As the crypto market steadily regains its former glory, the possibilities for investment and substantial profits in 2023 are endless. With abundant digital assets to choose from, it’s easy to feel overwhelmed when deciding which cryptos to consider.

Successfully navigating the dynamic world of Web3 requires a keen eye for undervalued projects with a unique value proposition, a thriving community, and the potential for extraordinary growth. So, imagine you have $1000 to spare—you might ask yourself, what coins to buy? Don’t worry, we got your back! We have compiled a list of tokens we would consider holding in with a spare $1000.

Note: The following suggestions do not constitute financial advice, and we assume no responsibility for any investment decisions based on this information.

Now, let’s dive into our selection of potentially lucrative crypto projects.

1. Arbitrum ($ARB) – $250

Arbitrum emerges as a Layer 2 scaling solution designed to enhance the speed, efficiency, and overall performance of Ethereum. Its core objective revolves around consolidating tens of thousands of transactions into a single batch, effectively reducing congestion on Ethereum. At the heart of the Arbitrum Blockchain lies its native coin, $ARB, which serves purposes of governance and staking.

A notable event in Arbitrum’s journey was its iconic airdrop, which rewarded early users with tokens. Approximately 12.75% of the total token supply, equivalent to 1.162 billion tokens, was allocated for this airdrop.

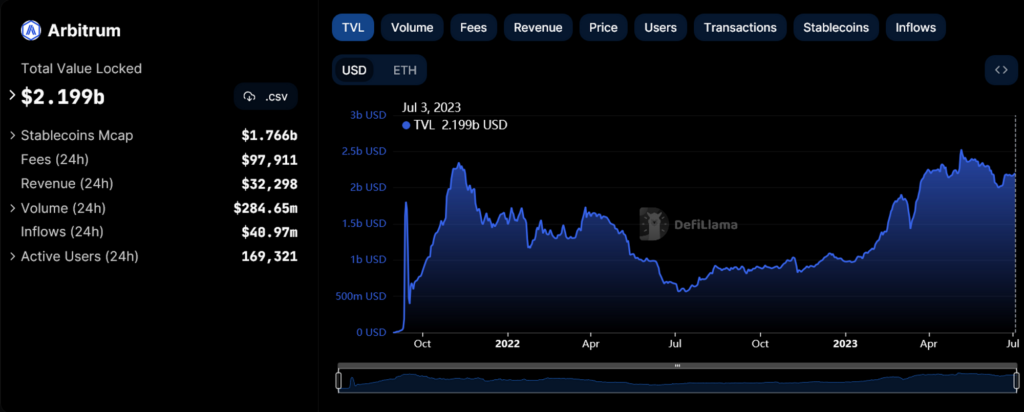

Source: DeFiLlama

Arbitrum has already achieved an impressive feat by securing the No. 4 position regarding total value locked (TVL), a crucial metric for gauging blockchain activity. Currently, the chain boasts a locked value of approximately $2.199 billion, surpassing its Layer 2 counterparts. These numbers serve as concrete evidence of Arbitrum’s success, dispelling any claims of overhype.

- Tokenomics

- Price: $1.10.

- Market Cap: $1,39 billion.

- Circulating Supply: 1,275,000,000.

- Total Supply: 10,000,000,000.

- Max Supply: 10,000,000,000.

Where to Buy $ARB?

You can buy $ARB on almost all CEXs. For example:

And also on the following DEXs:

Welcome @rubicondefi to the ecosystem 💙🧡

Check out this thread for more details👇🙌 https://t.co/JpPYiWjq6j

— Arbitrum (💙,🧡) (@arbitrum) July 6, 2023

Considering its focus on addressing Ethereum’s scalability challenges, Arbitrum possesses significant investment potential. As the Ethereum ecosystem expands, the demand for scalable solutions like Arbitrum will inevitably surge.

If we were to allocate a $1000 portfolio, we would consider investing approximately 25% of the funds in $ARB. However, holding $ARB should be based on individual investment goals, risk tolerance, and overall portfolio diversification strategy.

2. Aleph Zero ($AZERO) – $200

Aleph Zero has established itself as an enterprise-oriented and privacy-focused layer-1 public blockchain and is renowned for its outstanding performance. By addressing the speed, scalability, validation time, and security concerns of existing blockchains, Aleph Zero aims to revolutionize the blockchain landscape.

Notably, it employs a unique Directed Acyclic Graph (DAG) consensus protocol, which has undergone rigorous peer-reviewed evaluation. You can read our beginner’s guide to learn more about the project.

Last week we welcomed the official release of @Ledger app built by @_zondax_ and could see @AZERO.ID flourish with over 1,000 testnet domains already minted.

We’re looking forward to releasing the Mainnet 11.1 and are doing the final touches before the public AMM DEX can be… pic.twitter.com/Hck2MYdHUl

— Aleph Zero (@Aleph__Zero) July 4, 2023

The native coin of the Aleph Zero blockchain is $AZERO. During its inception, $AZERO had a total supply of 300 million coins, with an annual inflation rate of 30 million.

