Amidst a major market event, quarterly Bitcoin and Ethereum options expire on June 30th. Carrying a combined notional value of $7 billion. The staggering figure surpasses the previous quarter’s worth by a staggering $300 million. Also, derivatives trading fever has been on the rise, fueled by multiple ETF filings. With much anticipation in Crypto, how has the NFT market faired?

Whilst BTC firmly holds to its perch above the $30,000 mark, providing some much-needed hopium. Other major cryptos, including ETH, are also in the green zone. But that’s crypto. Let’s now dive into the weekly outlook of the NFT market.

1) NFT Trade Volume Hasn’t Spiked

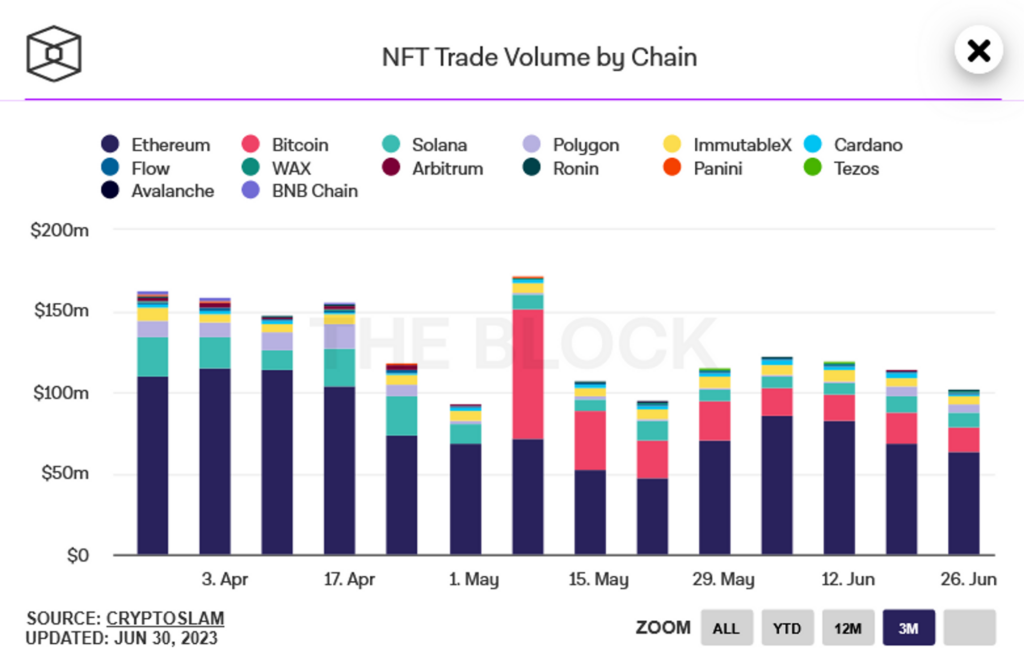

The NFT market experienced a fairly flat trading volume in the final week of June, continuing the downward trend observed in previous weeks. Despite attempts to address the challenges, the market faces difficulties, warranting an analysis of its dynamics and metrics.

Source: The Block

The total trading volume for the week amounted to $63.23 million on the Ethereum chain and $101.94 million across all chains. When compared to the previous figures of $68.23 million and $114.46 million, respectively. It is evident that trading volume has slightly decreased.

Trading volume remains a crucial metric for measuring success in the NFT market. Still, it is necessary to acknowledge that wash trading, particularly among collectors seeking rewards on platforms like Blur, can influence this number.

