There is a new saying that “data is the new gold.” And your ability to analyze data could be the difference between profit and loss for you, especially in a market like ours. So, top traders have some secrets that keep them at the top of their game. They rely on several analytical tools to make their decisions.

We already shared a couple of these tools in the first part of this article. So, we’ll add a few more to the list. Analytical tools can help you maximize your crypto rewards. They’ll reduce your chances of losses, as the data provided can help you spot risks.

Benefits of Using Analytical Tools to Boost Crypto Rewards

Furthermore, these tools can give you an edge in your decision-making by helping you spot opportunities and make informed decisions. The projects providing these tools know that information is a huge part of your success. Using these tools gives you a competitive advantage over others. These tools will come in handy for:

- Newbies in the crypto market: They seek accurate information on their preferred projects.

- An experienced investor: They are looking for detailed insight into projects in specific sectors to shape their decisions.

- Traders: They are looking for accurate data to spot and close good trades.

These tools will also lead to increased transparency in the crypto industry. Users already have insight into the health and statistics of a project. So no one can “fake it to make it” anymore. Now let’s get to our list.

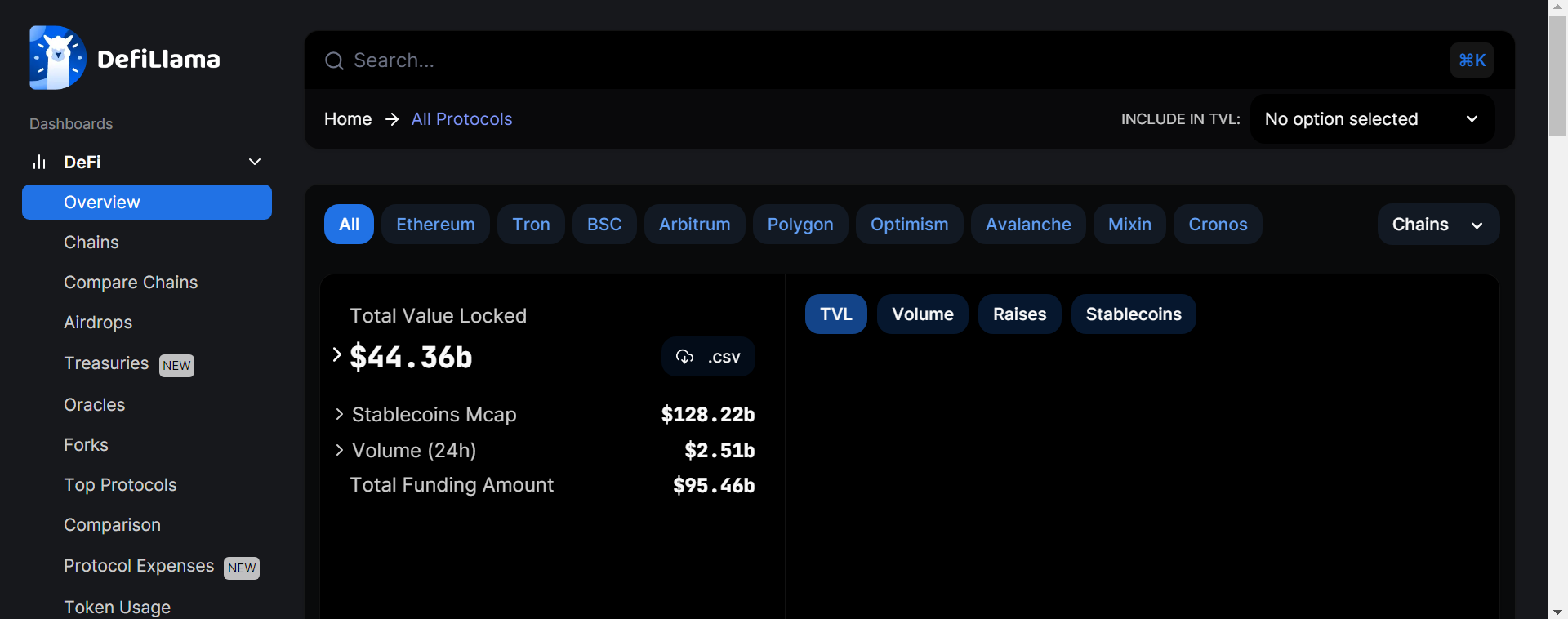

1) DeFiLlama

Our list wouldn’t be complete without adding DeFiLlama. This project is arguably the biggest source for people seeking data on a project’s Total Value locked (TVL). TVL measures the total value of digital assets staked or locked in a decentralized finance (DeFi) platform. A higher TVL for a project tends to portray it as trustworthy.

DeFillama compiles TVL data from more than 100 different chains and presents it in simple visualizations. So, protocols with more market awareness tend to have a higher TVL.

DeFiLlama tracks more than 2,000 protocols and more than 100 different blockchains. You can browse blockchains, protocols, airdrops, and much more with DefiLlama’s user-friendly interface, which houses all TVL information.

Source: Twitter

It provides aggregated data for various market indicators, enabling you to monitor a project’s progress. You can also use DeFillama’s list of trading pairs to quickly locate a high-performing liquidity pool. Furthermore, you can leverage DeFi Llama’s dashboard to track DeFi activities such as borrowing, staking liquidity, and lending.

