BTC, the pioneering cryptocurrency, has experienced exponential growth in popularity and demand in recent years. and with the application for a Bitcoin ETF by BlackRock and other funds, Bitcoin’s demand will be at another level.

This article delves into the speculation that investment funds, such as BlackRock, may resort to creating fictitious Bitcoin. This will be to bridge the impending gap between Bitcoin’s supply and demand. Additionally, it explores potential consequences, including increased regulatory scrutiny. Also, the potential for BRICS countries to enhance Bitcoin’s role in international trade.

Bitcoin Distribution Overview

To evaluate the likelihood of investment funds creating fictitious Bitcoin, we must first consider Bitcoin’s current distribution. Bitcoin is held in different ways: non-custodial wallets, centralized and decentralized exchanges, and there are Bitcoins that are not created yet. While the exact distribution is challenging to determine, estimations can provide insight:

- Non-Custodial Wallets: Bitcoin enthusiasts and individual investors often store their Bitcoin in non-custodial wallets, which allows them to retain complete control over their funds. It is estimated that a significant portion of the current Bitcoin supply is stored in non-custodial wallets. Still, the exact amount remains uncertain due to the anonymity and decentralized nature of the cryptocurrency. In December 2022, more than 1 million non-custodial wallets have at least 0.1 BTC, so this metric is higher now.

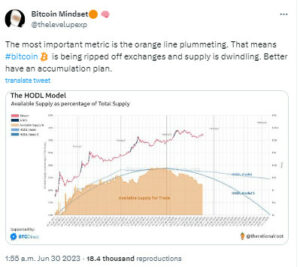

- Exchanges: Exchanges serve as trading platforms and custodians for Bitcoin. While it is challenging to provide an exact figure, it is estimated that a substantial amount of Bitcoin is held by exchanges. In December 2021, according to Cryptorank, only 6.3% of the total Bitcoin supply is left on exchange wallets. So I’m sure nowadays there is a lot less.

- Remaining Mined Bitcoin: The way this cryptocurrency operates on a predetermined supply schedule, with a total of 21 million Bitcoins set to be mined. As of today, there are 19.4 million coins, so there are 1.6 million yet to be mined. This scarcity adds to the concern about whether the existing Bitcoin supply can meet future demand.

Source: Twitter

Investment Funds will Need to Create Fictitious Bitcoins

Given the projected surge in demand for Bitcoin due to ETFs, concerns have been raised that investment funds may resort to creating fictitious Bitcoin to fill the potential gap. In other words, with less than 1.6 million bitcoins available to be minted until approx the year 2140 and with less than 6% of Bitcoin’s supply available in exchanges, it’s impossible that investment funds could cover its HUGE demand to properly back ETFs. So, what are they going to do?

These investment funds would create fictitious Bitcoin hinges on their ability to manipulate the decentralized nature of the cryptocurrency. The notion that investment funds would risk their reputation and engage in fraudulent practices by creating fictitious coins is highly speculative. The consequences of engaging in such practices would far outweigh any potential gains.

Potential Consequences and Considerations

It is essential to explore the potential consequences associated with the hypothetical scenario:

- Increased Regulatory Scrutiny: The surge in demand for Bitcoin ETFs may lead regulators to enact stricter oversight and regulations on non-custodial wallets. Governments might introduce mechanisms to freeze and confiscate funds to mitigate potential risks associated with fictitious coins or illicit activities. BlackRock will try to do everything it can to have enough Bitcoin to cover its business.

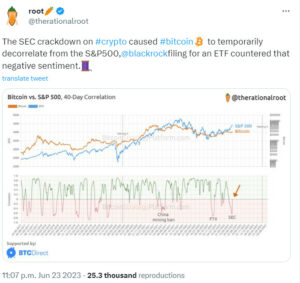

- Bitcoin’s Price Surge: The projected demand for Bitcoin ETFs, coupled with the potential adoption of Bitcoin as a prominent currency for international trade among BRICS countries, could fuel significant price appreciation. The scarcity of Bitcoin and increased global recognition could drive substantial growth in its valuation.

- ETFs and BRICS: The anticipated increase in demand for Bitcoin could contribute to significant price appreciation. The potential adoption of Bitcoin in international trade among BRICS countries. As the scarcity of BTC becomes more apparent, its value may grow at an accelerated pace.

In an environment of increased regulation and scrutiny, it becomes crucial for BTC holders to carefully evaluate their choice of wallets. Opting for reputable and regulated wallet providers can help mitigate potential risks associated with regulatory interventions.

Source: Twitter

Conclusion

It is essential to acknowledge the potential consequences associated with the surge in demand for ETFs. Governments may introduce stricter regulations and scrutiny towards non-custodial wallets. Aiming to ensure transparency and mitigate risks. This may lead to a more regulated environment for BTC holders and investors.

Finally, concerns surrounding fictitious BTCs creation exist. It is crucial to rely on the principles of transparency, decentralization, and regulatory oversight. To ensure the continued growth and stability of the cryptocurrency market.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.