Source: Dune

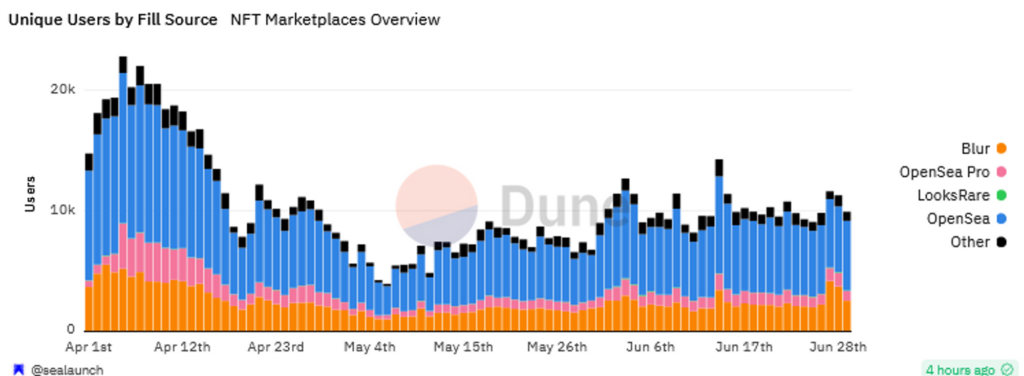

Currently, we are witnessing a decline in trading volume while the number of traders remains consistent. This scenario indicates a shift in their behavior, potentially suggesting that more NFT traders engage in smaller trades or hold onto their assets. The data could indicate a lack of sustained interest and participation from traders.

Furthermore, the emergence of NFT collections collecting royalties can eat into potential trading profits, which aligns with the observed decrease in trading volumes. However, creators are exploring new income-generating strategies, making NFT royalties less relevant in the long run.

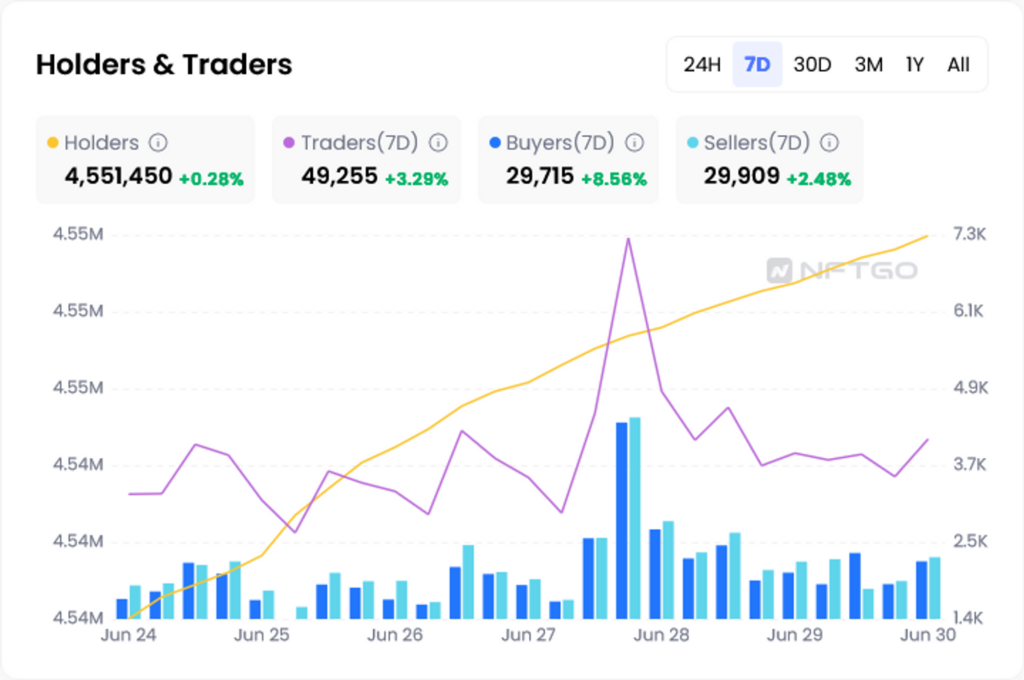

2) Holders Continues To HODL

During the past week, there has been a slight increase in the number of NFT holders, rising by 0.28% to reach a total of 4,551,450 holders. Similarly, the number of NFT traders saw a marginal increase of 3.29%, totaling 49,255 traders. The number of buyers also experienced growth, with an 8.56% rise to reach 29,715 buyers.

