It is incredible to see both the crypto and TradFi markets in green through the initial weeks of February. This scenario is after FED Chair Jerome Powell said the U.S. would increase the rates by 25 bps.

The disinflation could propel Bitcoin to $24,000, but let’s see what’s going on in the cryptocurrency market this week.

Bitcoin Is in Green, and Retailers Are Back!

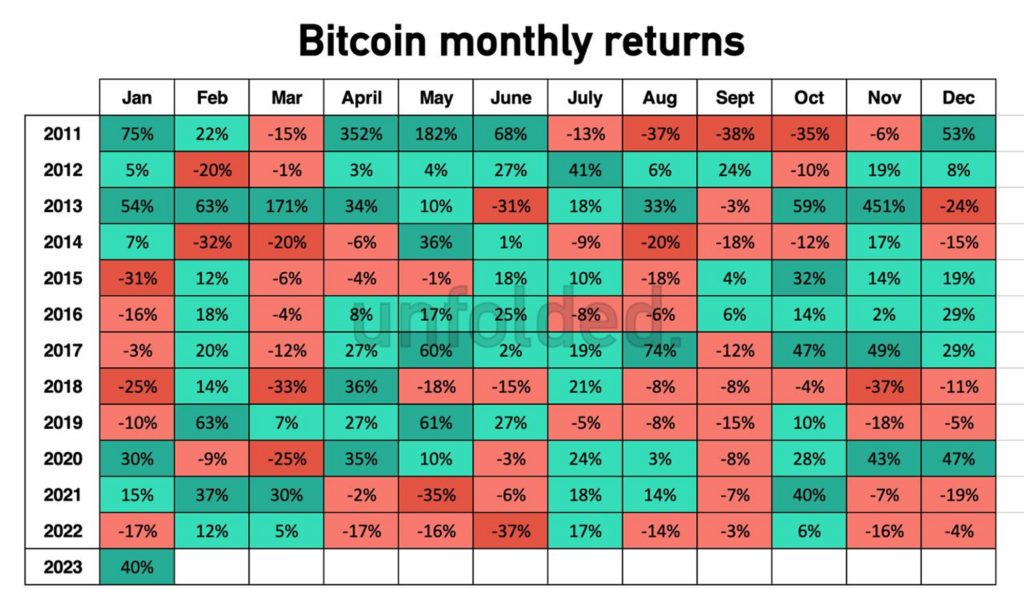

Bitcoin had its most satisfactory month since October 2021 and its best January gains since 2013.

