While we hold Mantle as a Hedge to our primary L1 Holds, we have received queries about SEI. Let’s see if SEI cuts!

SEI is an independent L1 built on Cosmos, and Mantle is an Ethereum L2 powered by Bybit, the biggest exchange for traders. If you like this kind of content, you can subscribe to Altcoin Buzz Alpha. Let’s discover a Mantle vs SEI insight.

Mantle vs SEI: Key Insights

Overall, Mantle has a better value proposition and profitability than Sei. Sei is faster and cheaper, but the Ethereum ecosystem has more volume and attention, and thus, Mantle could emerge stronger. So, SEI doesn’t cut a 1.5B marketcap. Here are some. Some fundamental comparisons

| Token | SEI | Mantle | Verdict |

|---|---|---|---|

| Marketcap | $1.5B | $1.9B | Mantle and SEI have limited room for growth |

| FDV | $6.3B | $3.7B | SEI FDV is almost 90% higher than Mantle, indicating future sell pressure. Thus, dips in Mantle can be DCA opportunities, while dips in SEI can not |

| Daily Volume | $200M | $200M | |

| Ecosystem Fund | $120M | $250M+ in stablecoins ($10M for grants per quarter) | SEI has more disposable ecosystem funds, but only a few projects are building on Sei. |

| Development | Slow | Good | Sei and Mantle have a similar number of community developers. But the pulling power of the mantle is more |

| Social Activity | High | High | |

| Reserves | 9% of total supply | 30% of total supply | Sei reserves are primarily for staking rewards mainly, while Mantle reserves serve as incentives for builders and sustainability of protocol long-term |

| Narrative | Fast blockchain for trading (Now shifting to fast general-purpose blockchain) | L2 for tokenization | Both narratives are strong, but, Mantle has the upper hand in 2024 |

| Competition | High. Injective, with a $2.8B marketcap, is the leader | Relatively low, no other L2s focus on tokenization | Mantle has more to go in the long term. |

| Major unlocks | Starts from August 2024, 5m SEI tokens per day | None | Sei will dump tokens rather aggressively after August 2024. Mantle may retain value |

SEI Fundamental Analysis

Here are some important things to consider:

- 5X since launch (In October).

- Currently at $1.5B marketcap | $6.3B FDV | $200M daily volume.

- The team valuation of SEI (At final investment rounds) is $800M.

- Ecosystem Fund has $120M.

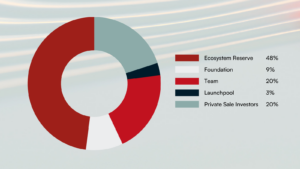

Here is SEI’s tokenomics:

Source: SEI Docs

Private sale investors hold 20%, which is extremely large.

SEI’s Value Proposition

Positioned as the fastest L1 custom-made for trading. Does not have a trading app yet.

Has an ecosystem, but mostly 3rd party dApps. For example, SEI has listed Pyth and Sushiswap as their ecosystem dApps; however, these protocols do not build on SEI.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.