Source: NFTGo

Conversely, the number of sellers grew by 2.48% to reach 29,909 sellers. Interestingly, these figures reflect a shift in the dynamics of the NFT market, showcasing relatively stable trading activity and consistent demand for NFTs. Moreover, it may indicate a short-term equilibrium in the market’s pace, where supply and demand align to sustain a steady flow of transactions.

3) OpenSea: Decline In Transactions | Incline In Trade Volume

OpenSea, the leading NFT marketplace, has observed a decline in key metrics throughout the current week. The total number of unique active wallets (UAW) decreased by 2.06% to reach 64.4k, indicating a reduction in user engagement on the platform.

Moreover, the number of transactions on the platform experienced a notable decline of 10.24%, settling at 156.25k. This decrease reflects a drop in overall trading activity, indicating a potential slowdown in the NFT market’s momentum on OpenSea.

Source: OpenSea | DappRadar

Interestingly, despite declining user engagement and transaction volume, the trade volume on OpenSea saw a significant increase of 53.65%, reaching $30.59 million. This data suggests that although fewer transactions were taking place, the value of those transactions was higher, potentially involving high-value NFTs or rare collectibles.

However, it is worth noting that the smart contract balance witnessed a slight decrease of 1.43%, amounting to $65.63k, indicating a small reduction in the total value of funds locked in the smart contracts on OpenSea.

4) Trading Activity in Blur On The Rise

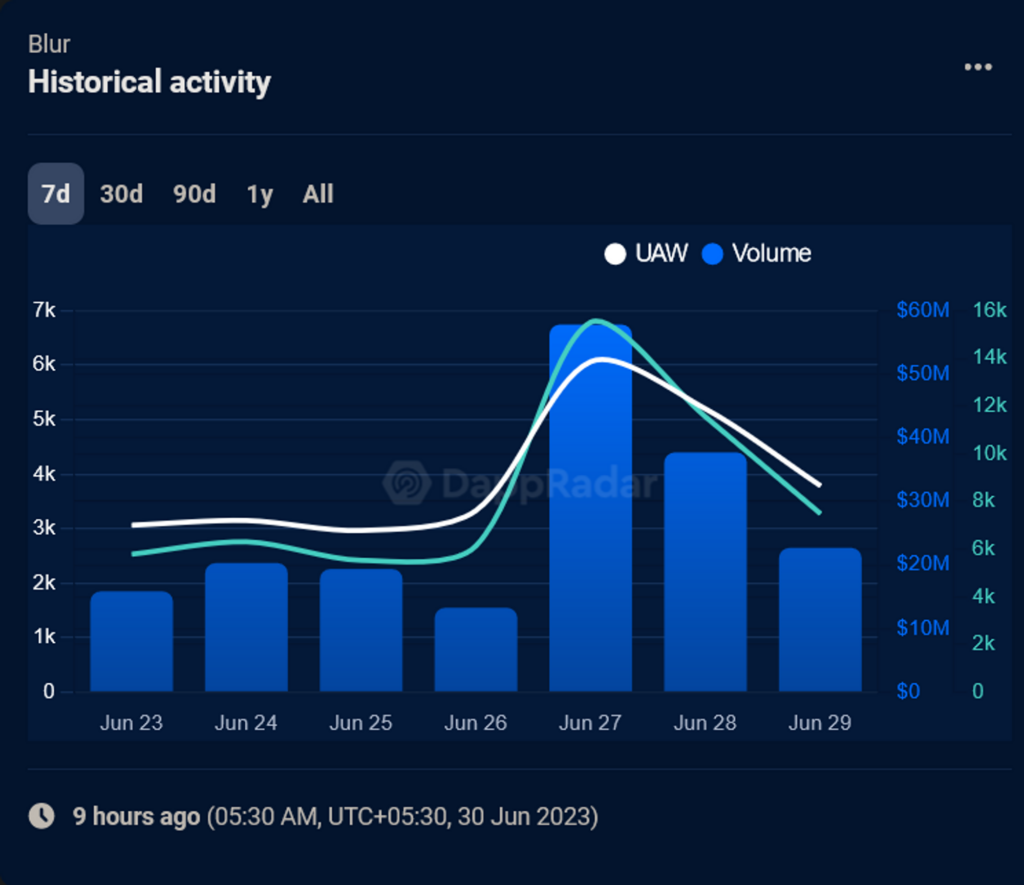

The Blur marketplace has witnessed a remarkable turnaround in trading activity during the week, contrasting with the previous week’s decline.