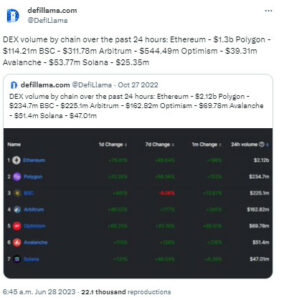

2) Token Terminal

Token Terminal is another vital analytics tool. This platform helps investors compare the financial metrics of different crypto projects, such as their revenue and profits. It compares the financial conditions of different protocols. Furthermore, it also allows you to see the metrics of a specific crypto sector, such as DeFi, lending, exchanges, etc.

Some of the metrics that Token Terminal tracks include:

- FDV figures.

- Circulating supply.

- Trading volumes.

- Token holders.

- TVLs.

- Fees.

- Token incentives.

- P/S and P/F ratios.

- Daily active users.

Source: Twitter

Token Terminal comes in handy if you want to do a fundamental analysis of a project. Using a tool like this can help you detect scams by checking their financials.

3) Stable.Fish

This is a lesser-known but valuable tool. Stable.Fish is an APY and ROI aggregator. It tracks the real APY of stablecoins in DeFi. The project monitors historical and actual returns. Stable.Fish tracks over 100 protocols to provide accurate data based on actual returns.

Source: Twitter

4) Dune Analytics

Dune is one of the research powerhouses in the blockchain. It provides you with a wide amount of well-presented data for you to discover, explore, or even share your knowledge with the market. Dune has data covering L1s, L2s, and even NFT projects.

The technical analysis charts on this platform are easy to grasp. So, even if you are new to crypto, you’ll find it easy to use Dune. These charts can also help you track short-term and long-term trends.

Source: Twitter

The best part is that anyone can create their own queries, and compile data inside dashboards.

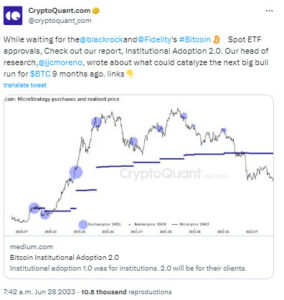

5) CryptoQuant

CryptoQuant provides visuals about almost all parts of the blockchain market. It helps you with data on the inflows of different exchanges. So, this information lets you know what the market sentiment is like at any given time. You’ll know if people are buying or selling.

Source: Twitter

You can improve your analysis and future decisions by using the crypto tools on this list, depending on the data you require. These tools are important for understanding what’s going on in the market at any given time.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.