The tokenomics of a project goes a long way to spot the chaff from the real deal. This means knowing a project that’s going to be a failure and one that has the potential to succeed.

We recently published an article on how to spot bad tokenomics. That was the first part and this is the second.

We agree that nothing is set in stone in crypto. Any project can fail, even the best. But some projects aren’t worth the stress. From the way they are structured, we can tell that they are bound for trouble. And spotting bad tokenomics is a good way to judge.

In our previous piece, we listed four factors to spot:

- Bad or Undisclosed Vesting Schedule

- Inflationary Supply

- Governance

- Non-Verified Token Contract

This time around, we’ll give you another four factors to watch out for. However, not every project with weakness in their tokenomics is fraudulent or will fail. But, it’s better to be armed with knowledge for safety than to feel sorry. So, let’s get to it.

Infinte supply

Tokenomics also talks about a token’s maximum supply. Maximum supply refers to the number of tokens that exist on the blockchain. Now, a token’s maximum supply directly affects its perceived value. A project is deemed valuable if the supply is low. However, a project with an infinite supply sounds like a red flag. A token’s value might increase or decrease based on how scarce it is.

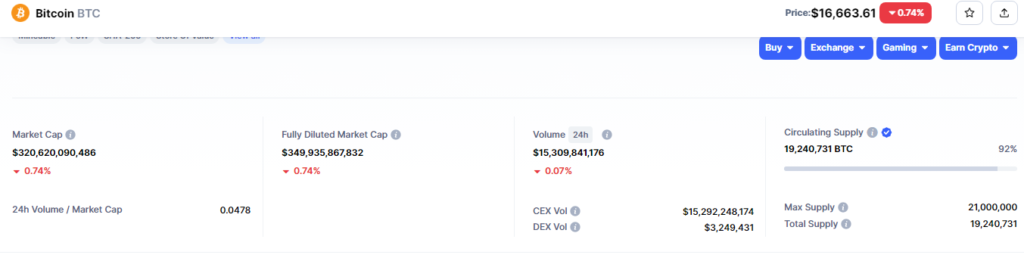

For example, Bitcoin’s tokenomics has it that no more than 21 million coins can ever be mined. This makes Bitcoin valuable because, in a sense, it is scarce. Everyone wants to get it. And since everyone wants it, the price is always going to be competitive, which makes it, like gold, a good investment.

About 80 percent of Bitcoin’s total supply has already been mined. So, that explains the rush. Now, because a project has an infinite supply doesn’t mean its fraudulent. Ethereum practically has an infinite supply and, after Bitcoin, it is the next most popular cryptocurrency. However, Ethereum is the king of DeFi. ETH is used for gas fees and Ethereum has the busiest DeFi ecosystem. So, ETH is always going to be valuable. Not many projects have the same purpose and value as Ethereum.

Unlimited supply isn’t necessarily a terrible thing, and in certain circumstances, it’s merely a temporary solution while the project creators figure out how many tokens they actually need. For instance, the PancakeSwap team ultimately established $CAKE at 750 million after operating with an unlimited supply for more than a year.

So, generally speaking, a token with an infinite supply might not be a smart investment because there wouldn’t be competing demand for it. And this means the price won’t be increasing as you’d like.