Various metrics indicate substantial growth and engagement on the platform. The number of unique active wallets interacting with Blur surged by 19.02%, reaching 16.96k wallets, signifying a heightened level of user participation and interest in Blur.

Source: Blur | DappRadar

Additionally, trading activity experienced a significant boost of 39.72%, with the number of transactions totaling 59.56k.

The trading volume on Blur demonstrated an astonishing growth of 110.81%, soaring to $190.35 million. This substantial rise indicates a significant increase in the overall value of transactions on the platform, suggesting that higher-value NFTs or sought-after collectibles may have been involved.

Furthermore, the smart contract balance experienced a notable increase of 4.58%, growing to $125.59 million. This rise suggests an increase in the value of funds held within the smart contracts on Blur, further reinforcing the positive market activity on this platform.

One possible contributing factor to this surge in Blur’s metrics is the listing of Azuki Elemental, which likely generated heightened interest and trading activity on the platform.

5) Solana NFT: Decline In Activity

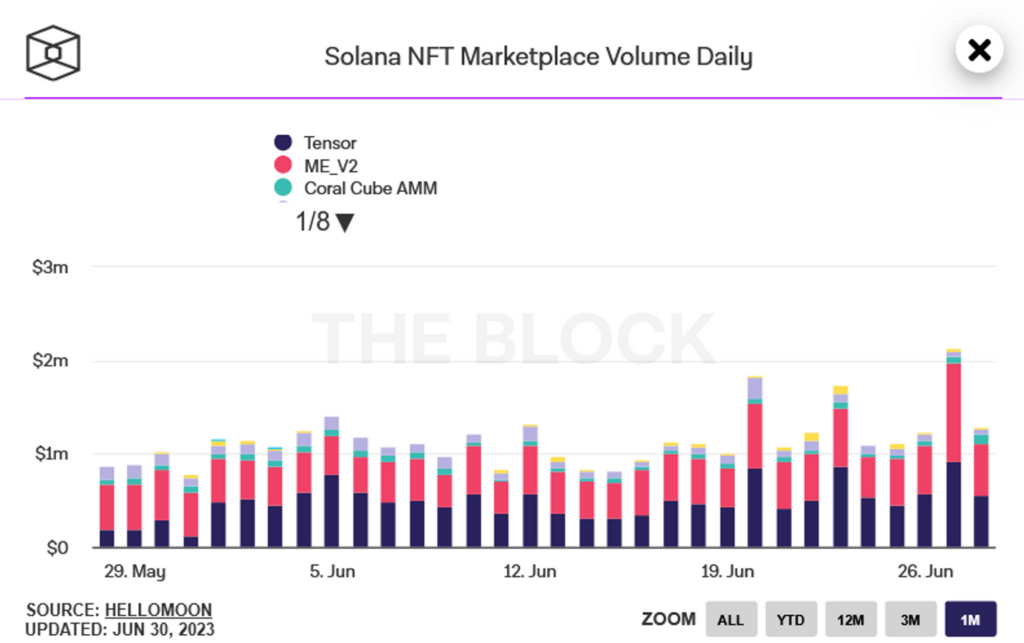

During the current week, the trading volume for NFTs across major Solana NFT marketplaces amounted to $1.29 million, reflecting a significant decline of 39.43% compared to the previous week. Tensor accounted for the highest trading volume among these marketplaces, reaching $562.56K. Magic Eden followed closely behind with a trading volume of $551.6K. Other Solana NFT marketplaces recorded trading volumes below $100K each.

Source: The Block

Interestingly, there has been a shift in the leading marketplace for Solana NFT trading compared to the previous week. Last week, Magic Eden held the top position, but this week, Tensor has emerged as the market leader in terms of trading volume.