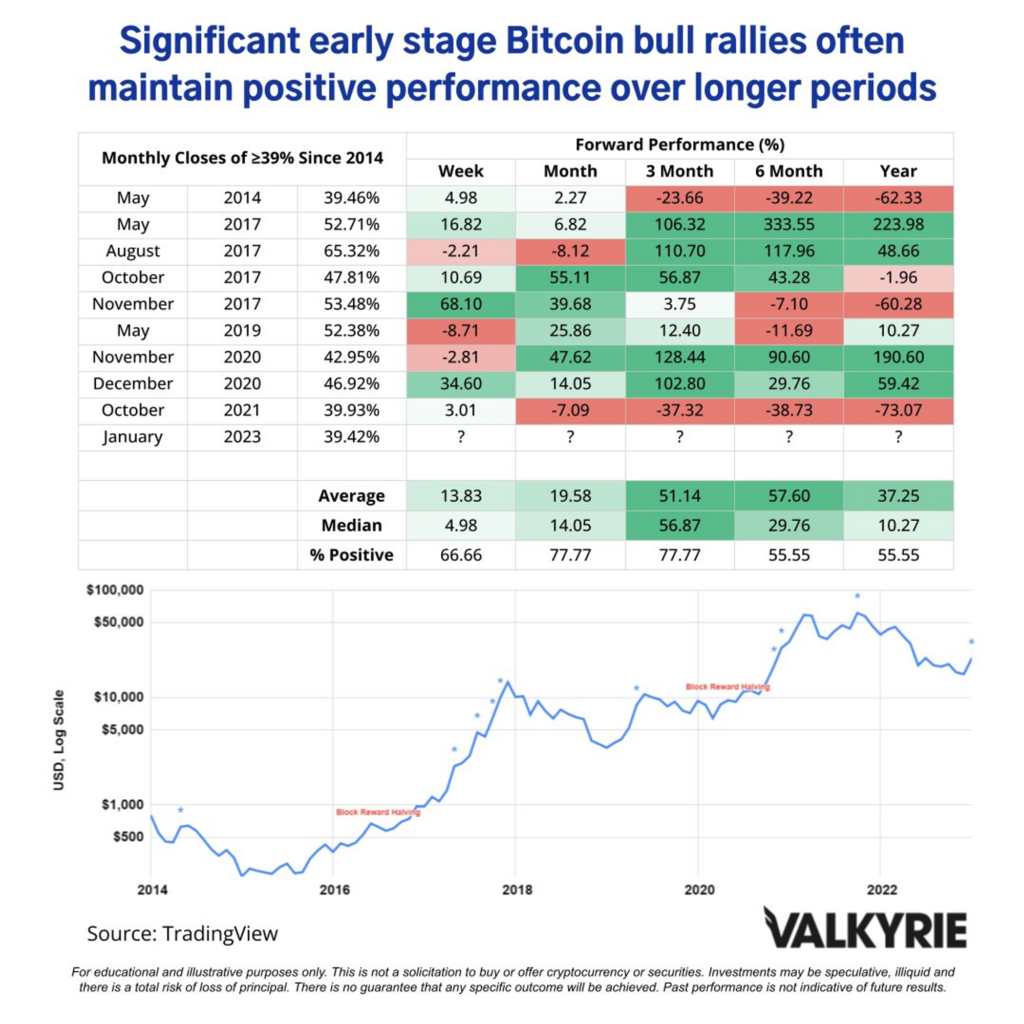

Only ten occasions of monthly Bitcoin bull rallies of 39% or more have occurred since 2014. Typically, these rallies continued to perform well over the following year.

But How Are Short-Term Holders Faring?

When STH SOPR falls below 1.00, as shown by the green box, most short-term holders are selling their bitcoins at a loss. And as most short-term investors are in a state of intense panic and are quick to sell at a loss, this is a period of accumulation.

The green box has historically signaled price bottoms for Bitcoin. Spikes over 1.00 indicate that UTXOs spent on the network accounting for their lifespan of between 1 hour and 155 days are being spent profitably during the price upsurge.

Retailers are again active in the market, reaping profits from the recent increase in Bitcoin’s price. And the likelihood of a near-term price peak starts to rise as soon as retail begins to feel euphoria.

High on Hopium?

