So here is the big news! I sold some of one position and added a brand new coin to my portfolio. What did I sell? Why did I sell? And what did I add and Why?

Well stick around and find out because you could make some profits here.

Big Portfolio Change

On April 19th, we hit one of our goals and made a change. We announced it on Twitter. Do you guys follow us there? If not, you should. So exactly what happened?

We have an addition to our portfolio.

We appreciated the #Lukso run. However, we are disciplined. So we took a 10% profit at $16 LYXe and invested in this coin. This has the potential to become 100x. 👇

Watch, why do we think so? https://t.co/MkepT0UkVX#AlephZero #azero

— Altcoin Buzz (@Altcoinbuzzio) April 20, 2023

Profitable portfolios set rules and stick to them. They never fall in love with one project. This is why we have a rule for re-evaluation when down 30%. And also why we have a rule on when to take profits.

And we hit one of our profit goals on our small-cap powerhouse Lukso. Lukso hit our first profit goal of 100% and kept going. In fact, we are at a 3x now. We bought at $4.84 and sold $100 worth or 10% at $16.

So, portfolio management rules are important. And it’s never a bad idea to take some profits and take some money off the table. Although in this case, we are reinvesting. But still, the idea is the same. By selling 10% of our Lukso, our original cost basis goes down from $300 to $200. That’s smart investing to lower your cost basis. And we are diversifying into more high quality. Also, smart for a portfolio.

This is less aggressive than the idea of letting your winners run but no one ever lost money taking a profit.

Winners & Losers

Let’s see how the rest of the portfolio did last month.

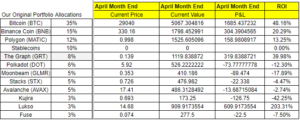

First, the losers. Last month, we had 2, now we have 5. Our 2 from March were Fuse and Kujira and both are still slightly out of the money for us. But nothing big has changed. Here is a summary of our portfolio and its ROI (Return over investment).

In fact, Kujira’s GHOST release will likely be a big plus for the ecosystem. And our 2 most recent purchases before today, Stacks and Moonbeam have both lost a little money so far. Stacks is near breakeven while Moonbeam is down 17% so far in just a few weeks. But we like the coin not just for today but for 2 or 3 years from now so we are not panicking.

And Polkadot went from slightly profitable to a slight loss. Now the Winners. Bitcoin continues to lead the market in this bear market rally or whatever it is. Its return is 48% over the 6 months we’ve held our portfolio. But it’s not our biggest return. At 203%, Lukso is crushing it. Other than Lukso, the biggest caps are doing the best for us, which is the general market trend now.

Bitcoin, The Graph, Polygon, and BNB are between 13 and 40% ROI. This is why uneven weighting in your investments is important. We’ve captured most of the Bitcoin gains and avoided losses of other altcoin portfolios. Overall, Bitcoin came screaming back at 48% and Ethereum’s total return is 38%, while ours is just behind them at 27.72%.

Adding Top Privacy Coin

So what are we doing with our Lukso money? We are buying something else to add to our portfolio. And we decided on one of our top privacy projects, Aleph Zero. So as of the 19th, we have a price of $1.400. That means we bought $100 worth or 71.42 $AZERO.

As the week passes by, here's what we accomplished since the last update! ✅

If you want to give a go to the ink! wrapper, you'll find it here: https://t.co/RR3kfT3kR1

Looking forward to your feedback on this tool! pic.twitter.com/ceMGf5o2ur

— Aleph Zero (@Aleph__Zero) May 4, 2023

We love privacy as a theme and think that Aleph Zero will be one of crypto’s leading privacy projects. It’s really as simple as that. Although Aleph has other factors we like too like good tokenomics and liquidity or its desire to bring enterprises into the blockchain.

How is your portfolio doing? Let us know in the comments below.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.