Lido Finance offers liquid staking on their staked assets. They find themselves in a key position recently, with their stETH tokens. However, they offer more than just this token. In total, Lido staking offers 5 different tokens.

When staking on Lido, you receive a new token that pegs 1:1 with the underlying asset. With this token, you can earn passive income on DeFi. That is liquid staking in a nutshell. So, let’s find out how you can stake on Lido Finance.

How Does Lido Staking Work?

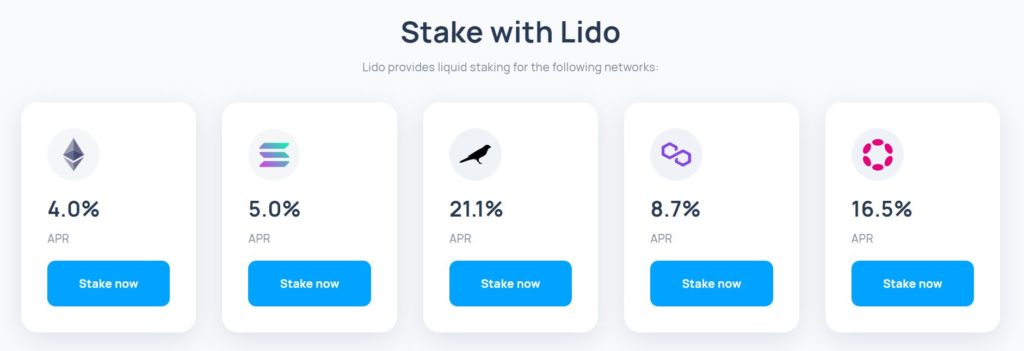

Staking on the Lido Protocol works easily. However, when you stake an asset, it’s locked. As already mentioned, the Lido protocol gives you a derivative token in return. When you stake one of the five available assets with them, you get a token that’s pegged 1:1 to this asset. Here’s a list of the available tokens, their liquid tokens, and the current APR.

| Network | Token | Liquid token | APR |

| Ethereum | ETH | stETH | 4% |

| Solana | SOL | stSOL | 5.5% |

| Kusama | KSM | stKSM | 21.1% |

| Polkadot | DOT | stDOT | 16.5% |

| Polygon | MATIC | stMATIC | 8.7% |

Source: Lido Staking

Note: Lido will take a 10% fee on your earned staking rewards. So, not on the staked amount.

Moreover, you make two-way gains whilst staking on Lido:

- Your stake earns yields.

- You can use your liquid token on DeFi and earn passive income. It’s also possible to sell your st token.

The top Lido Finance token for staking is ETH, with its stETH. This takes the biggest share of all five tokens. On the other hand, Polkadot is the new kid on the Lido staking block. They joined Lido on May 31, 2022. In our recent article on Lido Finance, you can find more info about the Lido DAO and what Lido Finance is about.

So, let’s have a look at these five tokens and their staking conditions.

1) Lido Staking With ETH

Any amount of ether that you stake on Lido, on the Beacon chain, will get locked. You won’t be able to unlock this Ether until Phase 2 of Ethereum happens when they change from PoW to PoS. However, for each amount of staked ETH, you receive the same amount of stETH in return. ETH and stETH peg 1:1.

You can move stETH around and trade it at will. This liquid staking allows you to use your stETH in various DeFi options and get passive income.

Moreover, self-staking ETH requires you to stake 32 ETH and technical know-how. You also need specific equipment and be online 24/7/365. Otherwise, you get penalized. Lido staking takes these barriers away. You can stake any amount of ETH. Although your ETH gets locked, you get the liquid stETH tokens.

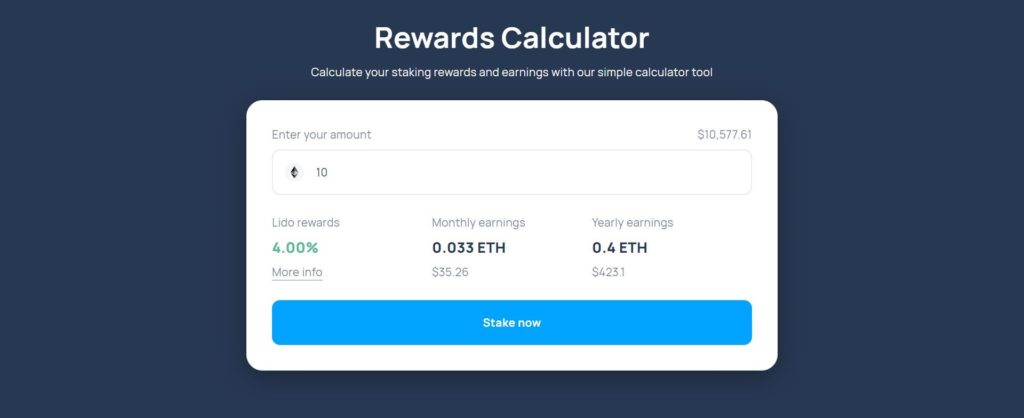

In addition, Lido gives staking rewards within 24 hours of your deposit. There’s no need to wait for validator activation. Lido staking rewards for ETH, the APR, will grow if more active stakers join. However, it will not exceed Ethereum’s APR. See the picture below for a Lido staking calculator.

