Amid regulatory uncertainty surrounding Binance and China’s economic woes, Bitcoin is in the red.

Bitcoin fell below $29,000 for the first time in over a month following reports from the Wall Street Journal stating that Binance CEO, CZ, indicated in a private conversation that the crypto exchange’s affiliates had engaged in wash trading several years ago. How is the market reacting?

Macro Scene

In 2023, regulatory pressure in the United States has been intense. Gary Gensler, who has been vocal about his skepticism towards cryptocurrencies, asserted that crypto is unnecessary as the U.S. Dollar is already sufficient.

Moreover, the early defeat in the Ripple Labs case left Gensler “disappointed,” prompting him to seek an additional $72 million to expand his agency. He aims to tackle the challenges posed by the “Wild West of the crypto markets, rife with noncompliance, where investors have put hard-earned assets at risk in a highly speculative asset class.”

JUST IN:

SEC Chair Gary Gensler speaks about Ripple XRP ruling for first time, since last weeks court ruling pic.twitter.com/0lOzJEDs1e

— Whale (@WhaleChart) July 17, 2023

Meanwhile, the U.S. Department of Justice (DoJ) has committed to doubling its staff on the crypto crime team to combat crypto-related offenses.

Besides, a recent report from the Bank for International Settlements (BIS), renowned as the bank for central banks, revealed disturbing facts about central bank digital currencies (CBDCs). The report highlighted that 93% of central banks are actively working on CBDCs, raising concerns about their implications. We should be worried!

FedNow and a Centralized Future

Recently, the Fed introduced its FedNow instant payments system, a move aimed at embracing modernity. However, this step towards the new century comes with a catch – a more centralized and controlled future of finance awaits those interested in it.

While prominent traditional financial institutions have joined the initiative, providing their customers with immediate 24/7/365 payment settlement, there are notable differences between FedNow and crypto techs, especially stablecoins.

One concerning aspect of FedNow is its potential to centralize the U.S. banking system further and extend big government’s reach into the financial affairs of ordinary American citizens.

The Federal Reserve claims it won’t access individuals’ bank accounts or control their spending, but it is evident that the Central Bank will wield influence over the transaction settlement process. Instead of directly controlling account access, the Fed plans to offer “fraud prevention tools.”

Source: Federal Reserve

Even though the current use of fraud prevention tools may seem harmless, granting the Federal Reserve the authority to determine what constitutes a good or bad transaction is alarming and has potentially disastrous consequences. The fear of the Fed positioning itself as the ultimate arbiter raises serious concerns about individual financial autonomy and privacy.

A Step Towards An Orwellian Surveillance State?

Certainly, FedNow surpasses existing payment solutions, and with the support of the American Central Bank, it seems inevitable that FedNow will eventually replace the outdated legacy system.

However, this shift raises concerns. Once FedNow becomes the standard, the Federal Reserve, and consequently, the United States Government, will possess the power to inflict significant financial hardships on individuals under the pretext of a “fraud alert.”

This authority could lead to blackballing individuals from the financial system without the need for warrants or due process. Some experts argue that FedNow’s successful implementation might spare us from the potential downsides of a Central Bank Digital Currency (CBDC). Yet, it is apparent that this new instant payment solution also requires Americans to relinquish some degree of control over their financial independence to the government.

This is the future of payments with FedNow & CBDCs. Biometric info linked to your social credit account linked to your wallet 👀pic.twitter.com/6GbgwcBzHe

— Coin Bureau (@coinbureau) July 19, 2023

The true intentions behind the Federal Reserve’s expanded power over the US domestic payments system remain uncertain. Without any means of verification, we have no choice but to place our trust in their actions.

Other Macro Events

Russia’s withdrawal from a grain deal with Ukraine, seemingly in response to the Crimean Bridge attack, is likely to exacerbate inflation and unrest in developing countries already facing difficulties.

Meanwhile, tensions between the US and China are persisting, with confirmation from Treasury Secretary Janet Yellen that the US will not ease trade restrictions on China. China’s refusal to address the concerns that triggered the tariffs further indicates that the US-China tensions will remain unresolved.

