By now, most people in the crypto space know that Ethereum is about to change from PoW to PoS. The long-awaited Merge. This means that you can stake your ETH. Even before the Merge takes place. There are a few platforms that offer this service already. Lido Finance is the biggest among them.

Staking ETH is not that easy for a retail investor. It’s expensive and requires technical knowledge. However, Lido makes it easy to stake your ETH. So, let’s have a look at what Lido Finance is all about.

What Is Lido Finance?

Lido Finance offers liquid staking for ETH and a few other tokens. This means that for every ETH you stake on the Lido protocol, you receive 1 stETH. A tokenized version of staked Ether. In other words, it is a liquid token. You can now use these stETH tokens and earn passive income on DeFi platforms. There’s also no required lock-up period. Lido also doesn’t ask for a minimum staking amount.

Source: Lido

This contrasts with staking ETH directly on Ethereum. Here, your ETH gets locked until the Merge. It also takes at least 32 ETH that you need to stake, to operate a node. Not to mention, that staking ETH is rather technical. Lido takes all these hurdles away. It lets you invest any amount of ETH you want, in an easy and non-technical way. Furthermore, stETH pegs 1:1 with ETH. Or at least, that’s the idea.

StETH De-pegged from ETH

However, one problem is that stETH de-pegged from ETH. That was at the root of the issues for Celsius. On the other hand, it opens up delayed arbitrage opportunities. If you buy stETH now below the ETH price, you can swap each stETH back to 1 ETH after The Merge. So, it’s not classic arbitrage, which happens instantly.

What you need to keep in mind, is that you can’t get your ETH back, until The Merge happens. Once Ethereum puts transfers and smart contracts on the Ethereum 2 chain, you can swap your stETH back to ETH. The de-peg of UST also played a role, investors lost their trust quickly. They rushed to sell stETH. Finally, when investors started to take money off Celsius as a whole, Celsius couldn’t pay them. Because it had no access to its ETH, it’s locked away. They also couldn’t sell their stETH and what they could sell, they sold at a loss. There were other factors in play as well, but it shows what impact this de-peg had.

stETH has depegged to 0.97 stETH / 1 ETH … and seems intent on staying there. pic.twitter.com/PgmEl9bFWp

— Mark Jeffrey (@markjeffrey) June 9, 2022

However, you do receive stETH once you start staking ETH on Lido. Now you can use this the same way as ETH. It allows you to take part in trading, lending, yield farming, etc. Furthermore, you stake your underlying asset and get yield for it. In the meantime, you also secure the network.

The Lido DAO

The Lido DAO governs Lido’s liquid staking protocols. This means that node operators don’t have direct access to your staked Ether. The Lido DAO picks the node operators.

Lido launched back in December 2020. Shortly after the Beacon chain launched. We saw already that staking on Ethereum has a few hurdles. You need to stake at least 32 ETH, so your staked ETH gets locked away, and it requires technical know-how. The Lido DAO takes all these hurdles away. Here is an example of a voting process of the Lido DAO:

With the recent introduction of the Lido on Ethereum Scorecard – a set of attributes important for the decentralisation of Lido – we mentioned the importance of a vote timelock as a governance safeguard.

It’s time to bring this to life. https://t.co/buTB6RvHJT

— Lido (@LidoFinance) June 28, 2022

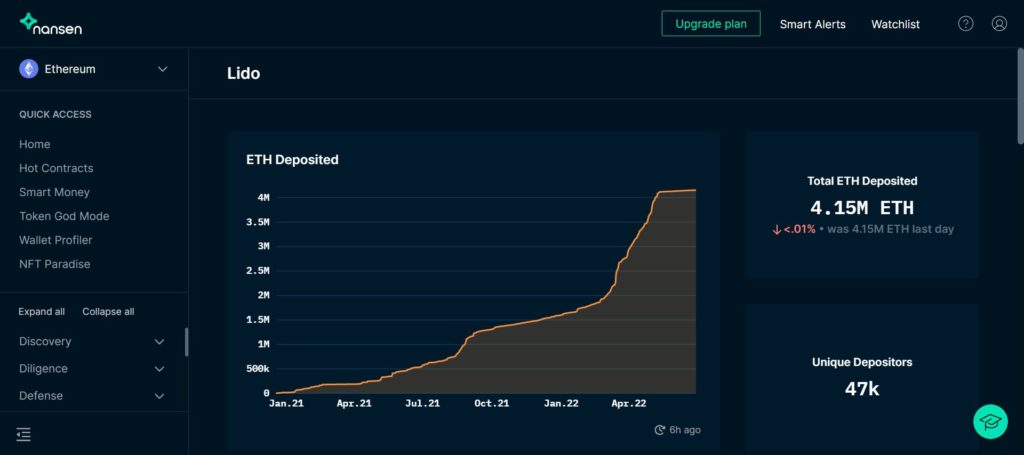

However, DAO stands for Decentralized Autonomous Organization. Despite this name, there are concerns about the decentralized part of Lido. The problem is that ETH Lido staking exceeds a certain percentage of total staked ETH. Currently, Lido stakes almost 4.15 million ETH. According to the Ethereum website, the total of staked ETH is 13,607,019. So, Lido stakes almost 32%.

Is the Lido DAO a Threat to Ethereum?

Danny Ryan thinks this causes a threat to the Ethereum blockchain. He is a researcher at the Ethereum Foundation. Ryan argues that Liquid staking derivatives (LSD) such as Lido should have no more than 25% of all staked coins. There’s a good article on this complicated matter, that explains this well.