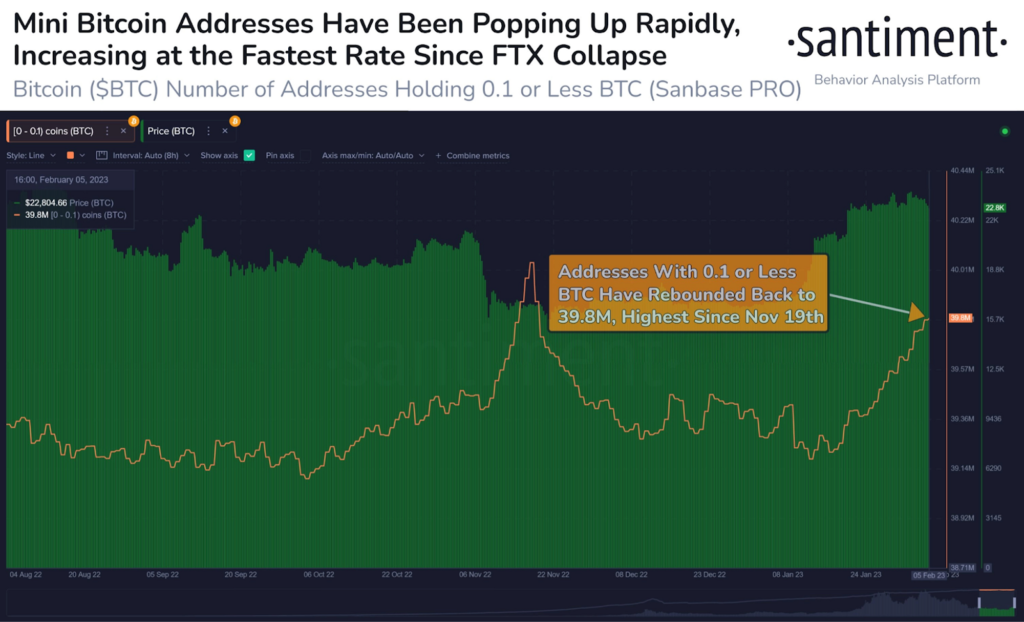

Small BTC address growth was severely constrained in 2022 and plunged to new lows after the FTX debacle, but a sizable upsurge in January implies trading confidence is back.

A market FOMO (fear of missing out) was sparked, particularly among small BTC investors, as the price of Bitcoin surged beyond $20,000 in the second week of January.

After January 13, there was significant growth in BTC addresses holding 0.1 BTC or less. Data from Santiment shows that 620,000 new BTC addresses have appeared following the January 13 BTC price surge, totaling 39.8 million.

Small Bitcoin addresses have increased recently at their most remarkable rate since November 2022, when BTC fell to its cycle low of about $16,000.

The uptick of Bitcoin addresses holding modest sums suggests rising investor optimism in 2023.

Now that, in addition to Bitcoin, several altcoins have also hit multi-month highs, and the whole cryptocurrency market has risen by over 30%, sentiment in the market is becoming increasingly bullish.

The first week of February saw Bitcoin maintain its upward trend, hitting a five-month high of over $24,000. The price is still hovering near $22,800 at the time of writing, as the $24,000 barrier proved too much to maintain.

Some market analysts predict that February may not be as positive as January.

They have cautioned that the recovery in cryptocurrency and equities this year may turn negative this month due to uncertainty about how upcoming macroeconomic data from the United States may affect market sentiment. We could attribute the impending downward trend to the extent of the Federal Reserve’s interest rate hikes.

New Paradigm Around the Corner?

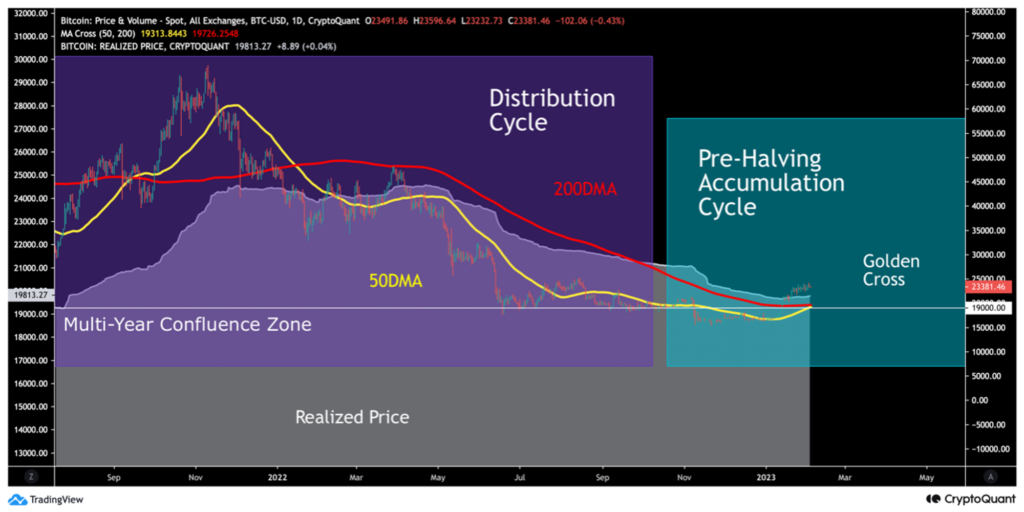

In the first few weeks of 2023, Bitcoin has risen by approximately 43%, reflecting its tremendous momentum.

The spot price has risen above both moving averages in January, which hints that things are going well. Additionally, BTC is generating a golden cross setup as the 50-day moving average surpasses the 200-day moving average.

Besides, BTC rose above the realized price (grey) indicator. The realized price is significant since it shows the average cost of all Bitcoin trades.

