Binance Research, the research arm of crypto exchange Binance, has released a report titled “Institutional Crypto Outlook Survey.”

The Binance research was carried out in collaboration with Binance VIP and Institutional. It provides an optimized digital asset trading experience for institutional clients such as asset managers, hedge funds, market makers, brokers, family offices, and proprietary trading companies. So, this report consists in a survey that explores the opinions of Binance institutional clients and VIP users on their disposition towards the crypto market in 2023.

Source: Binance Research

The Binance Research survey ran from March 31st to May 15th. It covered questions on the respondent’s preferences, attitudes, adoption, and motivations toward cryptocurrency investments. Now, let’s summarize the report based on key metrics.

1) Allocation

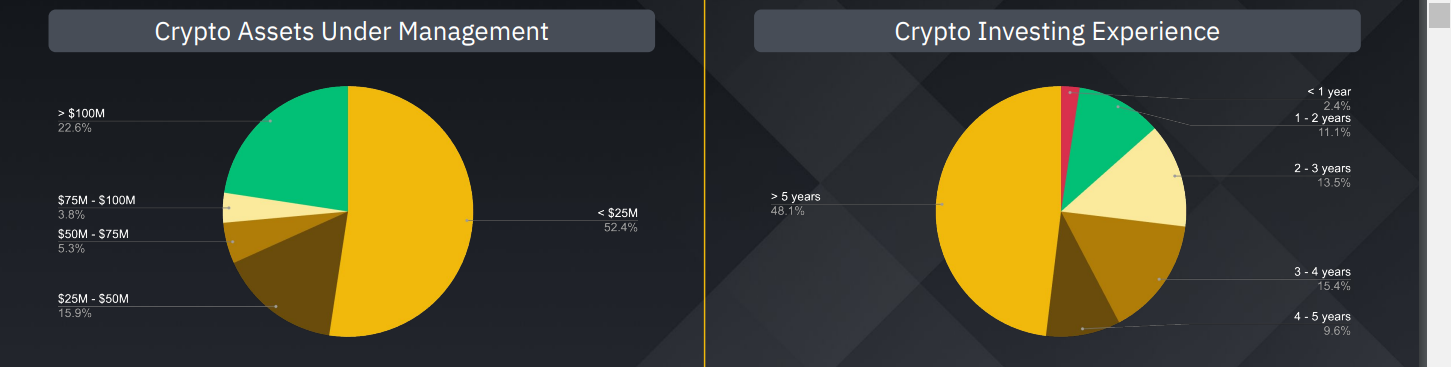

The research surveyed more than 200 global institutional investors and provided key insight into the disposition of these investors towards crypto. Almost half of the respondents, (48.1%) had more than 5 years of experience in crypto investment.

The research showed that around 47.1% of the respondents did not alter their crypto allocation over the past year, while about 35.6% of institutional investors increased their allocation during the same time frame.

Source: Binance Research

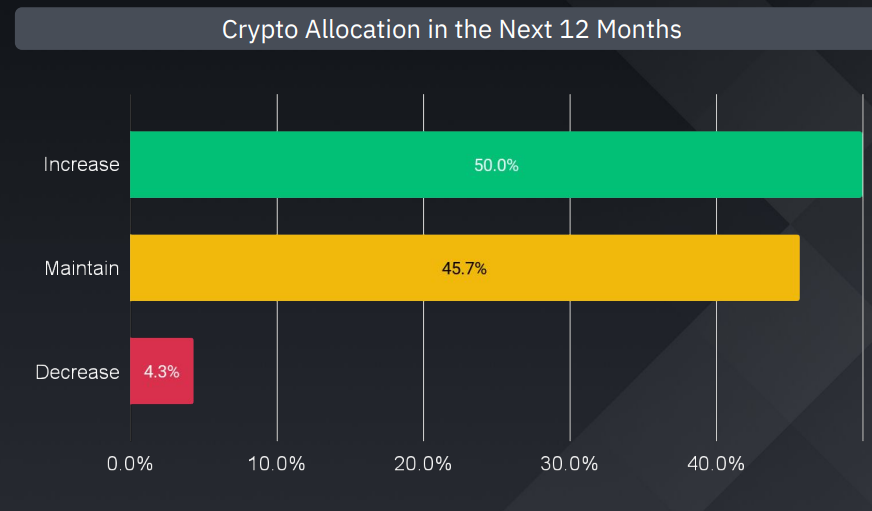

Interestingly, half of the institutional investors in crypto assets plan to increase their allocation over the next 12 months, expressing a positive outlook on the market. However, 4.3% of these investors plan to reduce their crypto allocation in the coming months.