In a nutshell, the cartelization of block space can happen. This is because Lido determines who can be a node operator. In the end, Lido can lead to a centralized attack on the network. This is because the lion’s share of staking power becomes too concentrated. A risk is that they can potentially interrupt the recording of new blocks.

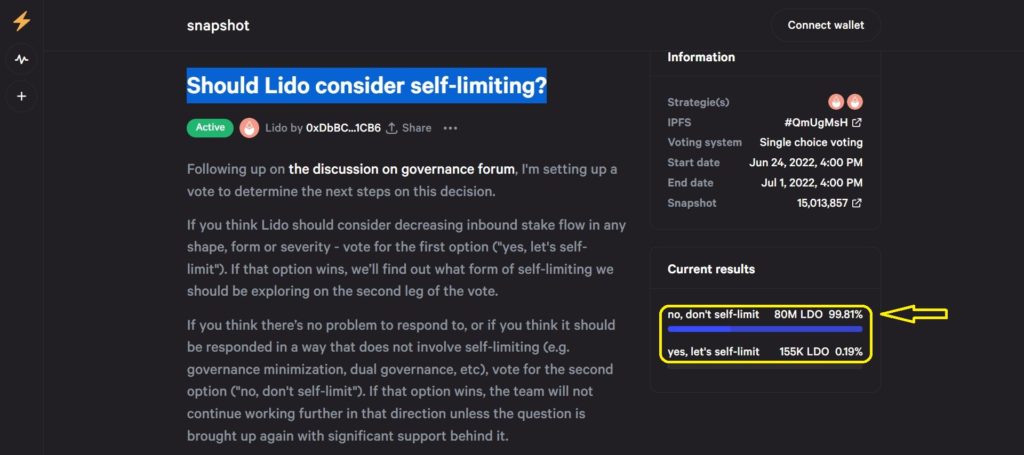

In the Lido camp, they don’t necessarily agree with this view. Vasiliy Shapovalov, CTP at P2P, started a governance vote on Lido. The title “Should Lido consider self-limiting?”. The result, which came out on June 28th, 2022, showed that 99.81% cast a no vote. See the picture below:

Source: Lido governance forum

The Lido Ecosystem

We list the other tokens that you can currently stake on the Lido protocol below. These are the following chains are compatible with Lido:

- Solana (SOL)—Receive stSOL and use it across DeFi. In the meantime, your staked SOL works across the Solana ecosystem. APR is 5.5%.

- Kusama (KSM)—You get stKSM. Receive each day staking rewards from your KSM. Your stKSM works in DeFi on the Kusama and Moonriver ecosystems. APR is 21.1%.

- Polkadot (DOT)—This gives you stDOT. Get daily DOT staking rewards. Let your stDOT work DeFi on the Polkadot and Moonbeam ecosystems. APR is 16.5%.

- Polygon (MATIC)—Get stMATIC whilst staking MATIC tokens. Unlock your MATIC tokens. APR is 8.7%.

Lido on Polkadot is here!https://t.co/gJh5AX3z6Z 🏝️

Stake your DOT with Lido for daily rewards and full control over your staked tokens. pic.twitter.com/VilI5dTsLd

— Lido (@LidoFinance) May 31, 2022

The same liquid staking principle works for these tokens. Furthermore, there are 27 projects that are part of the greater Lido ecosystem. They either offer to stake at Lido or are in another way involved in the process. For example;

- DEX—Curve, 1inch, Aave, Balancer.

- CEX—FTX, Gemini.

- Wallets—MetaMask, Trust Wallet, Ledger.

- Aggregators—CoinGecko, CoinMarketCap.

Lido Staking

In this article, we don’t go all the way about explaining how to stake Lido. We cover the basics here and refer you to our Lido staking article for the full low down.

Staking on Lido is easy and convenient. You can stake any amount and in turn, you receive a derivative token like stSOL, stDOT, etc.

Also, Lido staking offers two main benefits:

- Stake your ETH and get rewards for it. Currently, the Lido staking rewards are at 4%.

- Receive a reward token pegged 1:1 to the underlying asset. With this token, you can earn passive income on DeFi. Lido offers an easy-to-use Lido staking calculator.

This reward token is what Lido calls ‘liquid staking‘. The current Lido APR is lower than Ethereum’s APR. It will also not exceed Ethereum’s APR, which currently is ~4.2%.

Source: Nansen

Lido Tokenomics

Lido has two tokens:

- The stETH token: As already explained, stETH is a liquid token. This means that you can use it in DeFi. You can lend it, borrow it, or use it as collateral. It’s also possible to sell this token.

The current price of stETH is $1,067.28. The market cap is $4.51 billion with 4.233 million tokens in circulation. To show the de-peg, the current price of ETH is $1,111.95. Currently, stETH ranks 18th in market cap rank.

- The LDO token: The LIDO Finance token or LDO token is the governance token. Each token means 1 vote.

The current price is $0.505916. The market cap is $229 million. The TVL is $4.8 billion. Out of 1 billion tokens, 454 million are in circulation.

Conclusion

Lido Finance is taking up a key position in the crypto space. Somehow, they managed, almost under the shadow of the night, to reach the top 20 by market cap.

StETH also played an important role in the Celsius’s insolvency. However, some influential people, think that Lido might become a threat to Ethereum. For instance, Danny Ryan and Vitalik Buterin. Under certain circumstances, this can become a reality. So, Lido met already these circumstances, as explained in the Lido DAO section. It looks like both parties haven’t said the last word about this. Despite the DAO voting against a self-limit on the inbound stake flow.

⬆️ Win $6,699 worth of bonuses in the exclusive MEXC & Altcoin Buzz Giveaway! Find out more here.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.