DePIN and AI are some of the biggest narratives in 2024. DePIN stands for Decentralized Physical Infrastructure Network. So, these networks provide infrastructure services. AI means Artificial Intelligence. It can take over human tasks but needs extensive training for this. Now, Akash Network manages to combine both these narratives.

So, we dive into the Akash Network to find out what it is and how it works.

What Is Akash Network?

Akash Network offers a GPU marketplace. Here, you can sell and buy decentralized cloud computing resources. It’s an open-source project and it has an active community. This community offers excessive GPU on its marketplace or buys it there. You can also buy GPU as hardware. However, this is expensive. That’s why renting your GPU on a marketplace is ideal. You rent what you need, and you’re not left with unused GPU.

Akash is part of the Cosmos Hub and IBC. That’s the Inter-Blockchain Communication Protocol. This allows all Cosmos Hub chains to talk to each other.

Now, a GPU is a Graphics Processing Unit. This is a specialized electronic circuit. At first, it helped to increase computer graphics and image processing speeds. So, it is widely used in gaming. However, over time, devs added more capabilities. GPU became more programmable and flexible. This made it more suitable for AI. Furthermore, the GPU is faster and more efficient with mathematical equations, compared to the CPU. For example, GPU now gives better access to:

- High-performance computing (HPC).

- Deep learning.

- Parallel processing.

- Large language model (LLM), and much more.

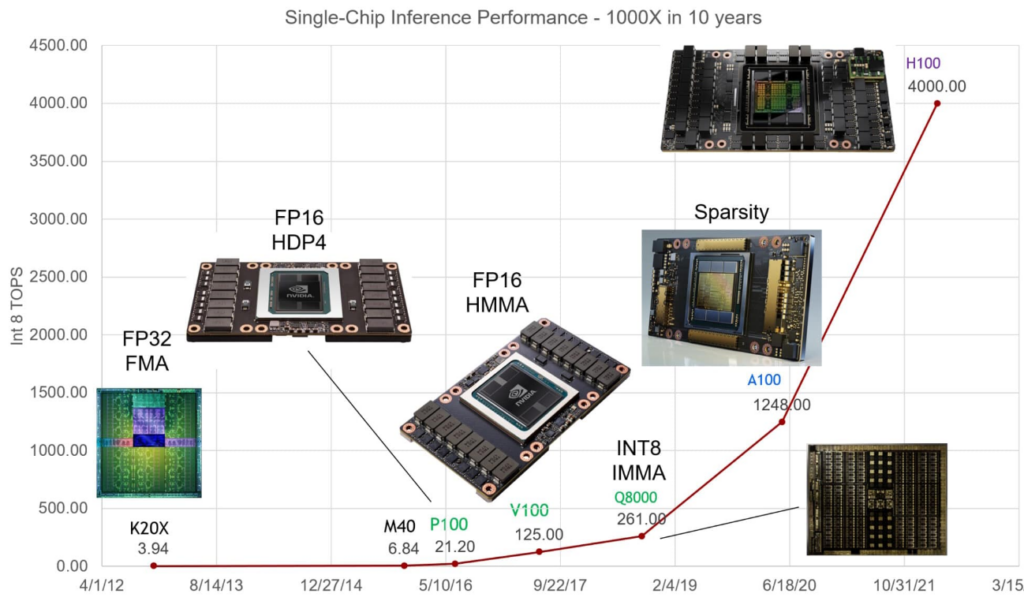

So, together with gaming and AI, we have two massive narratives that are in constant need of GPU. To supply this GPU, Akash operates a marketplace. More on this in a moment. Akash is also in direct competition with the three big names in cloud firms. These are Amazon, Microsoft, and Google. Besides these three big names, there’s also stiff competition in the decentralized space. Nonetheless, by decentralizing its service, Akash can offer this service around 80% cheaper. That’s compared to the three big companies. The picture below shows how GPU became 1,000x faster during the last 10 years.

Source: Nvidea blog

How Does Akash Network Work?

Akash Network works effectively and simply. It has its native $AKT token. You use this token to buy GPU on its marketplace. On the other hand, if you offer GPU on the marketplace, you receive your reward in $AKT. So, this decentralized marketplace is the center point of the Akash Network. It calls itself the Airbnb for data centers.