Aleph Zero presents a promising alternative to current layer-1 blockchains, posing a formidable challenge. Its exceptional transaction throughput position it as an ideal enterprise-grade blockchain supporting private transactions and smart contracts.

- Tokenomics

- Price: $0.8488

- Market Cap: $197.9 million.

- Circulating Supply: 233,634,267.

- Total Supply: 335,737,651.

- Max Supply: Infinite

Where to Buy $AZERO?

The following exchanges currently list $AZERO:

https://t.co/O6JR8D0pPR testnet milestone, 👇https://t.co/7xMNRjhysi

— Aleph Zero (@Aleph__Zero) July 4, 2023

Given its unique blockchain tech tailored for enterprise applications, along with upcoming updates and improvements, Aleph Zero is poised to gain prominence. Consequently, investing in $AZERO may prove to be a lucrative long-term investment.

If we were to allocate a $1000 portfolio, we would consider investing approximately 20% of the funds in $AZERO. However, as we said before- investing in $AZERO should be based on individual investment goals, risk tolerance, and overall portfolio diversification strategy.

3. Morpheus Network ($MNW) – $200

Morpheus Network emerges as a supply chain Software-as-a-Service (SaaS) middleware platform, seamlessly integrating legacy and emerging technologies. Built on blockchain tech, Morpheus aims to streamline logistics operations. By bringing together experts in global trade, information security, blockchain, and artificial intelligence, Morpheus.Network endeavors to address the inefficiencies identified by the World Economic Forum within the $15 trillion industry.

Unlock the full potential of your supply chain with Arbitrum! Explore how this Ethereum Layer 2 solution is enhancing traceability, automating processes, and preventing counterfeiting.

Dive into the details: https://t.co/nmiSWHMREQ#SupplyChain #Arbitrum #Blockchain #ARB #MNW pic.twitter.com/bj4mxvizZj

— Morpheus.Network (@MNWSupplyChain) July 6, 2023

The fuel powering Morpheus Network’s automation platform is $MNW token. $MNW enables the utilization of Ethereum-based Smart Contracts as pre-defined, automated work contracts, shipping and customs documents, and automated international payments. $MNW tokens serve as a value-based utility, functioning as a form of currency and facilitating transaction fee payments. Essentially, $MNW tokens drive the vital components necessary to optimize global trade.

- Tokenomics

- Price: $1.03.

- Market Cap: $38.4 million.

- Circulating Supply: 37,5 million.

- Total Supply: 47,897,218.

- Max Supply: 47,897,218

Where to Buy $MNW?

Users can buy $MNW on many popular CEXS like:

🚀 Embrace digital transformation in your supply chain! Find out how Polygon’s integration with #MNW streamlines operations, promotes trust, and optimizes compliance document tracing.

Read more: https://t.co/OD1RCAoKXp#DigitalTransformation #SupplyChain #Blockchain #Polygon pic.twitter.com/DgfE7gf0u2

— Morpheus.Network (@MNWSupplyChain) June 30, 2023

Morpheus Network maintains a strong focus on assisting companies and government organizations to eliminate inefficiencies and overcome barriers to optimize and automate their supply chain operations. With its intriguing and vital use case, investing in $MNW holds the potential for long-term profitability. Well, if it can survive the harsh regulatory landscape.

Nevertheless, we would consider investing approximately 20% of the $1000 portfolio in $MNW.

4. Injective ($INJ) – $250

The Injective Protocol introduces a fully decentralized layer-2 exchange platform for trading derivatives. Its features encompass a decentralized order book and a trade execution coordinator, ensuring a transparent and front-running-free trading experience.

Moreover, utilizing an EVM-compatible environment, the Injective Protocol harnesses layer-2 blockchain tech to compile transfers on the Injective Chain. This EVM is constructed atop the Cosmos-SDK, serving as a side chain enabling scalable Ethereum Network implementation.

📚Injective ecosystem news is live!

– @MitoFinance early access launch

– @HelixApp_ milestone achieved

– $INJ burns

& MORE!Enjoy Ninjas! 🥷🍿 https://t.co/PzrKoEKySF pic.twitter.com/JFOjWOmi6w

— Cosmic Validator ⚛️ (@CosmicValidator) July 6, 2023

At the core of the Injective Protocol lies its main utility token, $INJ. The token serves various purposes, including protocol governance, dApp value capture, Proof-of-Stake (PoS) security, developer incentives, and staking.

Notably, the $INJ token follows a highly deflationary model. Every week, the project utilizing a buyback and burn mechanism auctions off 60% of the fees generated by dApps on Injective. This strategy significantly reduces the supply of $INJ over time.

- Tokenomics

- Price: $7.93.

- Market Cap: $663.9 million.

- Circulating Supply: 80,005,555.

- Total Supply: 100,000,000.