Geopolitical Context and TSMC’s US Plant Delay

TSMC, the major Taiwanese microchip manufacturer, has postponed opening its US plant to 2025 due to a shortage of skilled labor. Given the geopolitical situation, this delay might incentivize the US to protect Taiwan from a potential Chinese invasion, as the absence of TSMC could impact the US plant’s operations.

In a related matter, the current US administration reportedly plans to introduce a label for devices that indicates their resilience against cyber attacks. This move suggests a real concern about near-term cyber attack risks. Notably, some recently accused China of hacking emails belonging to US officials.

On July 11, Microsoft revealed that a Chinese hacking group it calls Storm-0558 was able to access the email systems of US government agencies, potentially compromising hundreds of thousands of emails. https://t.co/I9vIdb9ELV

— WIRED (@WIRED) July 22, 2023

Regarding the SEC’s stance on crypto, Chairman Gary Gensler’s comments indicate that the agency will persist with its anti-crypto efforts despite losing against Ripple in court. He intends to continue pushing for “crypto compliance,” signaling that enforcement actions in the crypto space will continue in the foreseeable future.

Spot Bitcoin ETF Applications and the 45-Day Clock

Nevertheless, remarks like these are causing substantial regulatory uncertainty in the United States to the extent that NASDAQ has decided to abandon its plans to provide crypto custody services.

This development holds greater significance than one might realize because recent applications for spot Bitcoin ETFs suggest that the existing rules for crypto custody are relatively clear. If that is not the case, it raises concerns.

GM Crypto Twitter

The US 🇺🇸 #SEC will start the approval process today for the Spot #BitcoinETF applications.

The SEC will have 45 days to rule or extend the review.

Your move #GaryGensler

Lets Go ✌️ pic.twitter.com/JdG9U4SCdY

— Crypto Rand (@crypto_rand) July 19, 2023

In any event, the clock has officially started ticking for the spot Bitcoin ETF applications. The SEC now has 45 days to either approve, deny, or delay its decision on these applications (though it’s not entirely clear if it’s 45 regular days or 45 business days). Assuming 45 business days, the SEC’s verdict on these applications will come around mid-September.

Uncertainty Surrounding Binance and Tether

Between now and mid-September, many developments could occur, and the focus of concern has been on Binance. Apart from laying off employees, the exchange has reportedly scaled back employee benefits, possibly in preparation for substantial settlements with regulatory authorities worldwide.

However, such settlements may not be sufficient to resolve all issues. It’s essential to remember that the SEC has not yet approved a spot Bitcoin ETF due to concerns about the market manipulation of BTC in the spot market.

Notably, most of BTC’s trading volume occurs outside the US, often paired with the USDT stablecoin (also offshore). As a result, reducing the influence of platforms like Binance is an ongoing objective.

This situation raises the question of whether there will be a comprehensive crackdown on Binance or Tether. The truth is, no one knows for certain.

4

— H.E. Justin Sun 孙宇晨 (@justinsuntron) July 17, 2023

While Binance and Tether have attracted attention, other areas like Tron, where most USDT and almost all TUSD exists, have also been under scrutiny. Founder Justin Sun’s recent tweet “4” has created speculation about an impending FUD that may surface soon.

China’s Woes

Around the same time, China’s ruling Communist Party’s top decision-making body, the 24-member Politburo led by President Xi Jinping, stated that the country’s economy is encountering new challenges, making economic recovery difficult.

At the beginning of the year, analysts widely regarded China’s reopening of its economy as a significant positive factor for risk assets, including cryptocurrencies. Notably, the official Xinhua News Agency’s published readout of the Politburo’s statement did not contain any announcements regarding large-scale fiscal or monetary stimulus measures.

China is grappling with several issues, such as weak consumer spending after an initial boost following the easing of COVID-19 lockdown measures, declining factory-gate prices, and challenges in the housing and real estate sectors. Consequently, there has been an expectation in the markets for a strong monetary or fiscal response from Beijing.