2) Outlook

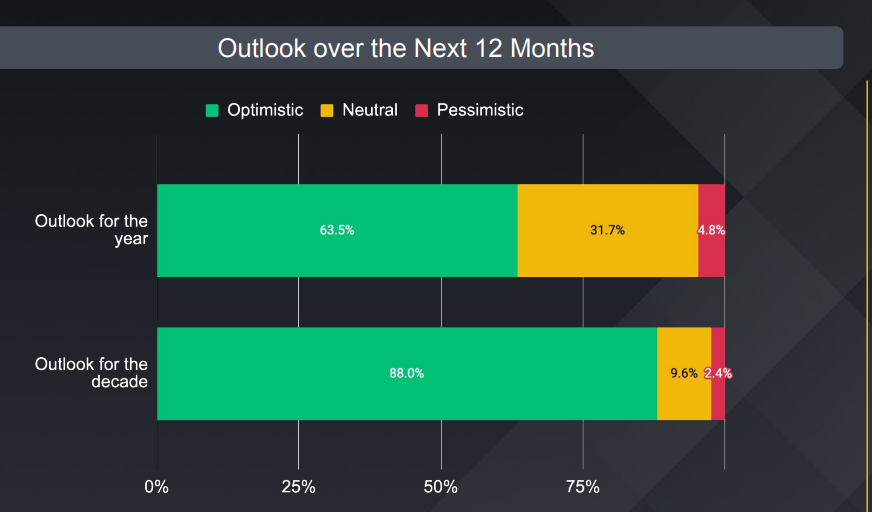

The crypto market has been through different difficulties over the last 12 months. Institutional investors have different opinions about the future of crypto. Of those surveyed, 63.5% said they are optimistic about the future of cryptocurrency in the coming 12 months.

Source: Binance Research

Interestingly, these investors expressed strong optimism for the coming decade. When asked about their outlook for the crypto industry in the coming decade, the level of investor confidence climbed to an astonishing 88.0%.

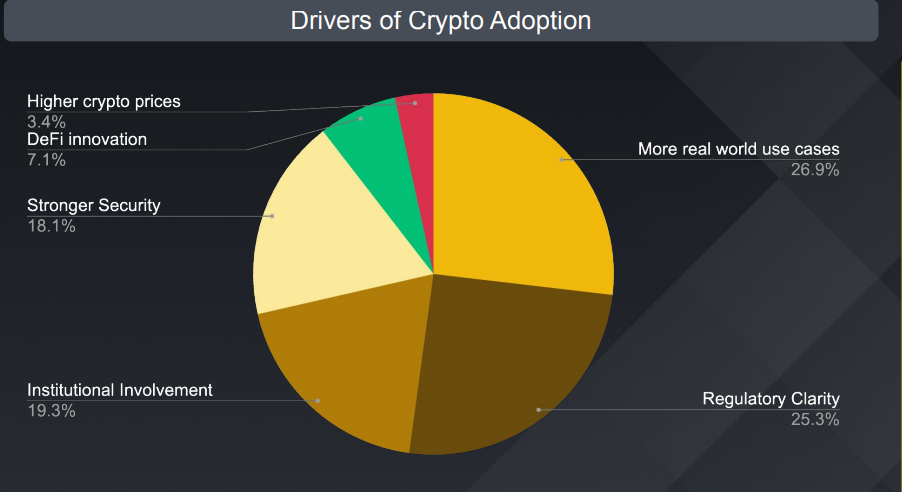

Institutional investors also expressed optimism about crypto adoption. However, they noted that regulatory clarity and real-world use cases would be key factors.