- Max Supply: 100,000,000

Where to Buy $INJ?

You can buy $INJ on almost all CEXs:

And on DEXs like:

The combination of features offered by the Injective Protocol caters to individual and institutional investors alike. Besides, the availability of trading derivatives positions the network for adoption by traditional trading firms on a large scale.

New staking management tools and updates have been released on the Injective Hub!

Now you can get an easy overview of your staked $INJ, claim all rewards in one click and much more ☀️

Head on over to the Injective Hub to try it out! pic.twitter.com/WXZi2URlS6

— Injective 🥷 (@Injective_) July 4, 2023

Furthermore, the current iteration of the Injective Protocol holds immense potential to revolutionize decentralized derivatives trading. Unlike existing DEXs, Injective Protocol strives to eliminate front-running while enhancing liquidity and order execution. As a result, we can anticipate increased adoption in the future.

We would consider investing approximately 25% of the $1000 portfolio in $INJ. After all, as a relatively established cryptocurrency, having some $INJ can be a fail-safe for the portfolio.

5. Goldfinch ($GFI) – 100$

Goldfinch is a decentralized lending protocol operating on Ethereum, catering specifically to borrowers in emerging markets. The protocol offers uncollateralized lending, connecting borrowers with a pool of investors who provide capital in exchange for a portion of the borrower’s future cash flows. Presenting itself as “Real yields, from real companies,” Goldfinch Finance is a project to keep an eye on.

Real world assets and credit are now being digitized and integrated into DeFi protocols, transforming traditional finance as we know it

The power of pooled funds is creating unprecedented array of borrowing opportunities.@maplefinance @goldfinch_fi https://t.co/umB8HvYdfJ

— Adam Blumberg (@Interaxis8) June 8, 2023

One key factor differentiating Goldfinch is its unique credit model, “trust through consensus.” This credit scoring system evaluates the creditworthiness of borrowers based on their historical behavior, adding a layer of trust to the lending process.

While the platform requires collateral as a safety measure, Goldfinch sets itself apart from other DeFi lending protocols by allowing complete collateralization of loans using off-chain assets and income. This inclusive approach has the potential to impact borrowers worldwide significantly and is a crucial element that could make DeFi lending accessible to a broader audience.

Moreover, a community DAO oversees the governance of the Goldfinch protocol. This DAO makes important decisions, including contract upgrades, protocol configurations, selection of Unique Entity Check providers, rewards and distribution of the native governance token, and emergency protocol pausing.

$GFI, the native token of Goldfinch, serves as the native governance token. So, $GFI holders can vote on significant governance matters, such as protocol upgrades, parameter adjustments, and the selection of Unique Entity Check providers. Additionally, you can stake $GFI to earn rewards through the protocol’s staking mechanisms.

Currently, there is no inflationary issuance, although the company has expressed the possibility of introducing marginal inflation after approximately three years after the protocol’s launch.

Where to Buy $GFI?

You can buy $GFI from leading exchanges like:

How are #blockchain lending solutions solving many African entrepreneurs lack of access to funding? 🤔

Find out in our latest publication titled @goldfinch_fi blockchain lending – Closing the entrepreneurial finance gap 👇🏾https://t.co/QiC1oi7iPU

— Bankless Africa (@Bankless_Africa) May 29, 2023

But be careful not to get confused with GameFi Protocol (GFI) and Gravity Finance (GFI).

Goldfinch stands out as an early entrant in the enterprise sector, positioning itself well to cater to a specific market need. By providing businesses with increased access to funding, the protocol enables them to expand their ideas and concepts. With its unique focus on serving the business sector and its innovative lending approach, Goldfinch aims to simplify and democratize DeFi lending. The protocol holds promising prospects for contributing to the growth of the DeFi ecosystem, provided all its ecosystem participants adhere to existing regulations.

We would consider investing approximately 10% of the $1000 portfolio in $GFI. As a relatively new cryptocurrency, investing significant funds in $GFI carries some risk, especially considering the harsh regulatory landscape. Nevertheless, its interesting use case and the tokenomics make it a low-cap gem.

Conclusion

While this article has highlighted a few promising tokens, it is essential to remember that the crypto market is highly volatile and speculative. As such, you should make any investment decision carefully considering individual risk tolerance and long-term investment goals.

Arbitrum, Aleph Zero, Morpheus Network, Injective, and Goldfinch each present compelling use cases and unique features that set them apart in the competitive landscape of cryptocurrencies. From scalability solutions to enterprise-oriented lending platforms, these projects showcase the innovation and potential that the blockchain industry continues to offer.

Nonetheless, DYOR before investing is crucial. While the prospect of significant profits may be enticing, it is equally vital to be aware of the inherent risks associated with the crypto market. Ultimately, choosing projects to invest in with $1000 should align with your financial goals and risk appetite.

Disclaimer: The information provided in this article is for informational purposes only, and readers should not consider it as financial advice.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.