Bitcoin, often seen as closely tied to fiat liquidity and considered the riskiest among risk assets, likely experienced a decline in response to China’s growth concerns and the absence of significant stimulus indications. Now let’s move to on-chain!

An Increasingly Concentrated Crypto Market?

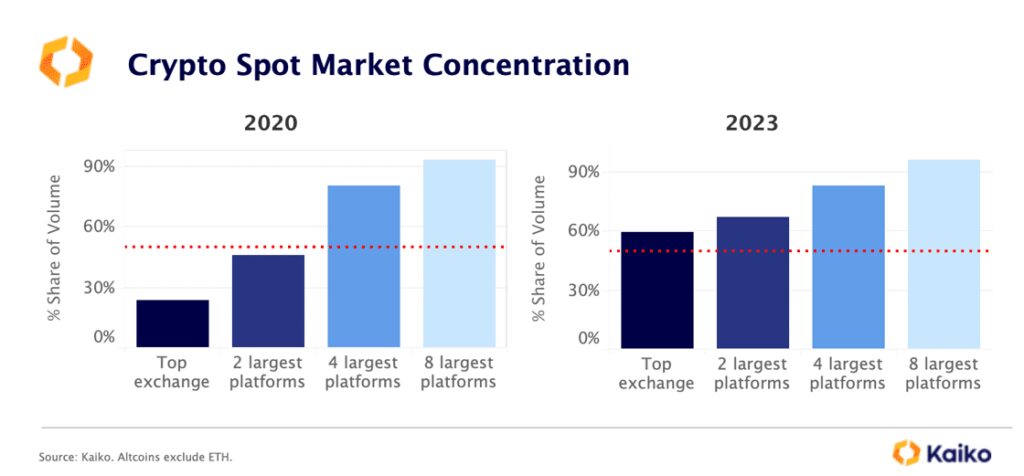

Source: Kaiko

Over the past three years, the crypto markets have witnessed a notable shift towards concentration, with one exchange, Binance, dominating most trading activity in 2023. This scenario starkly contrasts the situation in 2020, when the largest exchange accounted for just 24% of the global trade volume, and the combined volumes of the two largest platforms were still below 50%.

This growing concentration could indicate a continuing trend, especially amid a broader decline in market activity, which poses challenges for smaller exchanges that face increasing pressure.

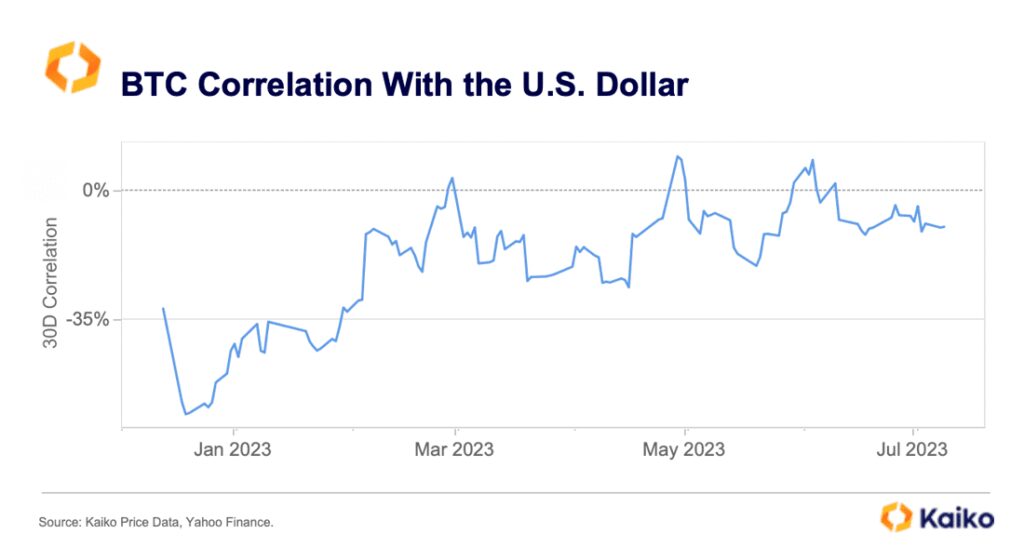

BTC Shows Reduced Inverse Correlation With The USD

This year, the historical inverse relationship between BTC and the US Dollar has significantly weakened, decreasing from -60% to -10%. This shift occurred as the US Dollar index (DXY) dropped below the 100 mark in July, a level not seen since April 2022.