6) Polygon NFT: A Dynamic Market

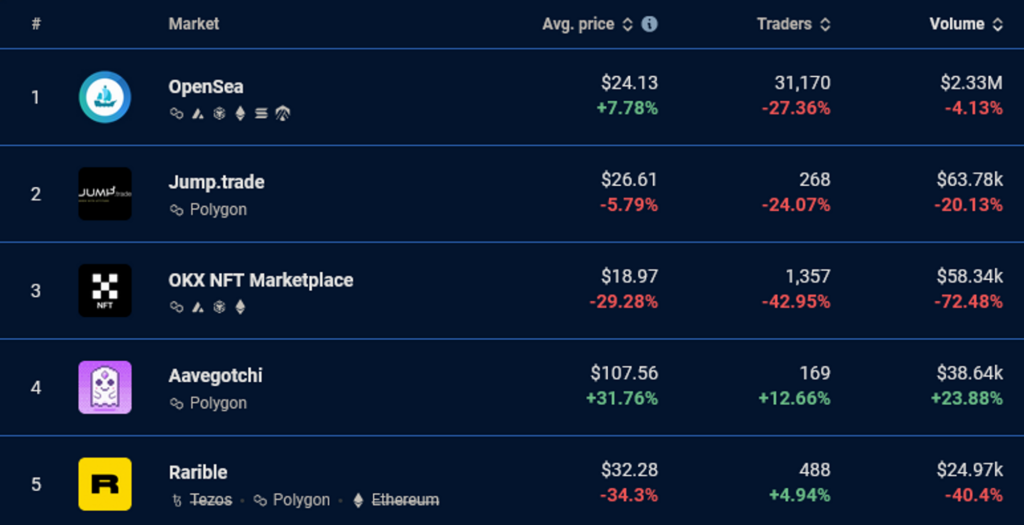

The NFT landscape on Polygon presents a dynamic scenario with varying trends across different platforms. In OpenSea, the average price of Polygon assets rose by 7.78%, reaching $24.13. However, the number of traders fell significantly by 27.36% to 31,170. The trading volume experienced a slight decline of 4.13% to $2.33 million.

Source: Polygon | DappRadar

Contrastingly, the average price of Polygon assets declined in platforms like Jump.trade and OKX. Moreover, the number of traders and the trading volume of these platforms witnessed double-digit declines.

7) Quick News Round-Up

- Gary Vaynerchuk-Backed Candy Digital and Palm NFT Studio Join Forces in Official Merger Announcement

- Under the unified brand of Candy Digital, the two firms will collaborate to leverage their expertise in digital experiences. This will span sports, entertainment, arts, and culture.

- This partnership will encompass renowned brands such as MLB, NASCAR, and Netflix.

- Fxhash 2.0 Unveils Ethereum Integration and On-Chain Minting

- Fxhash 2.0 is scheduled for a late 2023 release and is set to commemorate this significant milestone with a series of URL and IRL events.

- Solana’s NFT Protocol, Cardinal, Announces Plans to Discontinue Operations Soon.

- The team behind the project took to social media to share that this decision was made in light of challenging economic conditions.

- If users fail to withdraw their assets by the August 26 deadline, Cardinal has implemented a policy wherein the remaining assets will be automatically withdrawn to the depositors’ address.

- Crossmint, a web3 infrastructure company, introduces Wallet-as-a-Service to broaden NFT use cases.

- The NFT WaaS tech stack enables users to create smart contracts, send NFTs via email, and generate wallets for collectors.

- Vodafone Affirms Cardano NFT Plans Amid Rumors

- Vodafone ranks as the ninth-largest telecom company globally.

- Vodafone chose the Cardano blockchain for its strong community, sustainability focus, and cross-chain potential.

- Lacoste Enhances NFT Ecosystem with Exciting New Rewards Features

- On Thursday, the renowned French fashion brand Lacoste expanded its NFT ecosystem, introducing a rewarding and co-creation feature for its UNDW3 community.

- The recent expansion of the Lacoste Web3 universe offers holders access to engaging creative sessions, contests, interactive conversations, and immersive video games.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.