Source: Lido Finance

2) Lido Staking With SOL

When you stake SOL on Lido, you receive the liquid stSOL token. It allows gaining passive staking rewards. However, you don’t need to run your staking infrastructure. You can use stSOL in the Solana DeFi ecosystem. Unstaking is easy. You just swap anytime on the secondary market.

However, stSOL is not a rebase token, like stETH. In other words, you won’t collect new tokens as a reward. Your reward is in the form of appreciated stSOL value. You can swap your stSOL back for SOL. Lido will transfer the accrued SOL rewards to your account, upon redemption. In turn, you can unstake this SOL and get liquid SOL, after 2-3 days. So, it’s also possible to swap on the open market. For example, Saber and Raydium have supported pools for this. You can find an extensive explanation on the liquid Lido staking page for Solana.

SOL to stSOL in one click ⚡️

You can now stake your $SOL with Lido in one click using the @slope_finance wallet!

Earning yield on your SOL and securing the network has never been easier. pic.twitter.com/dADDKwlyKK

— Lido on Solana (@LidoOnSolana) June 29, 2022

3) Lido Staking With KSM

You receive your staked KSM rewards every 24 hours. There are no bonding or unbonding periods, like with third-party protocols. You also minimize the risk of a KSM slashing event.

2/ ⛓ Lido is a staking derivatives protocol and one of the first apps to support xcKSM, which will be used to securely provide access to $KSM and relay chain staking functionality from the Moonriver-based EVM environment.

Learn more 👇https://t.co/bmzuGXgCBu

— Moonriver Network (@MoonriverNW) February 18, 2022

Your stKSM is a rebasable token. Very much like stETH. Each staking day, your balance increases. Kusama currently holds the highest Lido APR percentage, at 21.1%. More information is available on the Lido Kusama staking page.

4) Lido Staking With Polkadot

Polkadot is the latest addition to the Lido staking ecosystem. With Lido staking, you can stake your DOT on Polkadot/Moonbeam. You receive daily rewards. The liquid stDOT token gives you access to the DeFi ecosystems of Moonbeam and Polkadot.

You can stake and unstake at will. There are also various yield opportunities. All across Polkadot. The stDOT token is a rebasable token with daily rewards. You can also reduce the slashing risk when using the ledger splitting system. So, that is when Polkadot splits staking rewards among nominators.

Moreover, your liquid stDOT token can earn yield in various ways. For example, on Moonbeam. You can use your staked DOT as collateral in Curve stable pools. You can keep your cross-chain DOT, or xcDOT, in your MetaMask, unlike DOT. The advantage of Moonbeam is that it is fully Ethereum compatible. More information is in this Lido blog.

Lido on Polkadot is here!https://t.co/gJh5AX3z6Z 🏝️

Stake your DOT with Lido for daily rewards and full control over your staked tokens. pic.twitter.com/VilI5dTsLd

— Lido (@LidoFinance) May 31, 2022

5) Lido Staking With Polygon (MATIC)

Stake MATIC with Lido and receive stMATIC. As a result, you can use these tokens across the DeFi ecosystem of Polygon. It is an ERC-20 token, but it’s not rebasable. This means that your stMATIC amount doesn’t increase on a daily basis. However, your stMATIC value changes. This depends on how many staking rewards you earned, relative to MATIC.

LIDO is coming to #Polygon@shard_labs is bringing the Lido Liquid staking solution to Polygon. Users will be able to stake $MATIC & get stMATIC in return for use in other DeFi protocols. Polygon will bring blockchain infrastructure to the masses.

🌐: https://t.co/RXmyCCEoKg pic.twitter.com/VnPLbbdCEB

— Polygon – MATIC 💚 (@0xPolygon) September 3, 2021

Lido added Polygon in early March 2022 to their staking ecosystem. For more information, check their blog.

Is Lido Staking Safe?

Staking with Lido has some potential risks. Here’s a list of six risks that can occur when staking with Lido.

- Smart contract security—Bugs or a vulnerability. However, Lido has an open-source code. They also underwent various audits.

- ETH 2.0 risks:

- Technical risk—ETH 2 may have some risks. So, any bugs in ETH 2 bring a slashing or fluctuation risk.

- Adoption risk—In case that ETH 2 fails, there may well be a price difference between stETH and ETH. For instance, when there’s a lack of adoption for ETH 2.

- DAO key management risk—A part of the staked ETH funds can become locked. For example, when signatories across a certain threshold lose their key shares.

- Slashing risk—If a validator fails, up to 100% of staked funds can be at risk. As a result, Lido uses a variety of reputable node operators. Out of Lido fees, they also pay an insurance.

- stETH price risk—stETH can de-peg from ETH.

One safe way to stake with Lido is to stake directly on your Ledger hardware wallet. This way your coins are safe since you don’t connect your wallet to the internet. This video explains how to do this:

Conclusion

We showed you how you can stake the five available crypto tokens on Lido Finance. We went into detail for each individual token. Furthermore, we also showed you the associated risks when staking with Lido.

Lido Finance is claiming a seat on the front row in the current crypto space. The Ethereum Merge is something we all look forward to, and Lido is at the forefront of this.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.