Source: Kaiko

The decline in the DXY was triggered by softer-than-expected US inflation data, leading to speculations that the Federal Reserve may be nearing the end of its hiking cycle.

Despite a slight recovery in the DXY last week, supported by disinflation in the UK and dovish comments from European Central Bank (ECB) officials, it remains well below its peak in September 2022, when it stood at over 114.

It’s worth noting that while this change in correlation may not be a persistent trend, it has coincided with a steady reduction in the share of USD-denominated BTC trade volumes. The proportion of BTC traded against the US Dollar declined from 77% of the total BTC-fiat volume in October 2022 to 64% in July.

Stablecoin Market Cap Hits Lowest Point Since August 2021

The declining trend in the market capitalization of stablecoins has persisted for 16 consecutive months, with a further 0.82% decrease in July, bringing the total to $127 billion. It marks the lowest market cap level since August 2021.

Source: CCData

Additionally, the market cap dominance of stablecoins declined slightly from 10.5% to 10.3% in July, indicating a relative decrease in their share compared to other cryptocurrencies.

Despite the drop in market capitalization, stablecoin trading volumes surged by 16.6% to reach $482 billion in July. This increase in trading activity followed the filing of spot Bitcoin ETFs by several TradFi companies, including major players like BlackRock and Fidelity. The introduction of these ETFs injected optimism and prompted higher trading activities in the market a few days prior.

Bitcoin ETP Demonstrates Steadfast Growth

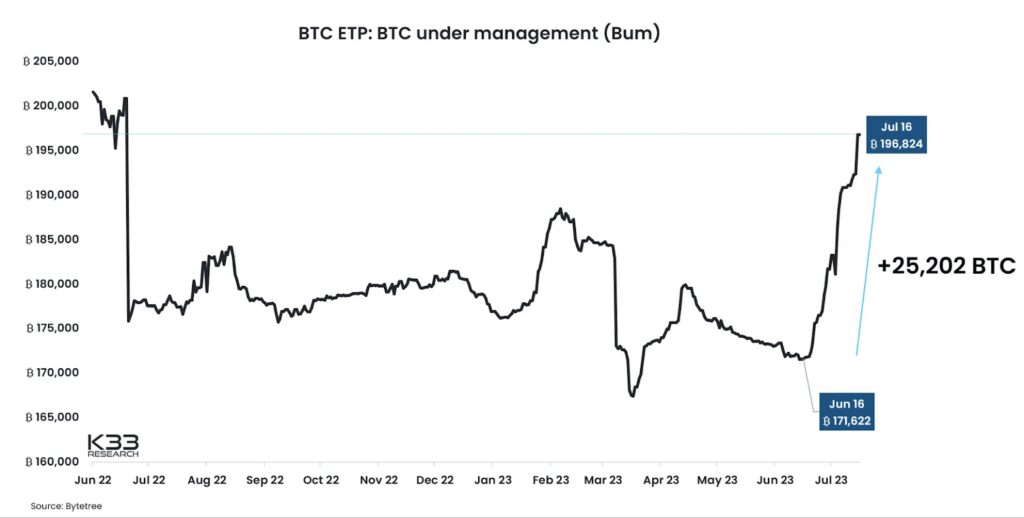

Bitcoin exchange-traded funds (ETFs) have emerged as a means to provide retail investors and those hesitant about directly investing in cryptocurrencies with indirect access to bitcoin-related assets. These ETFs are traded on traditional exchanges, allowing investors to participate in the Bitcoin market without owning the underlying assets.

