On June 1st, China allowed Hong Kong to start limited crypto retail trading. This is big news. Many exchanges plan to get a license in Hong Kong. And, is this the start of a Chinese coins invasion? Will China reverse its crypto ban?

In light of this, we look at 4 top Chinese coins under $1. This is Part 1 of a three-part series. Let’s discover them.

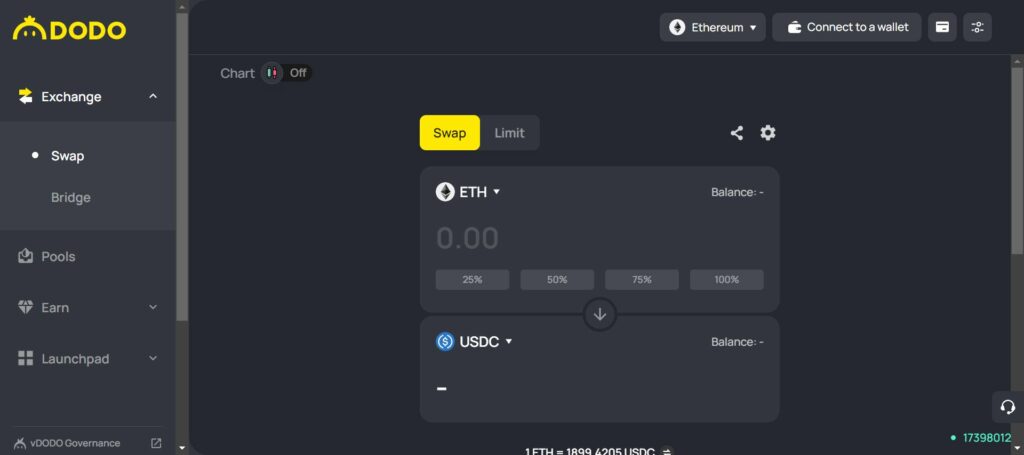

1) DODO (DODO)

Dodo is a DEX using a proactive market maker model (PMM). This means that it copies real human trader and market maker behavior. It uses price oracles for this. In this case, DODO uses Chainlink Price Feeds. This includes traditional order book trading.

In other words, it moves the price curves of the assets it follows whenever the market changes. It has a pricing formula that allows depositing a single asset instead of a pair. As a result, there’s no impermanent loss. Furthermore, all trading pairs are with USDC.

Source: Twitter

In a nutshell, DODO combines the best of both the DeFi and centralized exchanges. It offers the best AMM features and the orderbook of CEX. This increases liquidity and lowers slippage. DODO is active on various chains. For example:

- Ethereum

- BSC

- Polygon

- Arbitrum, and more.

Now get this, DODO is Chinese owned and the link to the Chinese coins. The founders and owners are Chinese crypto OGs. Diane Dai was proactive during the DeFi introduction to China. Mingda Lei has a PhD from Peking Uni but dropped out, He’s the person behind the PMM idea. Qi Wang launched China’s first oracle project, DOS Network. Below is a picture of the DODO UI.

Source: DODO

2) Cortex (CTXC)

Cortex is all about AI with blockchain technology. It’s an autonomous and decentralized AI system. On their website, they claim to be: “The first decentralized world computer capable of running AI and AI-powered dApps on the blockchain.”

The protocol uses zk Rollups to achieve this. That’s their zkMatrix layer 2 solution. It bundles L2 batch transactions on the main chain. As a result, you get a higher transaction per second (TPS) rate. This also results in lower transaction fees.

The interesting part is, that Cortex has already been building AI for over 4 years. So, Cortex adds AI to smart contracts. The following video gives a good explanation of how this works. Since China is big on AI, this is one of the Chinese coins to keep an eye out on.

3) Phoenix Global (PHB)

Phoenix Global was the result of a merger between APEX Network and Red Pulse Phoenix. This happened back in 2020. Their headquarters are in Shanghai. So, there’s the Chinese coins angle for you. The protocol has three components:

- Computation Layer 2 – This is their computational layer. It’s a Web3-based infrastructure platform that offers AI computing services. This layer offers AI on demand.

- Enterprise Layer 1 – This is an EVM-compatible, scalable, and enterprise-grade blockchain.

- Phoenix Oracle – The oracle interacts safely with off-chain data. It takes care of data transactions and exchanges. It’s natively integrated with the Layer 1 chain.

We touched already briefly on China’s fascination with AI. That’s the narrative here. However, all their products are currently in their testnet phases. A limited number of users have access to the test nets. There are, for example:

- The Alpha net – This helps retail and independent traders with AI. They have access to a set of tools to optimize trading.

- Phoenix Layer 2 – This bridges on-chain protocols with off-chain data and AI models.

Since the platform is on the BNB Chain, their native PHB token is a BEP 20 token. Over the last year, the PHB token went up 439%. The following video explains Phoenix Global.

4) Linear Finance (LINA)

Linear Finance calls itself the first cross-chain compatible, delta-one asset protocol. So, what does that mean? Cross-chain is easy. It’s available on various blockchains. For example:

- Ethereum.

- BSC Chain.

- Polkadot.

- Moonbeam.

Delta One means that Linear Finance offers derivatives. So, if the original asset sees a price movement, the derivative should see the same movement. Linear Finance offers a variety of apps, for instance:

- Buildr – For staking the LINA token and building LUSD. The latter is the base currency of the Linear Exchange.

- Exchange – The custom-built exchange. It offers liquid assets with no slippage and unlimited liquidity.

- Swap – A custom-built swap.

- Vault – A yield-generating vault. Lock LUSD, BUSD, or LINA and earn passive income.

Their headquarters are in Hong Kong. Here we go, this covers the Chinese coins angle. The LINA token saw a price increase of 89.9% over the last 14 days. Over the last year, the token is up by 97%. The following video gives a brief explanation of Linear Finance.

Conclusion

This is Part 1 of a three-part series about Hong Kong and Chinese coins. Here are links to Part 1 and Part 3. In this article, we covered DODO (DODO), Cortex (CTXC), Phoenix Global (PHB), and Linear Finance (LINA). This is all because as of 1st June, Hong Kong allows crypto trading again.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.