Algorand has been around since 2019. MIT professor Silvio Micali is behind this project. He’s a computer scientist at the Massachusetts Institute of Technology. Algorand’s native token, ALGO, ranks currently for market cap at #38.

So, it’s time to have a closer look at what Algorand is all about. This is Part 1 of a two-article series.

AlgoKit is going to revolutionize the way #devs build on @algorand!@JohnAlanWoods shared the vision and even dropped some alpha about when it is launching 👀#GreenCrypto #TechTuesday #TopicTuesday #Algorand #AlgoFam pic.twitter.com/XS7THy7I8k

— Algorand Foundation (@AlgoFoundation) February 7, 2023

What Is Algorand?

Algorand is a Layer 1 blockchain. One of its focus points is sustainability. The team built Algorand as a green blockchain. It has a unique consensus mechanism, which makes this chain more energy efficient. A consensus mechanism makes sure that a cryptocurrency works. It deals with the validation of new blocks and the governance.

This blockchain produces new blocks in less than four seconds. Its transaction fees are a fraction of a cent. Currently, it’s around $0.0003. The chain can handle up to 6,000 TPS (transactions per second). The developers have their eyes set on 10,000 TPS.

This chain is open source, so everyone can use the code. It is one of the chains that tries to solve the blockchain trilemma. In other words, the devs look for decentralization, security, and scalability. However, the general idea is that a blockchain can manage two out of three features. As a result, they sacrifice the third feature. The following video shows an explanation of the Algorand core protocol.

What Are the ALGO Use Cases?

The ALGO token has a few use cases. For example:

- Pay for all transaction fees in the network.

- For governance. However, you need to commit your ALGO for a three-month period.

- Buy NFTs or goods and services.

- Take part in DeFi.

You can buy the ALGO token on most major exchanges. You can use the custodial wallets of a CEX. On the other hand, you can also get an ALGO-compatible non-custodial wallet for trading on a DEX. For example:

- KeepKey

- Free Wallet

- Pera Wallet

- MyAlgoWallet

- Algosigner

- Algorand Atomic Wallet

- Guarda Wallet

- Coinomi

- Magnum Wallet

You can also use hardware wallets like the Ledger or Trezor models.

When buying ALGO on Binance, a CEX, follow these steps.

Make sure to have a Binance account. You can buy ALGO with either fiat, a credit or debit card, or other cryptocurrencies. Binance offers seven trading pairs. Besides staples like USDT and BUSD, you can also buy ALGO with BTC, ETH, BNB, RUB, and TRY.

However, if you prefer a DEX, you can use Tinyman, a DEX on Algorand. Now you need a non-custodial wallet. Connect your wallet to Tinyman. You will need to have stablecoins or other compatible cryptocurrencies in your wallet. Once you’re connected, you can swap your staples or compatible crypto for ALGO.

Tinyman V2 is live and ready for you to join. 🌈 🦾#TinymanV2 #algofam

Don't miss out on this exciting migration to the land of V2.🚶♂️🚶♀️🍀 #tinyman #algorand #DeFi https://t.co/6X63bXQcSd pic.twitter.com/jjAD8UeoTk

— tinyman.algo (@tinymanorg) January 5, 2023

How to Be a Validator in Algorand

You can be a validator in Algorand by setting up and running a participation node. These are the validator nodes. This way, you help to decentralize the network consensus. At the same time, you improve the network’s security.

However, be aware that there are currently no financial rewards for doing so. You can set this up in two different ways. Firstly, as a stand-alone participation node. In other words, you set up your own node. On the other hand, you can also use the service of a NAAS provider. These offer “nodes as a service” and let you run a participation node.

Follow these steps to set up your own participation node.

- Generate a valid participation key.

- Register this key online with a special online registration transaction.

- You need to mark yourself offline or online.

The more ALGO you stake, the more likely it is that you can take part on voting for new blocks. To clarify, Algorand uses 90-day governance periods.

With a node provider, like Blockdaemon, you can also run your own node. In other words, you can run that node in your own name. In general, these providers offer non-custodial nodes. However, they all may have different sign-up procedures, so make sure to read up on them.

Since #Algorand's last upgrade, participation node runners can generate & register Falcon keys alongside the participation keys used during consensus! Follow @NoahGrossmanTM’s tutorial on how to participate in this first major step towards State Proofs 👉 https://t.co/g6DXEt25Q4

— Algorand (@Algorand) March 16, 2022

How to Use Algorand’s Explorer

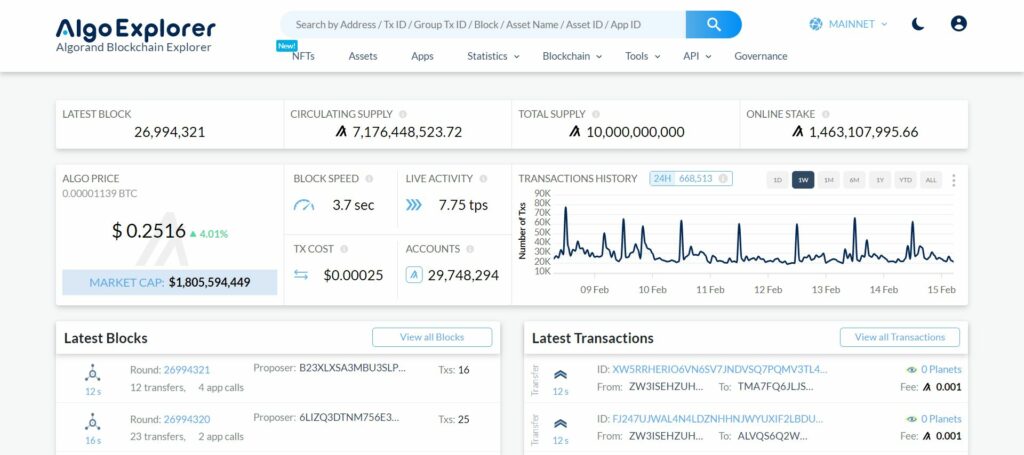

All blockchains have at least one or more blockchain explorers. Algorand is no different in this case. We will focus on AlgoExplorer. So, by just looking at the landing page, you can already find lots of useful information. For example, this page shows you:

- Latest block number.

- Total and circulating supply of the ALGO token.

- The number of online staked ALGO.

- ALGO price.

- Block speed.

- Transaction cost.

- TPS.

- Number of online accounts in the Algorand mainnet.

- Latest blocks and transactions.

You can take this one step further and use the “search box,” as shown in the picture below. Overall, you can find out specific information, for instance:

- Addresses.

- Transaction IDs.

- Group Transaction IDs.

- Blocks.

- Asset IDs.

- Or App IDs.

See the picture below, it shows the UI of the AlgoExplorer.

Conclusion

In Part 1 of this beginner’s guide to Algorand, we discussed four popular questions. This ranged, for example, from what Algorand is to how you can be a validator. In Part 2, we will cover another three popular questions.

The current price of the ALGO token is $0.252881. It has a market cap of $1.8 billion. The max supply is 10 billion tokens. However, the current total supply is almost 7.4 billion tokens. Out of these, 7.1 billion already circulate.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.