Source: Binance Research

3) Areas of Interest and Concern

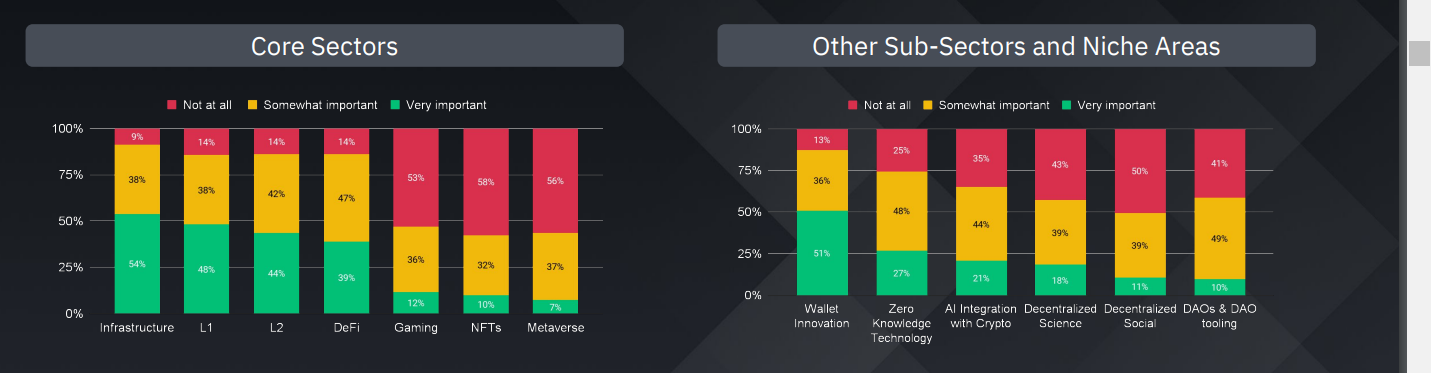

Binance Research reported that institutional investors identified Infrastructure as the most significant sector. An impressive 53.9% of the respondents considered infrastructure their priority, followed closely by Layer 1 and Layer 2 sectors at 48.1% and 43.8%, respectively.

Source: Binance Research

Also, 51.0% of investors were thrilled by the recent innovation in crypto wallets. These investors identified MPC, self-custody, and advanced UI/UX as key areas to focus on. In addition, about 26.9% were impressed by ZK technology. And 20.7% considered the integration of AI and Crypto as a key area of interest.

On the other hand, the respondents identified DeFi as their most popular category. The research listed spot DEXes as the most used dapp over the past three months. This was followed by perps DEXes, lending, and LSD. However, investors considered the NFT, gaming, and metaverse sectors as areas of low importance.

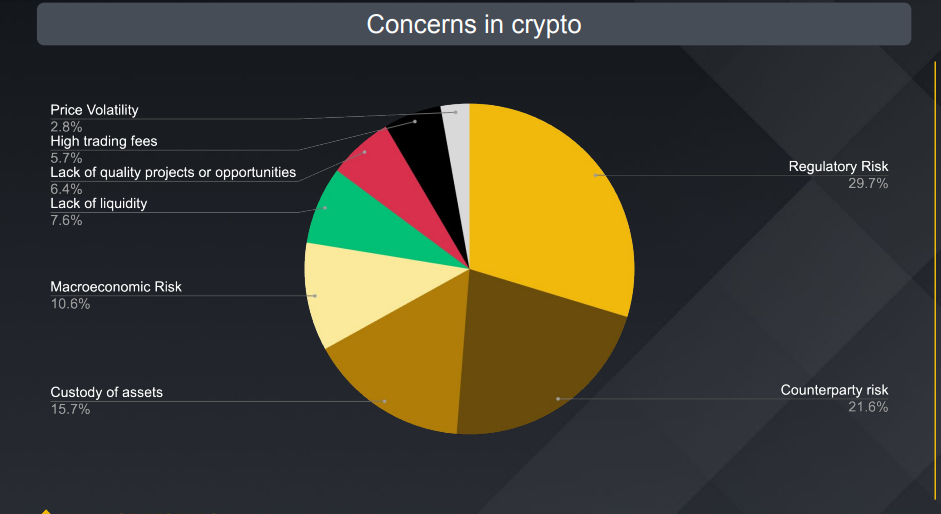

In terms of their areas of concern, 29.7% of the respondents identified regulatory risk as their core concern. Meanwhile, 21.6% listed counterparty risk, while 15.7% cited asset custody. Finally, 10.6% of the survey participants listed macroeconomic risk as their top worry for the industry.

Source: Binance Research

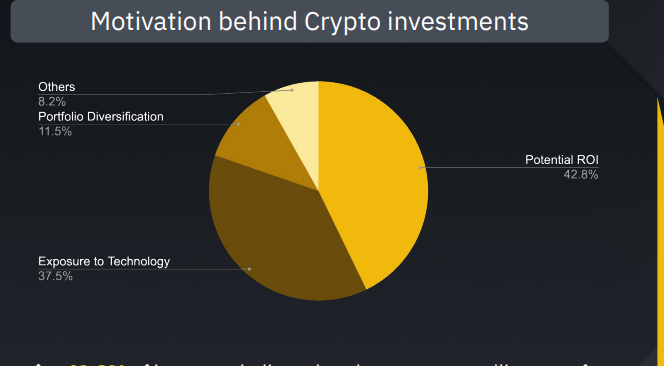

4) Motive

About 42.8% of investors cited the potential for a Return on Investment (ROI) as their main motivation for investing in cryptocurrencies, while 37.5% said they were driven by the desire to be exposed to emerging technology.