At the same time, the realized price shows that regular Bitcoin investors are turning a profit on their purchases.

From June through December 2022, the market has dragged the spot price below the realized price. The spot was oversold for six months if we neglected local rises over the realized price.

In conclusion, Bitcoin is presently poised to enter a new paradigm as it crosses many vital markers. The technical golden cross will support the spot price of Bitcoin, and the realized price has transformed into a support area. Moreover, Bitcoin trades above the multi-year confluence zone (white) and advances further into the pre-halving accumulation cycle (turquoise).

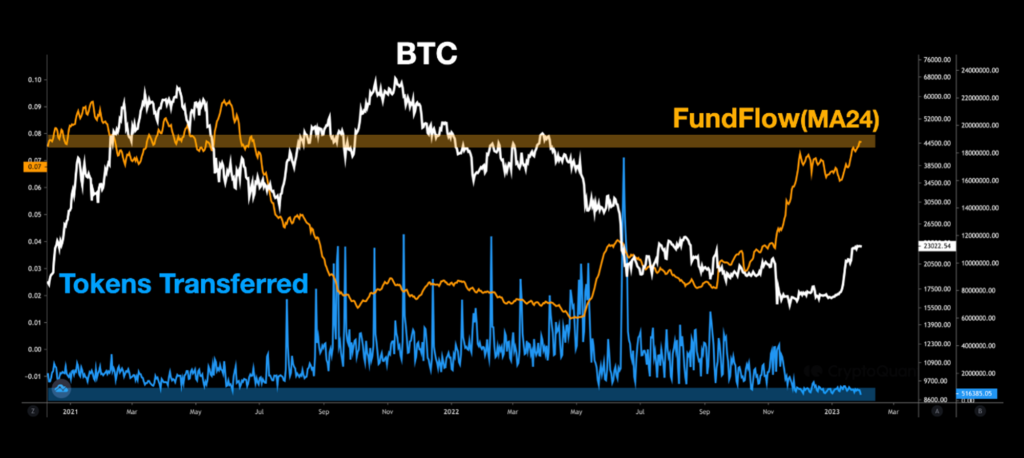

Stablecoins and Fund Flow Ratio

Stablecoins are the market’s liquidity. But how does their change affect the market?

When the number of stablecoins skyrocketed after Covid-19 in 2020, it sparked a bull market in crypto. However, in February 2022, when the stablecoin supply started to decline, a bear market emerged.

Although Bitcoin prices have soared dramatically due to the recent short-term surge in stablecoin circulation, a dead cross might happen again. The crypto space will most likely experience a bear market again if the number of stablecoins in circulation remains static.

What About the Fund Flow Ratio?

Currently, the “Fund Flow Ratio (MA24)” has almost achieved the bull market top of 2021, suggesting that investors are actively using the exchange for trading or accumulating.

On the other hand, the “tokens transferred” metric is at an all-time low and shows a low level of BTC movement. It is because only a small number of forces are active in the low liquidity market. Institutional investors who favor over-the-counter trading are significantly less interested in the market.

