There are very few web3 projects that, in 365 days, grew by 1962%. Don’t forget that we were in the worst bear market in our short history.

This cross-chain project has important investors like Crypto.com Capital, Spartan, and Signum Capital. Also, it has 6 different audit reports. Let’s discover more about it.

What is Pendle?

Pendle is a permissionless yield-trading project where users can execute various yield-management strategies. Simply put, this platform gives users the next level of yield control. It provides various options to exit, hedge, or even long their yield. More opportunities to generate extra money.

Attention🚨! @binance is launching a new gem on their Launchpool – @pendle_fi 🚀

This is not just exciting for DeFi enthusiasts, but bullish for the entire crypto industry! Want to know how to PROFIT?

Let’s dive in! 🧵👇 pic.twitter.com/C34hcqEF23

— Finish 🏁 (@0xFinish) July 3, 2023

This porject has the following features:

-

- Yield Tokenization.

- Pendle AMM.

- vePENDLE.

Pendle Tokenomics

This is how it’s tokenomics works:

- 10% of the total token supply will be allocated to providing incentives.

- The team will receive 5.7% of the token supply.

- 19.2% of the supply will be used for ecosystem development.

- The remaining token supply will circulate within the community.

Token Utility

- $PENDLE

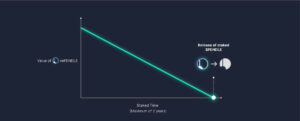

- Lock $PENDLE tokens to earn $vePENDLE tokens.

- Maximum locking period: 2 years.

- $vePENDLE

- Boosted APY in LP.

- Share in protocol revenue.

- Receive swap fees from voted pools.

- Vote on reward distribution.

Yield Tokenization on Pendle

Assets that are staked in Pendle’s liquidity pool (with a maturity date) in this project can be split into two tokens:

- Principal token (PT), which can be redeemed 1:1 with the principal asset after maturity.

- Yield token (YT), which continuously pays the yield of the principal asset.

Source: Pendle Docs

For example, if a user deposits 1 stETH to Pendle and locks it for 1 year, Pendle will split it into:

- 1 PT stETH, which can be converted into 1 stETH after 1 year.

- 1 YT stETH, which reflects the profit received for locking 1 stETH after 1 year.

The interesting thing here is that selling YT tokens right away allows you to hedge your asset’s APR at a fixed price. On the other hand, buying YT tokens is like creating a 1x long position for the APR of the asset, which can be leveraged by obtaining more YT. With the launch of new token concepts, there is a need for a marketplace in this project.

Pendle AMM

PT and YT will be traded via Pendle’s AMM, utilizing a single-token liquidity pool. It’s worth noting that the YT price is determined by the implied APY, which represents the market consensus yield rather than the underlying asset’s APY offered by the issuer.

Source: Pendle Docs

Not only for traders, but this AMM also profits LPers, who want to provide liquidity and earn APY on Pendle.

Key features on Pendle

- Minimal Impermanent Loss (IL): low price fluctuation of the pool assets – sustainable APY

- Customizable AMM: Concentrated liquidity in a range (CLMM) – optimize yield farming

- Capital Efficient: low slippage, multiple yields for LPers, and greater liquidity.

- Discounted Asset Purchases: enables users to buy PT at a discount and redeem them for underlying assets at maturity.

For multiple pools and yields, users can govern and maximize their investment with vePENDLE, the incentive channeling mechanism on Pendle. This vote-escrowed token can be received by locking PENDLE for a certain amount of time (max 2 years).

Source: Pendle Docs

Recent Milestones / Innovations

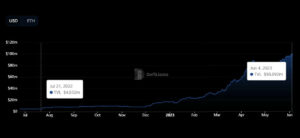

Pendle has crossed the $100 million mark in Total Value Locked (TVL). Its TVL has increased 20-fold from Jul 2022 to Jun 2023.

Source: Pendle Docs

Now the V2 upgrades Pendle into a real Trustless and Permissionless protocol with significant structural improvements in capital efficiency, LP risk, and fee accrual.

Pendle V2 is now live on Ethereum!

Come on over and pick up stETH, FRAX-USDC, and $LOOKS at a discount now: https://t.co/bCUbPzydP2 pic.twitter.com/64Y5f3nA6F

— Pendle (@pendle_fi) November 29, 2022

Liquidity Pools in Pendle

On Arbitrum, Pendle allows users to earn more rewards, by adding another reward layer – fees from Camelot. More than that, GRAIL holders can access Pendle’s facilities and manage their LP position in GRAIL/ARB, PENDLE/ETH, ARB/ETH

Pool三 makes your LP assets more productive, allowing you to earn an additional layer of rewards with the same liquidity you already have.

Sure, biting the grass works as far as lawn mowing goes, but imagine how much more effective you’d be with an electric lawnmower instead 🌾 pic.twitter.com/wJZVglwwUh

— Pendle (@pendle_fi) May 31, 2023

Since now this significant development of Pendle makes yield-boosting solutions for this protocol possible (and profitable of course). So the Pendle War begins.

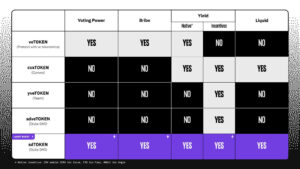

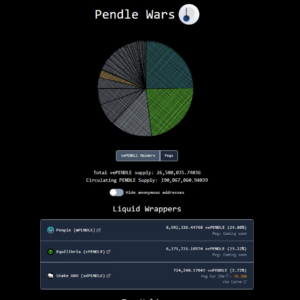

Note: The Pendle War is the fight between liquid wrappers, for every vePENDLE each could attract users (in exchange for auto-boosted yields). Currently, the war is between these 3 projects in this field:

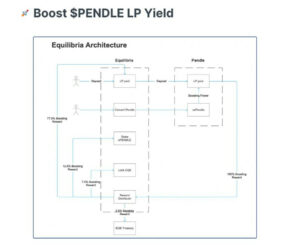

Equilibria Finance is the first yield booster on top of Pendle, it boosts Pendle LP yields by allocating Pendle revenue to those who stake PENDLE-LP tokens on Equilibria.

Source: Pendle Docs

2. Stake DAO

Stake DAO Liquid Lockers allow DeFi users to unlock lockable tokens (e.g. ANGLE, FXS, CRV) without having to compromise on yield, voting power, or liquidity.

Source: Pendle Docs

3. Penpie

Penpie has created mPENDLE, which allows users to earn a share of PENDLE rewards while enjoying increased flexibility. PENDLE holders can earn high APR% by converting their tokens into mPENDLE at a 1:1 ratio.

Our take on the war: looking at the numbers, we can say Equilibria has the full potential to be the dominating liquid wrapper on Pendle, just like what Convex is to Curve. But, we need to consider the more participants, the more competitive Pendle War becomes. And this will ultimately benefit users. Give them more options to maximize their yield.

Conclusions

Pendle is a great DeFi project on Arbitrum with effective yield management, strong partnerships, and a compelling LSDfi narrative. Users can make substantial investments with ease due to the project’s good mechanisms and reassurance.

Pendle today offers a diverse toolkit for users to manage various yield strategies. Both the fixed income and interest derivatives market within traditional finance are huge and we think that Pendle will be able to attract institutional capital as the protocol gets more battle-tested with time.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.