So, what does this decentralization entail? It means that a worldwide computer network stores your GPU. Like how Arweave and Filecoin store data. See the picture below. It shows how currently 83 providers offer GPU around the world.

Source: Akash website

You can also calculate how much you can earn with your excessive GPU. Akash offers a calculator for this purpose.

For consensus, Akash uses Delegated Proof of Stake (DPoS). That means that validators secure the network. You can stake your $AKT tokens and delegate them to a validator. In return, you receive $AKT tokens as a reward. The current APR is around 14.15%.

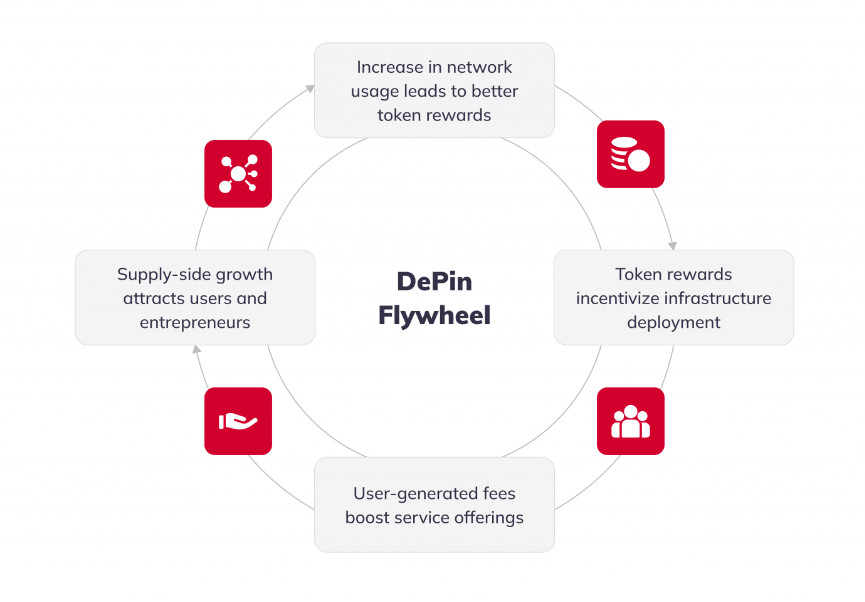

It appears that Akash’s role hasn’t played out yet. It’s rather the beginning. That’s because DePIN has a flywheel. So, let’s take a look at that. Users who rent out their GPU get rewarded with $AKT tokens. That’s also the basis of the DePIN economy model. Now we have a circle that keeps growing bigger all the time. There are three main parts to this.

- Attract people who rent out their GPU for $AKT rewards.

- Attract users that rent the offered GPU. Decentralized prices are much cheaper compared to centralized services.

- This creates a positive feedback loop. There’s an increase in user numbers. This results in suppliers receiving more rewards. As a result, both the supply and demand side increase. Thus, creating a flywheel. See the picture below.

Source: Ideasoft

The Akash Team

In 2018, Greg Osuri and Adam Bozanich founded Overclock Labs. They launched the Akash mainnet in September 2020. This was after they ran various testnet versions. Greg has a cloud engineering background that dates back to 2004. He’s also very active on X and gives great daily updates there. Adam has been a software engineer and architect since 2005. So, both have extensive engineering experience. At the same time, they’re also successful entrepreneurs.

The Coinbase listing is cool and all, but what's more intriguing is that Akash has set a new record for the number of active leases (applications) deployed on the network almost every day for the past month, with a new set of H100s, A100s, and A6000s will be coming online this… pic.twitter.com/fkHmSUJ5hk

— Greg Osuri ⟁ d/acc (@gregosuri) February 27, 2024

Conclusion

We took a closer look at the Akash Network ($AKT). We covered what the platform is about and how it works. For example, its GPU marketplace and how the DePIN flywheel fits into this narrative.

The current $AKT price is $4.84. It has a market cap of $1.1 billion. Currently, the token has a max supply of 388,539,008 tokens. The total and circulating supply is 229,142,478 $AKT tokens. There’s a burning mechanism in place that burns tokens used in transactions. So, that’s deflationary. However, there’s also an inflationary mechanism. For example, for staking rewards or airdrops. Over 1 year, $AKT is up by 915%. Over the last 30 days, that’s 34.5%.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.