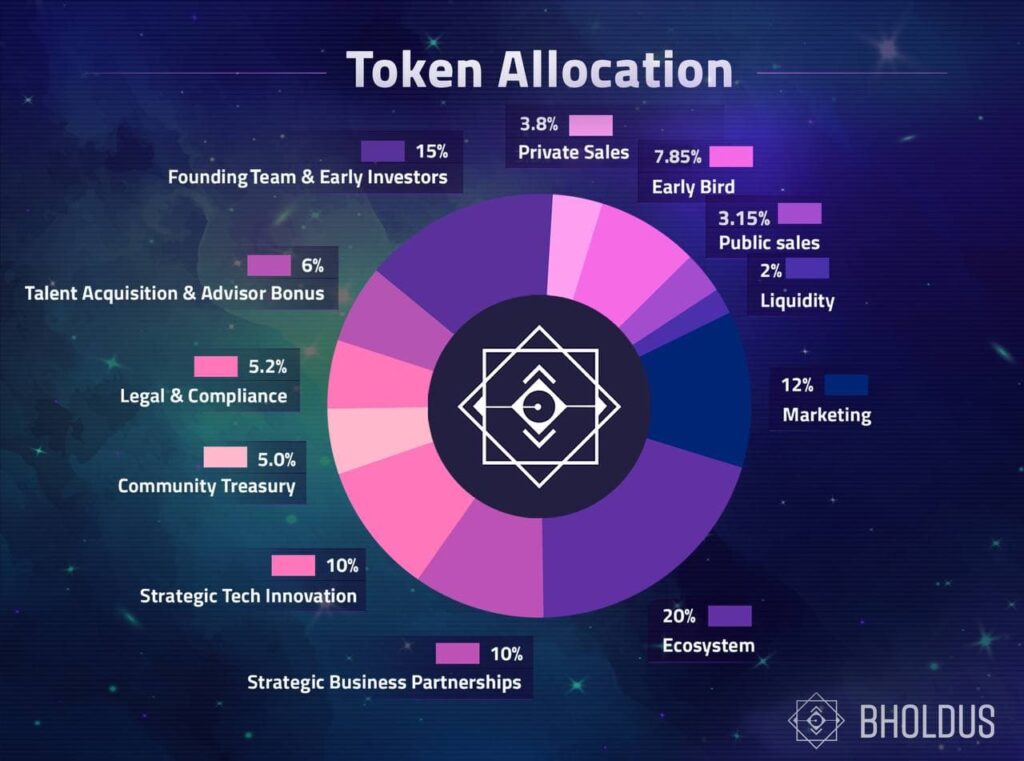

Less Token Allocation to the Public

Most people never look into the token distribution and allocation of a project. And that’s such a crucial part of the whole game. Knowing how many tokens each side gets could help you avoid a big price crash.

Look out for how much of the supply goes to insiders like project developers, advisors, private investors, etc. Then consider how much the general public gets via presales or IDOs, liquidity pools, ecosystem and community growth, etc.

The token will be more decentralized and better for the project and investors if the public gets more of the supply. You should avoid projects where the founders and investors hold the bulk of the tokens from private sales. It’s the ideal formula for market manipulation and centralization. The token should ultimately be readily available, with the general public holding the majority of the supply.

Usually, crypto whales and venture capitalists (VCs) love to dump tokens for a fast and easy payday. Not all VCs want quick money. Some actually want to see the market grow. However, VCs and the project do have to sell their tokens sometimes to raise cash. SO, it’s important to know how many tokens they have. This way, you stay prepared for any crash this sale will cause.

Utility

A token’s utility is another big part of the picture. You’ve got to ask yourself, “What purpose does the token serve that guarantees ongoing or increasing demand to sustain its value?”

ERC-223 tokens are an improved version of ERC-20 that address some of the issues with the original ERC-20 standard. They offer better protection against certain types of attacks and also allow for more efficient contract execution.

— Stefano Virgilli (@stefanovirgilli) December 22, 2022

That answer is important. ETH is always going to be useful. It is used for gas fees for all the projects using Ethereum. So, if a token has real utility, then the value will increase with time as the project develops.

There are two very different types of investments in crypto:

Those that generate token price based on hype & speculation, & those that are based on true demand for the token and generate real revenue.

Spend 2023 searching for projects that generate revenue. Those are the gems.

— 𝔅𝔲𝔩𝔩𝔯𝔲𝔫 𝔊𝔯𝔞𝔳𝔞𝔫𝔬 (@Bullrun_Gravano) December 22, 2022

Additionally, tokens with good utilities tend to avoid massive sell-offs. This is because the community is usually excited about the token’s ability and what it allows them to do. Here are a few examples of utility:

- Governance.

- Earning opportunities through activities such as mining, staking, yield farming, and revenue-sharing.

- Used as a medium of exchange.

- Used as collateral for other assets in the ecosystem.

Let’s give some examples.

For instance, the main uses of ETH are to pay for transaction fees, the development of decentralized applications, and smart contracts. On the other hand, people use Bitcoin for trades and as a store of value.

Too Many Tokens Sold to Early Investors to Promote Pump and Dump

You can be sure that scammers are taking advantage of pump and dump strategies when the price of an asset increases abruptly (pump), then sharply falls (dump). Stocks and other assets can experience this, not just crypto.

The FBI showing crypto influencers their own pump and dump tweets pic.twitter.com/KNoKbMKOX4

— Alan Carroll (@alancarroII) December 21, 2022

The majority of pump and dump tactics include a group of investors buying an asset at an early stage and then encouraging other investors to do the same to drive the price even higher. Price tends to crash when the first investors “dump” most or all of the tokens. So, investors who didn’t get in on the first line can sustain sizable losses.

The SafeMoon token is an alleged pump and dump scheme. The scheme involved celebrities such as Nick Carter, Soulja Boy, Lil Yachty, and Jake Paul. Pump and dump projects usually claim to:

- Have real-world use cases.

- Offer high returns.

- Support and credibility from celebrities.

As we said earlier, looking at how many tokens were allocated to early investors will help you predict a potential crash.

So that’s it. Spotting bad tokenomics can be a life saver. As we said earlier, a project could have loopholes in an area and still be credible. Ultimately, do your own research before investing.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.