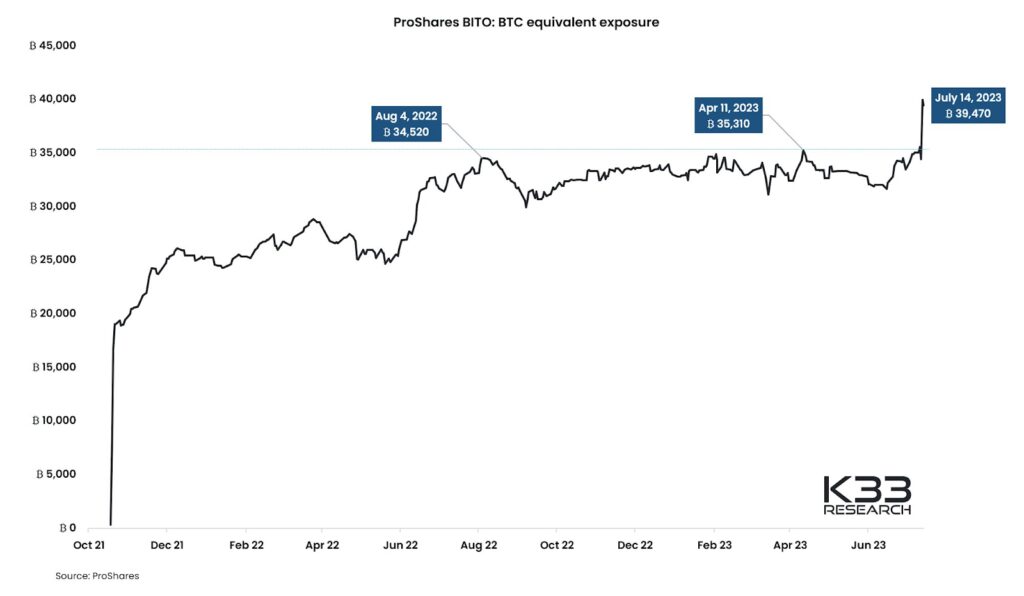

Source: K33 Research

In recent months, BTC Exchange-Traded Products (ETPs) have witnessed significant monthly net inflows, with 25,202 BTC added from June 16 to July 16. This surge in inflows marked the second-largest monthly increase in BTC ETPs, trailing only the launch of futures-based ETFs like BITO in the U.S. in 2021.

BITO, the ProShares Bitcoin Strategy ETF, made history as the first cryptocurrency ETF to be listed on a U.S. exchange when it began trading on the NYSE ARCA on October 19, 2021. Before BITO’s launch, crypto ETFs were already available in Canada and Europe.

Source: K33 Research

Regarding BITO’s performance, it recently attained a new all-time high in BTC equivalent exposure, growing by 4,425 BTC a few days ago. However, it’s worth noting that past spikes in BITO’s exposure have coincided with local market tops on August 4, 2022, and April 11, 2023.

Despite this, BITO’s overall BTC exposure had shown a relatively flat trend since June 2022 until the past week, when the market witnessed a notable range breakout.

