Recent indicators suggest a robust improvement in Bitcoin’s network health ahead of the upcoming halving in April.

Notably, the network’s hash rate reached a record 500 exahashes per second, spotlighting the current high level of mining activity and, consequently, the network’s safety. So, here are some positive signs that the market is giving us before Bitcoin’s halving.

1) The recorded hash rate of 500 exahashes per second is an all-time high.

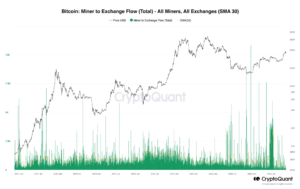

On-chain analytics from CryptoQuant reveal that outflows from known miner wallets to exchanges have hit their lowest levels in seven years.

This metric indicates a reduced movement of coins from miner wallets to exchange wallets, reflecting subdued activity by these entities in the open market. So, speculation arises regarding miners’ cautious approach, with limited BTC sales to sustain operations while anticipating potential BTC ETF approvals.

Miners may opt to hold onto their coins, potentially leveraging borrowing to cover expenses, especially considering the impending halving event, which many expect to double production costs.

2) Declining BTC Balances on Exchanges Amid Turmoil

Following a tumultuous month marked by withdrawal disruptions and legal actions against major crypto exchanges, BTC balances are once again on a downward trend. This reflects a broader pattern observed over the past five years, the reserves of BTC on exchanges continue to dwindle even lower.

Source: Glassnode

As per insights from on-chain analytics firm Glassnode, the collective BTC holdings of major exchanges have reached 2.332 million BTC.

It represents the smallest pool of available BTC since April 2018, excluding the recent lows witnessed in October. In contrast, the peak was recorded in March 2020, shortly after the cross-market crash triggered by the onset of the COVID-19 pandemic, with a total of 3.321 million BTC.

Besides, the aftermath of Binance’s record $4.3 billion fine and the traders’ reactions and withdrawal halts from exchanges like Poloniex and HTX following a hack further complicated the scenario in November. This means that we will not see major crashes (Excluding Black Swan events, and big whale manipulations), but some corrections.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.