Wanchain is all about interoperability. It connects blockchains to each other. DeFi apps and swaps are particularly popular on this chain. This means there are some excellent money-making opportunities here.

We are going to look at a few of these options to see how you can earn money from the Wanchain ecosystem. These options include:

- Staking

- Lending on Wanlend

- Farming on Wanswap

- Use NFTs for Staking on ZooKeeper

- Wanchain related NFTs

Staking on the Wanchain Ecosystem

Staking is pretty easy on this chain. If you delegate your vote, as many do, then you can earn 7.9% and if you run a validator node yourself, then you can increase that return up to 9.3%, according to Staking Rewards.

And in case staking is something that’s new to you, why is there a difference? You are assuming the technical risk and buying the hardware to connect directly into Wanchain’s system if you run a validator yourself. If you have the know-how, it can be a good business. Most don’t care to so they just delegate their vote in return for a slightly lower return.

By far, the largest custodial staker is KuCoin. And that means you can stake from within your KuCoin account but still under KuCoin’s control.

Some of the non-custodial stakers include:

- InfStones

- Wanswap

- Citadel.one

- And Tokenview among others

Almost 14% or $26 million of Wanchain’s supply is staked, according to Staking Rewards. So you are still early to stake here compared to some larger projects that have more than 50% staked tokens.

Lending on WanLend

Wanlend is the top lending DApp in the ecosystem. There are some amazing opportunities here too.

The primary way that Wanchain works across chains is through a vaulting and wrapped token process. They do it using their own token standard WRC-20. Here’s how it works:

- You have USDC

- You deposit it at Wanchain

- They vault it and mint (1:1) their wrapped token wanUSDC

- wanUSDC is ready to use on their platform

So wanUSDC is the wrapped version of USDC. In other words, the risks are as low as the risk of holding USDC.

Which makes it even more amazing that you can use Wanlend to lend out your wanUSDC and earn 22% on it.

This is one of the best rates on lending a stablecoin that we’ve seen anywhere in the cryptoeconomy. Wrapped Tether wanUSDT pays 16%, again one of the best rates we’ve seen. The wrapped Bitcoin token wanBTC pays 6%, also high.

At a little over $18 million TVL, Wanlend is growing and paying aggressive rates to attract more capital.

Farming on Wanswap

With over $42 million TVL in farming, Wanswap is past the proof of concept stage and looking to grow. As with Wanlend, you can find some aggressive rates here for relatively low risk trading pairs. Here are some of the examples we see:

- The wanUSDT/WAN pair pays 32% APY

- The WAN/wanETH pair pays 25.33% APY

- The very low risk stablecoin pair of wanUSDC/wanUSDT pays 1.2%

- And wanBTC/WAN pair pays 14.33%

The main risks in these pairs is if WAN moves much faster than the stablecoins in those pairs or much slower or opposite to the blue chips like BTC or ETH. These moves would cause an impermanent loss when you redeem your trading pair.

Also, all your payments here are in WASP, the Wanswap governanance token.

Use NFTs for Staking on ZooKeeper

You may have seen that we recently covered the partnership between Wanchain and ZooKeeper. That was about giving ZooKeeper a wrapped token to use on other blockchains. But ZooKeeper is a great opportunity when staying in their existing Wanchain ecosystem too.

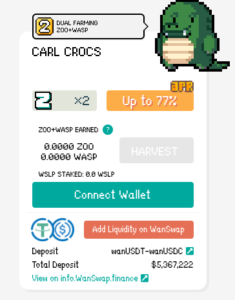

Here you can use your NFTs for staking. For example, you can farm the wanUSDT/wasUSDC pair and earn up to 77% and join more than $5.3 million USD deposited into that pair.

Source: ZooKeeper Finance

NFTs are for sale here too in the native $ZOO token. With the Crafting feature, you can merge 2 NFTs into one NFT that’s rarer and more valuable.

Wanchain Related NFTs

While not on Wanchain directly, there are 2 collections of related NFTs if you have knowledge of the community and believe in it. Both are available on OpenSea. One of them is Wanpunks, which has 184 items and a floor price of 0.02 ETH.

This is something that could be a good potential long-term investment if you believe in the ecosystem and its ability to grow.

Conclusion

We’ve looked at 5 different ways to take advantage of different opportunities on the Wanchain ecosystem. Some are high growth/high-risk opportunities like on ZooKeeper. Meanwhile, others are aggressively priced options against other apps like Lending or Farming.

Above all, this is a chain you should be watching for investment opportunities now and into the future.

Do you like our deeper analysis pieces like this? If so, you should join our trading group and look at our Altcoin Buzz Access program.

If you are super excited about Wanchain, just click below and check step by step review of their platform on our YouTube channel.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Wanchain and ZooKeeper. Copyright Altcoin Buzz Pte Ltd.