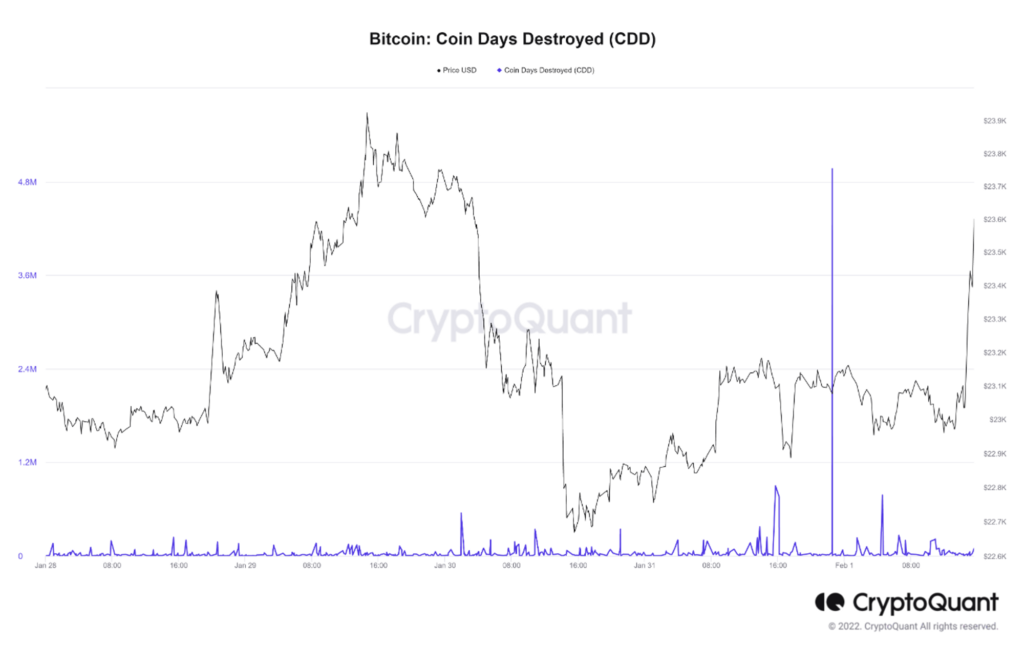

What Are Whales Doing Now?

Following the recent rise in the price of Bitcoin over the last two weeks, exchange Bitcoin whale activity has almost fallen to a year-low. However, it has increased over the previous two weeks, adding to the selling pressure on the markets. Additionally, on-chain data revealed some of the highest CDD statistics for 2023 before the FOMC meeting.

The 3-6 month age cohort’s cost base is around 20.4K. This level will function as a support when there is a selling scenario. On the plus side, the cost base for the next cohort (six to twelve months) is around $32,000.

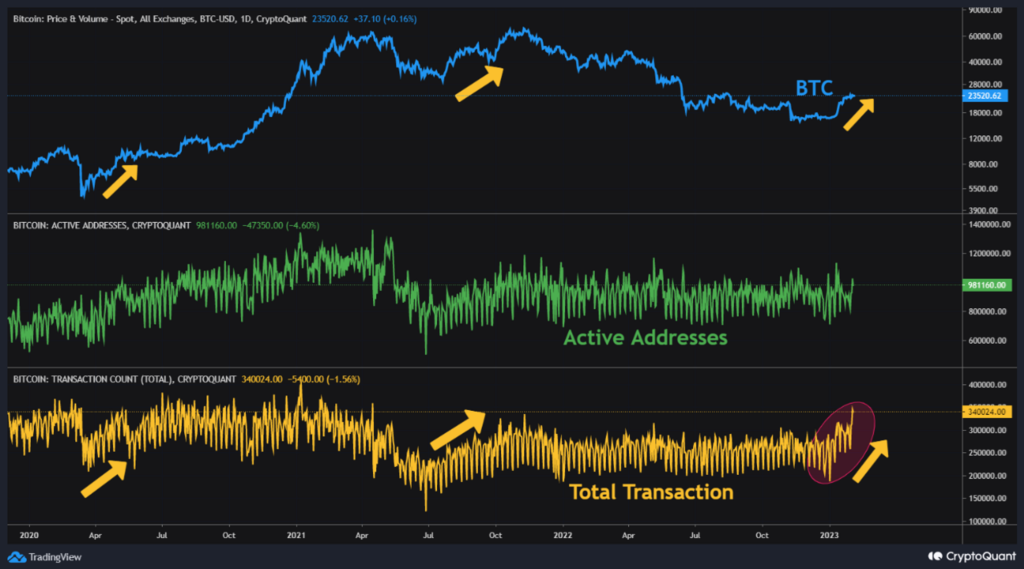

The Total Transaction Count of BTC has increased significantly recently, almost matching the bull market of 2021. But given that active addresses rarely changed, it is clear that a tiny number of whales had a significant effect on the cryptocurrency market.

The fact that the most recent increase was the longest and biggest during this down market is notable. However, whales often behave unexpectedly, so it may be some time before we learn their plans. We still need to exercise caution at this stage since an economic slump is still possible.

