Gauntlet is the platform we’re talking about. They are a financial modelling platform. In other words, a crypto quant company. This is short for quantitative analysis. In turn, it is a rather specialized sector in the financial world.

Quant firms, like Gauntlet, apply mathematical and statistical methods. With these, it is possible to make financial and business decisions. As a result, the DeFi world is making full use of these services. Moreover, lending and borrowing protocols are using this.

Source: Gauntlet website

What Is Gauntlet?

In 2018, Tarun Chitra founded Gauntlet. He gained executive experience on Wall Street. D.E. Shaw is his former workplace, a multinational hedge fund. However, Gauntlet started to focus on the crypto industry.

Gauntlet offers financial modelling tools. On top of that, they also offer simulation development and analysis. This allows protocols to run and test a wide range of assumptions. Platforms can use these tests for a variety of functions.

- Block rewards.

- MakerDAO stability fee.

- Hash power distribution.

- Network latency.

This system gives quick results. Most importantly because Gauntlet optimized its performance. This results in a more accurate and, in the same vein, more complex but also flexible simulation.

In other words, this is a great opportunity for a wide variety of DeFi protocols. They jumped on this opportunity and started to use Gauntlet’s tools. Aave, Compound, and SushiSwap are among their best known clients.

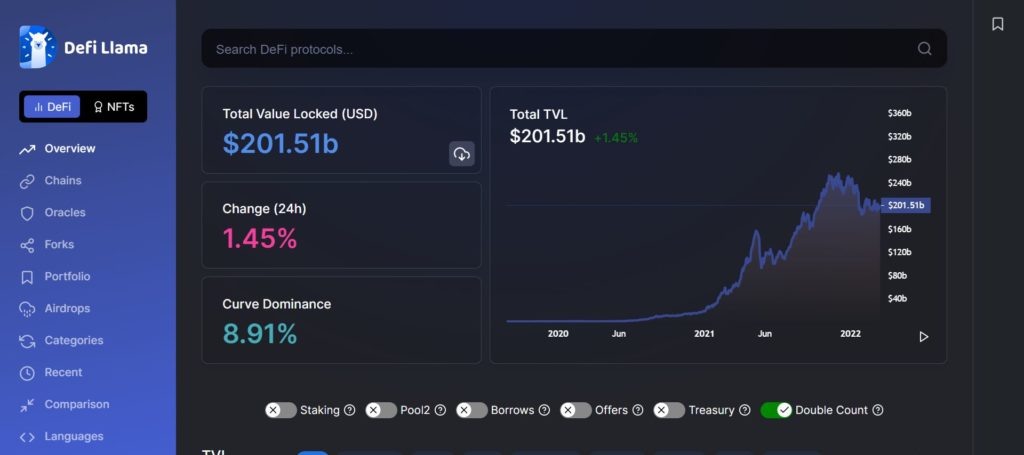

They are now in a much better position to offer their services being more accurate and precise. Among others, they can optimize their lending levels. Furthermore, they can also improve their collateral levels. As a direct result of their popularity, $38.5 billion of assets depend on Gauntlet. No wonder, considering that TVL among all DeFi platforms is at $201.5 billion.

Source: DeFi Llama

How Did Gauntlet Get Valued at $1 Billion?

The initial seed investment round delivered $2.9 million. Coinbase Ventures led this round in 2018. Thereafter, Coinbase Ventures raised another $4.4 million in 2020.

However, the real kicker came in March 2022 with a series B funding. Ribbit Capital, a venture firm out of Palo Alto, raised $23.8 million. Polychain Capital and Paradigm are among the investors. As a result, Gauntlet can now hire more staff. Furthermore, they started looking into gaming and other new fields.

All this combined led to an evaluation of over $1 billion for Gauntlet. That is a fast improvement. As a result, they are now considered a “unicorn” company. These are startup firms that receive a value over $1 billion. Now, the crypto and blockchain space has seen quite a few unicorn companies enter their ranks. Gauntlet is now officially among them.

To sum up, it goes without saying that this shows how fast the crypto and blockchain spaces grew. Just look at the last two years. Gauntlet may not be on the radar of retail investors. Nonetheless, they do profit from Gauntlet entering the world of DeFi. Albeit in an indirect way. On the other hand, DeFi protocols have a direct advantage. By seeking Gauntlet’s services, they can offer more accurate lending and collateral levels.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.