.

Real estate, bonds, and many other RWAs can be illiquid. However, with tokenization, you can make them accessible in the DeFi space. To make them even more accessible, you can also fractionalize them. This allows more people to get a piece of the action. It also makes them even more liquid. Maker (MKR) is currently the leading protocol in RWA tokenization. It has $2.75 billion allocated in different tokenized RWAs. So, tokenization is only one section of RWAs.

Another section is lending. The top protocols here are Goldfinch (GFI), Centrifuge (GFG), and Maple Finance (MPL). Especially Maple Finance and Goldfinch have seen recent price surges. The GFI 5token saw a 110% increase over the last 30 days. MPL went up 282% this year. Currently, CFG is rather undervalued. The picture below shows the ranking in DeFiLlama.

Source: DeFiLlama

So, before you start looking into similar projects, make sure to DYOR. Many projects get shilled. Make sure to look into their tokenomics. In other words, do a good fundamental analysis. For example, also make sure that they operate with a license.

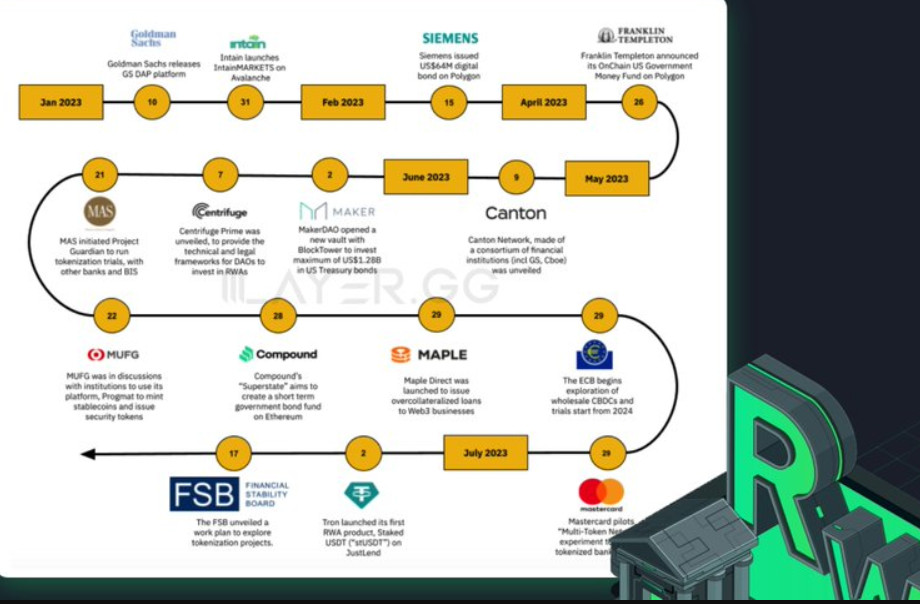

Further Adoption of RWAs

We already see a lot of adoption of RWAs. It certainly looks like this is not going to stop anytime soon. For example,

- UBS, Mastercard, DTCC, and Siemens started to adopt them. These are worldwide brands.

- The Hong Kong SFC (Security and Features Commission) also supports tokenization. They have a pro-crypto policy.

- Regulators in Singapore, Japan, the UK, and Switzerland plan asset tokenization pilots.

Did you notice anything in the above list? Right, they’re all non-crypto-based markets. So, that’s a good sign of TradFi mixing it up with DeFi. But we also have developments in the crypto market adoption. For instance,

- Larry Fink predicts securities as the next generation to be tokenized. He is the current BlackRock CEO. That’s another TradFi giant, embracing crypto.

- Tether (USDT) earns interest over $56.6 billion worth of U.S. T-bills it’s holding.

- Brian Armstrong mentions the need to build more real-world assets. He’s the CEO of Coinbase.

The picture below shows the development and adoption of RWAs.

Source: X

Conclusion

We see the RWA market growing. It’s projected to hit a $10 trillion market by 2030. That’s only 6 years from now. The potential is massive. It’s a perfect sample of how TradFi meets DeFi. Before you jump into any RWA projects, make sure to do your due diligence. DYOR is of importance here.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.