Brad Mills is a renowned investor, entrepreneur, and he hosts the Magic Internet Money podcast. Since 2011 he follows Bitcoin. He is also a Bitcoin Value Maximalist. Recently, he stated that Bitcoin is the obvious long-term institutional trade option. Everything competes with BTC, including ETH and all altcoins.

Furthermore, according to Brad, it’s the end of the crypto bubble. Ethereum faces many threats on its smart contract side. He sees two markets, one for Bitcoin and one for ETH and altcoins. At Altcoin Buzz, we argue against this idea. As you can guess, we love our altcoins. Let’s dive in and see what Brad has to say. And why we disagree…..

1/ The obvious long term institutional trade IMO is #Bitcoin to $1 million

The market will realize that the monetary properties of bitcoin are far superior to the monetary properties of other cryptos like ETH & SOLD & it should (aside from in bubbles) allocate to BTC. pic.twitter.com/6SayO9fStT

— Brad Mills 🔑 (@bradmillscan) May 22, 2022

Bitcoin Going Solo

Mills argues that the monetary properties of bitcoin are far superior compared to Ethereum. He also throws in all other altcoins. According to him, the market will realize this eventually. He sees Bitcoin completely decoupling from all other cryptocurrencies.

And if you are interested in the other side of this argument that is more pro-Bitcoin, we covered that too and you can find that article right here. We think you’ll get a lot of out of reading both in their entirety.

Bitcoin Dominance

Now, if we look at the Bitcoin dominance chart, this tells us a different story. In February 2017, BTC had a 95% dominance. However, this crashed heavily, and in January 2018, it was a mere 37.64%. It went up again to around 70% between August 2019 and December 2020. It crashed back to 40% in December 2021. There appears to be a slight recovery currently, it’s up to almost 47%. Still, that doesn’t speak in favor of Brad’s prediction.

Source: Tradingview

Institutional Investments

On the institutional investment front, BTC also doesn’t lead over other cryptocurrencies. MicroStrategy holds over 129,218 Bitcoins as of April 4, according to Bloomberg. BlackRock is the world’s largest asset manager. They have an indirect stake in this bitcoin. They hold a 14.56% stake in MicroStrategy, according to Forbes.

On the other hand, Grayscale’s Bitcoin Trust has a value of over $20 billion. They added altcoins like Litecoin, BAT, or Chainlink to their funds.

Currently, according to DeFi Llama, there’s also $67.39 billion locked in DeFi TVL. That is by no means from retail money only.

Furthermore, VCs like to bet on high-risk, high-return investments. Short-term volatility doesn’t faze them. They look at the fundamentals, they need to be strong. As a result, they raised almost $4 billion in a variety of crypto projects.

So, no Brad, currently, nothing indicates that BTC is about to decouple. Furthermore, institutions don’t put their eggs in just one basket. In contrast, they diversify, and in crypto this means only one thing: altcoins.

Ethereum Problems

The next thing Brad brings up is all kinds of issues with Ethereum. Now, sure, we all know that Ethereum does have its share of issues. Shortly, we will dissect his view on this.

In the meantime, he brings in the $1,200 price per kg of Aluminum in 1800. This was eventually corrected to $1. This of course caused financial ruin for spectators and investors. Those who valued aluminum over gold suffered big time. He now argues that Aluminum was the most used metal during WW2, and still has great value up to today.

He states that Ethereum and all L2s can power the entire financial system. However, he thinks it should still trade below $500 per ETH. Does it come as a surprise that he now compares ETH with Aluminum? No, of course not, every Bitcoin maximalist will do that.

Having said that, he does give Ethereum some credit. So, good on him. He states the following. “Ethereum’s leaders have built massive network effects regarding the blockchain’s usage. This includes its developer mind share and liquidity that rivals Bitcoin’s.“