Source: Binance Research

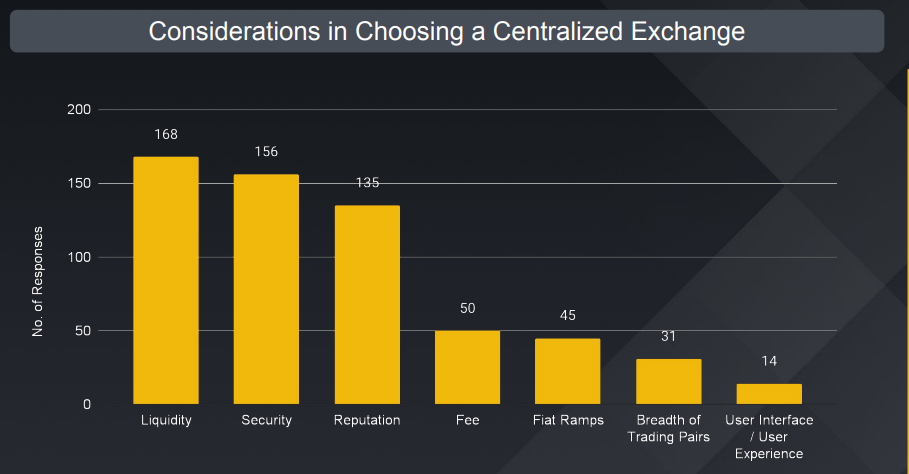

5) Evaluating Centralized Exchanges

About 90.5% of institutional investors trade on centralized exchanges. As per the report, only 20.2% of the respondents used institutional custodians to store their assets. Finally, only 14.9% of the respondents used self-custodial cold wallets.

Source: Binance Research

Investors identified liquidity as the biggest factor to consider when using a CEX. This was closely followed by security and the reputation of the platform.

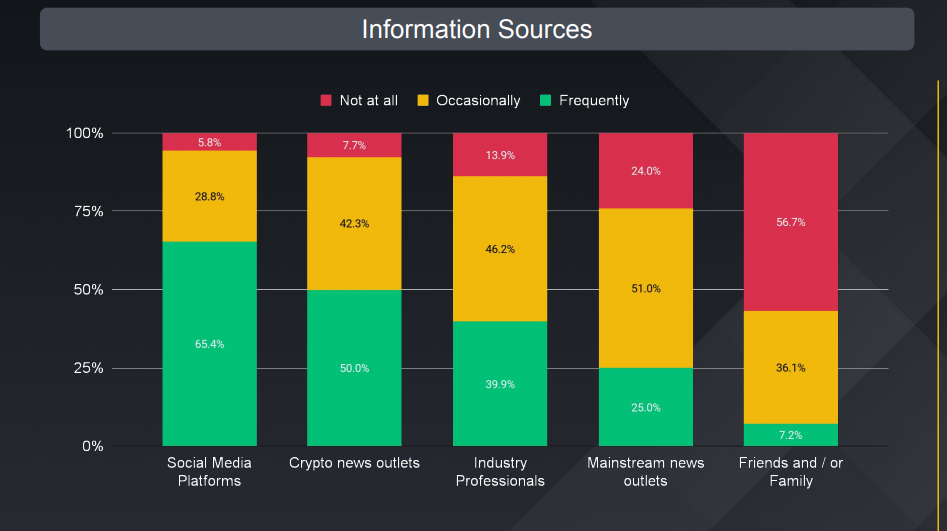

6) Sources of Information

65.4% of respondents said they visited social media sites such as Twitter, Telegram, and Discord to stay updated about the industry. Interestingly, the survey participants said they rarely used mainstream and business news sources.

Source: Binance Research

A small portion of the respondents said they relied on friends or family for information. Interestingly, about 50.0% of the respondents said they used crypto news portals such as Binance News, Coindesk, and Cointelegraph. About 39.9% got their information directly from industry specialists.

You can find the full report here.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.