Wonderland Money is a decentralized and autonomous organization. It’s a DeFi protocol that builds custom investment products. Furthermore, they are a DAO, in which you can influence the direction of the protocol. Their native token is the wMEMO token or Wonderful Memories.

That still doesn’t tell us a lot. So, it’s about time to have a look at Wonderland Money.

What Is Wonderland Money?

Wonderland is a DeFi protocol and a DAO. They focus on a couple of features:

- Venture capital investments

- Yield maximizing market strategies

- Expanding the utility of the Web3 and DeFi ecosystems

📢 The eligible submissions from our community NFT contest have been used to create a collection on OpenSea. Our charity auction is now LIVE!

Wonderland DAO Charitable Initiative 2022

• https://t.co/MC4KrsiWfH— Wonderland.Money (@Wonderland_fi) December 30, 2022

They envision this with two strategies:

- Building custom investment products.

- Partner with growing projects.

Their native token is wMEMO. This is the wrapped version of MEMO. There was also the TIME token, but MEMO and TIME are no longer available. They deprecated them in January 2022. If you still have MEMO, you can wrap it, so it becomes wMEMO. However, you can’t unwrap it anymore. As a result, wMEMO is multichain.

Wonderland Money lives on Avalanche. However, wMEMO has cross-chain operability with Ethereum, Fantom, and Arbitrum. They also claim to be the first decentralized reserve currency protocol.

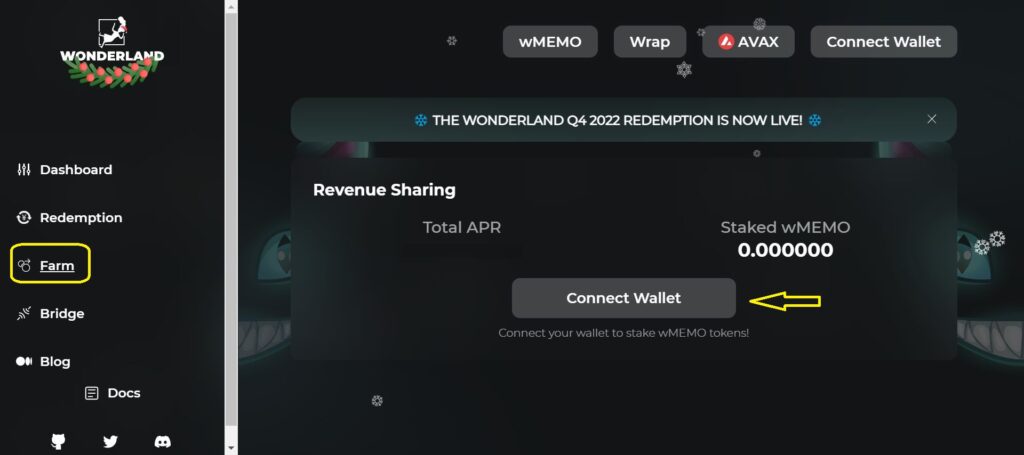

Their ecosystem allows users to stake wMEMO. As a result, this gives you revenue share. You can stake your tokens in the Wonderland dApp. Just click the ‘Farm‘ button. The staking rewards compound. See the picture below. The ‘Farm‘ tab is in yellow. You can use MetaMask or Wallet Connect.

Source: Wonderland Money farm app

How Does Wonderland Money Work?

Wonderland Money is a DAO and the wMEMO controls this DAO. So, if you want to take part in the DAO, you need to own wMEMO.

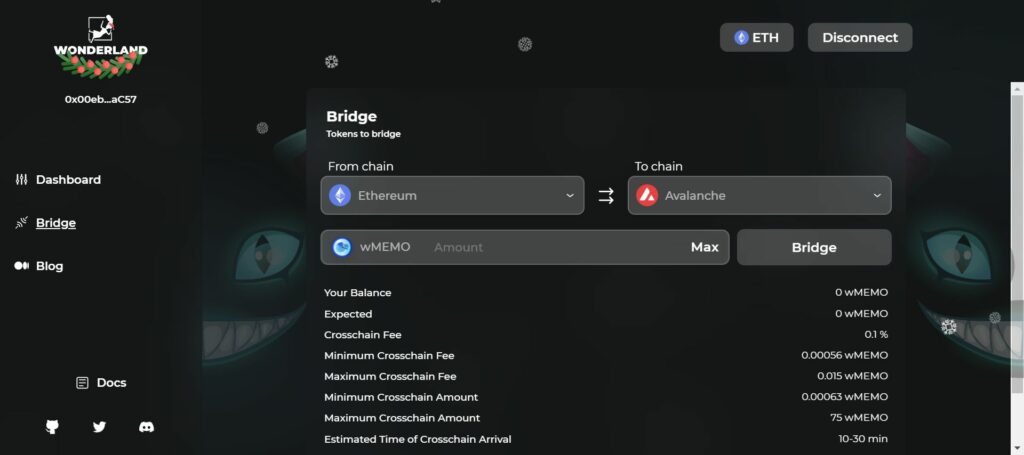

So, once you own wMEMO, you can vote and decide on the direction the DAO takes. You can also stake the token and get a revenue share. Furthermore, you can use a bridge, supported by multichain bridge. However, they use a different UI. The only token you can bridge is the wMEMO token. They generate revenue with four strategies:

- High-yield and low risk stablecoin positions.

- Early-stage token investments: The community assesses this on their government forum.

- Treasury management.

- Strong ecosystem partners.

Also, some of their investments are in:

- Betting with Betswap

- Liquid staking: They funded their own liquid staking options. To clarify, this runs only on the Avalanche and Fantom chains.

- Gaming

- NFTs

- DeFi

- L1/L2 infrastructure

A diversified portfolio of investment options. These are the only ones that investors allow to make public. In other words, they have other strategies in their portfolio. Below is a picture of their bridging page.

Source: Wonderland Money bridge app

How to Buy Wonderland Money Coin?

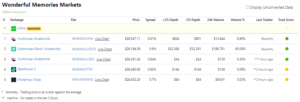

The wMEMO coin is only available on a few DEXs. On Avalanche, that is SushiSwap with 3 pairs and Kyberswap Elastic with 2 pairs. Uniswap V3 on Ethereum and Beethoven X and Morpheus Swap on Fantom also offer wMEMO. The last three DEXs only offer 1 pair each. Here is a complete list of exchanges where you can buy wMEMO:

Source: Coingecko

Conclusion

This is the first part of two articles about Wonderland Money. We answer more questions about Wonderland Money in our Part 2 article.

The current price of wMEMO is $28,029. The market cap is a self-proclaimed $107 million. According to CoinMarketCap, there is a max supply of 22.215 tokens. The self-reported circulating supply is 3,822 tokens. On the other hand, it has a total supply of 7644 tokens and an infinite max supply.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.