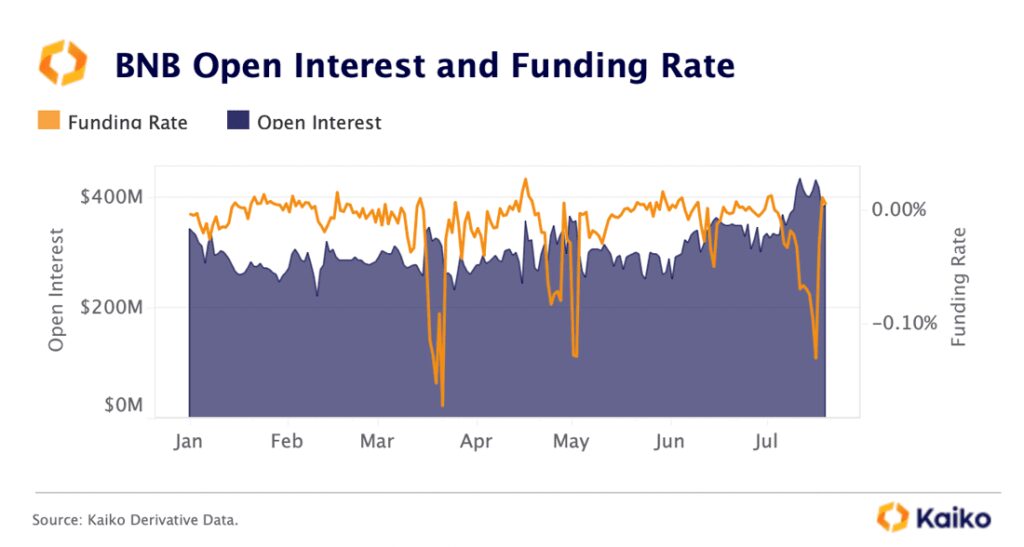

Users Bearish On Binance

Source: Kaiko

This month, the open interest of Binance’s BNB token reached its highest level since the collapse of FTX, indicating a surge in bearish bets on the exchange. These increased bearish sentiments coincided with rumors of mass layoffs at Binance. During this time, BNB funding rates experienced a decline to their lowest levels since the U.S. banking turmoil in March before stabilizing at more neutral levels.

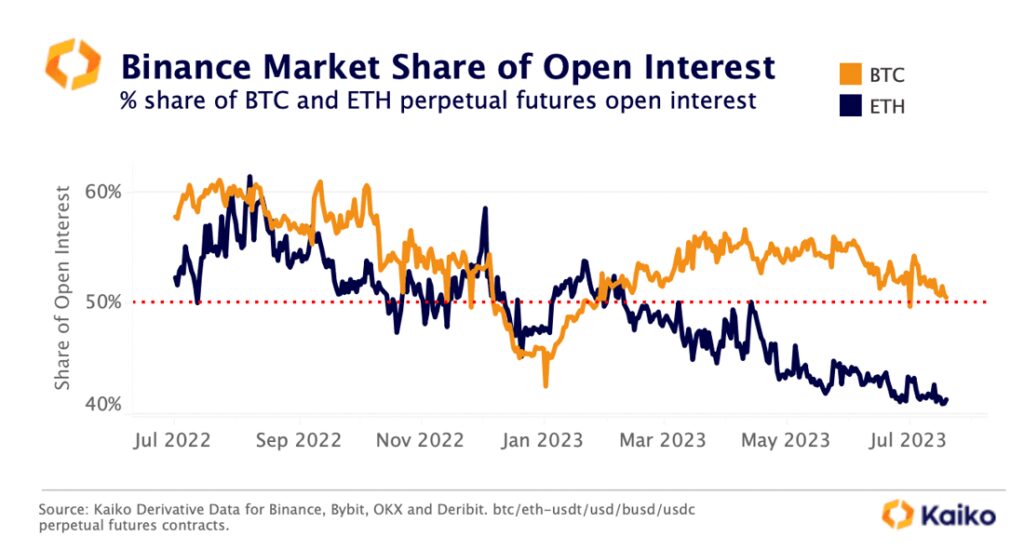

Source: Kaiko

Throughout the year, Binance has been experiencing a decline in dominance in both spot and derivative markets. In July, its ETH open interest market share fell to 41%, down from 55% a year ago.

Similarly, its share of BTC open interest dropped to 52%, down from 60% over the same period. This trend reflects heightened competition in offshore markets, with smaller exchanges like Bybit and OKX gaining traction and challenging Binance’s previous dominance.