The Crypto Bubble Is Over

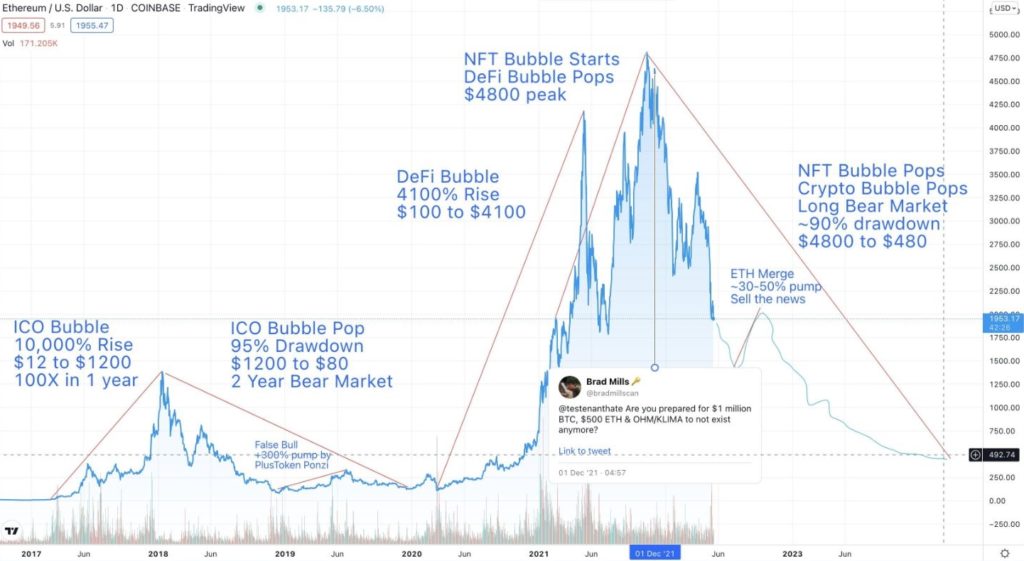

He continues to argue that the crypto bubble is over. He says the following. “ETH followed XRP, LTC & other alts that did not reclaim the previous cycle ATH in BTC terms.”

He compares everything, except Bitcoin, to a bubble. Besides, that it’s rather condescending, it’s also not true.

Source: Twitter

- ICO—In one-year 100x or a 10,000% rise. In the following two years, they drop 95% to $80. Rather than being a bubble, they evolve into something else. For example, IEOs or IDOs, and plenty more distribution options for token launches.

- DeFi—He thinks the DeFi bubble is popping. DeFi is only a few years old and still nascent. It seems that DeFi has all the potential to grow big. As in, massive. The new developments in DeFi are stunning and are far from over.

- NFTs—This bubble also popped, according to Mills. Well, most of the future use cases for NFTs are still unknown to us. The Nasdaq argues that these uses cases will make NFTs a large part of our future lives. Beyond gaming and digital art.

- Crypto—This bubble pops and Ethereum will see a price drop from $4,800 to $480. Well, it’s like looking into a crystal ball. A bear market is when assets drop in value. Some altcoins will not make it and we fully agree with that. However, once the bull run starts again, prices will also go north again. Capital.com predicts ETH to hit just short of $10,000 in 2025. Plenty of price predictions for 2030 see ETH hit anywhere between $25,000 to even $75,000.

Ethereum Problems According to Brad Mills

Time to look at some Ethereum problems that Brad brings up.

-

Policy risk of regulators stepping in.

-

Macro risk of severe recession.

The same accounts for Bitcoin, on both accounts. Peculiar to bring this up.

-

Technical risk for POS / ETH 2 merge.

Sure, that is a real risk. On the other hand, if the Merge works out fine, there are plenty of reasons why ETH will pump. See our article here.

-

Community risk of miner revolt causing issues. (POW protest, dumping ETH in retaliation like ETH foundation did to ETC & Roger Ver/Bitmain)

Forbes doesn’t agree with this view. It appears that the miners are accepting the change from PoW to PoS. Furthermore, a 51% attack is more theoretical than a practical risk.

-

Market cycle risk (ETH repeats last cycle, down 90%)

This can also turn around in a new ATH. And please, remind me where the BTC price is at the moment? This is a weak argument, not specifically aimed at ETH, it can also happen to BTC.

-

Keyman risk, Vitalik acting strangely, (wanting to move on from Eth?) + Joe Lubin looks tired.

This is no more than FUD and based on nothing but thin air. Sad to come up with non-issues like this as an argument. Where does that info come from that Vitalik wants to move on? And by the way, I also haven’t heard from Satoshi lately. Bitcoin did well without him, there is no reason why Ethereum should not do well IF Vitalik decides to call it a day.

-

Competitor Risk

This is a real risk. Instead of competing with BTC, as Brad thinks ETH should do, they compete with other chains. Ethereum has lots of competition from so-called Ethereum killers. However, none of them has managed to kill Ethereum. Collectively, they have taken a big chunk of market share away from Ethereum. L1 and L2 chains like Solana, Avalanche, or Cardano. Check our latest article on Ethereum.

Conclusion

Ethereum is still going strong. That’s despite what a Bitcoin maximalist like Brad Mills says. In his defense, he does give Ethereum a little credit. However, he doesn’t seem to look further than the length of his nose if it boils down to Bitcoin. Some of his arguments are non-arguments, and you would expect a stronger case, to make your point.

If Bitcoin hits a $1 million price, it means that BTC does 33x. If Ethereum hits $50,000, it means ETH did 28X. Ethereum, doing 33x, puts it at $60,000. Not unlikely to happen in the next 8 years. This does not indicate the market split as predicted by Brad. Not in a long shot. The bottom line is, both BTC and ETH holders will make profits if they buy now. And they lived together happily ever after.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.