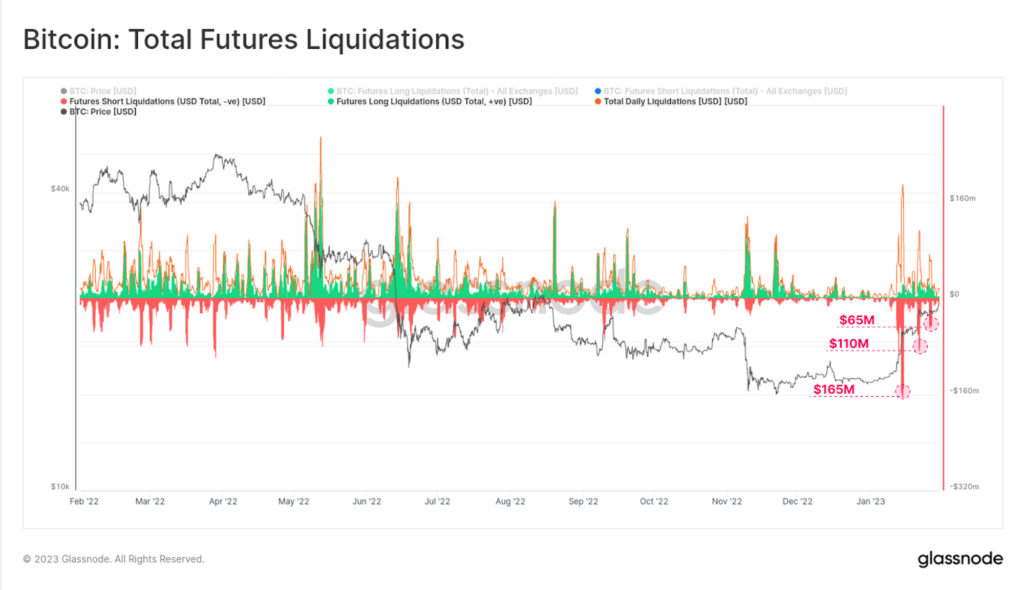

Short Squeezes

The new year has begun with a remarkable reversal of the downward trend during January after a protracted, grueling, and unpleasant 2022. Such rallies are often fueled, as is the case with the current surge, to some extent by short squeezes in the derivatives markets.

Over $495 million in short futures contracts had already been settled in three waves, noticeably with decreasing magnitude as the rally ended.

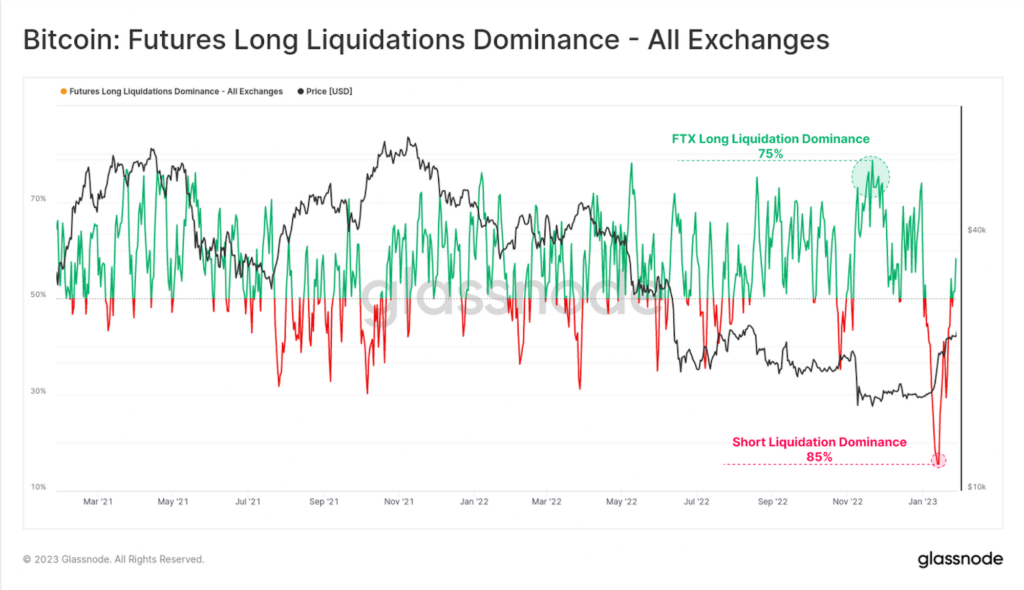

As can be seen, the first short squeeze in mid-January caught many traders off guard and resulted in a record-low long liquidation domination of 15% (i.e., shorts accounted for 85% of liquidations). It demonstrates how many traders were offside and is even more significant than the longs liquidated during the FTX collapse (75% long domination).