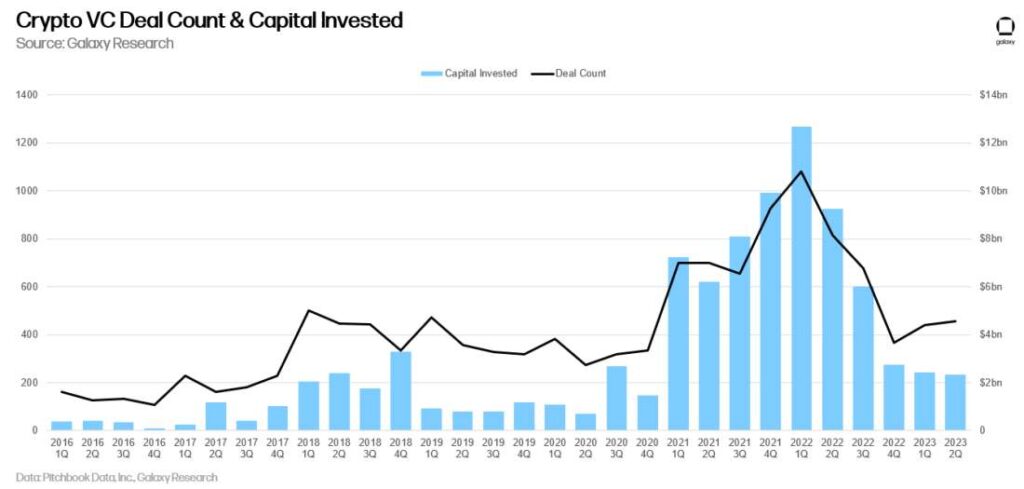

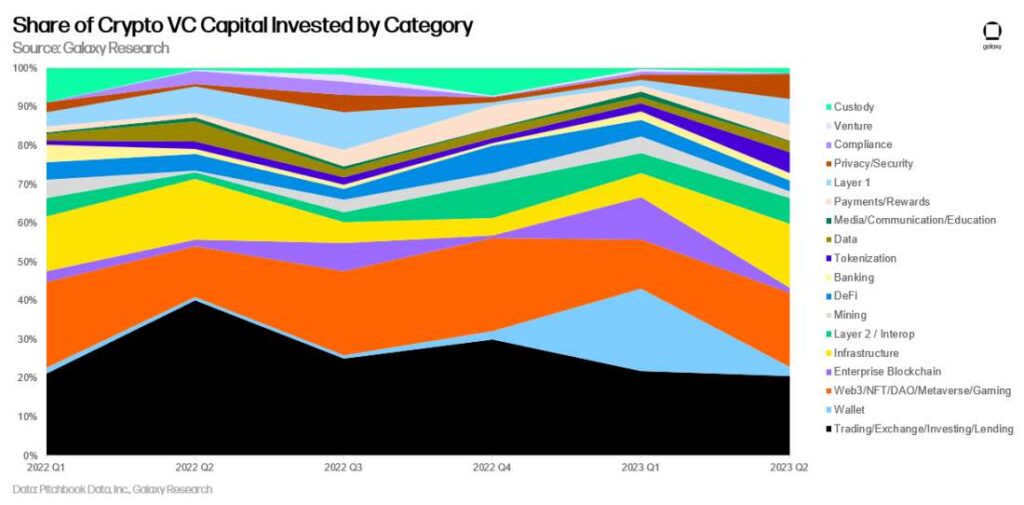

Crypto VC Bear Market Continues?

In Q2 2023, the crypto and blockchain sector experienced a notable decline in investment, with only $2.32 billion deployed, marking the lowest amount since Q4 2020 and representing a continued downtrend from the peak of $13 billion in Q1 2022.

Source: Galaxy Research

This downward trend has been evident in the past three quarters, with total funding for crypto and blockchain startups falling below the levels seen in just Q2 of the previous year.

During this period, Trading, Exchange, Investing, and Lending startups raised the most venture capital, securing $473 million, which accounted for 20% of the capital deployed. The second-highest amount of capital, $442 million, was raised by Web3, NFTs, Gaming, DAOs, and Metaverse startups, representing 19% of all venture capital deployed in Q2 2023.

Source: Galaxy Research

Notably, the Layer 2/Interop sector witnessed the largest deal of the quarter, with LayerZero raising a significant $120 million in a series B round. Other noteworthy deals included Magic Eden’s $52 million in the Web3/NFT space, Auradine’s $81 million in the infrastructure sector, and River Financial’s $35 million in Trading/Exchange.

Despite robust deal counts, the overall capital allocation to crypto startups has declined quarter over quarter, indicating a continuation of the crypto VC bear market. This trend is not isolated to the crypto sector, as the wider venture capital industry faces similar challenges amid rising interest rates.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.