We’ve been sharing lessons on how to navigate a bull run lately. And that’s because a bull run is upon us. For some, this would be their first experience with a crypto bull run.

But for others, this could be a time to right many wrongs. Let’s explore some tips that will help you grow the value of your crypto portfolio in the bull market.

There is Only 1 Bull Run Every Four Years

Bull markets are often a time of massive gains. But you can lose all these gains if you don’t take certain steps. Experts often say that the market isn’t your friend; it’s out to take your gain.

So, bull markets are filled with opportunities. However, not being aware of some of the pitfalls could limit how much profit you make. Here are some of the lessons to learn ahead of a bull run.

Tip 1: Understand Market Cycles

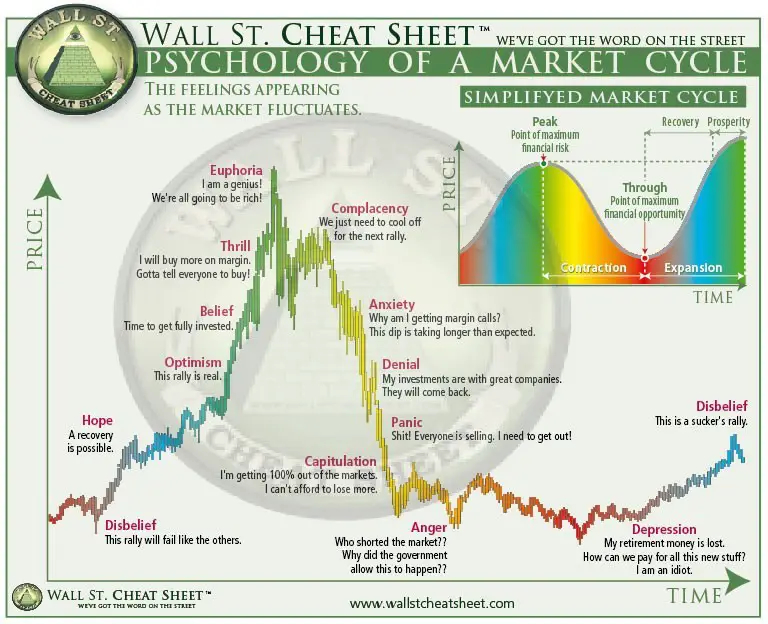

Understanding market cycles and psychology is an important way to boost your portfolio in a bull run. Market cycles, characterized by distinct expansion and contraction phases, offer traders invaluable insights.

Money markets are often thought to be unpredictable. However, there are patterns or cycles in how the market operates. Recognizing these patterns empowers investors to make informed decisions, optimizing entry and exit points.

Each phase of the market has associated sentiments and emotions. We predict a market cycle based on market activity and associated sentiment. There are four major phases of a market cycle:

- The accumulation phase: The sentiment involved at this stage is “the worst is behind us.” This occurs right after a major market crash. Traders believe prices have hit their worst possible price, and it is assumed safe to accumulate a token ahead of the bull run. This phase is marked by changing sentiments.

- The markup phase: This phase is characterized by positive sentiment. Prices move towards a long-term, consistent surge. There’s renewed interest in the market at this phase. Most consider this the actual bull phase. This is where FOMO happens the most. Everyone wants to take risks. So, this phase has more greed than caution.

- The distribution phase: The sentiment here is “the best is behind us.” So, big holders are looking to sell, which causes a shift in the market. At this point, doubts begin to creep into the market. In addition, this phase has lots of negative reports, which sparks more sell-offs.

- The markdown phase: This phase has more fear than greed. So, there’s a declining price and a lack of fresh capital in the market. This phase continues until the price cannot decline any further.

Why Should Traders Care?

Knowing these cycles helps traders plan their entry and exit strategies. It’s important to remember that these phases are not always linear and that the market may display traits from several phases simultaneously or quickly after one another. To properly understand market cycles, trailers can leverage:

- On-chain analytic tools like CoinGecko, Glassnode, Coinmarketcap, etc. These platforms provide historical data that serves as tools to predict

- Sentiment monitoring. Some tools help traders monitor market sentiment, such as fear and greed. This way, you can discern an accumulation phase and a markdown phase.

Tip 2: Do your Own Research.

There’s always a lot of hype in a bull run. The streets of Twitter are filled with noise, with each person hyping their investments. However, not all projects have adequate fundamentals. Some are simply fly-by-the-night stories.

In crypto, FUD is real.

But don't let it sway you.

Stay grounded, do your own research, and trust your gut before you ape into the "next 100x" coin.

— Lark Davis (@TheCryptoLark) December 10, 2023

An experienced trader knows best how to do their research. Others can serve as inspiration, but the decision on what to buy rests with the trader. Experts often advise traders to go for projects with solid fundamentals and real-world use cases.

Tip 3: Diversify your portfolio

Most traders make the mistake of focusing on one of two projects. But this can sometimes backfire. So, it’s often safer to invest in multiple projects within a sector you’re well versed in. Your likelihood of finding success is higher if your portfolio features coins from different projects in different niches.

Tip 4: Craft your strategy

Thriving in a bull market demands more than mere participation; it necessitates a bespoke strategy tailored to individual risk tolerance and goals. Craft a personalized allocation, perhaps 50% in reliable high-caps for stability, 30% in mid-caps for balanced risk-reward, and 15% in high-potential low-caps for substantial returns.

In a (crazy) bull run, the most formidable task is probably to stay calm and focus on identifying things that are purely speculative and things that are sustainable, and then execute a barbell strategy to have exposure to short-term hype and long-term alpha, respectively

— DeFi Cheetah 🐆 ¤ 🦙🦇🔊 (@DeFi_Cheetah) December 5, 2023

You can choose to dedicate 5% to speculative assets like meme coins for opportunistic ventures. Avoid the pitfalls of imitation; instead, create a strategy that resonates with your financial objectives and risk appetite.

Tip 5: Know your risk appetite

It’s important to know how much risk you can tolerate in a bull market. Don’t invest more than you can afford to lose without jeopardizing your financial stability. Set definite objectives and a plan of escape to prevent rash decisions. This helps provide a consistent path through market highs and lows.

Baby Steps to take to Investment

1. Learn about what investing entails

2. Know what you are trying to achieve? Do you want to grow your wealth or preserve your wealth.

3. Be patient, understand there's up and downs in investment. What's your risk apetite. https://t.co/hxGqV0niYG— Dara of Growth (@daraofgrowth) June 4, 2021

Tip 6: Learn technical analysis

Learning technical analysis is crucial for making wise decisions during a bull market. Although it can appear overwhelming at first, there are free lessons available on X or YouTube.

A fundamental understanding of trading patterns, RSI, MACD, and support/resistance levels is extremely helpful. With these tools at your disposal, you can improve your entry and exit strategies and convert market complexity into a tactical advantage.

Understanding the technical aspects of a crypto project is crucial in determining its potential for success. Moreover, it's important to monitor the activity of the development team to ensure they are actively maintaining and improving the technology and project. pic.twitter.com/PFcVJazl3V

— Blackbeard (@blackbeardXBT) October 30, 2023

Tip 7: Stay up-to-date

Stay informed about recent events in the market. Pay attention to Twitter and other news sites for fresh updates. Knowing what’s going on in the market helps you make wise decisions. Stay updated on the coins in your portfolio. Study their social media handles to monitor their activities.

6⃣ Staying up-to-date

This is an easy one. Keep up-to-date with the latest news. Stay tuned in but watch out for fake drama and those 'too-late-to-the-party' panics.

— Blackbeard (@blackbeardXBT) December 4, 2023