In the US, the SEC wants you to believe that crypto has no future. The same as the Chinese government did before. However, recently, we saw a whole set of companies willing to launch spot Bitcoin ETFs. The SEC now has 240 days, until February 2024, to accept or reject this.

So, this is one way how banks prepare for the coming bull run. Let’s dive straight into this and see what banks are up to.

Earlier This Year, Before the ETFs

1) Blackrock

BlackRock is one of the biggest financial institutions in the world. In 2022, they already partnered with Coinbase. Thus, providing access for their institutional clients to Bitcoin. That was already an interesting move. Institutional interest in crypto is growing. What better way for them to enter than through the biggest financial player in the world?

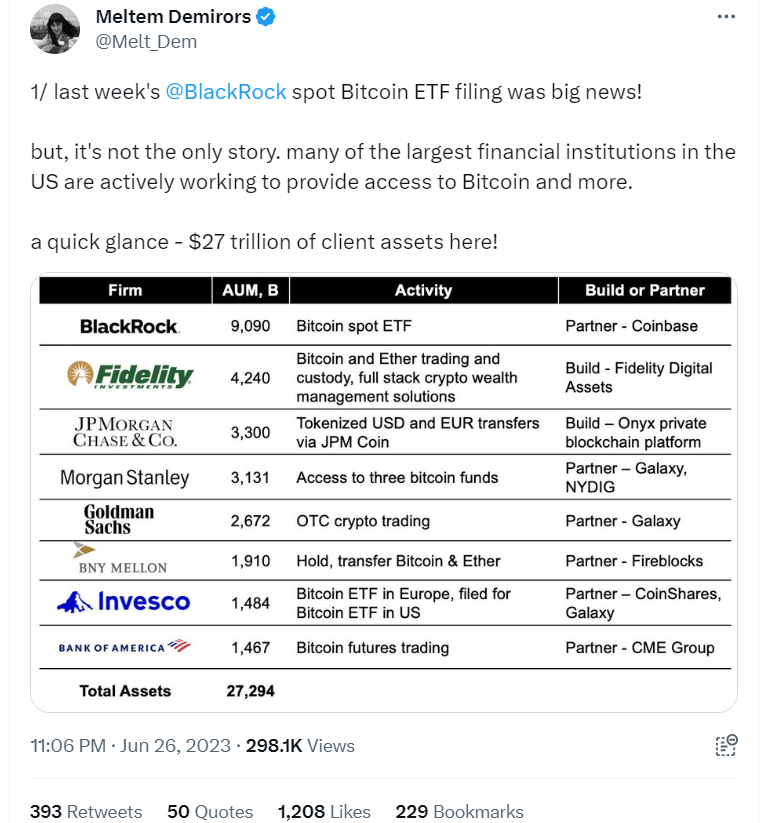

Source: Twitter

BlackRock is, worldwide, the largest asset manager. For a company of this size, it was a thrilling move. Both institutional money and the crypto space can benefit from this. So, now, in early 2023, BlackRock took another step. They dove into two new areas:

- Permissioned blockchains — These blockchains are inaccessible to the public. Or, in other words, they are closed blockchains. Most likely, they also have a control layer. Banks keep playing it safe.

- Tokenization of stocks and bonds. — Tokenization of Real-World Assets (RWA) is one of the up-and-coming narratives in crypto. For example, Realio (RIO), GoldFinch (GFI), or Centrifuge (CFG).

2) Fidelity

Fidelity Investments is another big player in the circles of financial institutions. They have been around since 2014. In March 2023, they opened their Fidelity Crypto department to retail users. This is a big move.

They offer, for example, low trading fees. On the other hand, they only offer two coins to start with. These are Bitcoin and Ethereum. However, their users can trade these two assets on the same platform as their stocks. This is a perfect combination of new digital assets, mingling with TradFi.

Fidelity already launched its Fidelity Advantage Bitcoin ETF or FBTG back in 2021. This fund already netted $50 million worth of assets earlier in March this year. In April 2022, they added another four ETF options. For instance, a Metaverse (FMET) and a Digital Payment (FDIG) offering.

An ETF is an Exchange-Traded Fund. So, investors can have exposure to, for example, Bitcoin, without actually owning Bitcoin. An ETF follows the price development of the main asset. In this case, Bitcoin. So, you don’t actually buy or hold Bitcoin. Instead, you buy units or shares of the ETF through a broker. The ETF holds the real Bitcoin but on behalf of the investors.

On one side we saw the collapse of a couple of smaller US banks. For example, Silvergate Capital or Signature Bank. As a result, we see the bigger financial fish grow even bigger. Plus, they started researching the crypto space. They want to get ready for the next bull run.

Source: Twitter

More Bitcoin ETFs

Bitcoin saw, during recent weeks, a price dip. The legal actions by the SEC had an impact. For example, Binance and Coinbase both got sued by the SEC in the US. These are currently the two biggest crypto exchanges in the world. Allegedly, they violated securities laws. As a result, the market dipped to $25,000.

However, during the last week or two, we saw some price hikes. This resulted in, Bitcoin finding itself back above $30,000. It appears that we have left the bottom of the bear market. A bull run may be in the making, although it may take a few more months before it kicks off.

The market got a real boost when BlackRock applied for a spot Bitcoin ETF. As already mentioned, they are the world’s largest asset managers. Interesting is that BlackRock has a success rate with the SEC for ETFs of 575 to 1. They only tend to apply for an ETF if they are convinced that they can get it. Within days, we saw a whole range of spot Bitcoin ETF applications. For instance, these companies applied:

- WisdomTree

- Invesco

- VanEck

- Fidelity

- Bitwise,

To date, the SEC has denied all spot Bitcoin ETF applications. Their argument is that it’s possible to manipulate the underlying market. On the other hand, since October 2021, they did allow future-based Bitcoin ETFs.

Furthermore, Deutsche Bank applied for a crypto custody license in Germany. This is another, well-known, worldwide financial player. So, taking all this into account, we saw Bitcoin back to $31,000 on 24th June.

Source: Twitter

Conclusion

The crypto winter is about to end. For example, Bitcoin is back over $30,000. We also see interest from banks and institutional money in the crypto market. During recent weeks, we saw at least six top financial institutions file for a spot in Bitcoin ETF. None other than BlackRock led this surge, the biggest asset manager in the world. These banks are setting themselves up for a pole position during the coming bull run.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.