The cash and carry basis has returned to positive territory across both perpetual swap and calendar futures, returning 7.3% and 3.3% annually, respectively. It follows a significant amount of backwardation in all futures markets in November and December, and it signals a recovery of an optimistic sentiment, potentially mixed with some speculations.

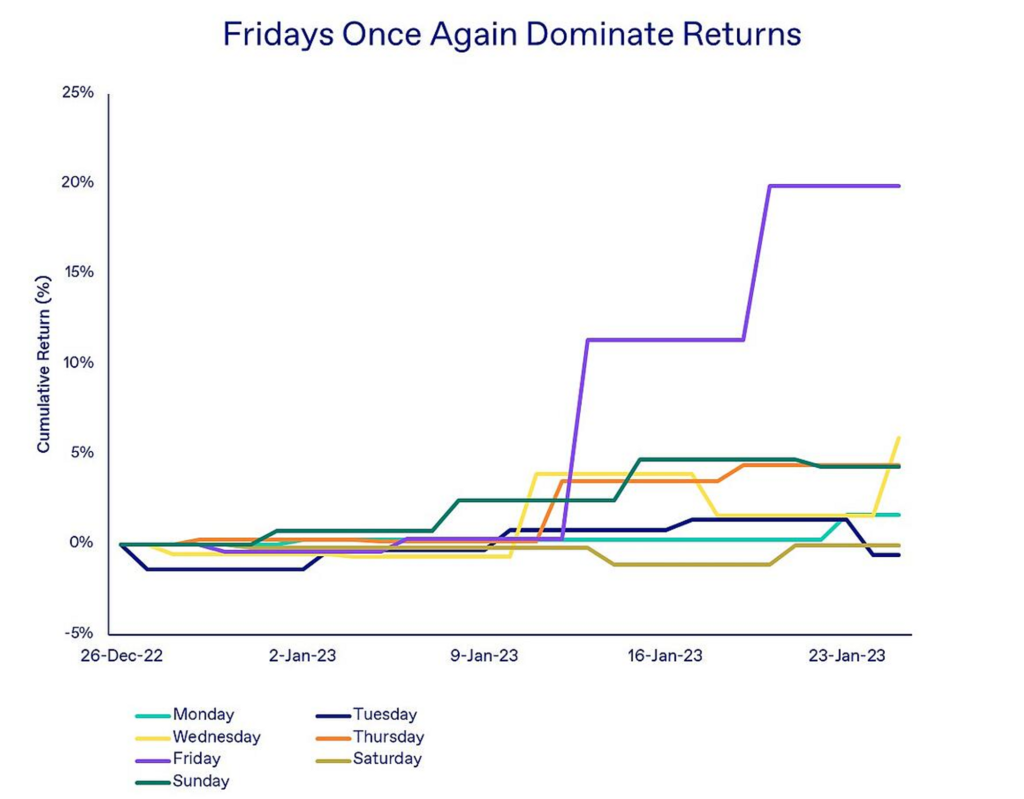

Friday Anomaly Back?

Amid this year’s boom, Bitcoin has returned to one of its old routines: posting significant weekend movements. This phenomenon has grown to be a fascinating aspect of the cryptocurrency market.

Contrary to most other assets, which typically trade Monday through Friday on regulated exchanges, BTC and the rest of the cryptocurrencies are tradable continuously every day of the week. And it has been seen in cryptocurrency markets before, with Bitcoin flying up — or plunging low — when other assets are at rest.

Until recently, Fridays were a drag on performance as the Friday anomaly peaked around when Bitcoin reached its all-time high about a year ago. The Friday oddity is returning after Bitcoin’s recent surge.

The phenomenon is related to a mix of fund inflows and money migrating onto retail exchanges before the weekend shutdown of the fiat banking system. Both explanations point that the Friday phenomenon positively correlates with the Bitcoin price.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.