The Cosmos ecosystem is on fire right now. Almost all Cosmos projects have already seen good upward price moves. Moreover, there were also some great airdrops.

For example, Celestia (TIA) which started at $2 and now sits at $15.6. $DYM and $SAGA are airdropping soon. Black Panther has its $BLACK token coming, and so on. But another great way to do well is with low-cap projects. So, we have 6 low cap gems for you, from the Cosmos ecosystem. Here’s Part 1 from our 2-part series. The picture below is the Cosmos Map of Zones.

Source: Cosmos Map of Zones

Here are 3 important Cosmos coins you should add to your watch list:

1) Quasar Finance (QSR)

The Cosmos ecosystem, or IBC, has a few undiscovered gems. Quasar Finance is one of them. It is a decentralized asset management or DAM platform. It has a couple of features going for it. For example, it is:

- Secure.

- Permissionless.

- Composable.

- Diversified.

gm 👋 Yesterday, we asked you about your knowledge of Concentrated Liquidity.

It turns out many of our followers are still curious about what it is and how it works. To help you out, we've just updated Part I of our CL blog series.

👉 Check out the updated Part I here:… pic.twitter.com/9jdNCya4MO

— Quasar 🛰️ (@QuasarFi) January 11, 2024

The IBC or Inter Blockchain Communication Protocol allows it to be interchain. Quasar offers vaults and vault strategies. It’s Cosmos’ leading yield platform and calls Osmosis its home. According to DeFiLlama, it currently has almost $7 million in TVL.

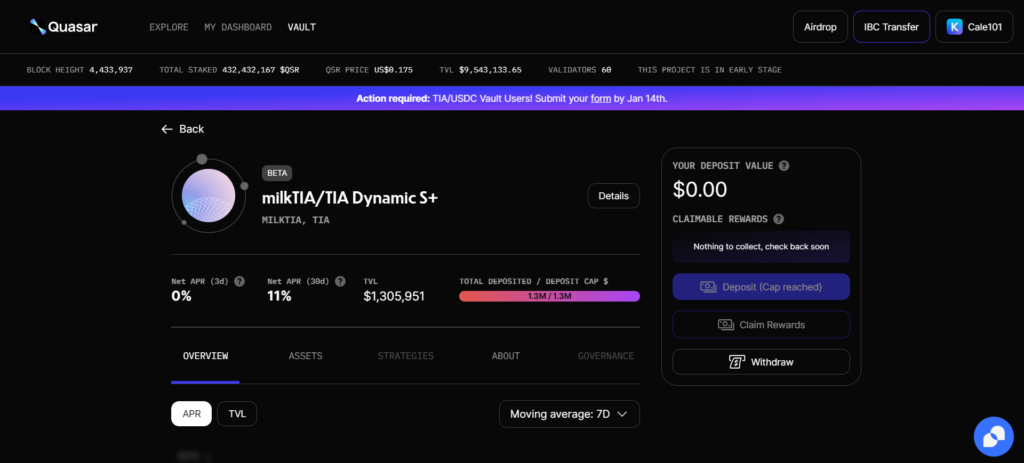

Recently, the MilkyWay platform offered to liquid-stake TIA on its platform. This is another protocol on Osmosis. You receive milkTIA as the derivative token. Quasar is one of the platforms that offers a milkTIA vault. However, due to popular demand, this milkTIA/TIA vault has reached max capacity. That vault alone has $1.3 million locked up.

The yield on Cosmos platforms can at times outperform Ethereum yields. Cosmos users like to get involved with their platforms and stake their assets. A win-win situation for both the users and the platforms.

The current QSR price is $0.165. This is also circling its new ATH. It has a market cap of $97 million. Max token supply is 1 billion and total token supply is 614 million. The circulating supply is 556 million QSR tokens. The picture below shows the milkTIA/TIA vault on Quasar.

Source: Quasar vaults

2) Comdex

Comdex is an infrastructure layer for DeFi on Cosmos. In other words, it offers various interoperable plug-and-play modules for projects. This allows them to build their DeFi platforms. Comdex wants to democratize finance. And revolutionize it.

Devs have a field day since Comdex automates everything. The platform also already boasts a small but sturdy ecosystem. It consists of wallets, Dapps, bridges, stablecoins, and explorers. For example, cSwap, ShipFi, Leap Wallet, Axelar, or Mintscan.

The Renaissance of RWA financing on Comdex. https://t.co/N6GK2CBI8X

— Comdex – Democratizing Finance (@ComdexOfficial) December 18, 2023

Furthermore, the platform has strong backers. It launched back in January 2022, and the CMDX token immediately hit an early ATH of $6.02. That’s 98.6% away from its current price. The current CMDX price is $0.0832. However, over the last 30 days, CMDX saw a 214% price increase. It has a market cap of $12.6 million. The max supply is 200 million tokens, with a total supply of 180.5 million tokens. The circulating supply is 151.9 million CMDX tokens.

Most crypto assets are in an isolated position. However, that’s a different ball game in the IBC. The IBC interoperability is what Comdex needs and wants. It allows the platform to offer its financial options. The IBC allows Comdex to offer secure, liquid, and cross-chain features. Not to mention staking and governance, something Cosmos is well-known for.

Introducing, CMDX 2.0: A New Horizon in Tokenomics

Excited to share our proposal for a revised CMDX tokenomics model!

Join the discussion: https://t.co/rjYIMXuQQD

— Comdex – Democratizing Finance (@ComdexOfficial) January 9, 2024

3) Sommelier Finance

Sommelier Finance offers yield in their vaults. It’s built with the Cosmos SDK, but bridges to Ethereum. This gives it access to EVM DeFi protocols. It uses rebalancing strategies for yield-earning options. Sommelier uses intelligent vaults. These can predict, react, and optimize market conditions.

$70 Million Dollars. That's it. That's the Tweet. pic.twitter.com/Jq5pnn9kFG

— Sommelier Finance (@sommfinance) January 10, 2024

The rebalancing happens off-chain by the Cosmos validators. The validators receive messages from strategists. Once they reach a consensus, they message the result via the bridge to the EVM chains. So, the validators only relay messages through the bridge, not assets. You deposit the actual assets on the EVM chains, they’re not bridged. Sommelier uses two bridges, an own bridge to Ethereum and Axelar to alt-EVMs. This gives Sommelier a unique architecture.

The current SOMM price is $0.2503. It has a market cap of $62.5 million. The max and total supply is 500 million tokens. Their circulating supply of SOMM tokens is 249 million. Like almost all other Cosmos tokens, SOMM also pumped over last year. It’s up 249.1% compared to a year ago. The picture below shows the Sommelier architecture.

1/2 Here's your friendly reminder that Sommelier has vaults for some of your favorite assets (ETH, WBTC and USDC) & ecosystems.

Gain exposure to LST DeFi through the Real Yield ETH, Turbo stETH (@LidoFinance) and Turbo swETH (@swellnetworkio).

Deposit at https://t.co/AxYSYAS8AX pic.twitter.com/CBsbTfMXVN

— Sommelier Finance (@sommfinance) January 8, 2024

Conclusion

This is Part 1 of a 2-part series about low-cap gems on Cosmos. In this part, we covered Quasar Finance, Comdex, and Sommelier Finance. Keep an eye out for Part 2.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.